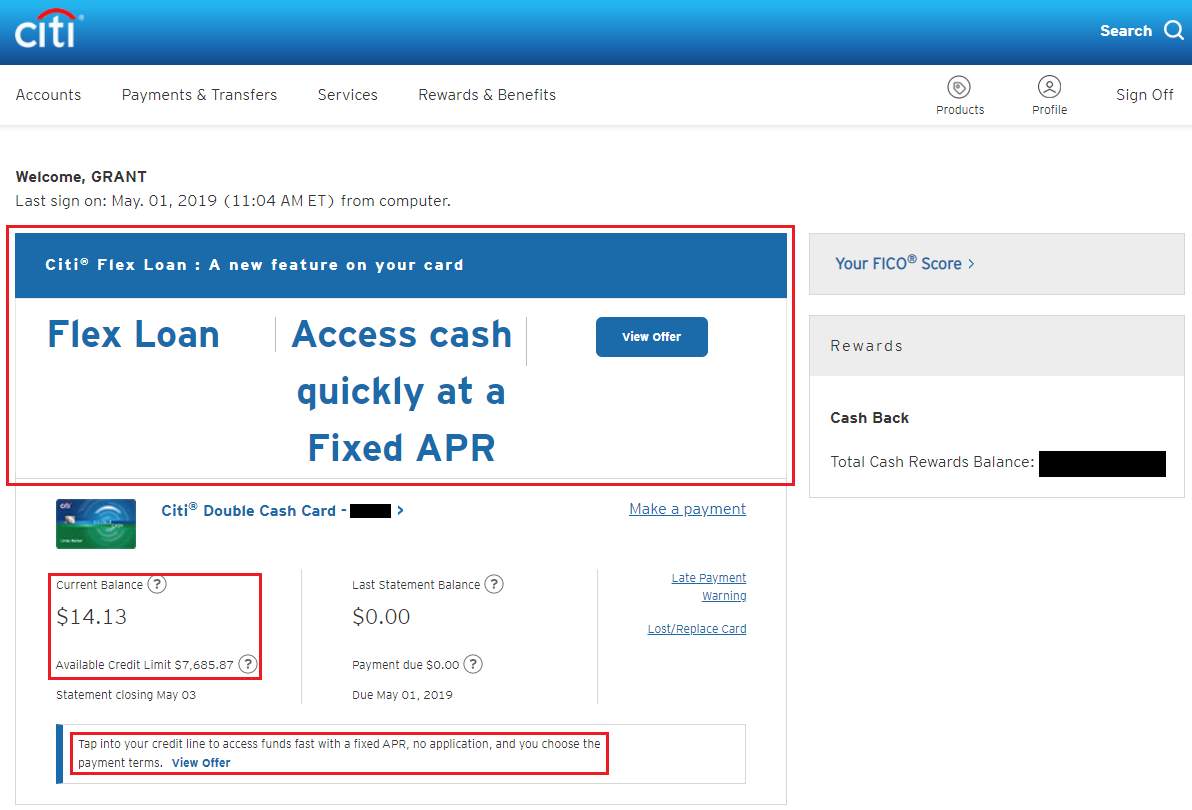

Good afternoon everyone, I just saw this new feature on my Citi online account. Citi introduced a new feature called Citi Flex Loan (learn more here) where you can basically get a cash advance up to your available credit limit. If you need a higher credit limit, you can Easily Request a Credit Limit Increase (No Hard Pull) via the Citi App. I am not saying this is a good idea, but I wanted to share the details with you in case you were interested. After I logged into my Citi online account, I saw this big banner above my Citi Double Cash Credit Card. I decided to check it out by clicking the View Offer button. FYI, my total credit limit is $7,700, but my current available credit limit is $7,685.87.

