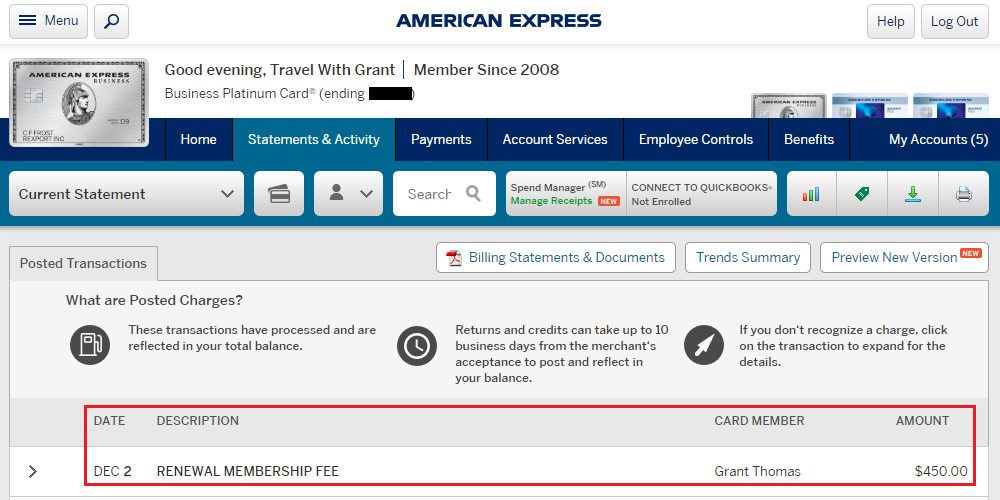

Good afternoon everyone. As part of my “Keep, Cancel or Convert?” series, I like to evaluate and reevaluate credit (and charge) cards to make sure they still deserve a spot in my wallet. 2 weeks ago, my $450 annual fee posted on my American Express Business Platinum Charge Card. I shared my outrage on the upcoming changes to the card and Shelli added her thoughts too. I am not going to go into all the nitty gritty details of the current card benefits and the upcoming card benefits, but I have decided to keep my American Express Business Platinum Charge Card until next December when the *gasp!* $595 annual fee posts to my account. Here is why this card is still worth the $450 annual fee I just paid…

I make good use of the $200 airline reimbursements each year, so that essentially drops the annual fee down to $250. I can justify the remaining $250 annual fee since I enjoy visiting the Centurion Lounges (especially the SFO Centurion Lounge). Getting free Marriott Gold Elite Status is nice, but Hilton Gold Elite Status is worthless to me, since I get Hilton Diamond Elite Status with the American Express Hilton Aspire Credit Card. I don’t rent many rental cars, but I appreciate the free National Emerald Club Executive Status, Avis Preferred Status, and Hertz Gold Plus Rewards Status. Also, if you have many friends or family members, you can add them as authorized users / employees and get each one an American Express Business Green Charge Card (no annual fee for Green cards). When you do that, each cardmember receives the $100 Global Entry reimbursement.

I don’t put much value on the free Priority Pass membership, since I have several memberships with other high end credit cards. I am cheap and don’t book Fine Hotels & Resorts. And I prefer to pay for travel with my Chase Sapphire Reserve Credit Card and earn 3x than earn 5x with the American Express Business Platinum Charge Card because I like the travel protections and benefits offered by Chase.

I am not looking forward to the upcoming changes and I am really not looking forward to the much higher annual fee. The only reason I keep my American Express Business Platinum Charge Card is for Centurion Lounge access, so it looks like I will have to get creative in order to access the Centurion Lounges after December 2019. I really wish American Express would offer a Centurion Lounge only card or membership, I would gladly convert to that card.

I know this post is not very useful for those of you who have annual fees posting after February, but if your annual fee posts before February, I say hold onto the card for 1 more year, go to the Centurion Lounges as much as possible, and try not to let the upcoming negative changes bring you down. If you have any questions, please leave a comment below. Have a great day everyone!

P.S. Check out other “Keep, Cancel or Convert?” blog posts here.

Oddly enough the new changes have made me more likely to keep the card – depending on the details of the WeWork benefit, it could be super useful to me (and if so, I can probably get my job to cover the annual fee).

How much would the annual fee cost? I’m considering getting the annual membership too and just going there for drinks every now and then and maybe some ping pong too :)

How can you not even talk about the 35% miles reduction with your airline of choice with this card, or first/biz on any airline? This could be the best benefit.

I select SWA as my airline of choice, so I haven’t tried the 35% redemption. That could be a game changer for some people though.

I used the 35% redemption last month for the first time. It’s slightly better than the CSR pay with points benefit. I booked a $980 CX fair with 98K points, but with the 35% kick-back, it came out to be 63.7K. If I had used the CSR pay with points, I would’ve booked at 65.3K. So the Amex pay with points was better, but not by much.

I could see the 35% kick-back being a game changer if one does not have the CSR, but if they have the CSR, it’s only slightly better, and one could make an argument it isn’t better if the increased annual fee is considered in the equation.

I will be canceling my Amex Biz Platinum this year before it renews. The new “benefits” are of no use to me. I will keep my Amex personal Platinum. The 5x airfare is a strong benefit for me as I typically spend around $30K annually on airfare.

The calculations are much closer than I thought they would be. I don’t blame you for canceling your AMEX Business Platinum, the new benefits are not worth the increased annual fee.

As a first time user I had a totally unexpected occurrence with regards to using MR points.

A few months ago I booked two tix for a total of 164,181 points. Within 24 hrs I cancelled the tickets – because the price had dropped significantly.

The same day I received a credit of $1,641.81 in my account.

Exactly a month later I received the 35% credit of 57,464 points in my account with the notice “Airline Bonus: Pay with Miles”.

That is very strange. So it sounds like in exchange for “paying” 106,717 MR points, you got a credit of $1,641.81, which is like cashing in MR points for 1.54 CPP. That is a great deal!

My biz plat renews in February. I would renew it at $450, but no way in hell I’m paying $595. So I’ll claim my $200 airline credits in January then cancel.

You might get the $450 annual fee instead of the $595 annual fee. If it posts at $450, will you keep the card for another year.

yes, i’ll keep it if the fee is $450

Yes, me too!