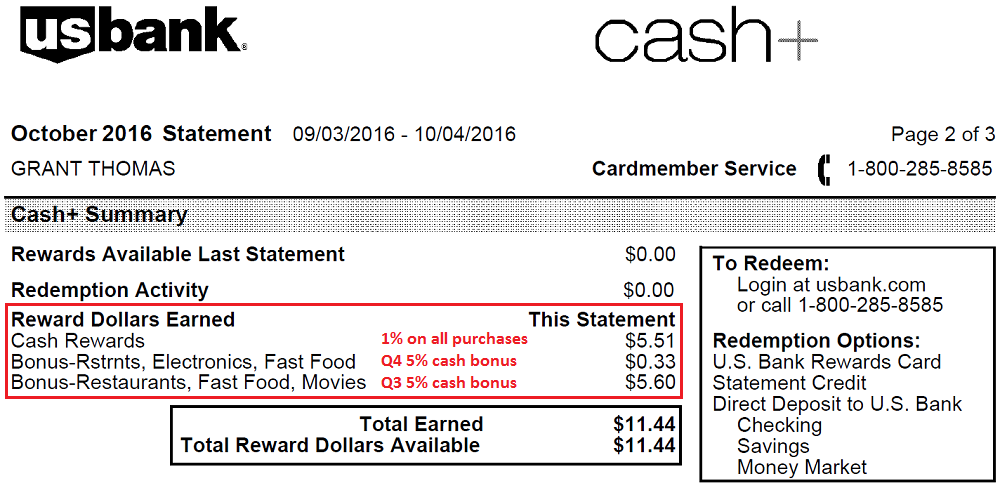

Good morning everyone, greetings from Maui. I just wanted to share a little trick I learned recently regarding my US Bank Cash Plus (Cash+) Credit Card. On my recent credit card statement, I saw 3 different line items for “Rewards Dollars Earned” (aka cash back), but I wanted to get a little more information regarding which transactions qualified for bonus cash back.

