Good morning everyone, happy Friday. I hope you have exciting Memorial Day Weekend plans. I will be exploring San Diego with my girlfriend and staying at the beautiful Andaz San Diego. Enough about me, let’s talk credit cards. This thought has been on my mind for the last few weeks, but sparked my interest with Thursday’s post about the Citi Prestige Credit Card trip delay policy, changing from 3 hours to 6 hours (effective July 29).

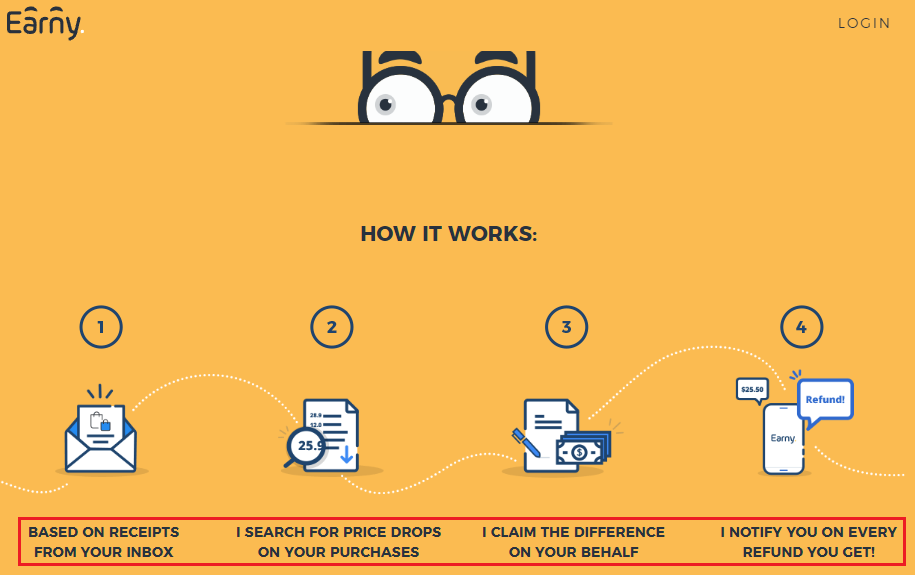

It seems that some credit card benefits are too popular (like Citi’s trip delay policy or Chase’s price protection) that the credit card companies are losing money paying out claims or inundating the services that process these claims. With several services that will automatically file price protection claims on your behalf (like Earny and Paribus) or automatically file trip delay claims on your behalf (like AirHelp and GetService), it’s no surprise that credit card companies are reducing or eliminating these credit card benefits. (I don’t use any of these services.)

On the other hand, there are a handful of credit card benefits that are underutilized (like Discover’s Extended Product Warranty, Return Guarantee, Purchase Protection, Auto Rental Insurance, and Flight Accident Insurance). Discover removed those credit card benefits on February 28 “due to low usage among cardmembers.” Credit card companies decide to remove certain benefits because consumers do not utilize the benefits often enough to justify the cost (whatever cost that might be).

I always thought it was funny that unpopular credit card benefits were shut down and benefits that were too popular were also shutdown or significantly reduced. It seems like there has to be a goldilocks zone between these 2 usage extremes. I have no idea how much credit card companies spend offering these benefits, or the average payout for each successful claim, but I’m sure the credit card companies track those costs pretty closely.

From the credit card company’s point of view, offering benefits that are hardly ever used is good for marketing (look how many awesome credit card benefits we have!) and also good for the finance team (look how little we paid to offer these credit card benefits!). When these 2 departments are both not happy (the credit card benefits are costing us more money than we take in from credit card swipes – we need to cut these benefits!), then changes get made. The one thing I know for sure is, credit card companies love to make money and hate to lose money.

What do you think of my credit card benefits goldilocks zone theory? Do you think I am onto something here? If you have any questions, please leave a comment below.

P.S. Have a great Memorial Day Weekend everyone!

Grant, just saw this article. You are on target. There are 3.8 billion loyalty program memberships held by Americans, but 81% or members say they don’t know what their benefits are, or how or when to use them.

Enter UseMyBenefits.com, a startup that wants to become The Google of Loyalty Program Benefits. Why shouldn’t you be able to walk into a store, sit down in a restaurant or shop on line, and have one place to go to determine what cash back, free items, discounts, services or other items you are entitled to, based on what you want to buy, when and where you want to buy it? These would be from your personal credit cards, auto clubs, non-profits and other loyalty programs you belong to.

UseMyBenefits.com is hard at work to make it a reality. RB