Updated at 10:50am PT on 12/5: According to the New York Times, Netflix paid $100 million to keep “Friends” for 1 more year. That is the power that “Friends” fans have over Netflix.

Good morning everyone. I am not sure if you heard the 2 big stories that broke Monday morning: Netflix was planning on removing the TV show “Friends” from their service beginning January 1 and American Express announced BIG changes to the American Express Business Platinum Charge Card. Not surprising, Netflix users freaked out and started complaining on Facebook and Twitter. Here are a few complaints from this USA Today article. After a few hours, Netflix reversed course and granted users’ wishes: “Friends” would be on Netflix through 2019. That’s one win for the little guys! But what about the second big story from Monday?

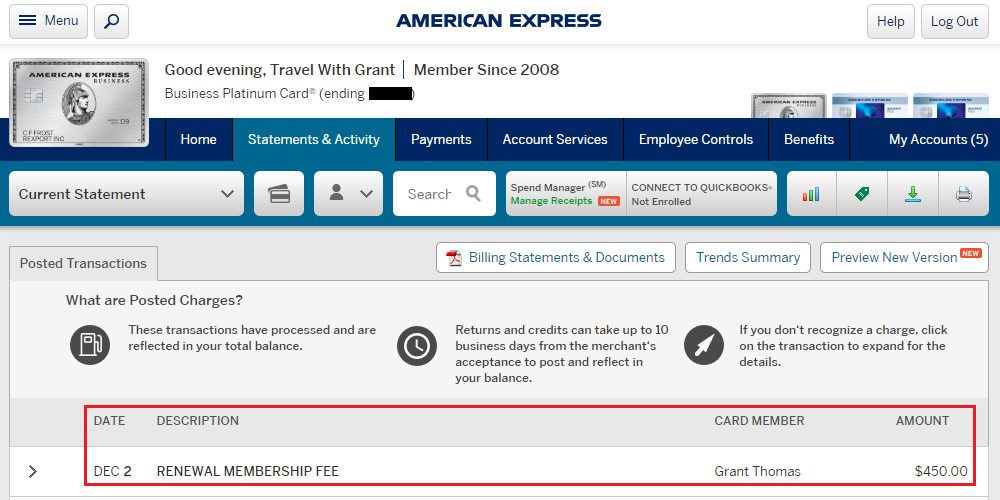

According to this Doctor of Credit post, the American Express Business Platinum Charge Card annual fee is increasing from $450 to $595 beginning in February 2019. In exchange for a $145 higher annual fee, here are the new benefits coming to the card (Frequent Miler also has some great insights about these new features):

- One year of complimentary Platinum Global Access from WeWork ($2,700 value), a network of premium workspaces around the world. With Platinum Global Access, enjoy over 300 workspaces in 75+ cities and 20+ countries.

- Up to $200 in statement credits annually for U.S. purchases with Dell on your Business Platinum Card.

- $100 hotel credit on qualifying charges at hundreds of properties in The Hotel Collection (up from $75) for new reservations made after January 1, 2019 when you book through Amex Travel.

Those 3 new features are worth approximately $0 to me and I hate going out of my way to get value for these new features. Even though my home PC and laptop are both Dell Computers, I do not have an immediate need to spend $200 a year at Dell. I have a full time job with a permanent office and I work on my blog when I am at home, so I do not need a WeWork membership (even though I have attended several SF Travel Hackers Meetups at WeWork locations and they are pretty cool locations). Lastly, I don’t want to book hotels through The Hotel Collection – I just don’t want to!

If you annual fee posts before February 2019, you will continue to pay the $450 annual fee. If your annual fee posts after February 2019, you will pay the $595 annual fee. Luckily, my $450 annual fee literally posted 2 days ago, so I don’t have to worry about the higher annual fee until December 2019, at which point I can evaluate how much value other American Express Business Platinum Charge Card holders have gotten out of the new features and decide if I want to keep the card open.

This brings me back to the beginning of this blog post. If “Friends” fans can complain to Netflix on social media and get Netflix to change their minds in a few hours, why can’t “small business owners” complain to American Express about the short notices and unnecessary changes to the American Express Business Platinum Charge Card? I’m sure our voices aren’t as loud as “Friends” fans, but we should at least try, what do we have to lose (except for an extra $145 for unwanted new features)?

If you have any questions or comments about “Friends” the higher annual fee coming soon to the American Express Business Platinum Charge Card, please leave a comment below. Thank you and have a great day.