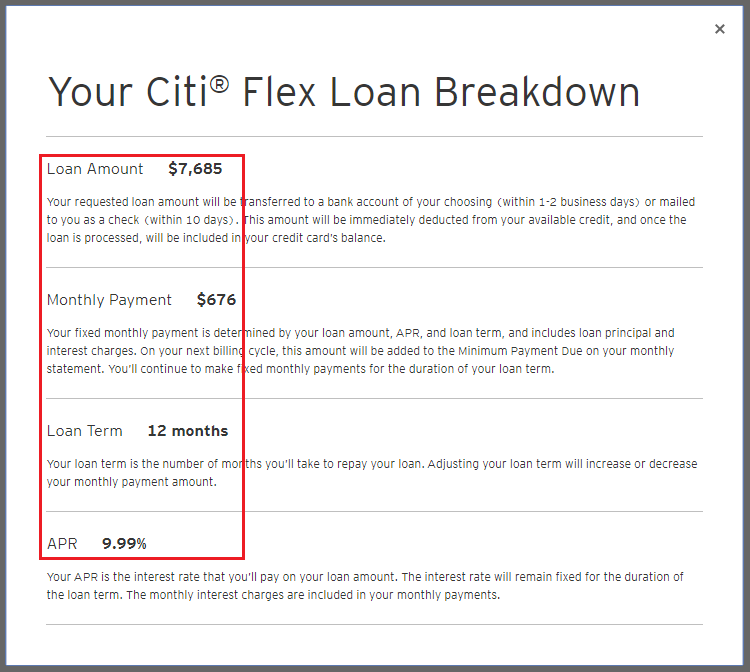

I have 5 Citi credit cards (Double Cash, Premier, and 3 AT&T Access More Credit Cards), but the Citi Flex Loan was only available on my Citi Double Cash. For the loan amount, it defaults to maxing out your available credit limit, but you can move the slider to change the amount. From the loan term drop down menu, you can select 12 months, 24 months, 36 months, 48 months, or 60 months. The monthly payment details will adjust in real-time based on changes to the loan amount and loan term. If you paid $676 for 12 months, you will have paid $8,112 over that 12 month period (5.6% more than the original amount of the loan).

I clicked the link to view the breakdown of the Citi Flex Loan. It has the same numbers as above with more information about each item. The Citi Flex Loan will be transferred to your bank account in 1-2 business days or mailed to you via check (check should arrive within 10 days).

