Good morning everyone, happy Saturday. On Friday morning, I received an email from PayPal with the subject line, “Notice of Policy Updates.” When I opened the email, I almost immediately deleted the email. The email looks like any other change of terms and conditions email that is super boring. But for whatever reason, I decided to look more closely at the email and see if there was anything newsworthy. Good thing I did, because there are 2 important changes and 1 semi important update. Like my good friend Stefan at Rapid Travel Chai always says, I always have my nose close to the screen looking at the small print. Do you see how boring this email looks?

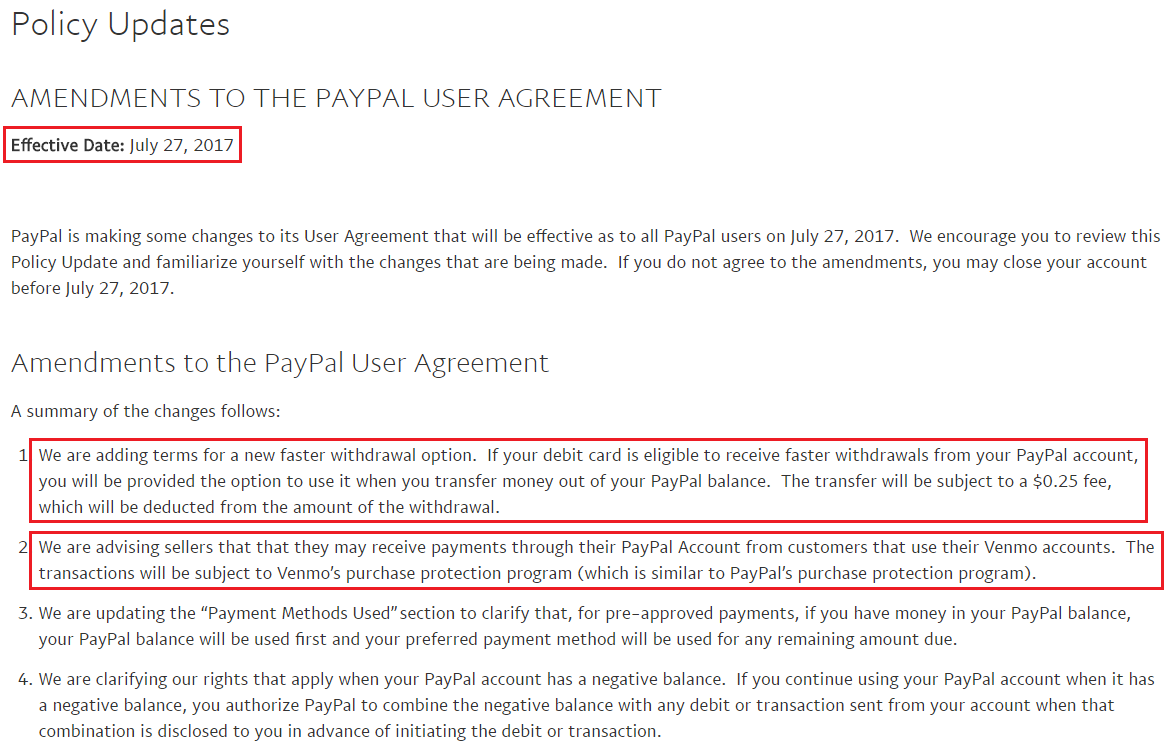

I clicked on the link in the email and went to the Amendments to the PayPal User Agreement page, with new policy updates that will become effective on July 27, 2017:

Here are the full changes and my notes in red (bolding for emphasis):

1. We are adding terms for a new faster withdrawal option. If your debit card is eligible to receive faster withdrawals from your PayPal account, you will be provided the option to use it when you transfer money out of your PayPal balance. The transfer will be subject to a $0.25 fee, which will be deducted from the amount of the withdrawal.

This is a pretty cool payment option that has been around for a while. Square Cash has used this technology to transfer funds from one person to another for at least a year. Instead of transferring money from your PayPal account to your checking account, PayPal will process a refund to your debit card and the money will show up in your checking account almost instantly. This will avoid the 1-3 business day transfer time for traditional ACH transfers from PayPal to your checking account. This is the only payment method supported by Square Cash and they do this for free, but PayPal wants to charge 25 cents per transfer. If it is a large amount of money and you can’t wait the standard 1-3 business days, the 25 cent fee might be a great deal.

2. We are advising sellers that that they may receive payments through their PayPal Account from customers that use their Venmo accounts. The transactions will be subject to Venmo’s purchase protection program (which is similar to PayPal’s purchase protection program).

For starters, Venmo is a very popular money transfer service that millennials use to pay each other for drinks, meals, concert tickets, electricity bill, rent and more (I have made or received a Venmo payment for each of those transactions over the last few weeks). It’s funny when I talk about Venmo since there is a big generational divide between users. Most people under 30 love and use Venmo all the time, while people over 30 have no idea what Venmo is. According to Wikipedia, “in 2012, Braintree acquired Venmo for $26.2 million. In 2013, PayPal acquired Braintree for $800 million.” PayPal has let Venmo be Venmo since the acquisition, but now it looks like you will be able to send Venmo payments to PayPal accounts. I don’t really understand how that will work, but I’m sure PayPal has a good idea.

