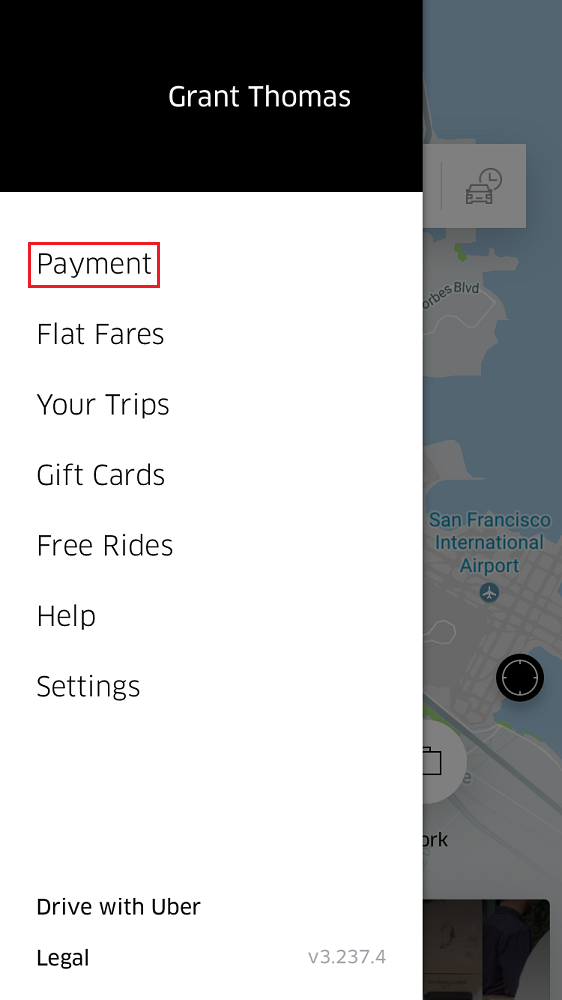

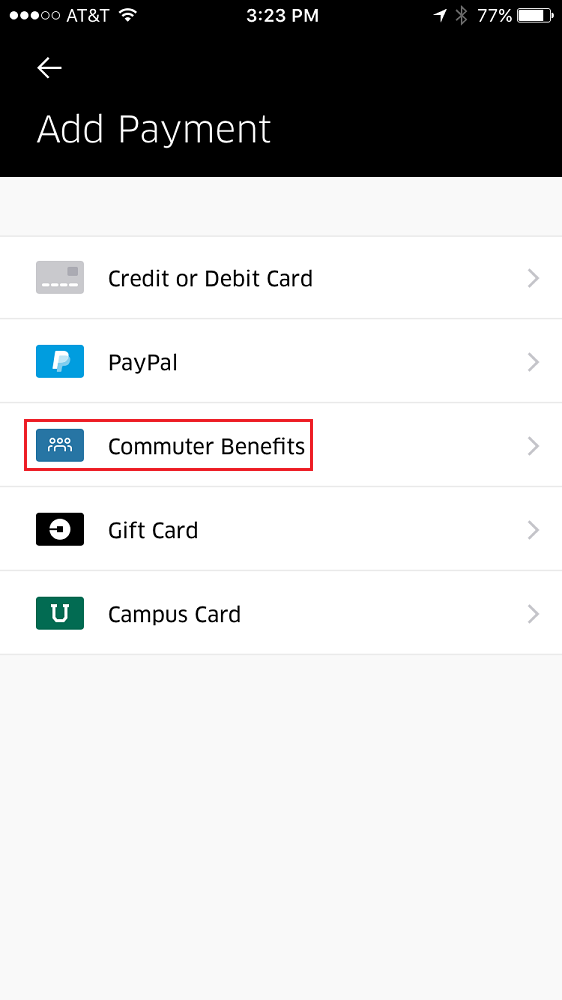

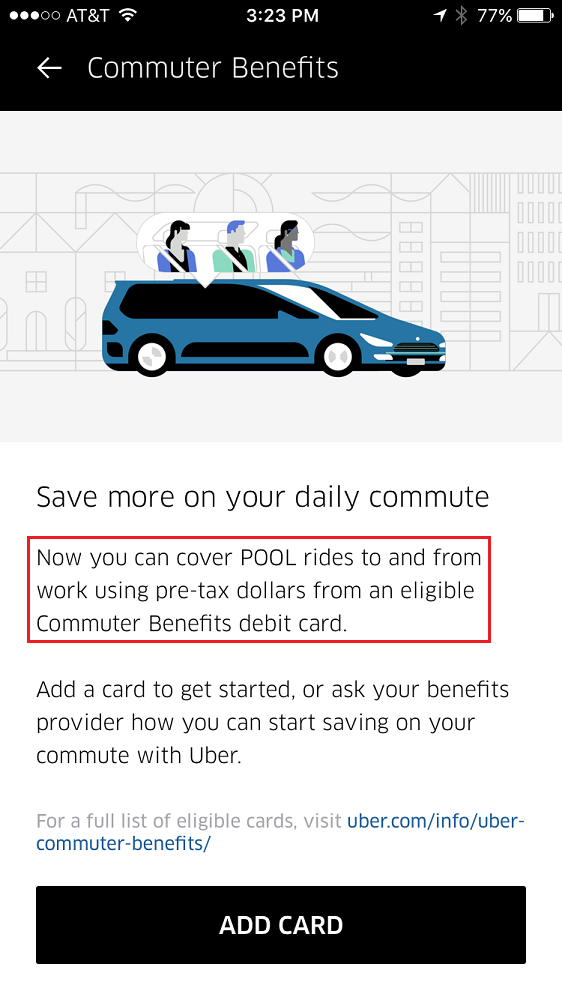

Good afternoon everyone, I hope you are having a great weekend. I was making changes to my Uber and Lyft account this weekend by setting my US Bank Cash Plus Credit Card as the default payment method since that credit card now offers 5% cash back for public transportation (including Uber and Lyft for Q2). While I was doing that, I noticed that the Uber app had Commuter Benefits as a payment method. I have a Commuter Check Prepaid Debit MasterCard through my work that allows me to use pre-tax dollars to pay for public transportation to and from work. If you have a similar commuter benefit card, you can add that card to your Uber app by clicking the payment tab, selecting Commuter Benefits and entering your card information.

Uber has a very detailed Commuter Benefits page that says, “You can now use eligible commuter benefits cards to pay for uberPOOL rides when you commute. This means you get more for your money by riding on pre-tax dollars.” Uber Pool is a carpool service that connects riders with other riders heading the same direction. By using Uber Pool, the ride is usually cheaper, but can also take longer since you might have to pick up and drop off a few people along the way before you get to your destination.

So, where can you use Uber Pool? “This option is available to uberPOOL riders in all US cities that offer uberPOOL: New York City, Boston, Washington D.C., San Francisco, Philadelphia, Atlanta, Denver, Miami, Las Vegas, Chicago, San Diego, Los Angeles, Seattle and all of New Jersey.”

