Good morning everyone, the title of this post may sound obvious, but let me explain some background info first. When my Citi American Airlines Executive Credit Card’s $450 annual fee posted, I called Citi and asked them to convert the card to a Citi Double Cash Credit Card. Unfortunately since the $450 annual fee had already posted to my credit card, I could not convert the card until paying off the $450 annual fee. After making a quick online payment from my Citigold Checking Account, I called back the next day to make the conversion.

Citi is strange with their conversion process. The entire “process” of converting a credit card takes about 51 days (I think that is what the rep said). During those 51 days, Citi will send out the new credit card, but the old credit card will still be active. During those 51 days, if I decide to cancel the conversion request, all I would have to do is call Citi and tell them to stop the conversion. If after 51 days, I have not called to cancel the conversion request, the old card would be closed and the new card would remain open, thus completing the conversion.

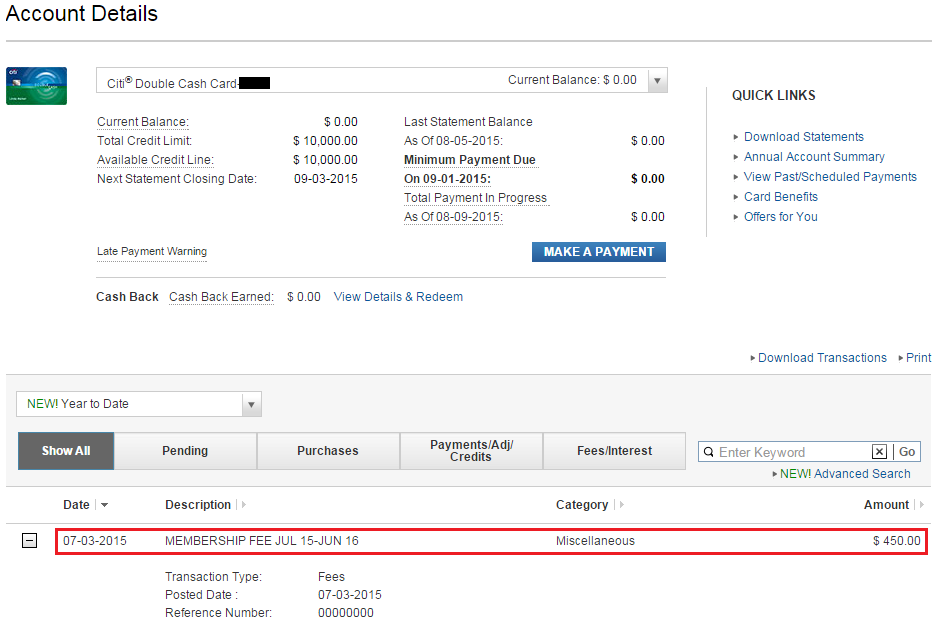

Long story short, on my new Citi Double Cash Credit Card, there is a $450 annual fee payment that I want refunded.

The $450 annual fee was paid in early July and my new Citi Double Cash Credit Card statement just closed in early August. I was hoping the $450 annual fee refund would appear on that statement. Unfortunately, it did not.

I called Citi and spoke with a helpful rep. I asked about the status of my annual fee refund and he did some research. Citi’s official policy is this: the annual fee refund would post within 1-2 billing cycles from the end of my conversion process. I asked when my conversion process would be officially completed and he said later this month. Then I asked if I would have to wait up to 2 months to get the annual fee credit, he said yes.

I politely mentioned that I paid the $450 annual fee on time, so I would like the $450 annual fee refund to show up sooner rather than later. (Bias alert: since I am a Citigold Checking Account customer, sometimes I get preferred treatment by Citi reps.) After placing me on hold for a few minutes to speak with a manager, the rep comes back and tells me that they can process the refund request immediately and it should show up in my account within 2-3 business days. Now that is more like it, Citi!