3. We are updating the “Payment Methods Used” section to clarify that, for pre-approved payments, if you have money in your PayPal balance, your PayPal balance will be used first and your preferred payment method will be used for any remaining amount due.

This might be a big deal or it might be nothing, we will see. A lot of sites accept PayPal as a payment method, but most of those are “pre-approved payments” whereby the “PayPal charge” goes through instantly, but the PayPal balance or funding credit card is charged later. It sounds like PayPal wants to use your PayPal balance first, even if you want to use a credit card. Secondly, if you have multiple credit cards linked to your PayPal account, the credit card used will only be the credit card listed as your preferred payment method. This might be bad if you plan on using your Chase Ink Bold/Plus/Preferred Credit Card to earn 5x Chase Ultimate Reward Points, but if you have a PayPal balance or a different credit card listed as your preferred payment method, the charge might not go onto your Chase Ink Bold/Plus/Preferred Credit Card. Like I said, this might be a big deal or it might be nothing, we will see.

4. We are clarifying our rights that apply when your PayPal account has a negative balance. If you continue using your PayPal account when it has a negative balance, you authorize PayPal to combine the negative balance with any debit or transaction sent from your account when that combination is disclosed to you in advance of initiating the debit or transaction.

I’m not very familiar with negative PayPal balances, but it usually happens when you sell something on eBay and the buyer opens a PayPal dispute. PayPal will pull the funds from your PayPal account and hold them in escrow / hostage until the dispute is over. It sounds like you can continue to run up a larger negative balance if you send money from your PayPal account. I’m not sure why PayPal would want you to run up a larger negative balance, but I’m sure they have a reason.

There you have it. Some major changes coming to PayPal in the next few weeks. I know nothing more than what is listed in the email or on their User Agreement page. If you have any other interpretations (or conspiracy theories) of the new terms, please let me know. If you have any questions, please leave a comment below. Have a great weekend everyone!

PayPal has long been a leader on person-to-person payments, so they need to adapt to compete with Venmo and other new FinTech start-ups.

Or just buy them up :)

Pingback: Cheap Barcelona Flights, Free Custom Luggage Tags, Lost In Paris Catacombs for 3 Days - BaldThoughts

Last summer, Square Cash began charging 1% for formerly-free instant transfers. I was pleased to see PayPal’s plans to roll out a low-cost fixed rate instead.

Oh no, not Square Cash! I haven’t used them in a while (obviously) but I am sad that they are charging a fee for this service.

The free Square Cash offering delivers the funds on the next business day (like PayPal). Main difference is that you can choose to automate the transfer so that it effortlessly flows to your bank, whereas PP still requires you to login and elect to transfer out the received funds.

Oh right, thanks for explaining the different withdrawal options. I like Square Cash’s automated withdrawal options.

In my case, the Square Cash option to automatically transfer received funds to a bank account was enabled. I’m guessing this is the default for legacy users, as the service didn’t originally offer any other options. However, as the service is now encouraging users to leave $$ in their Square Cash account, I suspect that transfer option is not the default for new folks.

Pingback: Recap: Best Uses Of JetAirways Miles, Fast Track To A-List & More - Doctor Of Credit

So does that mean (1) we can withdraw money to our normal debit cards?

-Thanks

Yes, if you have a debit card that works with this new withdraw feature.

Ok Thanks :)

has anybody been able to use this new withdrawal option yet in USA?

Has anyone been able to do this yet? What is an eligible debit card?

I think most of the national banks like Chase should work. What bank are you trying to use?

I just did this yesterday but could have waited (and avoided the fee), but I didn’t see where ithat was an option. Did I miss something?

I’m not sure, I don’t have a supported debit card linked to my PayPal account. You can always do a bank transfer to/from PayPal which is free.

Thank you for the quick reply. I believe I may have been charged because it was sent to my debit card instead of my bank account. I will try it the other way next time.

Sounds good, it should always be free to transfer funds to your checking/savings account.

It looked like they set it to that automatically (I just took money out of my paypal and noticed this come up for first time). I had to make sure to set it to bank pay so I wouldn’t get hit with the fee. I’m betting many missed that. Sneaky bastards aren’t they?

I came here for the same thing. Looking for an option to turn that off or make sure my bank was default. But noooope. I almost accidently hit it twice.

Under “Sending Money” preferences it says “we will default to your balance or bank TO AVOID YOU FEES.”

I guess that attitude towards their customers has changed…

How do I transfer money the standard free way instead of paying the .25?

Add your bank account to your PayPal account and withdraw funds from your PayPal account to your bank account. It’s free and should take 1-3 business days to post to your bank account.

It would be nice to have the option of transferring immediately and paying a fee or waiting a bit to transfer to an account. It doesn’t appear users have a choice. Either pay the fee to transfer to your debit card or carry a balance and use PayPal as your default payment method. Maybe I’m missing something?

You could always add the bank account associated with your debit card to your PayPal account and do a transfer from PayPal to your bank account for free.

I’ve still yet to find *any* eligible banking institution that supports the PayPal withdrawal to a debit card. Anyone else know of a bank that supports this?

It works with Wells Fargo debit cards. I have t tried any other debit card.