Good morning everyone, happy MLK Jr. Day. I hope you are having a great holiday weekend. Don’t forget to enter my giveaway for a chance to win a $10 Amazon eGift Card. By the time you read this post, I will be somewhere in Central America. A long time ago, I had a TD Bank checking account (thank you for the $200 checking account bonus, TD Bank) and I signed up for a TD Bank Connect Card. The TD Bank Connect Card is a prepaid reloadable debit card which can only be funded with a TD Bank credit card (I used my TD Bank Aeroplan Credit Card as the funding source).

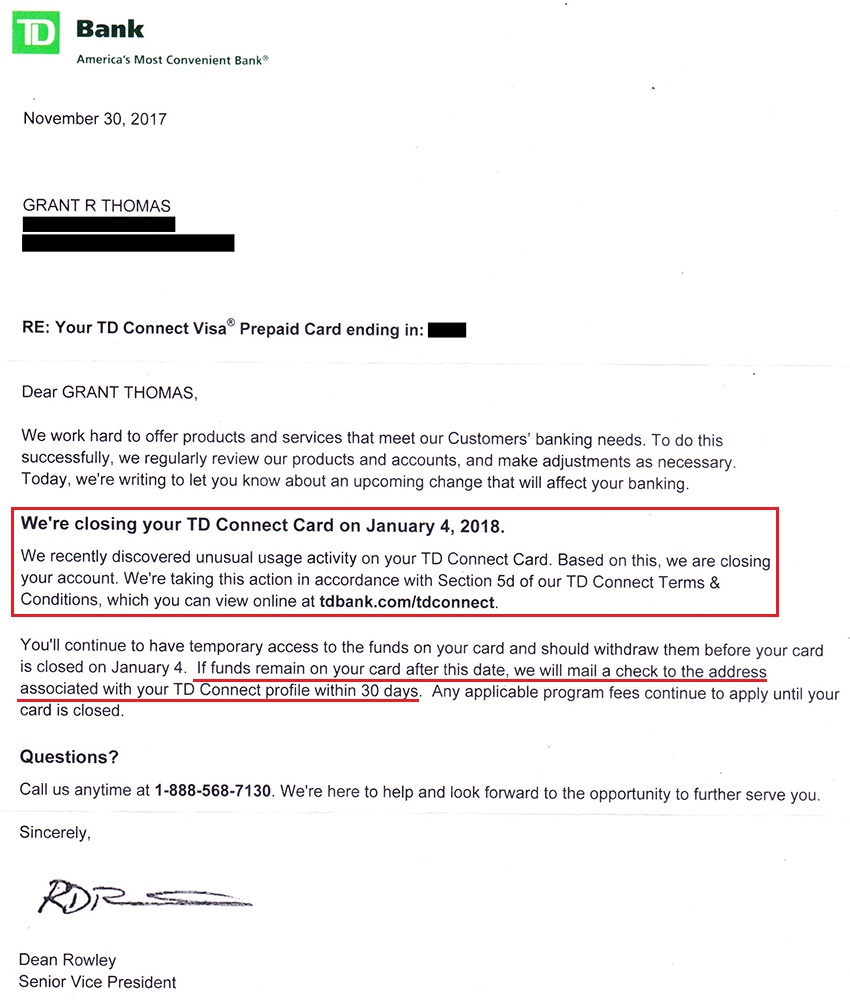

After several months of using my TD Bank Connect Card (and racking up Aeroplan miles on the credit card), I received the following letter from TD Bank stating that they were going to close my TD Bank Connect Card due to unusual activity (apparently loading and withdrawing funds from a prepaid reloadable debit card is unusual). Luckily, TD Bank sent me the letter in early December and told me they were going to close my TD Bank Connect Card on January 4, 2018. I’m not sure why they gave me a full month of use after they determined that they were going to close my card, but TD Bank is “America’s Most Convenient Bank”.

Since I had nothing to lose, I increased my use of the TD Bank Connect Card (go big or go home) until early January when my card was closed on January 4, 2018. At the bottom of the letter, it said that any funds left on the card after the card was closed would be sent back to me via check. I didn’t test that out since I didn’t want to float the money to TD Bank until I received the check, but I did give it a second thought.

