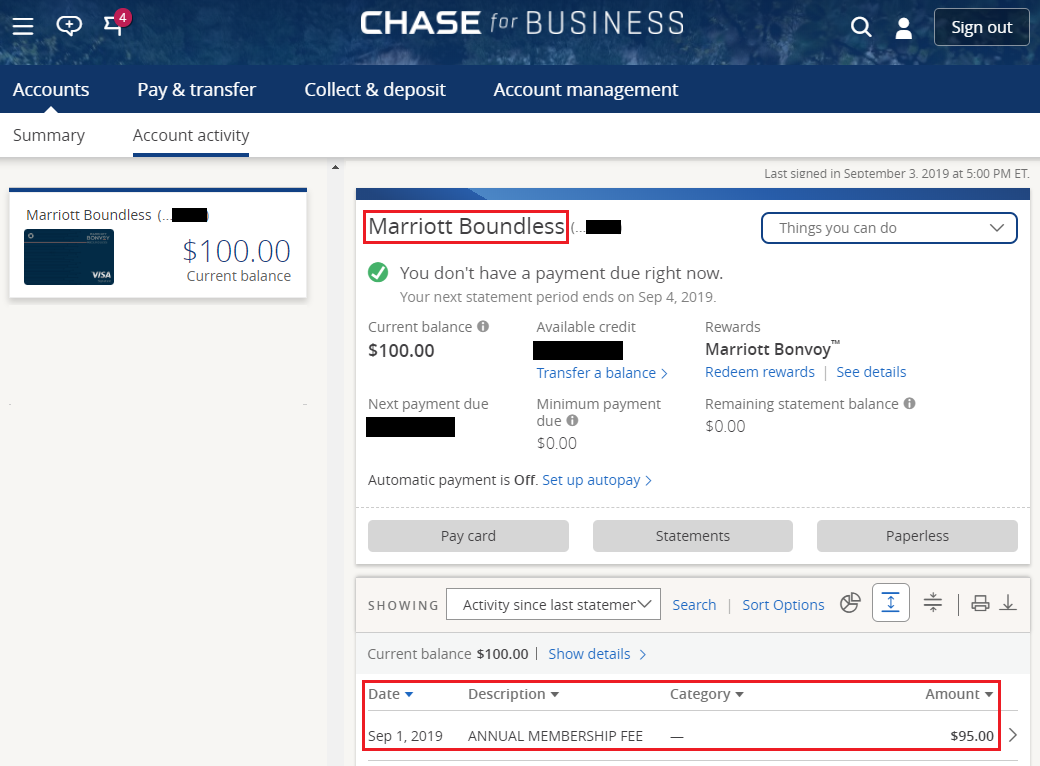

Good morning everyone, happy Friday! As part of my “Keep, Cancel or Convert?” series, I like to evaluate and reevaluate credit cards to make sure they still deserve a spot in my wallet (or credit card drawer). For today’s post, I was reviewing my Chase credit cards and noticed that the $95 annual fee posted to my Chase Marriott Bonvoy Boundless Credit Card. I have had this credit card in various forms over the last few years, starting with the $395 JPMorgan Chase Ritz Carlton Visa Infinite Credit Card, then to the $85 Chase Marriott Rewards Premier Credit Card, then to the $95 Chase Marriott Rewards Premier Plus Credit Card, and now the $95 Chase Marriott Bonvoy Boundless Credit Card. Hopefully that all made sense to you.

Even though I do not love Marriott Bonvoy (even more so after the upcoming Peak and Off-Peak pricing goes into effect), I have continued to keep this credit card for the free night certificate. I can usually get $150-$200 of value from the Marriott Bonvoy 35K Free Night Certificate. I always call when an annual fee posts and ask the credit card company to waive the annual fee (a really long shot), provide a partial statement credit (occasionally), or provide a targeted retention offer (sometimes). If you do not ask, you have a 0% chance of success – the worst they can say is no. So, what did I get offered and what I learn from the call?

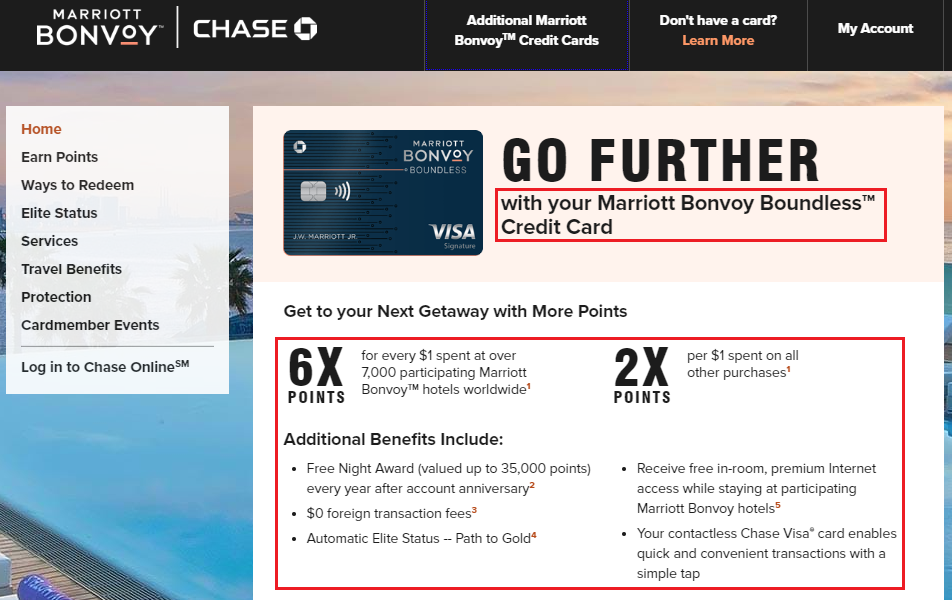

As a refresher, here are the benefits of the Chase Marriott Bonvoy Boundless Credit Card. Basically you earn 6x at Marriott Bonvoy hotels and a Marriott Marriott Bonvoy 35K Free Night Certificate. The other benefits do not matter to me.