Delta flier here. I gave up on these cards, totally worthless to me. The lounges are disgusting and I don’t drink so I don’t see the value anymore. I get airline status from a friend and just pay them cash for it. These cards are worthless. I don’t Uber Bc lyft is 20/30% cheaper in my area. Flights are cheaper when booked with the airline sites then through Amex. Find me one perk I can actually use from Amex. Please note, haven’t been upgraded to first since gave up reserve card but who cares, also an overrated experience.

Thank you for sharing your experience. I only carry the AMEX Biz Plat card because of Centurion Lounge access and the $200 airline reimbursement. I can live without all the other features.

Seems more prudent than ever to just get a group of friends to cycle the first year free ameriprise platinum that allows up to three AU’s

That is a great strategy if you have 3 friends you can trust to have the card but not spend any money on.

The new benefits are worthless to me as well. I’ll never use any of them. My small creative business is Mac based, and the other two benefits are just nothing I’d need. I was considering cancelling, but this news just confirms it’s time to close this card.

You can try asking for a retention offer the next time your annual fee is billed, but I’m doubtful AMEX will offer anything worthwhile. They don’t seem to care about customers.

If you suggest the complaint, i mean feedback route. What are the proper channels to get our voices heard? Amex doesn’t have SM, and calling in just to complain is a waste of time.

Complain publicly via Facebook or Twitter directly on their page.

I’ll do fb, are you going to leave your 2 cents too?

I already complained on Twitter.

The Amex Bis FB page is quite dead… But i posted some constructive feedback or suggestion on the Bis Plat post.. Don’t think it will happen, but worth a shot I guess.. Below is a repost of my comment.

“I love my Bis Plat card, as for the $450 fee – it is justifiable given the amount of travel my work takes me and I plan to keep this in my wallet for years to come. However, yesterday I received an email from your team saying come Feb next year, the fees are increasing to $595! That’s a staggering 32% increase! For some “bonus” perks forced down my throat that I absolutely don’t need for my business. Honestly, I don’t really mind pay more fees, but I wish AMEX would offer a variety of choice in your benefits, maybe say a choice of $200 rebate between Samsung/Apple/Dell/HP/IBM, as my line of work consist of more purchases with Apple and not Dell. So this way you can let your members choose from vendors that makes sense for their business and not feel stuck with only Dell. I’m also sure you guys can do much better than the wework benefit, your core demographic are members because of your superior travel elite benefits across the bis CC market. So focus and work on giving more of those travel perks, say introduce another hotel chain with elite status – Hyatt/SLH/GHA/IHG or add an Airline elite status, these can help AMEX generate extra revenue on other travel partners beyond your cobrand cards and I’m sure cardholders are more than welcome to put spend and experience different travel products. Then only the 32% increase in fee is justifiable to keep this card. It’s a competitive market out there, focus on the value that makes your product outshine your competitors like your recent gold card revamp (that was a hit!), else you are going to start seeing a drastic drop and jumpships in card membership come February – me included.”

That is a great, constructive comment for AMEX. I wish they would have asked Cardmembers what new features they wanted before selecting new features for all Cardmembers.

I am still unhappy with credit reversal on staples amex offer. I don’t think it’s worth $450 anyway.

That was annoying, if you are not getting enough value out of the card, cancel the card.

What’s so funny is that you think that complaints are likely to do something, and you use a ridiculous Netflix comparison to justify why. If you don’t like it, then cancel the card. All that I’ve read for the last year or two is that Centurion lounges are way too crowded and Amex has to do something to make them more exclusive, so you’d think that some people would be happy that Amex took a step to make that happen.

I honestly don’t think anything will change at AMEX with all the complaints. AMEX needs to build more lounges in more airports, I know that will cost money, but they can figure out how to pay for them.

@Grant, I actually think part of the fee increase is NOT to make more money, or justify more benefits, but to actually get RID of people holding the card who do not use it other than pay the fee, or even worse, “churners”.

I would look towards a collaboration between the RAT team, retention folks and the bean-counters to be behind part of this.

I think they actually want to only have people get this card from now on that actually use it in a business, as opposed to a lot of us that have “businesses”.

If AMEX stripped all the benefits and introduced a “Centurion Lounge Only Card” I would probably convert to that card. All of the other card benefits don’t excite me at all.

THat’s actually pretty brilliant! I am like you, not using a lot of the features. I live in a smallish city (Bellingham) and Uber is pretty useless here as well as I simply don’t use it most of the time.

Maybe a $XXXX amount of spend per year as a requirement would work for a card like that with an obviously lower annual fee as well.

Wish they’d listen more and punish less that is for sure!

Glad I’m not the only one who thinks like that. Bring on the American Express Centurion Only Card :)

Pingback: Keep, Cancel or Convert? American Express Business Platinum Charge Card