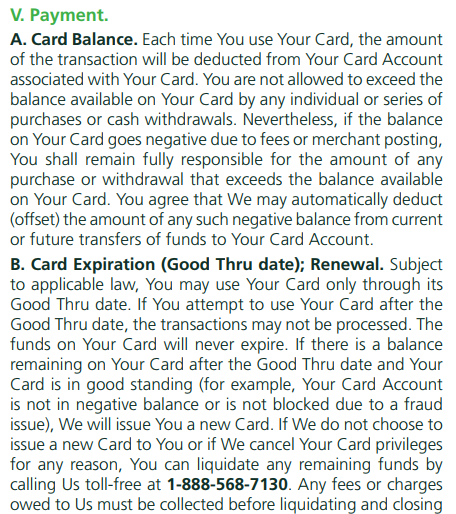

In the above letter, TD Bank referenced section 5d of the TD Bank Connect Card Terms & Conditions which basically says that TD Bank can close your TD Bank Connect Card for any reason if they suspect fraud or illegal activity.

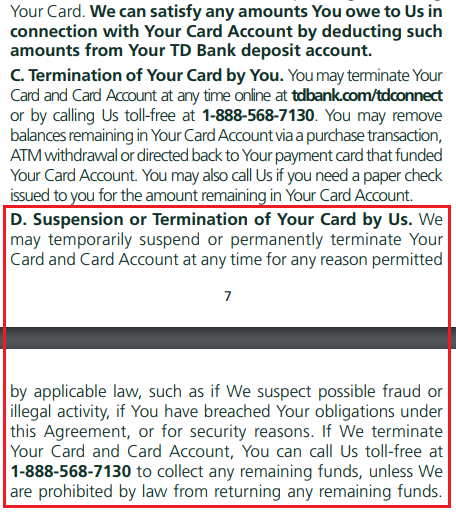

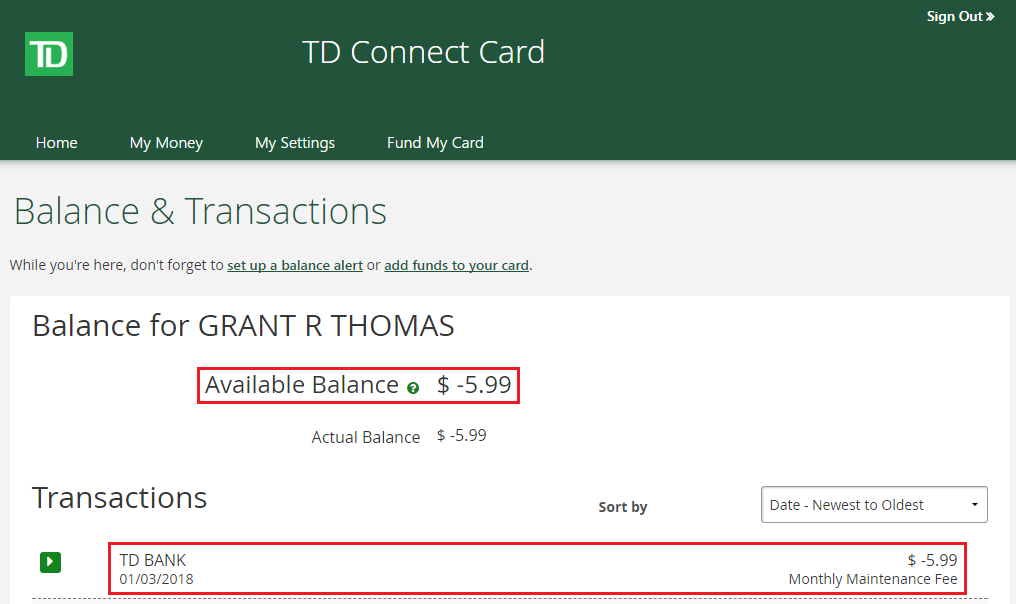

After loading and withdrawing funds from my TD Bank Connect Card several times in December, I had a $0 balance at the beginning of January. That is when TD Bank charges me the monthly fee on my TD Bank Connect Card. Since I had no funds on the card at that time, my account had a negative balance and my card was temporarily suspended until I brought the account balance back up to or above $0. Since the card was going to be shut down the following day, I just ignored the email.

