Reminder: I am hosting a Miles and Points Meetup today (March 14) in San Francisco at 12pm. If you are interested in joining me and other miles and points collectors, please read this post.

(Hat Tip to Miles to Memories)

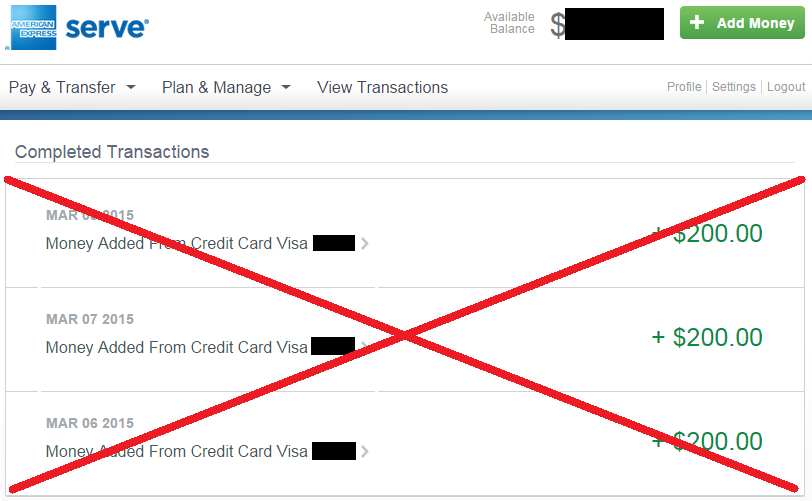

Good morning everyone, I have some bad news. For those of you with an American Express Serve Card (or SoftServe Card), you will only be able to use American Express credit cards for online reloads starting April 16. According to this sentence on Serve’s website (link):

Note: Starting April 16, 2015 you will only be able to use an American Express® Card if you want to load your account with a credit card. Discover, MasterCard and Visa credit cards will no longer be supported after April 16.

The reason this is bad news is that you *do not* earn any miles, points, or cash back when you use your American Express credit card for online Serve / SoftServe reloads. The purchases do count toward minimum spending, but nothing else.

Thankfully, American Express gave us some time to react to the news. From now through April 15, you can continue to use your Visa, MasterCard, Discover, and American Express credit card for online Serve / SoftServe reloads. One caveat though, some credit cards will charge you a cash advance fee, so please read this post to learn which cards are safe for online credit card reloads. In general, use a Chase or Barclays credit card to avoid cash advance fees.

Since this change is occurring mid-month, you will have plenty of time to complete your April credit card reloads to your Serve / SoftServe Card. After that point, I would probably drain my Serve / SoftServe Card and switch to a Redbird Card, if available.

Please take 5 seconds to answer the following 2 poll questions. You can choose more than 1 answer, if it applies to you. Thank you for your input.

It looks like American Express is slowly trying to kill off the Serve / SoftServe Card. It will be interesting / nerve-racking to see what American Express changes next to Bluebird and Redbird Cards. Every change is negative and makes these cards harder and harder to use.

If you have any questions, please leave a comment below. Have a great day everyone.

Will it affect WM VGC loads?

In-store VGC reloads are a different story. Some stores will start enforcing the “no gift card” policy, but other stores will continue working.

I’m hopeful that i can continue loading with my Fidelity Amex to earn 2% cash back. If not, I’m switching to Redbird!

The word on the street/blogosphere is that AMEX credit cards issued by other banks will still earn miles/points/cash back. I hope that is still true after April 16.

Scary. Hope they don’t mess with our cherished Redbird next!

I have no inside info on the matter, but I think the next Redbird “enhancement” will be to limit in-store credit card reloads to only $1,000. It is probably coming, so don’t be surprised when AMEX announces the change.

I hope this is just an Amex thing and not WM shakeup but we all know thats coming also.

There hasn’t been many “enhancements” to Bluebird in a while, so I wonder what AMEX is working on…

Darnit … There goes my 1600 miles per month of MS on Barclay arrival. Small beans I suppose for some ppl, but still means free lunch for 2 days each month.

Free money is free money, no matter how big or small.

