Good afternoon everyone, happy Friday! I have 2 Chase Freedom Flex Credit Cards (the second was a downgrade from a Chase Sapphire Preferred Credit Card) and Laura has an older Chase Freedom Credit Card (Visa version). In case you missed the announcement, Chase Freedom celebrated it’s 15th birthday this year and to mark this special occasion, Chase added 2 more bonus categories in March: Tax Preparation and Insurance. Tax prep and insurance are not the most exciting categories, but the timing couldn’t be better for us since we had $3,000 of car and home insurance payments to make this month. Before I made the insurance payments, I made sure that our Chase Freedom cards were registered and that we still had $1,500 in spend to do on our cards.

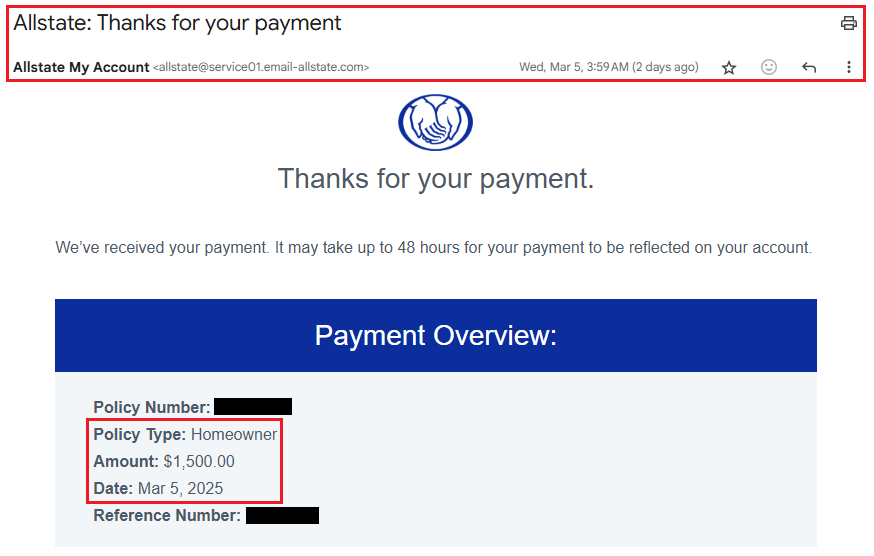

I made a $1,500 payment toward our home insurance (my Chase Freedom Flex) and then I made another $1,500 payment to cover the remaining home insurance and most of our car insurance (Laura’s Chase Freedom). Allstate was happy to take a few different payments to cover the full balance of our insurance bills.

