Good morning everyone, I learned from Doctor of Credit that the Citi Prestige® Card online offer increased the sign up bonus from 30,000 Citi ThankYou Points (TYPs) to 50,000 Citi TYPs. I was planning on applying for the 60,000 Citi TYP offer in a Citi Branch, but then I started to have second thoughts. Which offer was better?

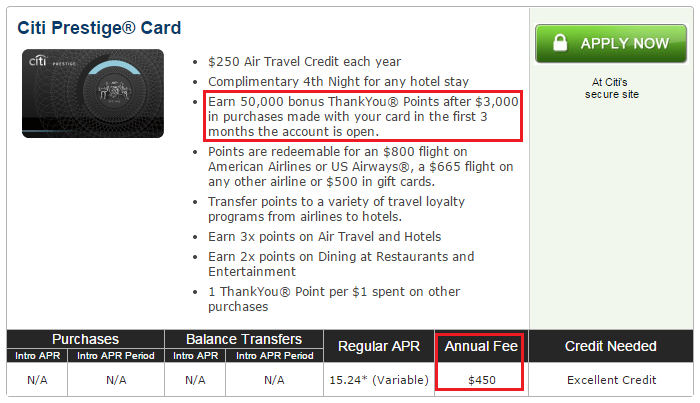

The current best online offer for the Citi Prestige® Card offers 50,000 Citi TYPs after spending $3,000 in 3 months and paying the $450 annual fee. All the other benefits are the same as the in-branch offer, so look for all the benefits at the bottom of this post.

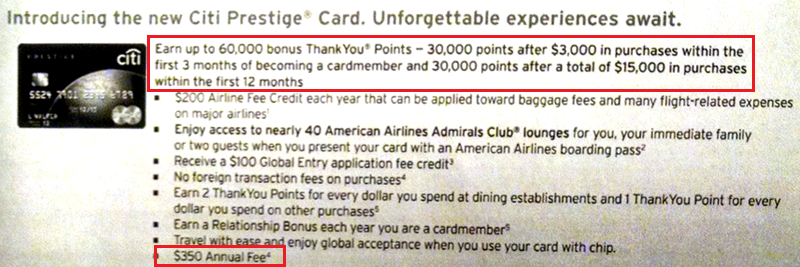

The Citi in-branch offer has a slightly different offer. You only get 30,000 Citi TYPs after spending $3,000 in the first 3 months, but you can get another 30,000 Citi TYPs after you spend another $12,000 in the first 12 months. The annual fee drops to $350, but you *need* to have a Citi Gold Checking account to get the in-branch offer.

Before I compare both offers, you need to ask yourself these questions:

- Are there any Citi Branches nearby?

- Do those branches have the in-branch offer? (Call a few branches and find out.)

- Do you want the hassle of signing up for a Citi Gold Checking account? (The entire process takes about 2 weeks to complete.)

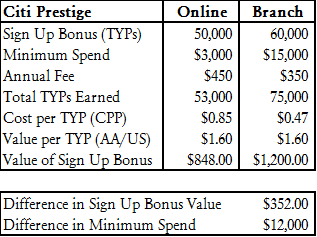

Assuming you said yes to all 3 questions, here is the comparison table:

Let me explain the table a little bit. After completing the minimum spend for both cards ($3,000 for online, $15,000 for in-branch), I added those Citi TYPs to the sign up bonus to get the total number of Citi TYPs earned for each offer. I then divided the annual fee by the number of Citi TYPs earned to get a CPP (cent per TYP / cost per TYP), since you are essentially buying a big chunk of Citi TYPs for $350 or $450. Using the Citi TYPs for travel on American Airlines and US Airways will probably be my only use for these Citi TYPs, so I put a fixed value of 1.6 cents per point (CPP). After multiplying the total number of Citi TYPs earned for each offer and multiplying them by 1.6 cents, the true sign up bonus value is $848 for the online offer and $1,200 for the in-branch offer. You will then need to subtract the annual fee and add in the value of all the perks the credit card offers. I did not calculate opportunity cost or cost to complete the minimum spend, so you may want to consider that as well.

Here are all the current perks of the Citi Prestige® Card:

- $250 Statement Credit for Air Travel each year ($250 off airline tickets every year)

- Complimentary 4th Night for any hotel stay (pay for 3 nights, get your 4th night free)

- Complimentary access to nearly 40 American Airlines Admirals Club® lounges, plus hundreds of VIP lounges through Priority Pass Select (includes complimentary access for all family members or 2 guests for every visit)

- Complimentary greens fees at more than 2,400 public and private golf courses around the globe

- Points are redeemable on American Airlines or US Airways at 1.6 CPP

- Transfer TYPs into miles with transfer partners (Cathay Pacific, EVA, Etihad, Air France / KLM, Garuda Indonesia, Malaysia, Qantas, Qatar, Singapore, Thai, & Virgin Atlantic)

- $100 Global Entry application fee credit ($100 fee will be reimbursed by Citi)

- No Foreign Transaction Fees on Purchases

- Earn 3x TYPs on Air Travel and Hotels

- Earn 2x TYPs on Dining at Restaurants and Entertainment

- Earn 1x TYP on other purchases

With that said, I will apply for the Citi Prestige® Card in my local Citi Branch on Saturday morning. My Citi AA Executive Credit Card just posted the $450 annual fee, so I will just move the entire credit line from that credit card to the Citi Prestige® Card.

