Good morning everyone. During my recent App-O-Rama, I applied for the US Bank Radisson Rewards Visa Signature Credit Card. This credit card offers 60,000 Radisson Rewards Points after spending $1,500 in 3 months. There is a $50 annual fee, but you get 25,000 Radisson Rewards Points every year for paying the annual fee. After I get the sign up bonus, I will call US Bank and ask them to upgrade me to the US Bank Radisson Rewards Premier Visa Signature Credit Card, which offers 40,000 Radisson Rewards Points every year when you pay the $75 annual fee.

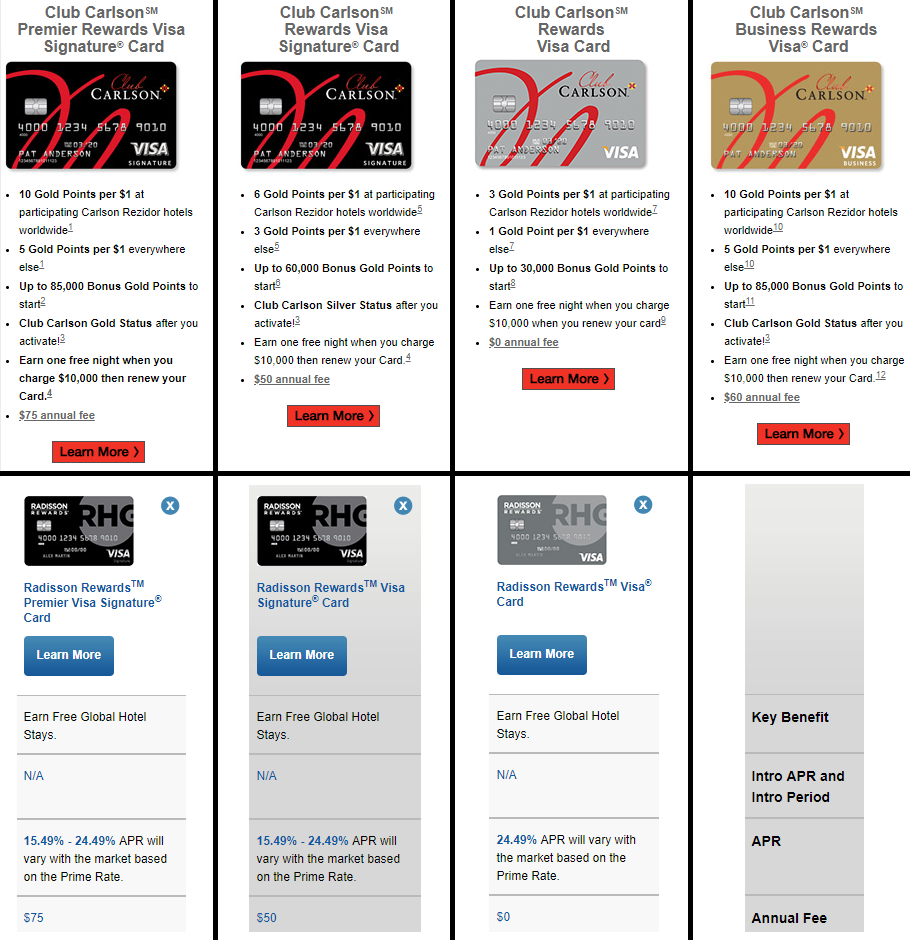

I already had the US Bank Radisson Rewards Premier Visa Signature Credit Card (previously named the US Bank Club Carlson Premier Rewards Visa Signature Credit Card) and the US Bank Radisson Rewards Business Visa Credit Card (previously named the US Bank Club Carlson Business Rewards Visa Credit Card). I created this helpful table to show you the before (top, Club Carlson) and after (bottom, Radisson Rewards) credit card names. Long story short, my application for the US Bank Radisson Rewards Visa Signature Credit Card went to pending and I assumed I would be declined for this credit card because I already have 6 US Bank credit cards and my ARS / SageStream credit reports are frozen. But as I later found out, that was not the case. Here’s how I found out that I was approved.

