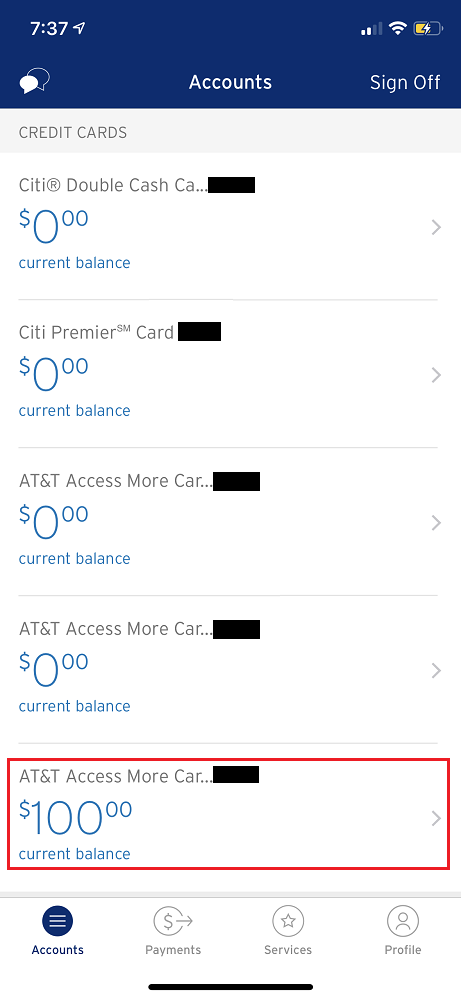

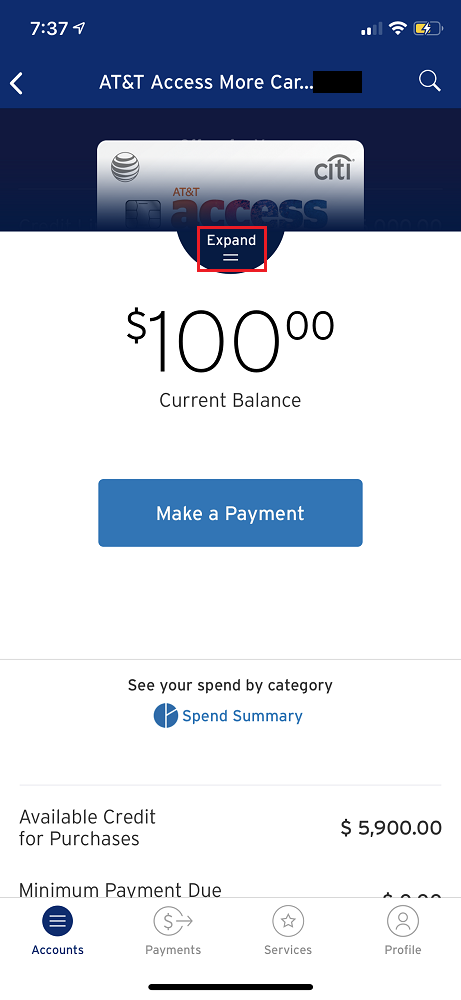

Good morning everyone. I stumbled on this a few days ago when I was using the Citi app to check on my Citi credit cards. I found out that you can request a credit limit increase instantly through the Citi app and there is no hard pull (which would affect your credit score). All 3 of my credit reports are frozen and I was able to request credit limit increases on all 5 of my Citi credit cards (and all 5 requests were instantly approved). Here’s how… Sign into the Citi app, select the credit card you want to request a credit limit increase, and then click the Expand button beneath the card art.