If you have any questions, please leave a comment below. Have a great weekend everyone!

P.S. If you plan on applying for the Citi Prestige® Card online, please consider using my credit card link. Thank you for your support!

Hey Grant, great post!

You didn’t mention that you will get 30,000 AA miles with your CITIgold bank account!

I live in TX where we have no CITI bank branches, but I read of people just calling a branch to get an app done for the CP CC. So, when you go in tomorrow, could you ask for additional apps for your friends please?

Additional apps for what, the Citigold Checking Account? I applied over the phone and the rep entered a special number to get a bank account bonus. That bonus hasn’t posted yet, so I am not sure if the code the rep used worked.

No, not the CG app, the app for the CITI Prestige 60,000 point card from the branch!

Oh ok. I’ll see if they will give me some extras.

Thanks Grant. I already have my CITIgold bank account set up and the let me fund it with a CC. I plan on getting the “in branch” deal in any case. I’ll MS the $15K with REDbird which brings me to my next question. Do CITI CC’s code as a purchase when you fund the REDcard at Target?

Yes. All credit cards code Redbird reload as a purchase.

Is 22k more TYP worth $140 to you?

Basically it comes down to that. Your charts a little complicated and you forgot to account for cash back you would have earned if you were to spend $12000 for the minimum spend.

For example, the extra $12000 in minimum spend, you would have put on another credit card anyway, which might have earned 2% cash back = $240.

To break it down:

The In branch offer gives you 22k more TYP at a net “cost” of $140 ($240 of forgone cash back, offset by the $100 lower annual fee).

That is a good point. The extra $12,000 in spend does have an opportunity cost that needs to be considered.

The math is a little flawed. If you compare spending 15K with both offers to make it more equal then the online offer the cost of the points come to .6 vs .47 cents.

True, the more spending you put on both cards (assuming no increase in cost) will drive down the CPP for each Citi TYP.

Don’t both cards need to be open 6+ months in order for you to move CL around?1

Not for Citi. I think you can move credit around whenever you want. Just call them and ask to move credit around.

They’ve only gotten better at this recently, but I think you still will have issues moving CL to totally different product lines. I can’t move CL from my TYP to Hilton card.

Hilton is the exception. I have a separate login for just my Citi Hilton HHonors Credit Card.

Maybe not a big deal to some, but i would say that annual fee of $100 less is pretty big savings in the “long term”.

If you plan on keeping the Prestige for many years, the $100 savings is a good reason to apply in branch.

Value per TYP $1.60?

It should be 1.6 cents not $1.60. Sorry

How many different cards does Citi allow 1 person to have?

At the same time? I have 6 personal cards and no biz cards.

It’s hard pull if you move credit around other than at time of opening.

I think I moved a lot of credit around when I was on the recon call. Sucks that there is a hard pull. I think Bank of America is the same. Chase is the best though, no pull.

I have a Citigold checking account that has been open for about a month. My plan was to close it after the AA miles from the promo hit my acct. If I got the Prestige now and paid the annual fee, then closed the Citigold account in a few months, would I be on the hook for the extra $100? E.g. does the Citigold acct have to stay open?

I don’t think Citi will charge you the extra $100 AF. That is too complicated for their IT system.

Another option is to “downgrade” your checking account to a regular checking. When you do this, the system will continue to show you as a gold account holder.

Is the regular checking account fee free?

That’s what I want to know too.

Not free but easy to keep free either

A) 1 ACH + 1 Billpay

B) $1500 monthly balance

Easy enough.

Apparently if you have a checking account, the annual fee for the non-branch offer is only $350. Can anyone confirm this? This may change the calculus for you, and others.

Any Citi checking account?

I don’t know. Doubtful. Probably Citigold, but haven’t found confirmation.

what about the $$800 in tax form equivalent to the 30k Citi gold checking bonus Citi sends you to report to IRS? That kills the checking account deal?

Citi is not sending out 1099s for the AA mile promo. I can’t speak to the 40k TY point promo, though.

I think both offers are safe.

I don’t think the current Citigold Checking Account bonus will require paying taxes.

@Craig, For which AA miles promo Citi is not sending the 1099s?

The 30k AA requiring 2 bill payments and $750 in debit transactions. I confirmed with 3 separate CSRs that a 1099 would not be distributed.

