Good morning everyone, happy Friday! By the time you read this post, I will be on my way to Denver for a short weekend trip (with a Sunday travel meetup in Denver). My love affair with US Bank continues as they continue to shower me in gifts (in the form of targeted spending offers) on my US Bank Club Carlson Business Credit Card and US Bank Cash Plus Credit Card. Let’s go through the offers and see if there are any winners.

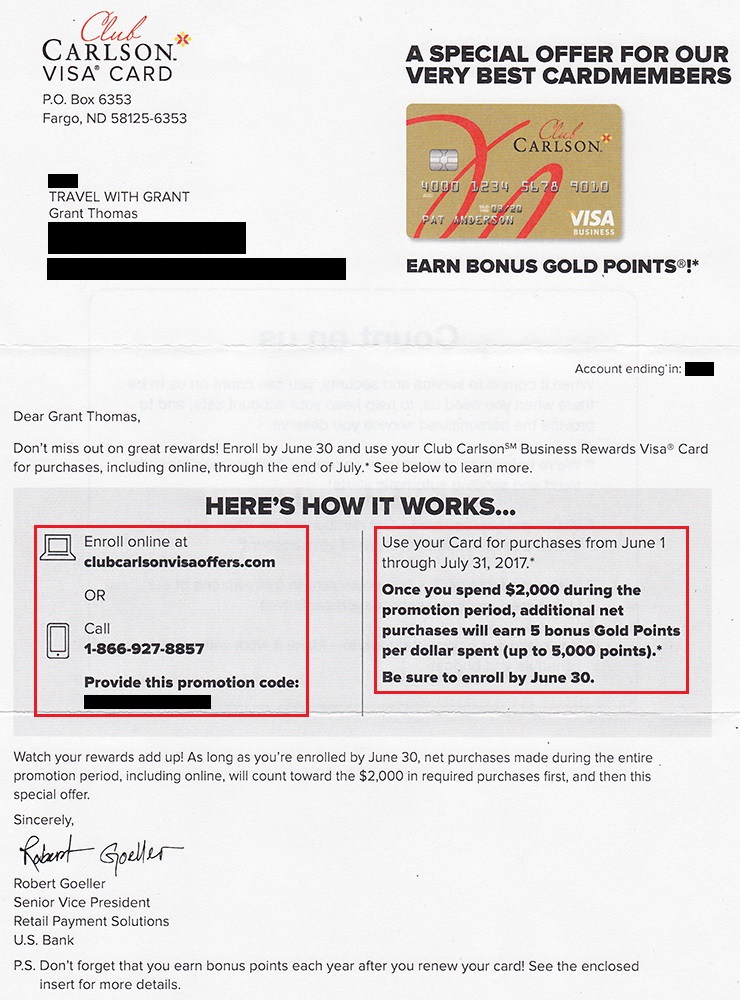

First up, I have a targeted spending offer on my US Bank Club Carlson Business Credit Card. After spending $2,000 on the credit card, I will earn an extra 5 Club Carlson Points per dollar, up to 5,000 bonus Club Carlson Points. To maximize the offer, I would need to spend exactly $3,000. I would receive $3,000 x 5 points per dollar = 15,000 Club Carlson Points + 5,000 bonus Club Carlson Points = 20,000 Club Carlson Points. 20,000 Club Carlson Points is worth ~$100 (each Club Carlson Point is worth 0.5 cents to me), so $100 / $3,000 = 3.33% return. Not bad, but I really don’t want any more Club Carlson Points, so I will pass on this offer.