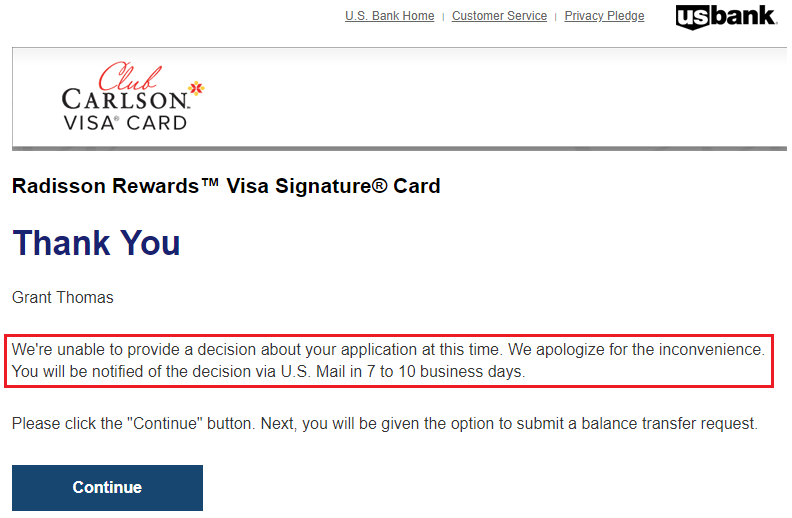

During the application process, I got a pending decision online. Instead of calling US Bank and trying to sweet talk them into approving me for the credit card (like I used to do years ago), I decided to play it cool and wait for US Bank’s decision.

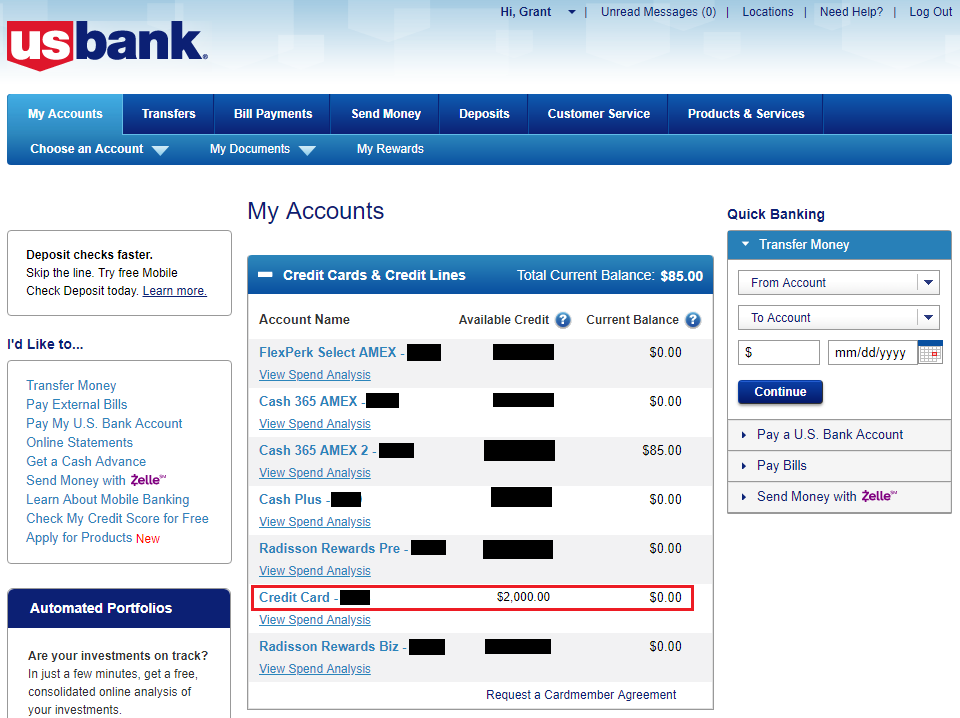

Fast forward to a few days ago. I logged into my US Bank online account and noticed a new credit card account listed. It was easy to spot this new credit card because I manually renamed all of my other US Bank credit cards. I decided to investigate, so I clicked on the unknown credit card account.