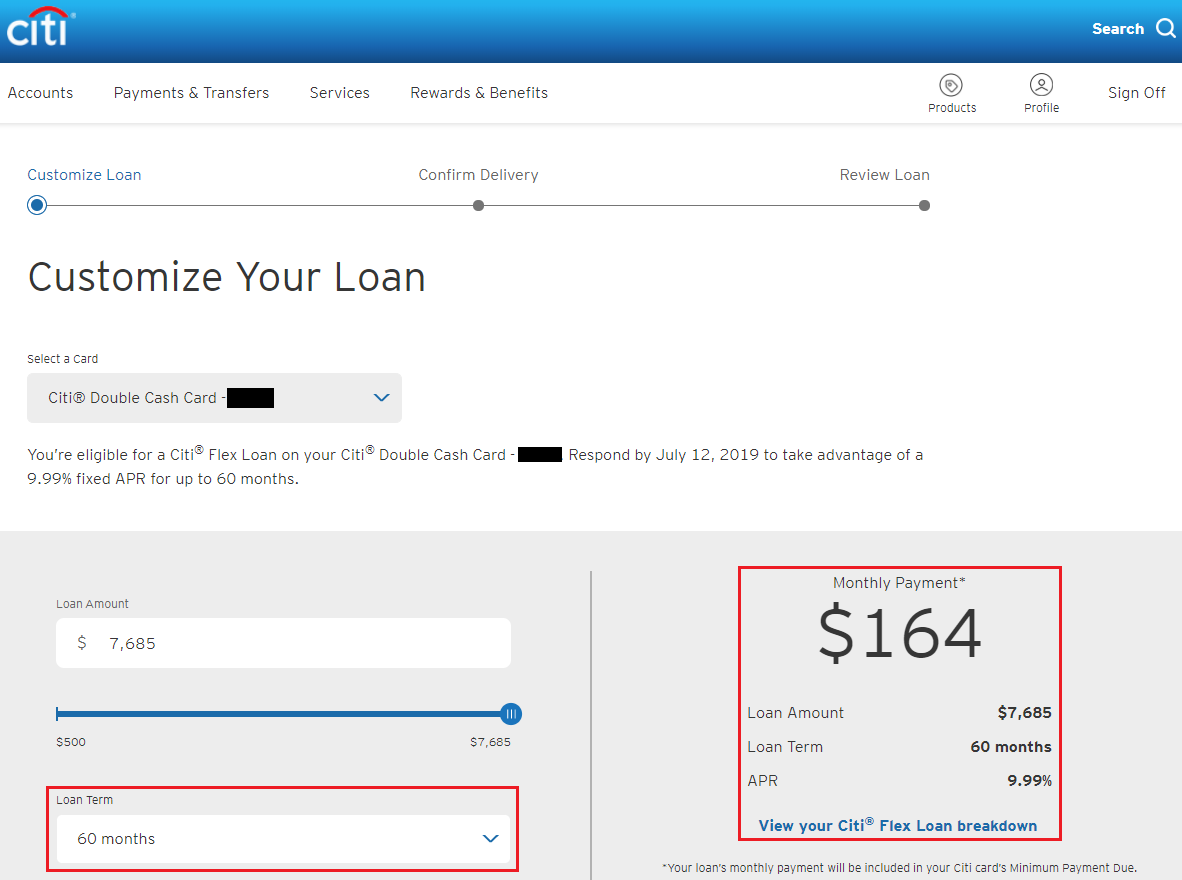

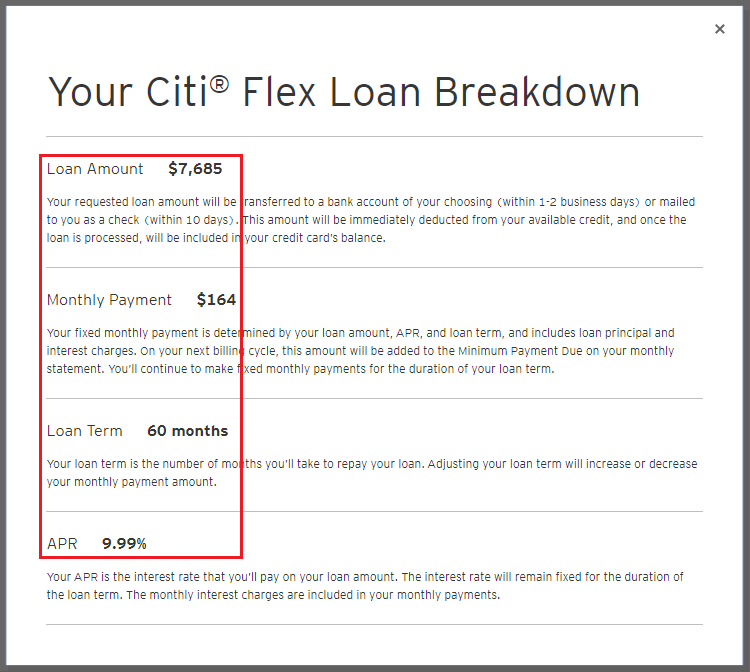

I adjusted the loan term to 60 months to see the change in monthly payment details. The APR stays the same, but the monthly payment goes down from $676 to $164. If you paid $164 for 64 months, you will have paid $10,496 over that 60 month period (36.6% more than the original amount of the loan).

Here are updated numbers of the Citi Flex Loan. The only change is to the monthly payment amount and the loan term.

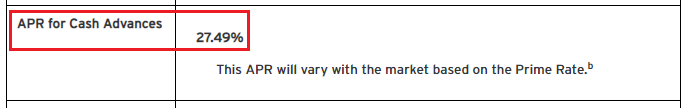

I doubt I will ever use a Citi Flex Loan, but it is definitely a much better deal that the official Citi Double Cash APR for cash advances of 27.49%.