You want people to use your credit card link. Yet I CANT find any. Your post should contain the link, make it easy for people to find. I dont want to hunt for it. Do it like MMS, put inside your post, underline it or whatever. Study Ben, mommypoints and see how they insert the link in the post, and do the same.

I do not have direct credit card links, just basic CreditCards.com links. I cannot link to specific cards, but all the links can be found here: http://travelwithgrant.com/credit-cards/

Have a great weekend.

Anyone know if you can get multiple Prestige cards like the Exec card and churn for multiple bonuses?

I’m sure that it is possible. PedroNY would probably know.

I’ve been wanting the prestige for a while but the only down side of it is it’s travel categories, or lack of. You only get points for airline and hotels compared to the Citi Thank You premier which recently changed the scope of “travel” to also include things such as car rentals, gas stations, travel agencies, taxi’s, cruise lines etc..

That right there is a huge difference in scope, hence why I haven’t jumped the gun yet.

It seems like a mistake for Citi to give their lesser card more earning potential than their Prestige card.

Since they are trying to be the Amex Plat-equivalent, it makes sense. The PRG is a much better card for everyday spend, while the Plat is for signup bonus and the associated perks. Same with Prestige/Premier.

The biggest mistake is the similarity of names. I can barely remember the difference and I have all three…Preferred/Premier/Prestige may sound great to a bunch of bean pushers, but it’s downright stupid as few consumers can be expected to know the difference. Better just to call them Silver, Gold, Platinum and then everyone knows which is the “best” card. Then role out the Black card for biggest suckers, er, “top spenders”….

I totally agree with you on the naming. Very confusion and hard to remember which card has which perks.

Pingback: Reminder: Sacramento Meetup Today at In-N-Out (12-2pm) | Travel with Grant

I applied at Citi Branch a month ago and got the $350 fee with tiered 30,000 point offer. All confirmed on phone with rep. I called a few days ago and swapped to the 50,000 point offer, so not 30,000 bonus at $15,000 now. Rather put the spend elsewhere and take the bird in the hand. I confirmed that only the promo bonus changes and the $350 annual fee remains. Affirmative and quick yes. I have no Citi banking relationship, just one other credit card. The lady told me as long as within 90 days, can swap promo offers.

Bottom line: You can get the $350 annual fee with 50,000 point promo with $3,000 spend if you want.

Now I can use some advice :)

My new Amex Gold Business promo is 50,000 points for $5,000 spend. I have Redcard and it works as you state – just test charged at Target and show as purchase. However, the terms and conditions clearly say “Eligible purchases do NOT include……purchases or reloading of prepaid cards or purchases of other cash equivalents.”

1) Has this terminology been on Amex cards for some time or is it now?

2) This clearly could be used to deny a promo bonus or points on spend. But everyone including Grant says no worries. I plan to RedCard the spend and see if the points hit and if not, can pay my 2nd quarter estimated taxes with the Amex to quickly hit the 5,000. Anyone have specific experience with RedCard and Amex bonus points?

3) Does the Prestige 3X travel include Gas now (April 19th I think officially) like the Premier? I thought they were making the categories the same, but the wording is a bit wierd. It would be great to have clarity on that from informed source.

Thanks for your time.

Jedi

Good idea in regards to the Citi Prestige offer, I may try that.

In regards to your AMEX PRG Biz Card, I think that terminology is on every AMEX credit card, so I think there is nothing to worry about.

This pic is from an upcoming post, but it has the new terms for the Citi Prestige after April 19: http://travelwithgrant.boardingarea.com/wp-content/uploads/2015/04/Citi-Prestige-Full-Offer-Details-Effective-April-19.png

Great news on Amex PRG, I can rest more at easy with RedCard. Regarding the link and post, that is what confuses me. The terms and conditions say Premier – those categories changing and more broad for travel. Is the Prestige doing the same? It does not read that way. Clearly says Premier.

Thanks for all the tips and strategy. This is going to be a fun year :)

This pick has the upcoming changes to the Citi Premier Credit Card: http://travelwithgrant.boardingarea.com/wp-content/uploads/2015/04/All-Citibranch-Offers-4-11-2015.png

Oooohhhh. I like that swapping of points offer. I’ll try that!

Go for it. It might be smart to followup with Citi to make sure the switch goes through properly.

Just left the branch. Signed up with the $350 AF (no Gold account–no Citi account at all), and I explained that I wished to change to the 50K sign up bonus. She didn’t seem phased, and said it wouldn’t be a problem, and to call as SOON as I received the card. WIN!

Nice job, glad you got the Citi Prestige with only the $350 AF.

Pingback: Citi Prestige MasterCard 50-100k points after $3,000 spend. - Page 15 - FlyerTalk Forums

Pingback: Hybrid Citi Prestige Credit Card Sign Up Bonus and Welcome Package | Travel with Grant