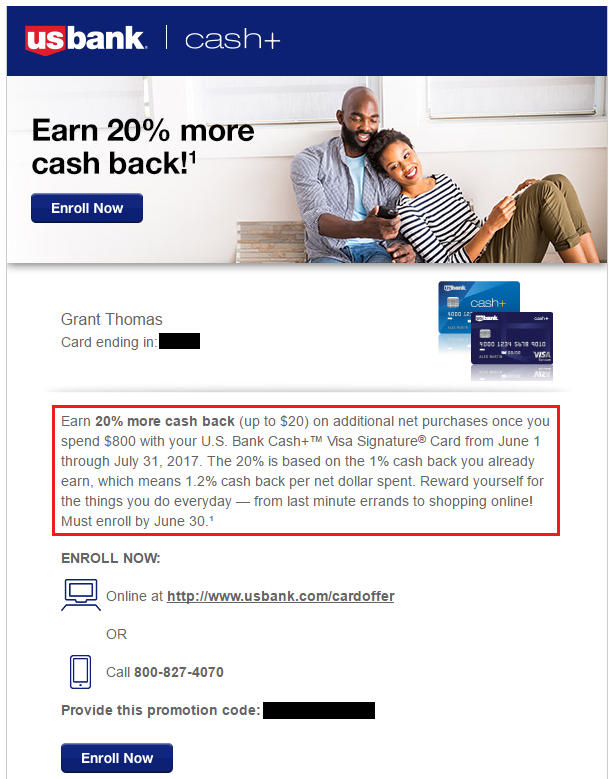

Up next, I have a targeted spending offer on my US Bank Cash Plus Credit Card. With this offer, I can get a 20% bonus on the amount of cash back I earn, up to $20. $20 is not enough for me to care about this offer, but since my US Bank Cash Plus Credit Card is the default payment method for my Lyft and Uber rides and I earn 5% cash back on those purchases with that credit card, I will gladly take the extra cash back. Thanks US Bank!

I don’t spend a lot of money on my US Bank credit cards, but I tend to get targeted spending offers from US Bank every month. Did you receive the same targeted spending offers? Did you receive any targeted spending offers on any of your other US Bank credit cards? Please share your data points below. If you have any questions, please leave a comment below. Have a great weekend everyone!

Club Carlson personal card received an offer for one extra point / $ after spending an initial $250. Up to 5000 bonus points. I probably won’t go out of my way to max out the offer, but I might shift some unbonused spend over, especially since I haven’t hit my $10k spending threshold for the free domestic night.

I might go for the US free night certificates if I have some leftover nonbonused spend later this year. Have you gotten good value out of the US free night certificates?

I’ve personally gotten good value out of mine (used one for the Radisson Blu in Chicago and another in Austin during a busy weekend when rates were silly high), but you’ll probably have to work harder to get value out of them than most other programs.

The biggest drawback imo is that Carlson doesn’t have many properties in downtown core areas, so you might end up burning it on an overnight stay at an airport property or a random Radisson or Country Inn. In that scenario, you’re still saving some money, but it’s pretty marginal vs spending on another card.

Yes, I agree. Not too many great Club Carlson properties in the US worth using the certificate at. Do you get the free nightbwhen your annual fee posts?

It takes a little while to post. My annual fee hit in March and I received the certificate in early May. It posted automatically without having to contact them, and it is valid through next May, so you’ll get a full year to use it after it posts.

From the data points I’ve seen on FlyerTalk and other places, you’re probably looking at 6-8 weeks to post and should assume that they’ll try to make you pay the annual fee before the certificate will show up.

Good to know, thank you. I will see when my annual fees are set to post on those credit cards. Have a great weekend.

I’ve also been targetted, but I’m worried since there are reports shutdowns with gc purchases with US Bank (mostly on Altitude but also Club Carlson cards). I have several Club Carlson’s but I’m nervous to start spending on them. Am I wrong here? or do you feel like you’ve established a consistent gift card purchasing pattern so aren’t concerned?

I haven’t purchased VGCs with any US Bank credit card in ages. I would start small and mix in other spend too.

Might be do-able if you had some Club Carlson stays to pair this up with. Otherwise I’ll pass. I didn’t even click on my offer.

I always click on the offer just in case my plans change or I need a book a trip for someone else. Also, there might be a 1 in a million chance that they accidentally give me the bonus points too.

After a multitude of online reports of US Bank shutdowns recently, as an MSer I’d approach a spending multiplier offer from US Bank as quite similiar to staked goat in lion country.

Yes, proceed with caution if you plan on doing any MS with US Bank credit cards.