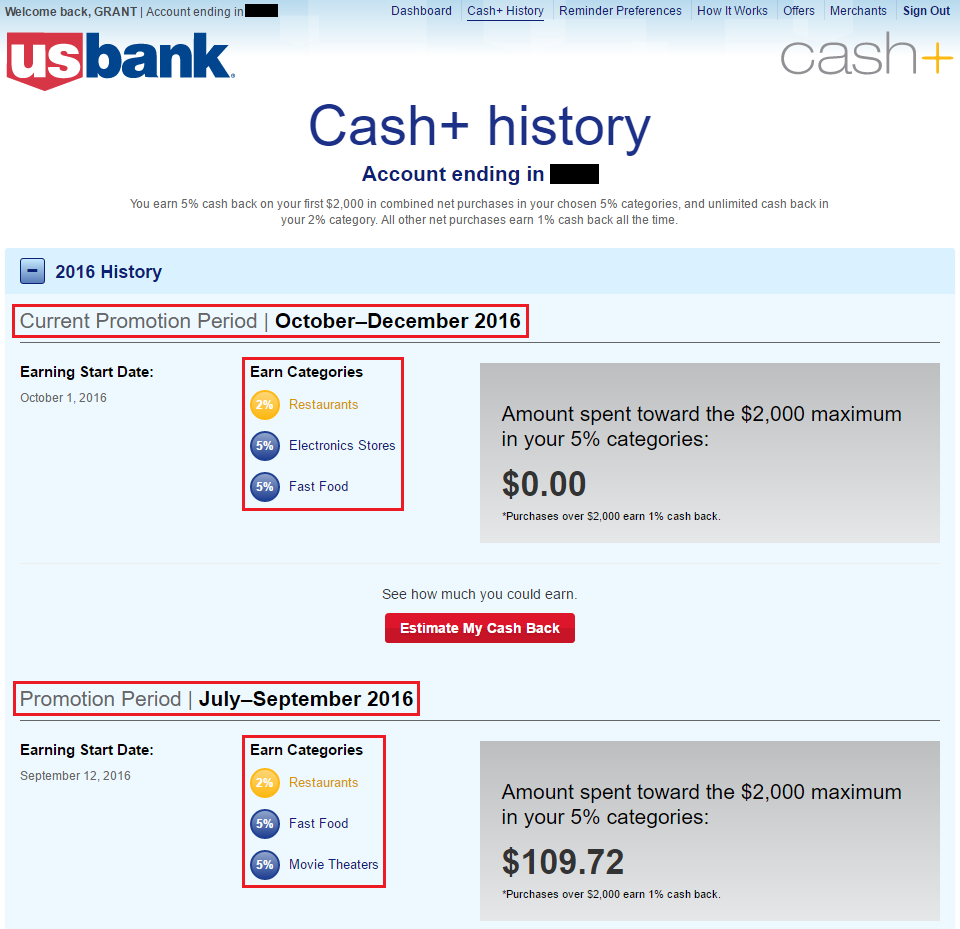

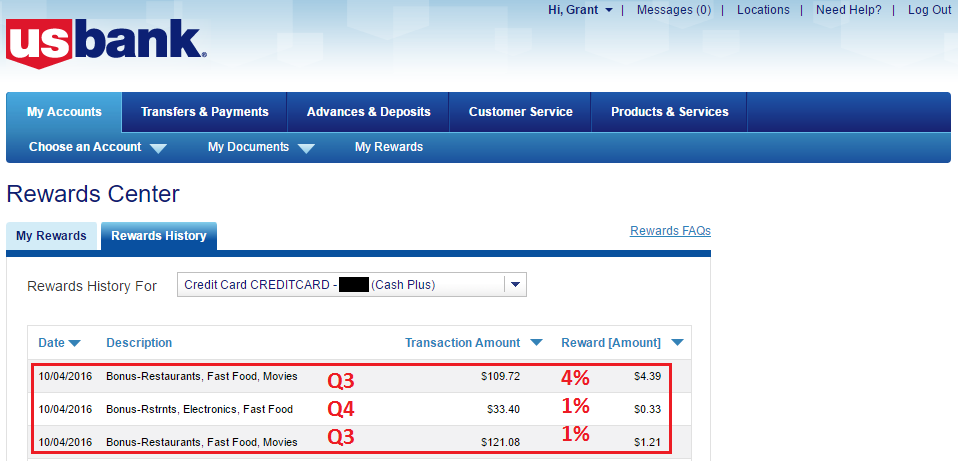

As a reminder, US Bank allows you to select two 5% cash back categories and one 2% cash back category every quarter. For Q3 (July, August, & September), I selected Fast Food and Movie Theaters for my 5% categories and Restaurants for my 2% category. For Q4 (October, November, & December), I selected Fast Food and Electronics Stores for my 5% categories and Restaurants for my 2% category. I wanted to see which purchases counted as restaurants (2% cash back) vs. fast food (5% cash back). If you selected different categories, you can follow the same steps below to identify qualifying purchases for your bonus categories.

To select your cash back categories or see which categories you selected, log into the US Bank Cash Plus portal. You can also see how much cash back you earned each quarter.