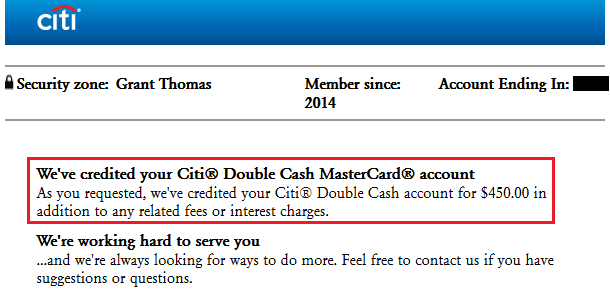

Shortly after the phone call, I received this email from Citi regarding the annual fee refund.

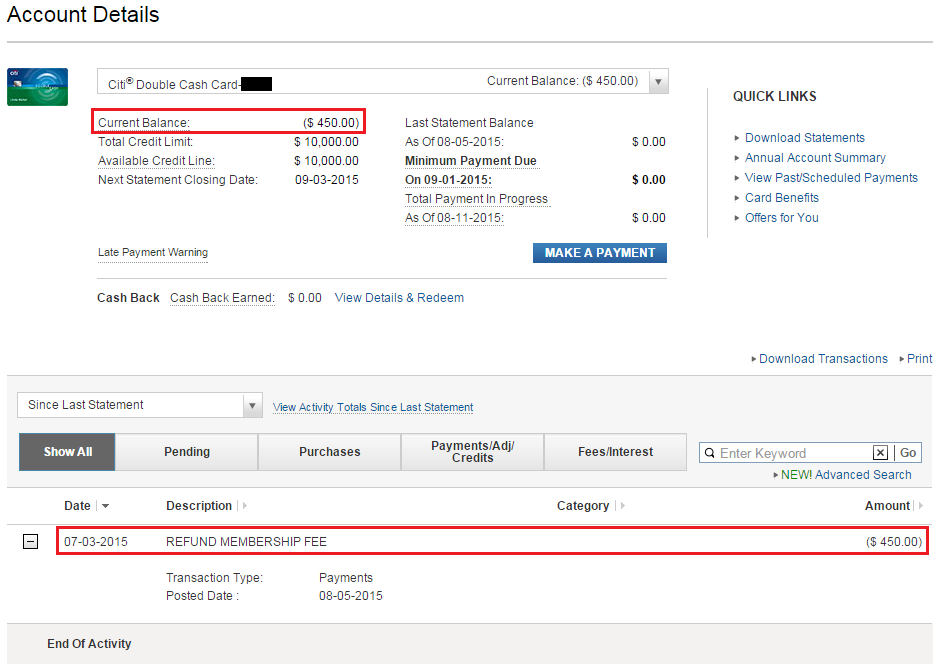

This morning, I checked my Citi online account and I saw a whopping $450 credit on my Citi Double Cash Credit Card. Interestingly, the annual fee refund has the same date as the original annual fee post date (July 3). At this point, I can either call in and have the $450 credit transferred to another Citi credit card, or I can keep the funds in this account until I make a purchase that I need to pay off.

I hope this post explains Citi’s credit card conversion process and encourages you to call Citi if your annual fee refund is taking longer than necessary to post. If you have any questions, please leave a comment below. Have a great day everyone!

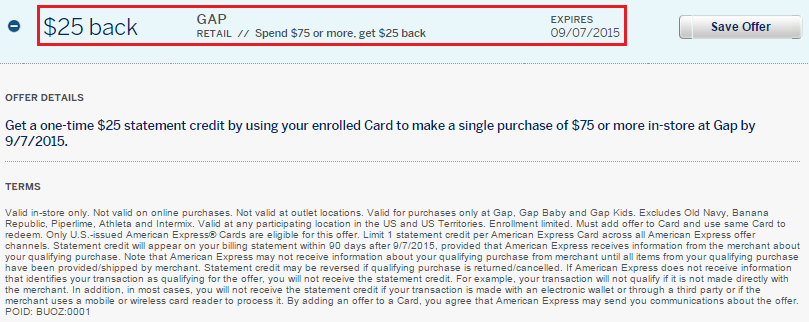

P.S. For blogging completeness, there is a new AMEX Offer from Gap: $25 Off $75 (#AMEXGap)