Saddening news, but such is the world of manufactured spending. I currently have a serve account in my name and a redbird in my wifes name. I’m tempted to convert my serve to a redbird but I don’t want to put all my eggs in one basket so to speak. I still enjoy being able to load gift cards onto my account at family dollar or walmart, and there’s not always a target nearby. Between walmart, family dollar and target, there should always be something nearby where I can load my cards. Plus maybe they will leave serve as it is and start making some changes to redbird sometime soon who knows.

Diversification is important to me in investing and manufactured spending.

Diversification is important but you can always switch between the reloadable cards if things change.

Grant, thanks for the poll. I suggested the idea on FT yesterday (not saying you read my comment) that it would be great to see some figures about the percentage of MS/points bloggers who have been aware of the generous REDcard (Redbird) limits but have still been on the fence about switching to REDcard, and also how those numbers might change with this announcement.

My prediction is that a significant number of people who have “been on the fence” about trading Serve/Bluebird for REDcard will make the switch now in advance of the April 16 deadline and we can’t say for sure that Amex didn’t intend this. I’m curious of (impossible to get) internal Target and Amex figures and why American Express made the decision to stop credit card loads to Serve now (as opposed to before or after). Someone not long ago made a comment that Amex was wanting to curtail credit card loads to Redbird but Target wanted to keep it as is and had agreed to share with Amex some of the fees it incurs due to it. I take any anonymous comment on the internet with a grain of salt, but still the timing of this is interesting.

I personally use 3 Redbird accts and don’t really see the rationale of foregoing the opportunity to use the current $5K/month Redbird limit for fear that in the future it might not be there.

I’m biased because I also sell online the temporary Redbird cards for people to register with and get the permanent card in their name, since most Target stores still don’t have the temp cards available. On that note, if anyone is interested pls email me at NoonRadar@gmail.com. I am not affiliated with this blog or any other major MS blogs. I do have many references on other MS blogs from people who got the Redbird from me.

I got a Redbird card from NoonRadar and loaded in store today with no problems. NoonRadar saved me a very long drive to my nearest store in a fast and affordable manner. Thanks!

Glad you are enjoying your Redbird Card!

A question and a comment: is fidelity Amex 2% cb the best card to use for this going forward?

Online debit still works so don’t forget $1500 in reward debit spend on soft card serve

As far as I know, reward debit cards will still work fine, but I don’t know many other AMEX CCs issued by other banks that have decent rewards.

Do you happen to know wether the serve card can be loaded by the Amex for target reloadable prepaid cards?

Great question, I have never tried. Test it out and please let me know if it works. Thank you.

Anyone know if you can load American Express gift cards to the Serve card at Walmart or online?

I believe you can only load Visa and MasterCard gift card inside Walmart, but you can load other credit cards online (no gift cards).

I heard that walmart no longer lets you do it? Since last year?

http://millionmilesecrets.com/2014/06/23/you-can-no-longer-load-vanilla-visa-cards-to-bluebird-at-walmart/

Yes, OVGCs are blocked by Walmart, but other Visa and MasterCard gift cards still work. Look for gift cards from US Bank or Gift Card Mall.

I switched after the Serve MS was curtailed. I actually ordered 4 cards over the past month online from user noon radar so if you’re interested but don’t have Redbird available in your state, I suggest doing that.

I’m planning a trip to Mexico and I was wondering if I’d be able to use my Amex Serve in Mexico?

Technically yes, but there are many merchants that charge a large fee for accepting credit cards (somewhere around 15% or so), so it might not make sense to use a credit card at those merchants.

Hello, just a quick reminder that I still do provide temporary activated Redbird cards info via email for a small fee. I’ve done it for hundreds, see this fore details & reviews: https://plus.google.com/u/0/+NoonRadar/posts/DTLVuZFe3Bp

In the next couple of days I will also update the guide to loading Redbird with gift cards, it will include step by step instructions on loading Redbird at registers with the new software after the POS upgrade: https://plus.google.com/u/0/+NoonRadar/posts/QZ1eCSFrdCG

My local Target got the POS update, so I will try to document the screens in a blog post.

Grant, my local Target stores just upgraded also, I loaded today to see the process and wrote a step by step guide: https://plus.google.com/u/0/+NoonRadar/posts/82eSPgNCGi5

When you load also, let me know if I missed something. I tried to remember everything as best as I could. Thanks.

I’ll check tomorrow at my local Target but I’ll check out your guide now. Thanks for the link.