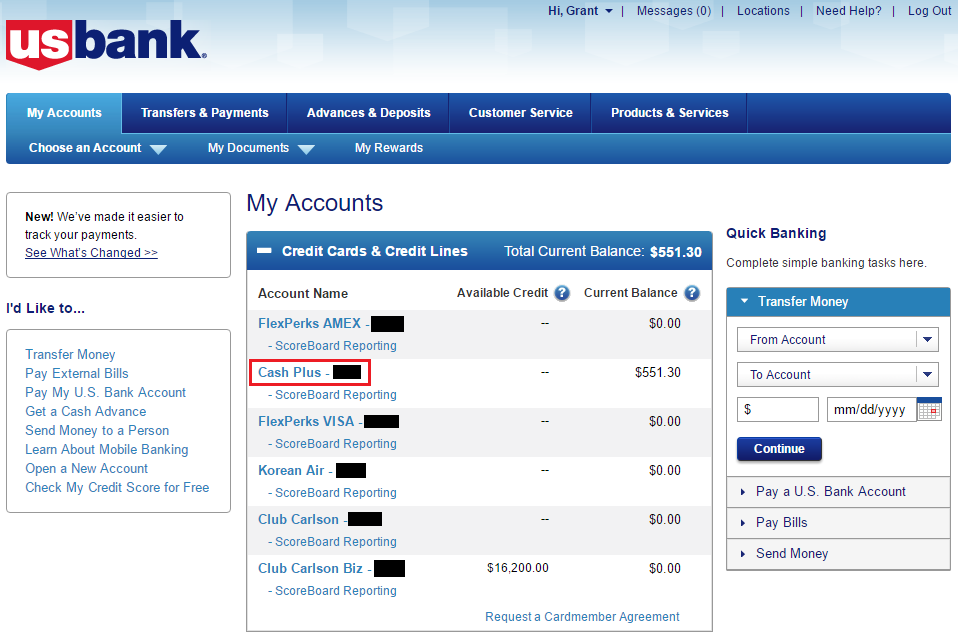

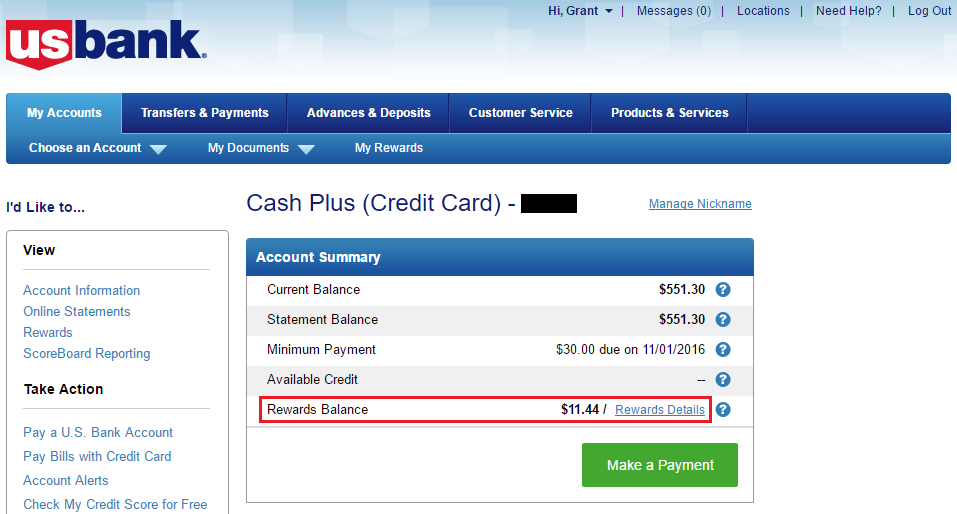

To get a deeper dive into the cash back transactions, log into your US Bank online account and select your US Bank Cash Plus Credit Card. Fun fact: you can rename the credit card default names to make them easier to identify.

At the top of the account page, you will see your current Rewards Balance (aka cash back balance).