P.P.S. If you have been living under a rock (or sleeping in this morning), the AMEX SPG Credit Card has raised the sign up bonus from 25,000 to 30,000 Starpoints *go crazy!*

Glad that I read this. I will convert my AT&T Universal Card to Citi Prestige card and expect to pay $350 annual fees (as a citi gold client). Hope this conversion will be allowed and the sign up bonus with minimum purchase will also be honoured.

I wouldn’t recommend converting your Citi AT&T card to a Citi Prestige. You might not be able to get the sign up bonus. You might be better off applying directly for the Citi Prestige online or in-branch.

It took Citibank over 2 months to refund my $450 on my two AA Executive cards. I called several times to get this accomplished.

Bummer, sorry it took them so long. Did you close the cards or convert them to other Citi cards?

Citi being Citi, something doesn’t seem standardized across this process. My wife and I both had Citi exec cards that we converted to DC cards a couple months ago. When we called in to convert, the AF was refunded immediately and new DC cards were placed in the mail. While the new cards were in transit, we could use our old exec cards and purchases made on that card were automatically transferred over to our new DC cards.

Odd that they didn’t refund you immediately upon conversion.

Hmm, interesting data points. It looks like there is a big discrepancy on the annual fee refund policy.

I don’t know how but I often get attacked by web intruders when I first attempt to get on your website. One i tried to use you amazon link and it took forever so I quit out of it. Perhaps you have some kind of virus/ whatever attached to your site? Just wondering.

Hi Denny, thank you for the heads up. This is a Boarding Area ad network issue that affects all BA blogs. I’m sorry for the trouble and I hope the issue is resolved soon.

Grant: Like you, I cancelled my Exec, but I then replaced it with the Prestige. Having a Gold account gives you a $100 price break on the Prestige, which gives you (after the $250 “airline” credit) a net annual fee of only $100. Admirals Club access for only $100!

All your TYPs then become worth 1.6 cents for AA tickets . . . which is sort of like getting any flight/any time awards for 25,000 points . . . assuming the tickets are $400.

I converted another card, an old Diamond, to the Double Cash.

I actually applied for the Citi Prestige and moved my credit line from a different Citi AA Exec card :)

I converted my Citi Exec to double cash and the fee posted in the process. I got the fee refunded by sending a secure message and then a followup secure message.

Excellent, thanks for the data point, Carl. Glad your AF refund request was easy.

I had a nightmare conversion. It took multiple reps and a supervisor of a supervisor to get my $450 and a dozen email messages. But finally got the last manager to pull up both accounts at the same time and see they owed me back $450.

Good to hear you finally were able to get your conversion completed and annual fee credit.

How long did you have ur aa exec. card before converting to double cash card?

I had both Citi AA Exec cards for 1 year. I don’t think you can convert the cards before the 1 year anniversary.

Do you know if you can also downgrade the Citi Prestige card to the Double Cash card? Thanks!

I’m pretty sure you can downgrade any Citi personal card to a Double Cash card.

Thanks for the quick reply.

I just applied for the Prestige and was told that the AF bills after just a few cycles. Thought it took a year?

The AF is billed on your first statement, it’s not waived the first year.

Thank God I found this blog. I converted my Citi Prestige to a Citi Premier. After a week, I was wondering why the $450 AF refund and the new $95 AF were not posted. When I downgraded my Hilton Reserve to the no AF Hilton, I received the $95 AF refund a week later, but now I remember that CSR specifically stating the he would expedite the refund. I’ll have to call Citi about the Prestige downgrade and will post the results to provide another data point.

Sounds good, thank you Edward.

I called Citi to ask them to expedite my $450 AF refund. The refund posted overnight. So kudos to Citi customer service!

Awesome, thank you for the datapoint, glad you got your AF refunded right away.