Good afternoon everyone. Hot off the heals of the massive Southwest Airlines devaluation this morning, I found another devaluation on my recent US Bank Smartly Checking account statement. The main dagger is how to waive the monthly maintenance fee: “Having an eligible personal U.S. Bank credit card no longer waives the Monthly Maintenance Fee”. Here are the full details:

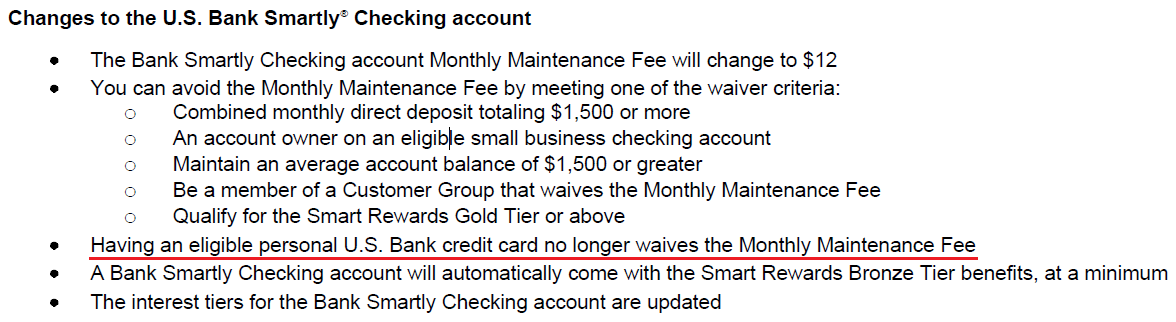

Changes to the U.S. Bank Smartly Checking account

-

- The Bank Smartly Checking account Monthly Maintenance Fee will change to $12

- You can avoid the Monthly Maintenance Fee by meeting one of the waiver criteria:

- Combined monthly direct deposit totaling $1,500 or more

- An account owner on an eligible small business checking account

- Maintain an average account balance of $1,500 or greater

- Be a member of a Customer Group that waives the Monthly Maintenance Fee

- Qualify for the Smart Rewards Gold Tier or above

- Having an eligible personal U.S. Bank credit card no longer waives the Monthly Maintenance Fee

- A Bank Smartly Checking account will automatically come with the Smart Rewards Bronze Tier benefits, at a minimum

- The interest tiers for the Bank Smartly Checking account are updated

Here are the current US Bank Smartly Checking monthly maintenance fee waiver details. As you can see, the current monthly maintenance fee is only $6.95 (but will increase to $12), but that can be waived with any of these 3 items. The $1,500 average account balance is the same, but having a US Bank credit card will no longer waive the fee, plus the monthly direct deposit requirement is increasing from $1,000 to $1,500.

If you are a member of any of these “customer groups,” you have additional ways to waive the monthly maintenance fee.

This change is a major disappointment since I usually keep a few dollars in my Smartly Checking account and having a US Bank credit card was a very easy way to waive the monthly maintenance fee. I do qualify for the Smart Rewards Gold Tier or above by having $100,000 in Roth IRA assets with US Bank, so that is now my saving grace to waive the fee. If you have any questions about this change, please leave a comment below. Have a great day everyone.

P.S. Here are the other upcoming US Bank changes listed on my statement:

Here’s what you should know

- Under Regulation CC, the following amounts for funds availability will be updated:

- In the Funds Availability: Your Ability to Withdraw Funds – All Accounts section

- Immediate Availability – All Accounts subsection and Longer Delays May Apply subsection, in all instances, $225 will be updated to $275 by July 1, 2025

- Longer Delays May Apply subsection and Special Rules for New Accounts – Retail Consumer and Business Accounts subsection, in all instances, $5,525 will be updated to $6,725 by July 1, 2025

- In the Funds Availability: Your Ability to Withdraw Funds – All Accounts section

- State Farm and Edward Jones product information, pricing information disclosure references and contact information are added throughout the document

- Under Electronic Fund Transfers for Consumer Customers, Types of Transactions section, Expanded Account Access subsection, added enrollment instructions

Changes to the U.S. Bank Smart Rewards program

- The U.S. Bank Smart Rewards Combined Qualifying Balance (CQB) calculation is updated

- The four Smart Rewards tiers, Primary, Plus, Premium and Pinnacle are discontinued and will be replaced with five Smart Rewards tiers, Bronze Tier, Silver Tier, Gold Tier, Platinum Tier and Platinum Plus Tier. These tiers are not associated with any consumer or business checking products that share the same name. The tier balance qualifications are updated to the following:

- Bronze Tier: Under $5,000

- Silver Tier: $5,000 – $24,999.99

- Gold Tier: $25,000 – $49,999.99

- Platinum Tier: $50,000 – $99,999.99

- Platinum Plus Tier: $100,000 and above

- Home Equity Loan or Personal Loan discount is being added for all tiers

- The tier balance qualification for the Standard Savings Interest Rate Lift benefit is being updated to include balances $25,000 or more

- These Smart Rewards benefits and tier qualification are being discontinued:

- The Safe Deposit Box annual rental fee discount (this benefit will remain for the Senior Customer Group)

- The Home Equity Line of Credit Annual Fee discount

- The Financial Consultation with a Wealth Management professional

- The credit account qualification for the Primary tier

- Elite Money Market

- An existing option to waive the Elite Money Market Monthly Maintenance Fee is updated to: Owner of a Bank Smartly Checking account with a minimum of Gold Tier

Changes to Customer Group benefits

Certain Customer Group benefits are updated as follows:

- Military

- All account owners receive Military customer group benefits on that account when an owner is a member of the Military customer group