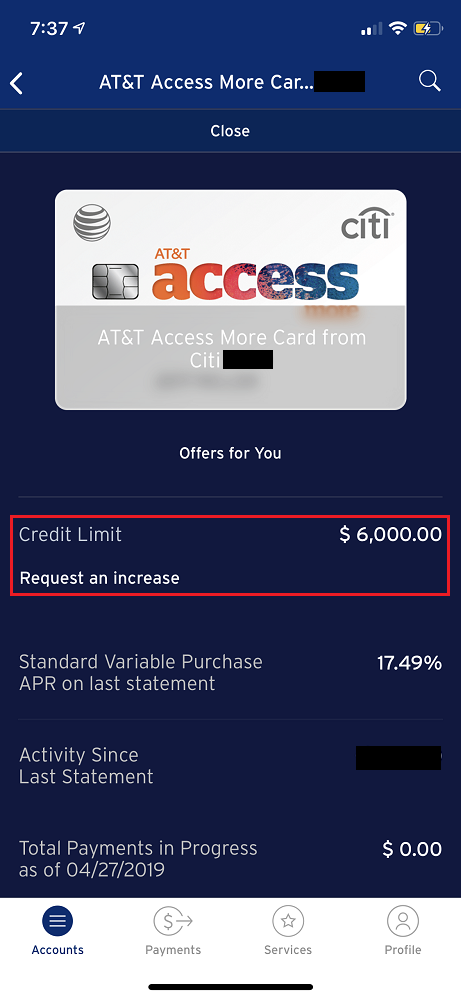

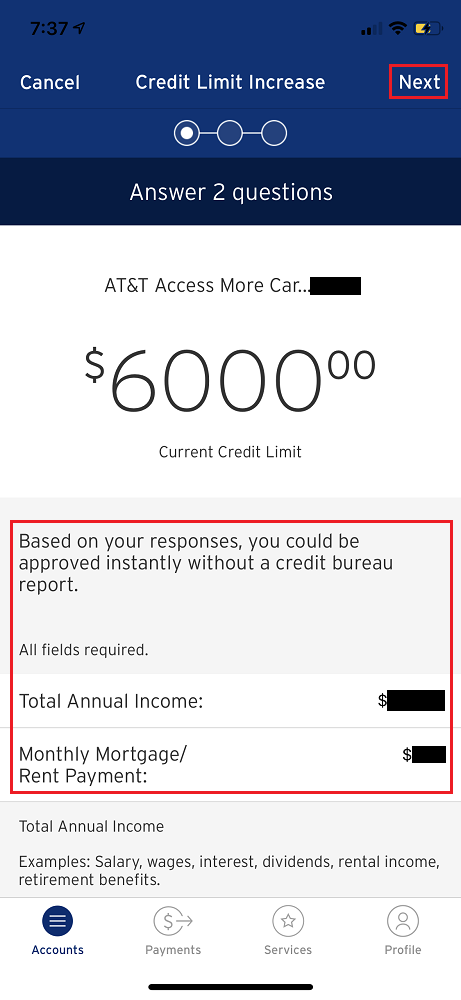

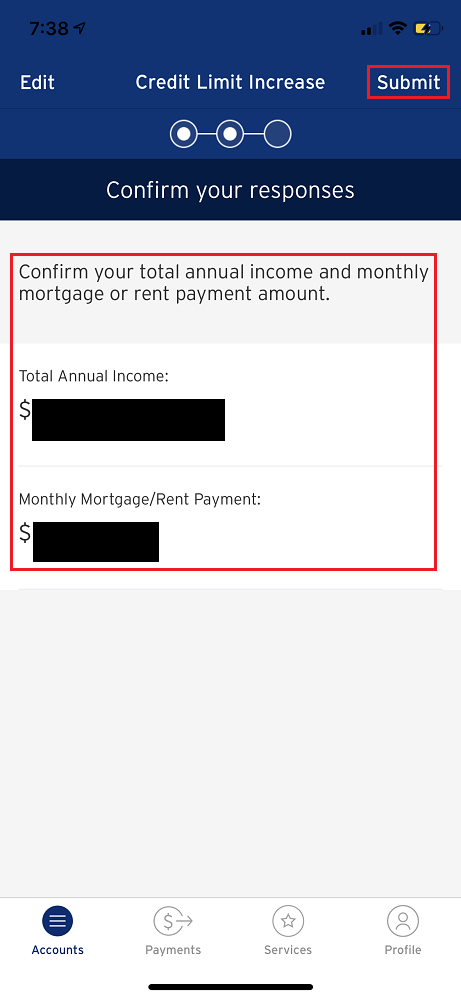

If you are eligible for a credit limit increase (I am not sure what the requirements are, but I have had all 5 of these Citi credit cards for 2+ years), you should see a message that reads “Request an Increase” underneath your current credit limit. Answer the questions Citi asks (I was asked about current annual income and monthly mortgage/rent payment) and click the Next button.

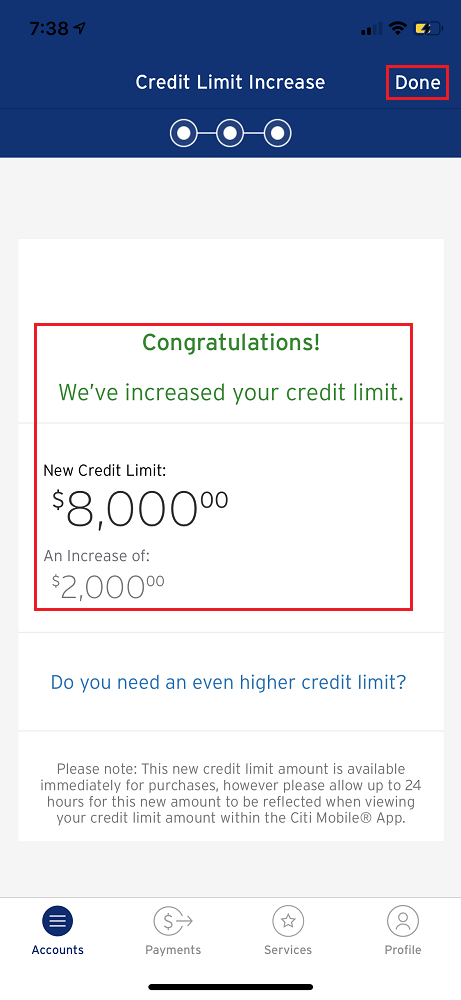

Confirm your answers are correct and click the Submit button. If you are approved for the credit limit increase, you should see a Congratulations message, along with your newly increased credit limit. As you can see, my $6,000 credit limit was increased $2,000 to $8,000. If you want an even higher credit limit, you can contact Citi, but they will do a hard pull.