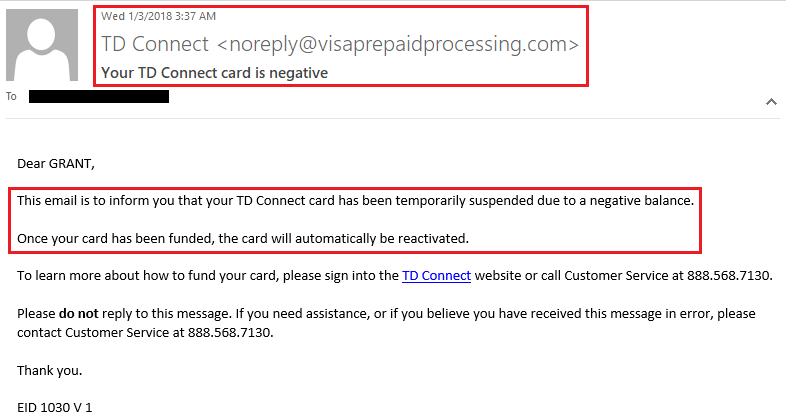

Here is what my TD Bank Connect Card account looked like with a negative balance.

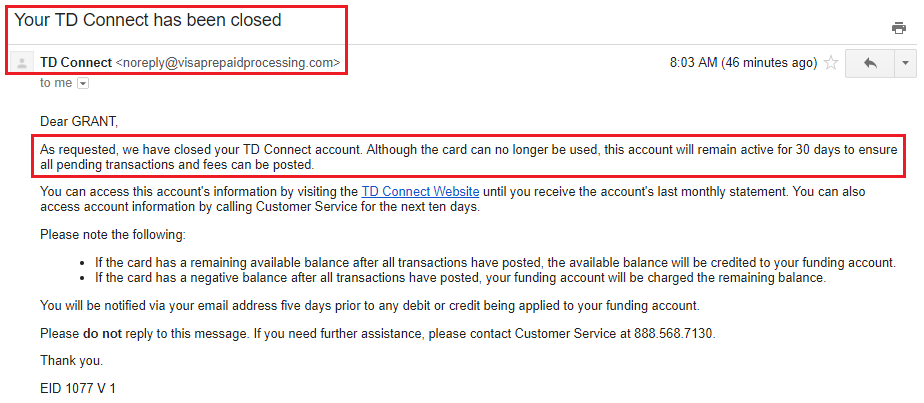

The following day (on January 4, 2018), I received another email from TD Bank telling me my TD Bank Connect Card was closed, “as requested” – not by me!