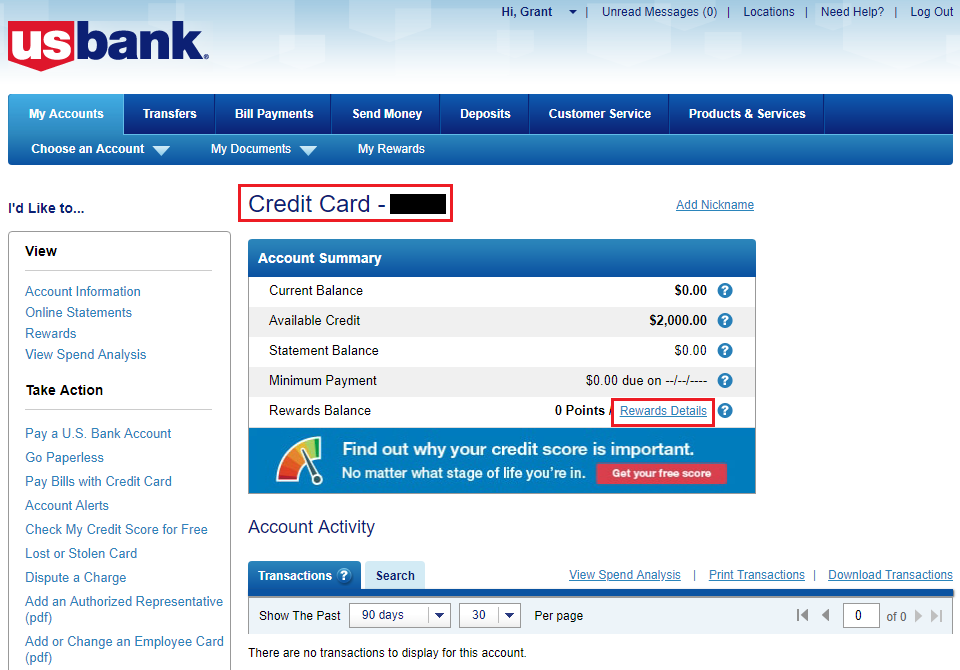

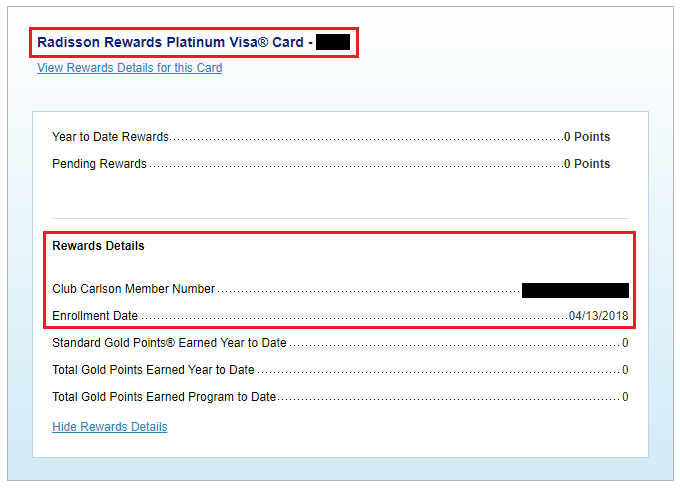

This page doesn’t provide any useful info that would help me identify this new credit card account. So I clicked the Rewards Details link.

That link brought me to the US Bank rewards page and down to my new Radisson Rewards Platinum Visa Credit Card account. I originally applied for the Visa Signature version, but since I was only approved for a $2,000 credit limit (Visa Signature requires a $5,000 credit limit), I was approved for the Platinum Visa version. I also recognized the Club Carlson member number (pssst US Bank, you should change that to say Radisson Rewards) that I created for this new credit card account. Lastly, the Enrollment Date makes it pretty obvious that this is a new account.

In a future post, I will share the card art and welcome letters that came with my new US Bank Radisson Rewards Platinum Visa Credit Card. If you have any questions about getting approved for US Bank credit cards, please leave a comment below. Have a great day everyone!

So can I keep the old Club Carlson Signature card (with my 40k points yearly) and still apply for a lower end new Rewards Visa Card? Love to add some more points, especially with the incoming Marriott deval. I can have both at the same time? CC Sig is the only US Bank card I have. Got it in 2013 or 14 I think. Used it in 2015 to stay at the Mayfair on that 2-for-1 50k nights they had then. It was sweet!

Yes, they are all separate credit cards, so you can get the $75 version, $50 version, $0 version, and $60 business version.

Great post (again). Any idea what the annual free points are for the $50 annual fee card? I already have the upper tier personal and business, and keep them for the annual free points.

Should be 25,000 Radisson Rewards Points every anniversary.

You won’t be able to upgrade. I tried with mine multiple times. Only close and open a new one in 2 years. After the fee hits you have to wait 8 weeks for the points to post.

Hmm, that is disappointing. I will still try and see if I can upgrade. If not, I will wait and try after the annual fee posts.

Pingback: My US Bank Radisson Rewards Credit Card Arrived; Why Does the Card Look Different?

Pingback: Marriott Starwood Contradictions, Free Marriott Night, New Airline Routes to Europe, Dark Pitcairn - TravelBloggerBuzz

What are the “Premier” approval odds vs the “Business” card? I’d rather get the Business card but don’t want to waste a hard inquiry if it’s more difficult. I don’t have a relationship with US Bank yet.

I would say approval odds are about the same for both cards since both cards are Visa Signature cards. I would go for the Premier card first if you do not have a banking relationship with US Bank.