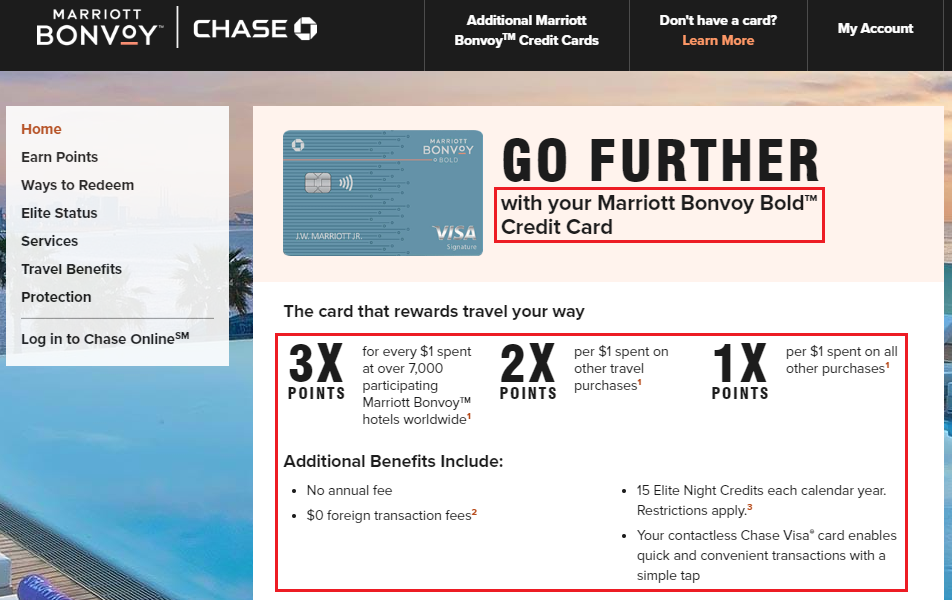

When I called Chase, I stated that the $95 annual fee just posted and that I was concerned about the upcoming changes to Peak and Off-Peak pricing and I wasn’t sure if I was going to keep the credit card going forward. I asked the rep if she could waive the annual fee – she could not – and I asked if there were any targeted spending offers – there were none. Her only solution was to tell me about the Chase Marriott Bonvoy Bold Credit Card. This credit card has no annual fee and no foreign exchange fees but does not include a Free Night Certificate.

I told her that the Marriott Bonvoy 35K Free Night Certificate was really important to me, so I would keep my Chase Marriott Bonvoy Boundless Credit Card open. She said that I had 30 days from the date the annual fee posted (September 1) to downgrade to the no annual fee Chase Marriott Bonvoy Bold Credit Card and get a full refund on the annual fee. If I downgraded within the first 60 days, Chase would provide a prorated annual fee refund. If I downgraded after 60 days, I would not get any prorated annual fee.

If you have any questions about the Chase Marriott Bonvoy Boundless Credit Card or Chase Marriott Bonvoy Bold Credit Card. please leave a comment below. Have a great weekend everyone!

Many of the credit card issuers are clamping down on card holders trying to get wavers. Mostly do to the hackers out there In the past if I had real issue with renewing called and received an acceptable adjustment. Bearing in mind my cards have been in my wallet for years some going back 20 years “loyalty does have it’s rewards”

I remember back 4-5 years ago when I would get annual fee waivers and decent retention offers all the time. Now, I can barely get any type of retention offer besides downgrading to a no annual fee card.

I tried this a few weeks ago with my Amex SPG and was offered 10K points with a reasonable spend requirement – but I was asking for 30K points. I never use the card anymore. I used to spend a ton on it but the point devaluation killed its value. So I cancelled it and will eventually get the no fee Chase Bonvoy card. I recently added the no annual fee Hilton Amex Card and received 100K points after spending $1K in 3 months. Hilton properties are not that bad…

I actually prefer Hilton properties over Marriott properties myself. Nice to see the huge sign up bonus on the no annual fee AMEX Hilton CC.

I’ve got the same card, annual fee was due on my early September statement. Made the call to Chase, pretty much the same answer back that you got (no waiver of AF, no offers on account). I told them to close the account (sometimes this triggers a transferred call to a different department…but not in this case). When the rep asked my confirmation to close the account, I told the rep I changed my mind, and kept it open. I agree with your assessment, should be able to squeeze out more than $95 in value with the free night.

Did you also get this line, “of there are offers on your account, you will receive an email from Chase”?

No, the rep didn’t mention that to me. My wife’s account had renewal in August, and pretty much the same call as well (no offers/credits, no waiver of AF). Neither of us hit these cards hard with spending during the year (mostly just the spend to open the card and then maybe a few hundred per year). My guess is since we’ re not that profitable to Chase with this card, they don’t need to keep us as a customer. We have several other chase cards that get most of our spend (CSR, Ink, Freedom, FdmUnl), maybe that factored in also (since we’d still be chase customers even if the Marriott cards got closed.)

I’m probably not a very valuable Chase customer either. I probably spend up to $1000/year on my personal Marriott CC and old Hyatt CC. I don’t spend anything on my business Marriott CC or old IHG Select CC, but I keep them around for the free night certificates.