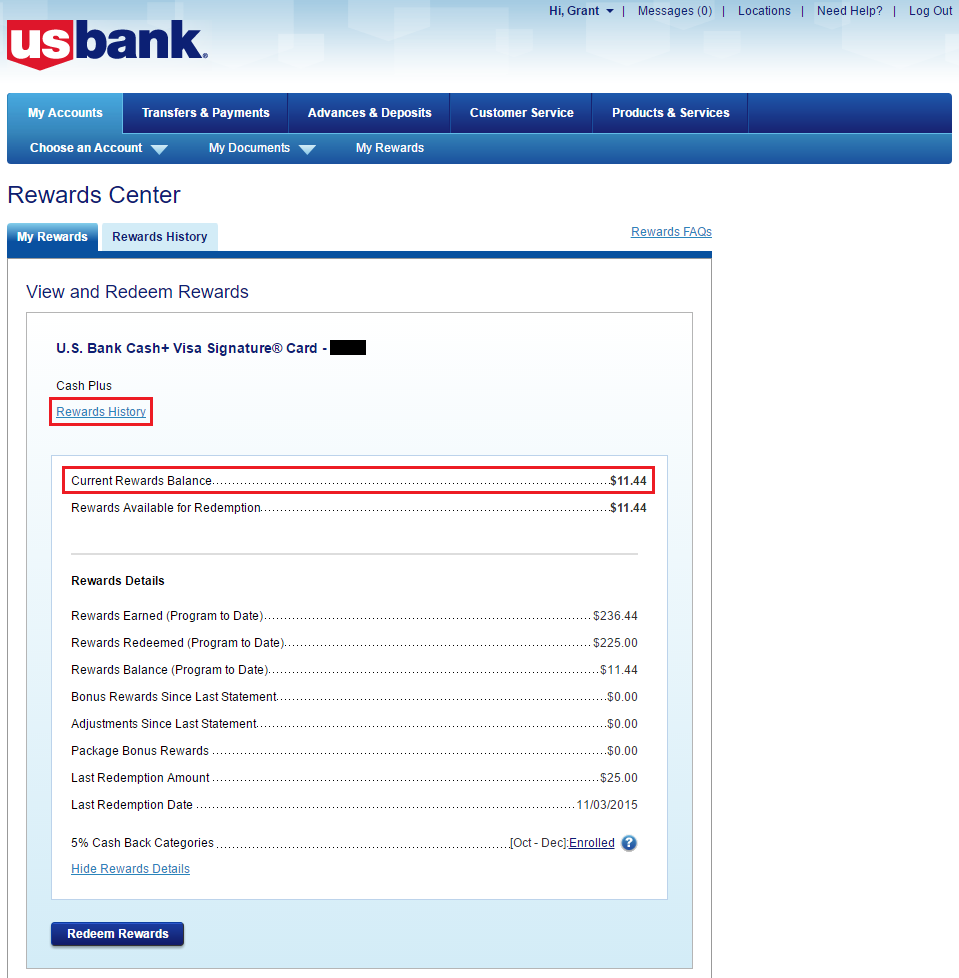

On this page, you can see a breakdown of how much cash back you have earned and redeemed with the credit card. If you click the Rewards History link, you can see more details.

If you search for transactions that start with “Bonus”, you can find the bonus line items and see how much cash back you earned for each line item.

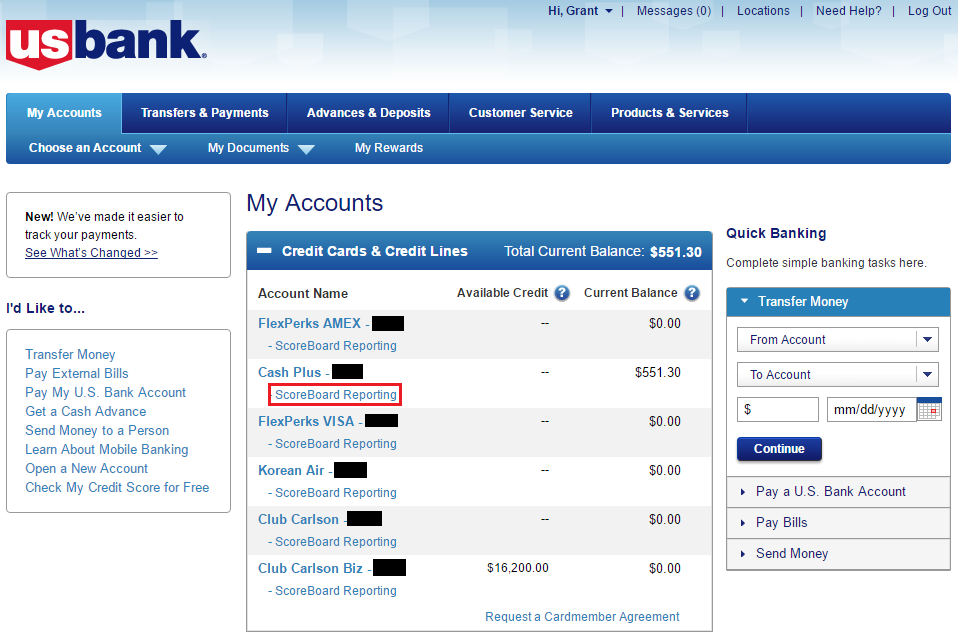

Another way to get more details about each qualifying transaction is to go back to your main US Bank online login and click ScoreBoard Reporting under your US Bank Cash Plus Credit Card.