- The 50% Safe Deposit Box annual rental fee discount is removed

- Automatic enrollment in the Plus tier is removed; however, you will continue to receive the following benefits:

- Monthly Maintenance Fee waiver on the Bank Smartly Checking account

- Unlimited fee waivers for Cashier’s Checks, Personal Money Orders and Stop Payments

- The first four Non-U.S. Bank ATM Transaction fees are waived per statement period

- For Non-U.S. Bank ATM Surcharge charged by ATM Owner (Domestic Only), the first fee is reimbursed (one per statement period)

- Standard Savings Interest Rate Lift: 10.00% of the standard interest rate

- IRA Annual Fee Waiver

- Wealth Management

- First four fees reimbursed per statement period for Non-U.S. Bank ATM Surcharge charged by an ATM Owner (Domestic only)

- You will continue to receive the following benefits:

- Premier service including:

- Access to a dedicated team of wealth professionals with planning, investment and banking expertise

- Dedicated concierge phone support

- Market and economic updates

- Exclusive event invitations

- Access to customer lending solutions, including Liquid Asset Secured lines of credit

- Higher money movement limits

- Immediate access to your funds

- Complimentary Wealth Management-branded personal checks

- Premier service including:

- Workplace-Financial Wellness Program

- Monthly Maintenance Fee waiver on the Bank Smartly Checking account

- The first four Non-U.S. Bank ATM Transaction fees are waived per statement period

- The 50% Safe Deposit Box annual rental fee discount is removed

- You will continue to receive the 50% discount on personal check re-orders (U.S. Bank logo or personal)

- U.S. Bank Global Transition Solutions (Formerly known as Referral Banking)

- Two incoming Wire Transfer fees waived per statement period

- The first four Non-U.S. Bank ATM Transaction fees are waived per statement period

- Automatic enrollment in the Primary tier is removed; however, you will continue to receive the following benefits:

- Monthly Maintenance Fee waiver on the Bank Smartly Checking account

- Standard Savings Interest Rate Lift: 5.00% of the standard interest rate

I then asked ChatGPT to provide the 2 most important items in each section and here they are:

Funds Availability (Regulation CC Updates)

- The immediate availability threshold increases from $225 to $275 by July 1, 2025.

- The longer delay limit for larger deposits increases from $5,525 to $6,725 by July 1, 2025.

Electronic Fund Transfers for Consumer Customers

- Expanded account access through new enrollment instructions.

- Additional product information added for State Farm and Edward Jones services.

U.S. Bank Smart Rewards Program Changes

- Four-tier system replaced with five new tiers (Bronze, Silver, Gold, Platinum, Platinum Plus).

- Home Equity Loan and Personal Loan discounts added across all tiers.

Eliminated Smart Rewards Benefits

- Safe Deposit Box annual rental fee discount (except for the Senior Customer Group).

- Home Equity Line of Credit Annual Fee discount removed.

Elite Money Market Account Updates

- New waiver requirement: Must own a Bank Smartly Checking account with a minimum of Gold Tier status.

Customer Group Benefits (Military & Wealth Management)

- Military customer group benefits extended to all account owners when one owner is a Military member.

- 50% Safe Deposit Box rental fee discount removed for both Military and Wealth Management customers.

U.S. Bank Global Transition Solutions (Referral Banking)

- Two incoming wire transfer fees waived per statement period.

- Four Non-U.S. Bank ATM transaction fees waived per statement period.

From what I see here they will still waive the fees for seniors. If that changes I’ll close the account. It’s not my primary checking account (or secondary). I maybe also close one of the two credit cards I have with them. I have two Altitude Go cards that I received when they stopped other cards (Raddison / Country Inn and something else). I did have a third of the Altitude Go, but closed that a while back.

Hi Carl, yes, there ares till waivers for seniors. Click the link above the customer groups screenshot to learn more.

You can convert an Altitude Go to a Cash Plus or Smartly card, if those cards interest you more.

I wanted to get the 4% tier on the US bank credit card by transferring in $100,000 in assets, but although I have a US Bank checking account, savings account, Altitude Reserve credit card, etc. and have never had trouble opening accounts with them, I was not allowed to open a self-directed brokerage account. Attempts (multiple) to get assistance at the branch nearby was fruitless. Do you have any idea why they would not let me open a brokerage account? I have ones with Fidelity, Schwab, and Merrill with no problem. Thanks. They won’t tell me any reason.

Hi Tom, that is very strange. I applied for the Roth IRA Self Directed Brokerage online (https://www.usbank.com/investing/online-investing/self-directed-investing.html) and didn’t have any problem opening the account online or doing an ACAT online. Did you get an error message or receive a letter in the mail explaining the rejection?

They did not explain; they just said they couldn’t open it. That was all the explanation I got from a bunch of reps. Thanks.

Wow, that is so strange. I’m sorry the US Bank reps were not helpful.

Very disappointing, but expected. Fees bring in revenue. However, from a consumers point of view, I recently opened a savings, checking, and was approved for two CCs purely for the cashback benefits. Longterm, I did/do not believe the average consumer could maintain $5K in the Smartly Savings to receive 2.5% cashback on the CC and why would anyone maintain $250K in any USBank account. Now with this checking change, I can’t see many retaining it without a waiver of some sort. I do expect the 4% CC to come with a cashback ceiling amount update within a year. Love the card, but not game.

Hi Heronva, I am dissapointed too. US Bank may need to generate more revenue in order to pay for the rewards on their Smartly Cards. I am hoping the 4% cash back stays as is throughout the year, but we will need to wait and see what happens.