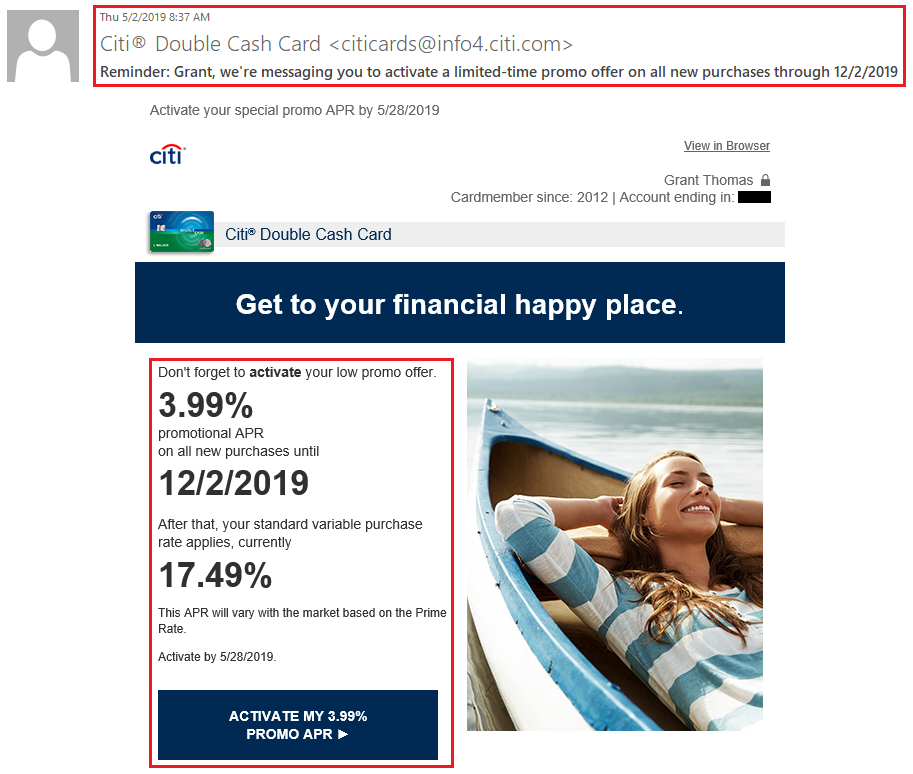

Maybe it is just me, but Citi loves sending me emails and letters about balance transfers and low APR offers on my Citi Double Cash Credit Card. For example, here is the email I received this morning.

If you have any questions about the Citi Flex Loan, please leave a comment below. Have a great day everyone!

I just got the ‘Flex Plan’ letter for both of the Citi cards I have (one of which has an insane balance due already). If I am understanding this correctly, the Flex Plan doesn’t do anything to help with the current balance, or regular purchases made on the card. So, it would only apply to actual loans that you take from the cards available balance?

The interest rate offered on one is 5.49% which is great, but a personal loan at our credit union is usually right around that same rate.

The other interest rate offered is 12.74%.

So, unless this helps us to pay off current balances, it doesn’t appear to be anything I should be signing up for. I just want to be sure I am understanding it correctly,

Thank you

I think you are understanding the Flex Loan correctly. The Flex Loan you take on a Citi CC can be used to pay other bills, but it would not help you pay down an existing Citi CC bill.

Hello I keep toying with the idea of a Flex Loan and cant decide what to do. But your comment above doesnt sound right. I thought you get the entire loan that you need deposited into your bank account and then you can pay off what you want, including other Citi cards and I have 3 of them.

I would call Citi and ask them about the Flex Loan. I’ve never used it before, so I’m not sure exactly how it works.

Is there a prepayment penalty?

I’m not sure, I would double check with Citi if you are interested in the Flex Loan.

What fraud protection if any is there? I know credit card purchases are fully covered, but I can’t find anything that says Flex Loans are. In this day of identity theft, I think that is important, but I can’t find anything written on it anywhere. I called Citi customer service, but couldn’t get a straight answer. Chase has a similar program. I called them and was immediately told that their loans are 100% protected. However, again nothing written that I can find, and their customer service said there was nothing in writing that you could refer me to or send me.

Regarding fraud, are you asking what would happen if someone fraudulently took out a Citi Flex Loan on your account?

Thanks, Grant. You understand my concern correctly. It is that someone fraudulently took out a Flex Loan on my account. I never plan to use it myself. I wish I had the choice of not having it added to the card, which I have had for years. I have a Chase card with the identical situation. The loan options on both cards begin this month.

Both banks wrote to notify me of the addition of the loan option. Neither mentioned fraud protection. I called Chase and was told it would be 100% protected. I called Citi. The person either didn’t know or was being evasive, but there was also a language barrier at Citi.

I read about the Fair Credit Billing Act which protects against fraudulent charges. However, I could not find anything that suggested that these loans would be covered.

I found an interesting post at https://www.creditcardinsider.com/blog/what-is-the-fair-credit-billing-act-fcba-and-how-does-it-protect-you/ It includes the following, “The law applies to “open end accounts.” These include credit cards and revolving charge accounts. The FCBA, however, does not apply to installment loans like mortgages, auto loans, or personal loans which you repay on a fixed schedule.”

In addition, the Fair Credit Billing Act was enacted in 1974 so I doubt this was an issue that they considered when writing it.

I believe if you monitor your Citi CCs and emails from Citi, you should see if someone fraudulently opens a Citi Flex Loan from your account. I’m sure they would need to know a lot of personal information about you in order to successfully open the loan. I’m personally not worried and assume Citi would take care of it quickly if it indeed happened.

Thanks, Grant. That is very helpful.