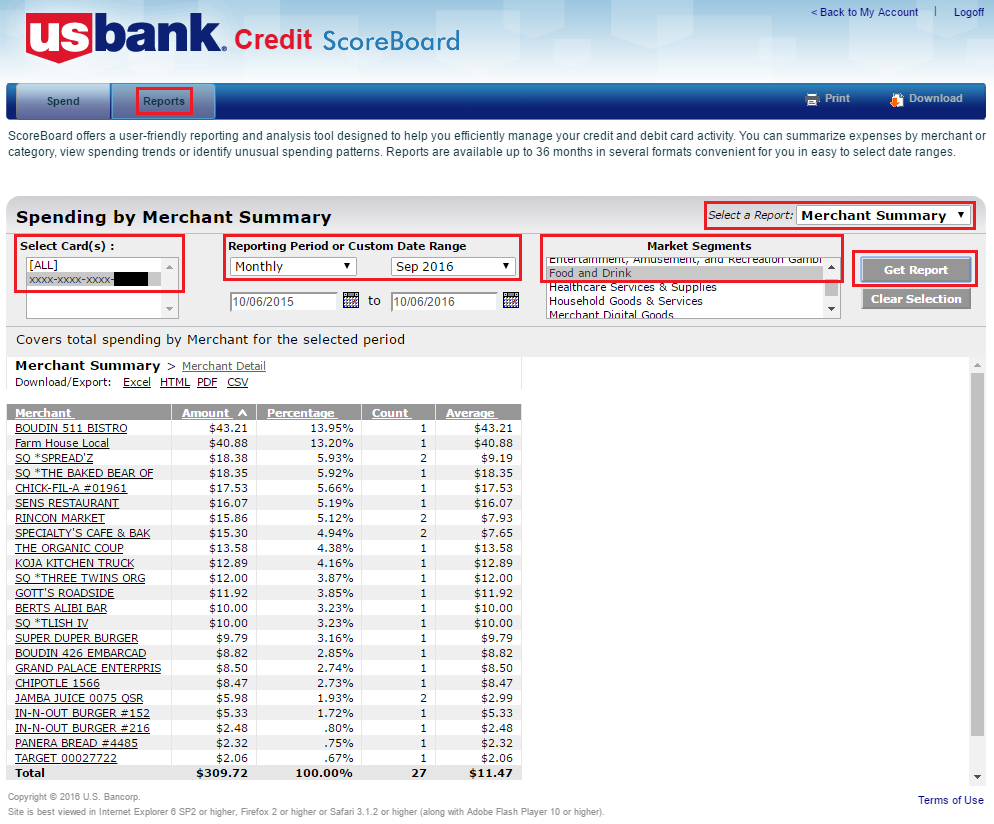

From here, follow these steps:

- Click the Reports tab

- Select Merchant Summary from the dropdown menu

- Select the US Bank Cash Plus Credit Card

- Select Monthly from the dropdown menu

- Select the month you want to view from the dropdown menu

- Select the Market Segment (Food and Drink) from the dropdown menu

- Then click the Get Report button

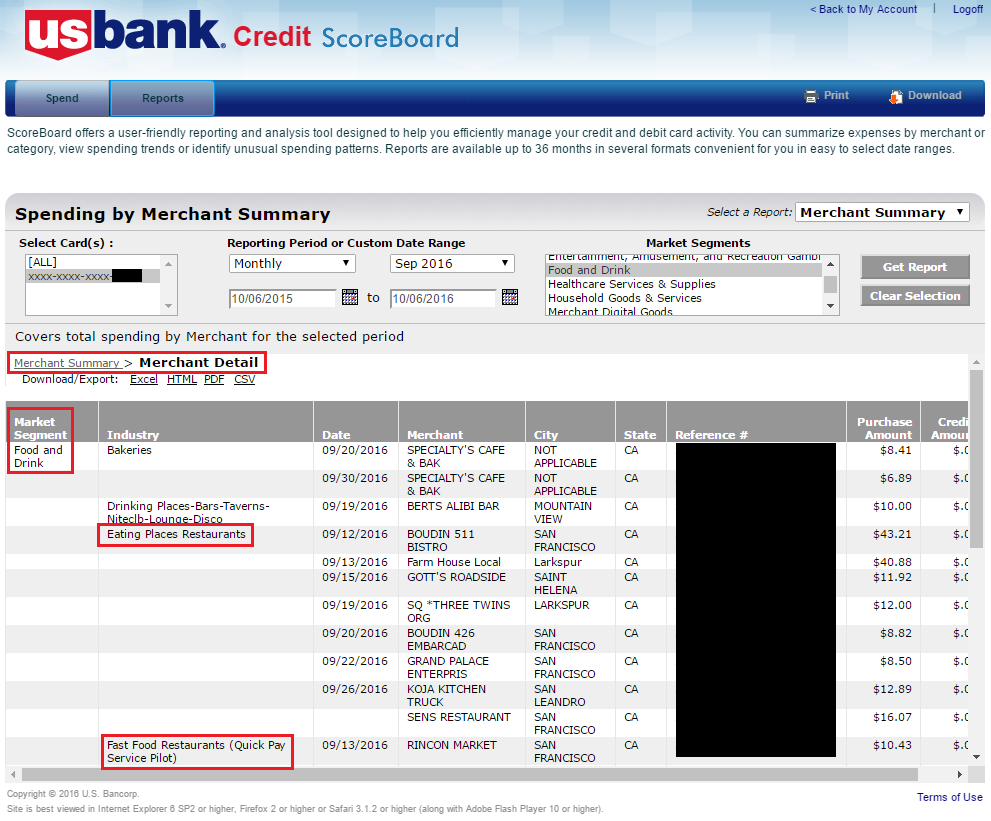

The last thing you need to do is click the Merchant Details link right above the report. From here, you can see all purchases from September 2016 that fell into the Food and Drink market segment. I think only “Eating Places Restaurants” and “Fast Food Restaurants” count as bonus categories. Other food-related industries do no count. If you add up all the purchases in your bonus categories, multiple them by 4%, you should get the same amount of cash back from the Rewards History section above.

I’m not sure if this step by step guide is super helpful, but I thought it was interesting. If you have any questions, please leave a comment below. Have a great day everyone!

Good morning Grant. I’m glad to hear that you have embarked on another trip, and this time it’s to the beautiful state of Hawaii!

Hawaii has always been one of my favorite places to visit. My fiancée and I are able to get flights there pretty easily through various rewards programs. However, getting a reward hotel is hard. They cost too much points and not worth it (the points could be used somewhere else for a lot more value). So we always end up staying at mediocre hotels and just pay around $150 per night, which gets expensive :(

I hope you can shed on light on how to stay in Hawaii with points or other inexpensive ways.

Lastly, I hope you will have lots of fun in Hawaii!

Hi Erik, Hawaii is awesome, as expected. No doubt, hotels are expensive here. If you come in the shoulder seasons (not summer, spring, or winter school breaks), the prices tend robbery cheaper. On Maui, I’m staying 5 nights at the Westin Kaanapali Villas on a hotel package ($800 + 5 day Avis car rental). On Kona, I’m staying at the Hilton Waikoloa Village using cash and points the first 2 nights and then 3 weekend night certificates from the Citi Hilton HHonors Reserve Credit Card sign up bonus and annual free night after spending $10,000 (I have 2 cards). The state still cost money, but they are much cheaper than the retail rate.

If you log in to your Cash+ card account, and click Download Transactions next to account activity, you can get the Merchant Category Classification code for each transaction directly.

Open the CSV file with Excel. In cell F2, paste “=LEFT(RIGHT(D2,13),5)” (without quotes).

Highlight F2 down to where your transactions end and Fill Down (Ctrl+D).

Click Sort & Filter -> Custom Sort, and sort by (Column F).

Here is a list of the MCCs: http://www.dm.usda.gov/procurement/card/card_x/mcc.pdf

5812 and 5813 count as restaurants. 5814 is fast food. I’ve run across 5462 (bakeries) and 5499 (misc. food stores) as well, but haven’t determined if they count as restaurants, most likely not.

Here is Visa’s site for determining MCCs by location: https://www.visa.com/supplierlocator/search/index.jsp

Great work Mike, that is a very helpful tip. It all comes down to the MCC that the merchant uses.