You can use Uber Pool with the following commuter benefits prepaid cards:

- WageWorks Commuter Prepaid MasterCard®

- WageWorks Visa® Prepaid Commuter Card

- TransitChek QuickPay Prepaid Visa® Card

- MyAmeriflex Mastercard®

- Beniversal Prepaid Mastercard®

- eTRAC Prepaid Mastercard®

- GoNavia Transit Benefit Card

- Commuter Check Prepaid Mastercard®

- PayFlex Card® Debit MasterCard®

- WEX Health Payment Card

- Flex Benefits Visa® Card

If you have any questions about the program, please check out the full guide or consult with your HR department. I am not responsible if you use your commuter benefits incorrectly.

Not to be outdone, Lyft has a similar commuter benefit program for their Lyft Line service (basically the same concept as Uber Pool). Here is what the Lyft Line Commuter Benefits page says, “Lyft has partnered with WageWorks®, Zenefits, Benefit Resource, Commuter Benefit Solutions, and Navia to help make your commute easier. When you take Line rides in New York City, Boston, Seattle, or Miami, you can save up to 40% by using pre-tax dollars to pay for commute.” Since Uber Pool works with commuter benefits in San Francisco, the same should apply for Lyft Line. I contacted Lyft on Twitter to see why San Francisco is missing from that page. My guess and hope is that this page was written a few weeks/months ago when they did not have San Francisco approval and forgot to include it in the list. I will update this post when I hear back.