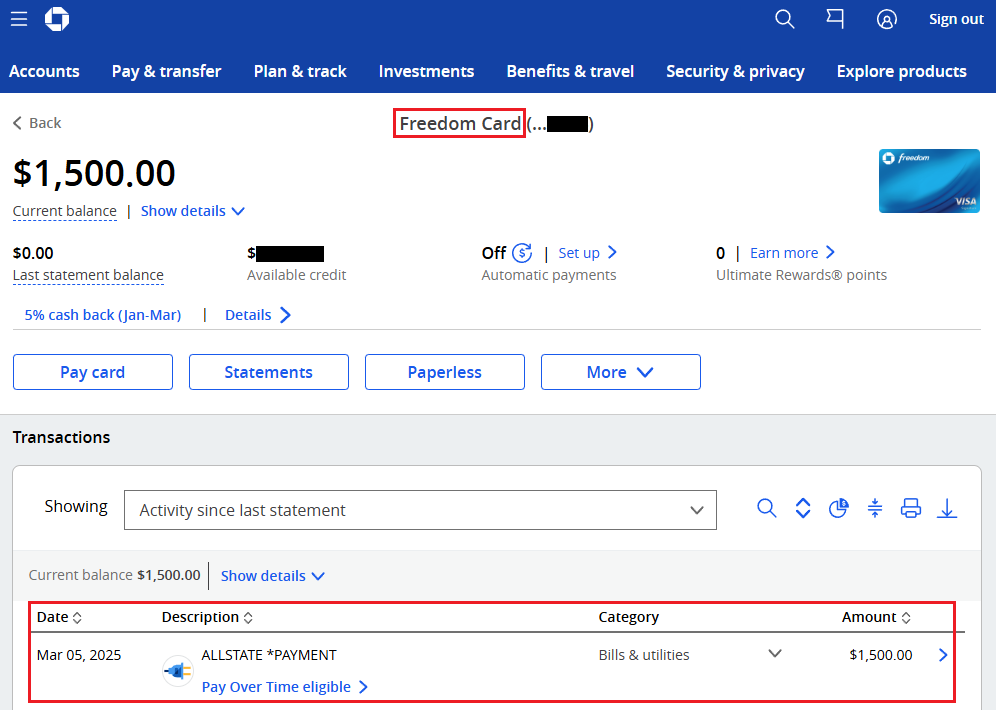

A day later, the Allstate purchases posted to our Chase Freedom cards…

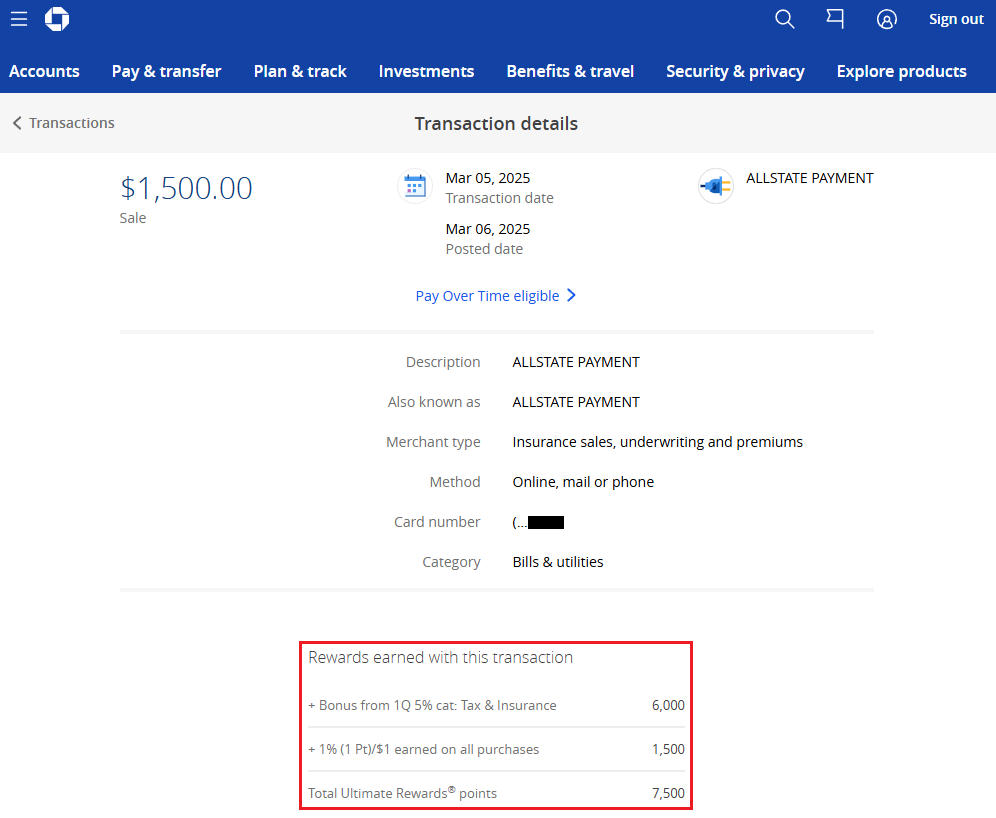

…and the 7,500 Chase Ultimate Reward Points posted to both of our cards.

I love being able to complete the bonus spending for 2 Chase Freedom cards from home in a matter of minutes. Chase hasn’t released the standard or bonus categories for Q2 yet (that should be available in the next week), but I am curious what those categories will be. If you have any questions about the insurance bonus category or making payments to Allstate, please leave a comment below. Have a great weekend everyone!