Good morning everyone. A few weeks ago, Bank of America changed their rules in terms of approving new personal credit card applications. Doctor of Credit has a very good post about the new “2/3/4 Rule” which he states that Bank of American will “only approve you for at most two cards per rolling 2 months, three cards per rolling 12 months, and four cards per rolling 24 months. Let’s call this the ‘2/3/4 rule’.” Luckily, Bank of America business credit cards do not count toward the “2/3/4 Rule.” The comments and data points from that post are pretty conclusive, so instead of fighting the new rule, let’s see how we can play with this new rule.

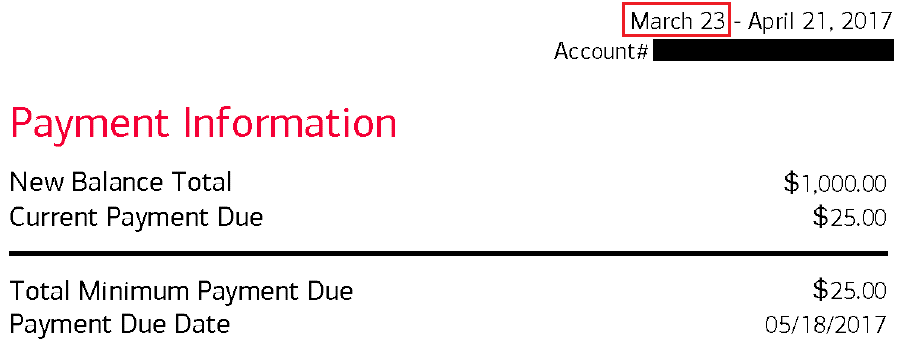

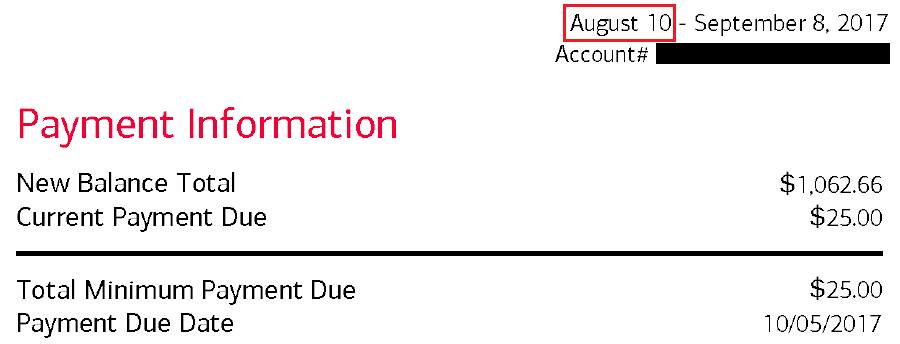

I am OCD and I save all my credit card statements for every credit card from every month. I have statements for all my open and closed credit cards. I wanted to find out the opening date for all my Bank of America credit cards, so I opened the first statement for each credit card and looked at the first date printed on my statement. For example, I am pretty confident my opening date is right around March 23, 2017, for the credit card on the left and August 10, 2017, for the credit card on the right.

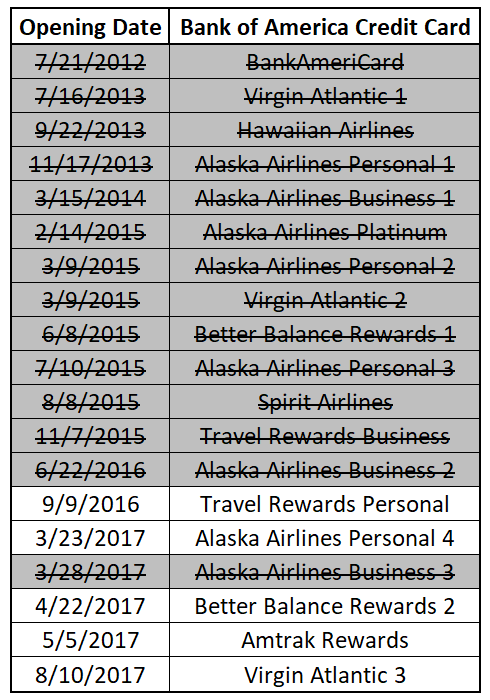

- Left table: I then plugged in all my Bank of America credit cards (both personal and business) into a spreadsheet along with the opening date. The table is sorted by credit card name.

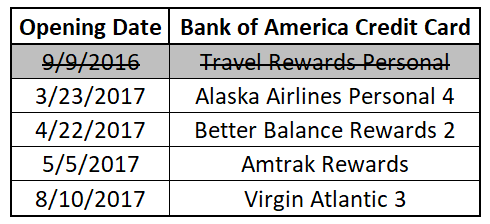

- Right table: I then sorted the table by the opening date (form oldest to newest).

- Left table: I then crossed off all the credit cards I applied for more than 2 years ago. Since today’s date in October 25, 2017, I crossed off all credit cards that I applied for before October 25, 2015.

- Right table: I then crossed off all business credit cards because those credit cards are not affected by the “2/3/4 Rule”.

- Left table: I was then left with 5 personal credit cards.

- Right table: Since the “2/3/4 Rule” only looks at your last 4 credit cards, I removed the oldest credit card.

As you can tell, I got 4 Bank of America personal credit cards since March 23, 2017. Based on the “2/3/4 Rule,” I cannot have more than 4 personal credit card approvals in the last 2 years, therefore, I cannot apply for another Bank of America personal credit card until after March 23, 2019. Ouch! For fun, I calculated my 2 credit cards in a rolling 2 month period and 3 credit cards in a rolling 12 months. I am outside the 2 month rolling period, but my 12 month rolling period would reset on April 22, 2018. All that is meaningless since I am really screwed by the 4 credit cards in a rolling 2 years.

I hope this process helps you better determine when you are eligible for Bank of America personal credit cards. Until March 23, 2019, I plan on applying for a few Bank of America Business credit cards and I hope business credit cards are not going to be added to the “2/3/4 Rule.” If you have any questions, please leave a comment below. Have a great day everyone!

How rigorous is the Bank of America Business CC approval process?

I got instantly approved for my most recent BofA Alaska Airlines Biz CC, so I don’t think it is too difficult. Good luck on your next biz application :)

Thanks for posting this. Do you know how many BoA personal cards you can have open at one time? I currently have 6.

I don’t think there is maximimum number of CCs that BofA will approve you for. I know people that have more than 10 BofA CCs.

You’re a tracking guru Grant!!

Thank you Bodie, great seeing you in Chicago this past weekend as well :)