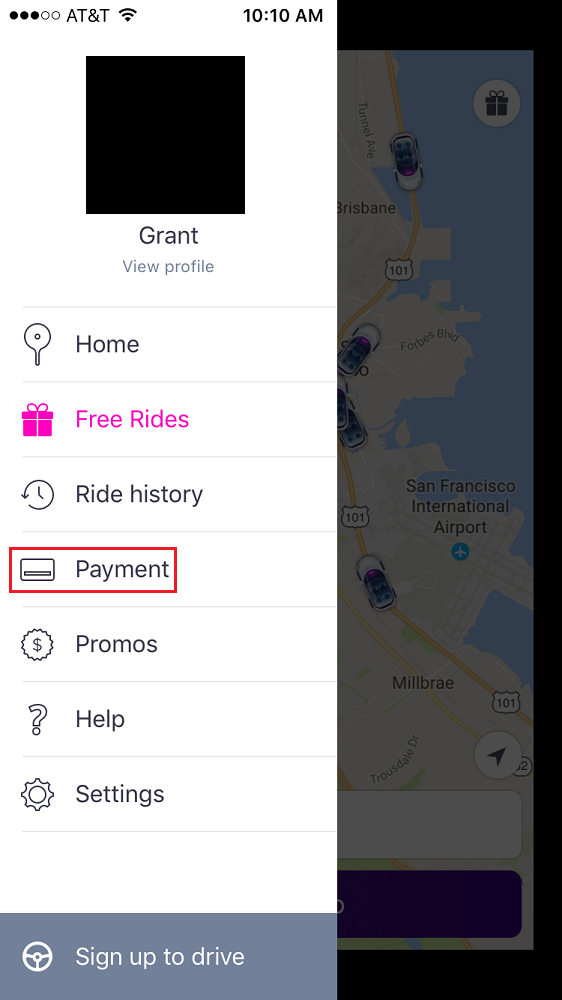

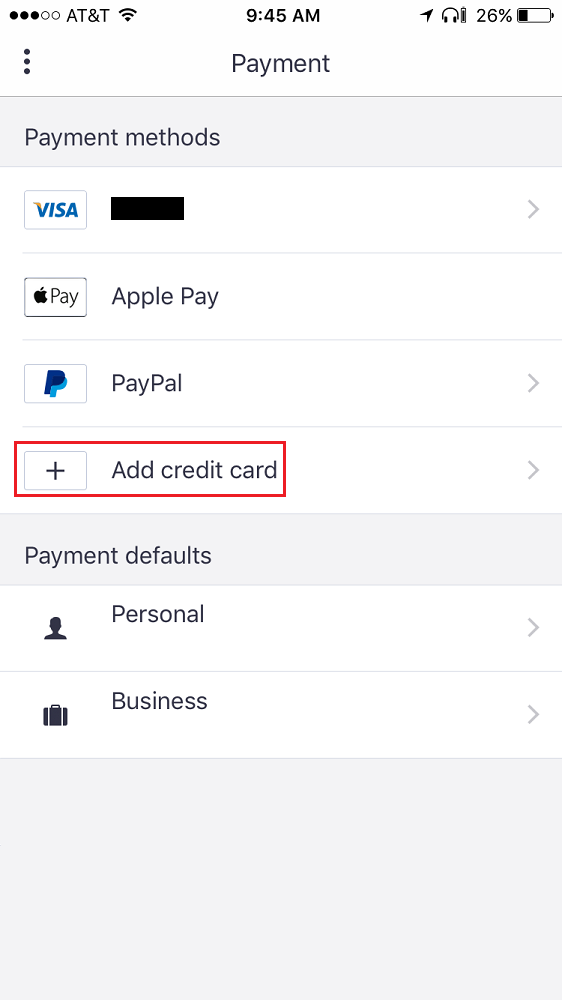

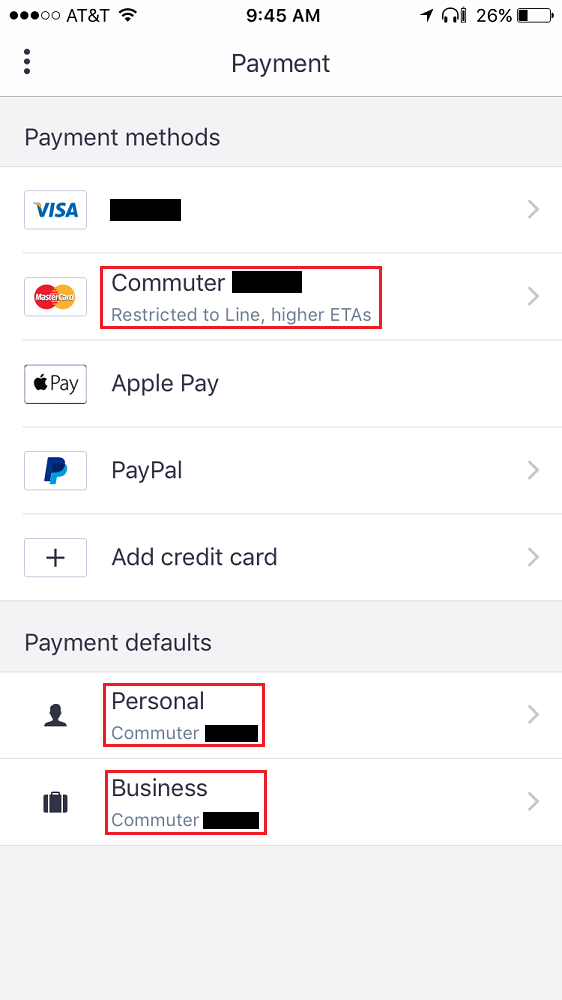

If you live in one of the approved cities and have a commuter benefit card, you can add the card to your Lyft app by clicking the Payment tab, then clicking Add Credit Card. The app will automatically detect if the card is eligible for commuter benefits. I also made that card my default payment method for both personal and business profiles. If I use Lyft Line for non-commute rides or request a standard Lyft ride, I can use my US Bank Cash Plus Credit Card instead.

Here are the important details from the Lyft Line Commuter Benefits page:

Which commuter benefits providers are eligible?

We work with WageWorks, TransitChek, Benefit Resource, Commuter Benefit Solutions, Ameriflex, Navia, Zenefits, and EBPA. If your employer has a different provider, you won’t be able to use your pre-tax dollars to pay for Line rides at this time.

Which commuter benefits prepaid cards can be used to pay for Line rides?

- Beniversal Prepaid MasterCard®

- Commuter Check Prepaid MasterCard®

- EBPA Benefits Debit MasterCard®

- eTRAC Prepaid MasterCard®

- Flex Benefits Visa® Card

- MyAmeriflex Benefits MasterCard®

- Navia Debit MasterCard®

- PayFlex Card® Debit MasterCard®

- TransitChek Visa® Prepaid Card

- TransitChek Visa® QuickPay Prepaid Card

- WageWorks Commuter Prepaid MasterCard®

- WageWorks Visa® Prepaid Commuter Card

- WEX Health Payment Card

- Zenefits Debit MasterCard®

If you have any questions about the program, please check out the full guide or consult with your HR department. I am not responsible if you use your commuter benefits incorrectly. If you have any questions, please leave a comment below. Have a great day everyone!

From what I understand you can only use commuter benefits if your vehicle holds at least 6 passengers in addition to the driver – that’s why Lyft says you will experience longer wait times. Not sure why Uber doesn’t make that clearer.

I believe both sites mentioned the 6 person vehicle but I guess Uber doesn’t make it as obvious.

As of today it appears that Lyft is still not supporting commuter benefits in SF. I was able to use my commuter benefits (WageWorks) on Uber but for a much more expensive rate than Left Line was quoting ($31 vs $19)

Thank you for the data points, Ed.