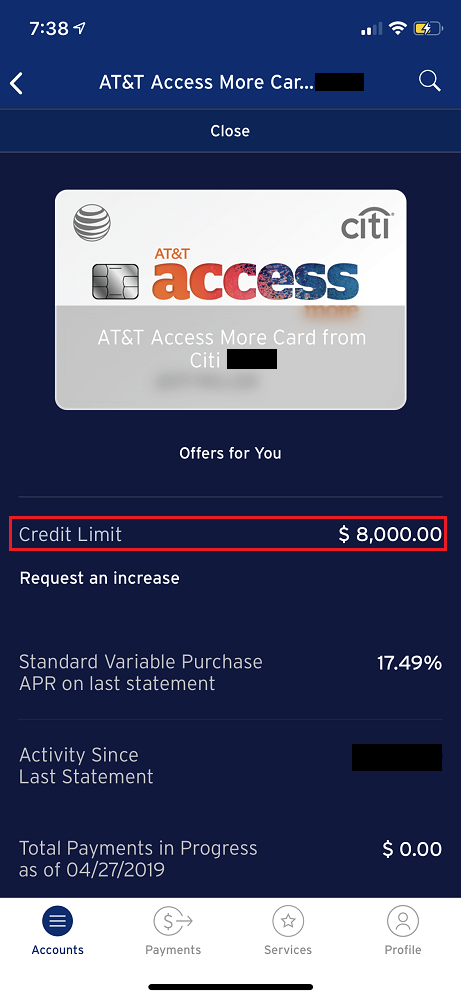

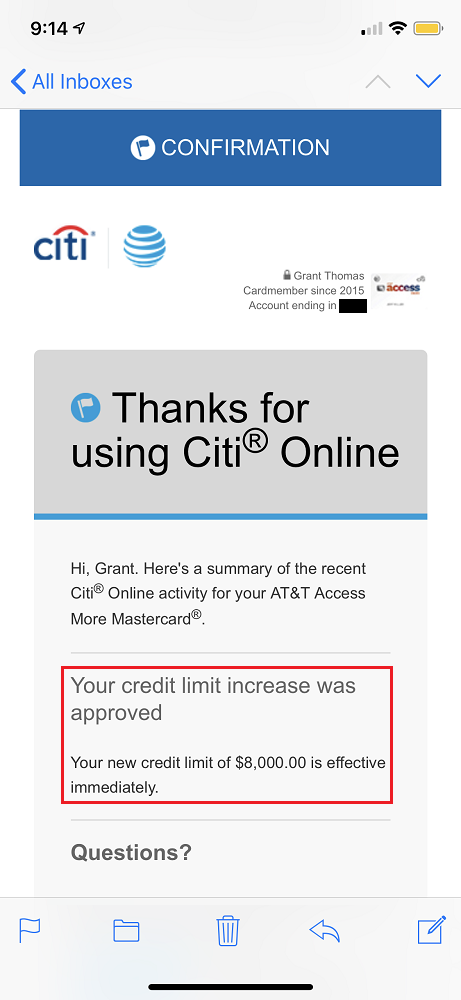

The newly increased credit limit is instantly available to you and can be seen in the Citi app. You will also receive a confirmation email from Citi (email arrived about 30 minutes after I was approved for the credit limit increase).

I repeated the same steps for all 5 of my Citi credit cards and each credit card received a credit limit increase of between $1,500 – $2,000. After 2 minutes, I had increased my total credit limit with Citi between $7,500 – $10,000. Having a higher credit limits means that I will have a lower credit utilization ratio which will increase my credit score. I’m not sure how often you can request a credit limit increase via the Citi app.

If you have any questions about requesting a credit limit increase through the Citi app, please leave a comment below. Have a great day everyone!

Thanks for this walk-through, Grant. I’d recently gotten solicited to do this for my Prestige (Citi sent email and even snail mail encouraging me to see what was behind the Request an increase button), but I guess I presumed using the option when they hadn’t targeted you would be a HP. I tried this for my Citi AA and it instantly added $3.5k to my CL, bringing it in line with the Prestige increase they’d provided last month.

That’s great, I’m glad you were instantly approved for the credit limit increase. I’m sure I got similar emails from Citi regarding requesting credit limit increases but probably instantly dismissed them because I thought there would be a hard pull too. After several days, I still haven’t gotten any credit monitoring alerts from any of the services I use.

Do you have multiple Citi CCs? Are they also eligible for a credit limit increase? If yes, will you request credit limit increases on those CCs as well?

Grant, you are the man. Got a 8k increase on my Prestige, 3k on the Double Cash and 2k on Citi Premier. That worked like a champ!

That’s great news, I’m glad you were able to get credit limit increases on your Citi CCs :)

Pingback: Citi Adds Flex Loan Feature to Some Citi Credit Cards (Instant Cash Advance for 9.99% APR)

Thanks Grant. It just worked on myDC. Your content sharing is unique. Keep it up.

Great, glad to hear :)

Pingback: Quick & Easy Credit Limit Increases with the Citi App (No Hard Pull or Credit Check)