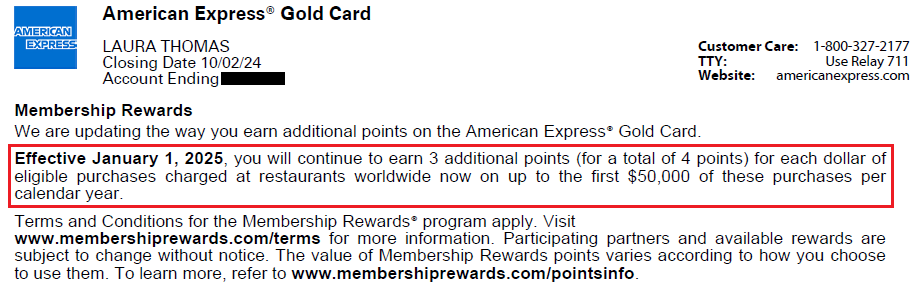

Good morning everyone, happy Friday! Laura was reviewing her recent American Express Gold Card statement and noticed an upcoming change that said:

Effective January 1, 2025, you will continue to earn 3 additional points (for a total of 4 points) for each dollar of eligible purchases charged at restaurants worldwide now on up to the first $50,000 of these purchases per calendar year.

Previously, I do not believe there was a cap on restaurant purchases that would earn 4x AMEX Membership Rewards. I did some more digging to learn more.

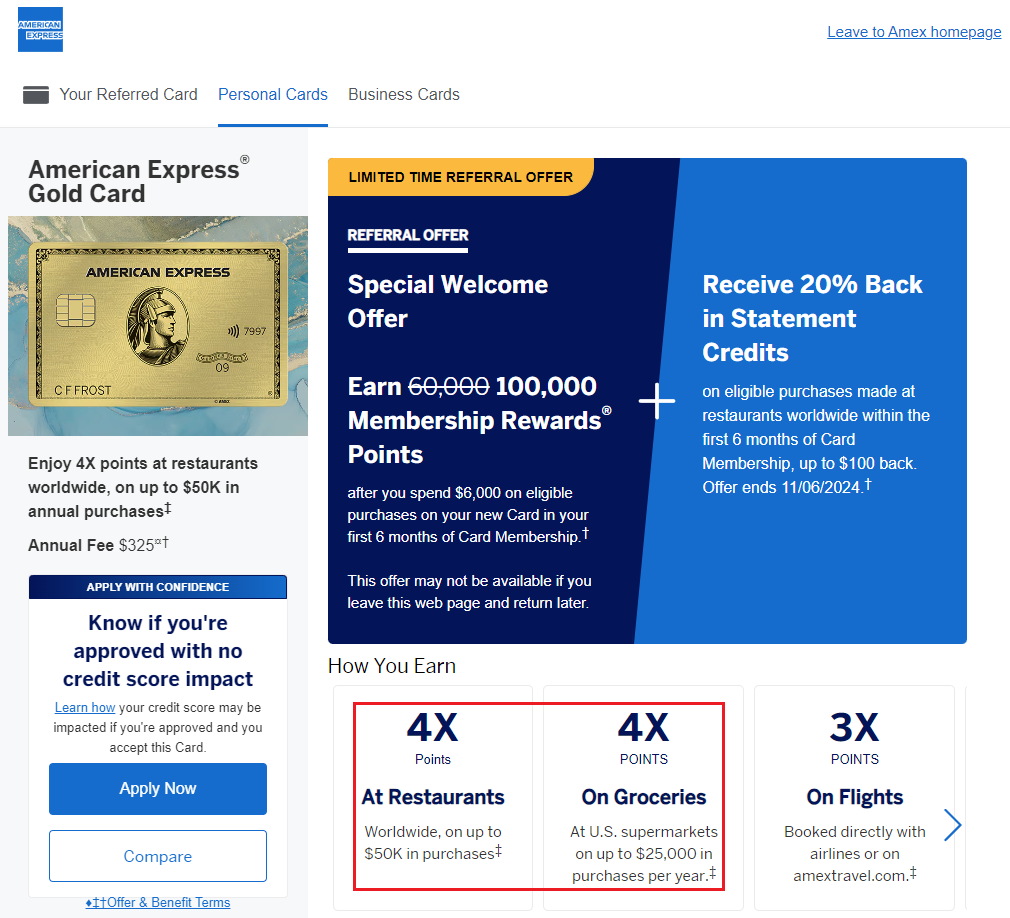

On the American Express Gold Card homepage, the current offer does show the new $50K cap for restaurants:

- 4X Points At Restaurants – Worldwide, on up to $50K in purchases‡

- 4X Points On Groceries – At U.S. supermarkets on up to $25,000 in purchases per year.‡

I then went to the terms and conditions section to find more about the $50K restaurant cap, and this is what I found:

The Gold Card Membership Rewards

Basic Card Members will earn one point for each dollar charged for an eligible purchase in each billing period on The American Express Gold Card or an Additional Card on their Account. Basic Card Members will earn: 3 additional points (for a total of 4 points) for each dollar of eligible purchases charged at restaurants worldwide (on the first $50,000 of eligible purchases per calendar year beginning on 1/1/2025); 3 additional points (for a total of 4 points) on the first $25,000 of eligible purchases per calendar year at supermarkets located in the U.S. (superstores, convenience stores, warehouse clubs, and meal-kit delivery services are not considered supermarkets); 2 additional points (for a total of 3 points) for each dollar of eligible purchases charged on airfare on a scheduled flight charged directly with passenger airlines (charter flights and private jet flights are excluded) and airfare charged directly through amextravel.com; and 1 additional point (for a total of 2 points) for each dollar of eligible purchases charged through amextravel.com for prepaid hotels, prepaid car rentals, or cruise reservations (non-prepaid car rentals, non-prepaid hotels, ticketing services or other fees are excluded). Bonuses you may receive with your Card on other purchase categories or in connection with promotions or offers from American Express may not be combined with this benefit. Basic Card Members may not earn additional points for purchases at a restaurant located within another establishment (e.g., a restaurant inside a hotel, casino, or event venue), events held within a restaurant, purchases made through third-party food delivery services outside of the U.S., or purchases at bars, nightclubs, cafeterias, caterers, theatre clubs, breweries, bakeries, and meeting venues. Please allow 8-12 weeks after the qualifying purchase is charged to your Card Account for points to be posted to the account. Eligible purchases are purchases for goods and services minus returns and other credits. Eligible purchases do NOT include fees or interest charges, cash advances, person to person payments, purchases of gift cards, purchases of travelers checks, purchases or reloading of prepaid cards, or purchases of other cash equivalents. Additional terms and restrictions apply. Merchants are assigned codes based on what they primarily sell. We group certain merchant codes into categories that are eligible for additional points. A purchase with a merchant will not earn additional points if the merchant’s code is not included in an additional points category. Basic Card Members may not receive additional points if we receive inaccurate information or are otherwise unable to identify your purchase as eligible for an additional points category. For example, Basic Card Members may not receive additional points when: a merchant uses a third-party to sell their products or services; or a merchant uses a third-party to process or submit your transaction to us (e.g., using mobile or wireless card readers); or you choose to make a purchase using a third-party payment account or make a purchase using a mobile or digital wallet. Please visit americanexpress.com/rewards-info for more information about rewards.

I’m sure 99% of AMEX Gold cardmembers do not spend more than $50K per year at restaurants, but this will affect the 1% of cardmembers who do spend more than that at restaurants each year. To get around that limit, you could have multiple AMEX Gold cards or get an American Express Business Gold Card that has a $150K limits on restaurants, if that is the category where you spend the most. If you have any questions about this change, please leave a comment below. Have a great weekend everyone!

This was announced months ago. What is this, amateur hour?

Hi Tom, sorry I missed the announcement a few months ago. I just reported on the new change listed on my AMEX Gold Card statement.