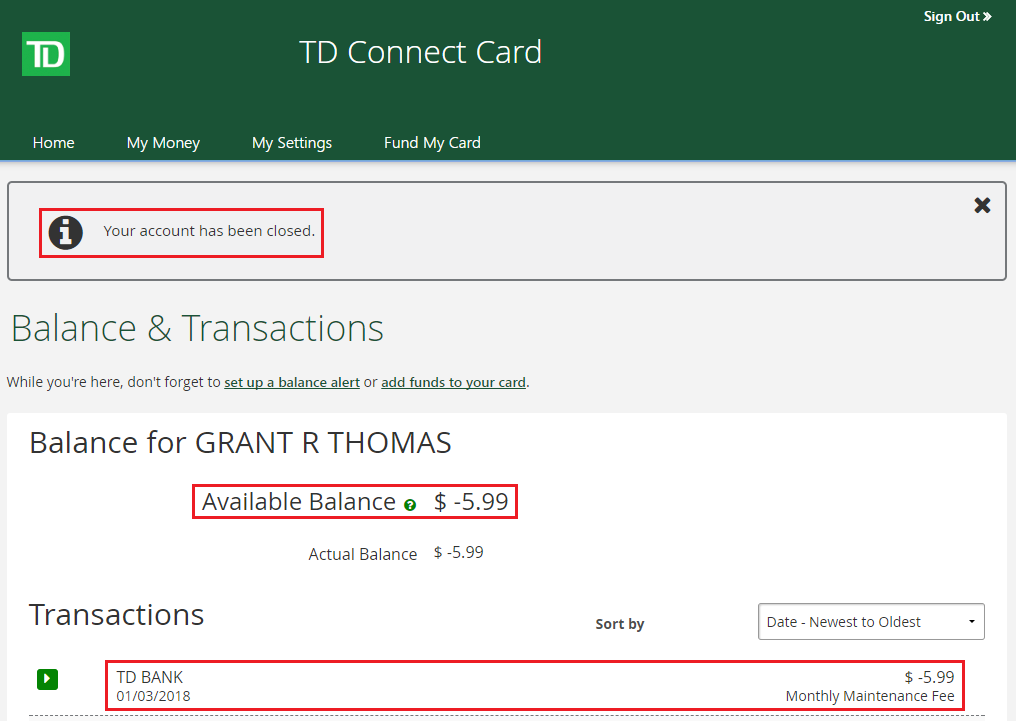

My account still had a negative account balance, but now there was a note at the top of the page that my TD Bank Connect Card was closed.

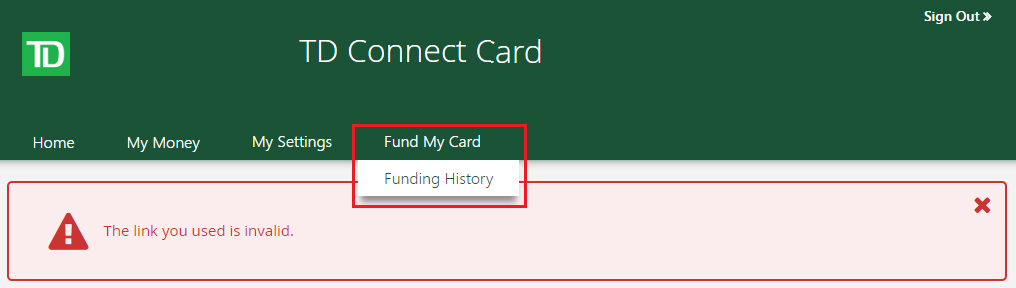

When I clicked the Fund My Card tab, I got the following error message.

Oh well, it was a good run. Thank you for helping me meet the minimum spend on my TD Bank Aeroplan Credit Card and for racking up some Aeroplan miles. Now I just need to find a good use for Aeroplan miles. If you have any questions, please leave a comment below. Have a great day everyone!

Since I grew up on the border, I know the popular belief about how generally Canadians are just really nice guys is largely a myth, but still ….. OK, we think you’re using your card for fraudulent activity so we’re going to close it, but here’s a month’s free ride so do you best until then. Gotta love it. I’d also probably cut them a check for $5.99, lest the vengeful gods of Chexx interfere with future bank account opening bonus activity.

I don’t think the debit card is associated with the Chex system, so I don’t think I need to worry.

Seems like Canada now has a RAT infestation. First, the RATs took over Delta in Atlanta (then chewed the electrical cables and shut down the airport), next the RATs overran AMEX, then they terrorized Chase Bank customers 24 by 5 (woulda been 24 by 7 if RATs worked on weekends), and now these evil cousins of Willard’s Ben have scurried to the Great White North and infested Toronto Dominion (TD). Let’s hope that the trappers up there will finally catch this swarm of vermin, tan their furry little hides and turn them into Naked and Afraid RAT-Kabobs. :)

Say it ain’t so. Let’s run all the rats out of town!

C’mon Grant, brag a little. How many miles did you rack up over how many months?

I have ~40k Aeroplan miles, but 25k came from the TD Bank Aeroplan Credit Card sign up bonus, so I MSed ~15k miles. Not big numbers by any means and I still have no idea what I am going to do with ~40k Aeroplan miles.

How much did you load onto the Connect card at any one time?

$1,500 max. That is what my cash advance limit is on my TD Bank Aeroplan CC. The charge went through as a cash advance, but posted as a purchase and earned miles.

How were you able to get a TD Bank account, credit card and prepaid debit card? I thought the TD Bank account bonus is only available in certain states on the east coast. If any of those deals are available nationwide, then I might try to get them myself.

https://www.doctorofcredit.com/best-bank-account-bonuses/#TD_Bank_up_To_300_Checking_Bonus_CT_DC_DE_FL_MD_ME_MA_NC_NH_NJ_NY_PA_RI_SC_VT_VA

I have an address in New York that I used and I applied for the checking account in person.