If you’ve just started paying more attention to your financial health and wellness, you may have heard about some easy ways to start micro-investing. However, it can be difficult to begin when you’ve never had an investment profile before, especially if you don’t have enough capital for a solid play-portfolio.

There are quite a few personal finance apps out there to help consumers get started on day trading and micro-investing, but it’s up to you to figure out which ones are relevant to you. If you are just beginning but want to learn more about micro-investing, I definitely recommend signing up for Acorns.

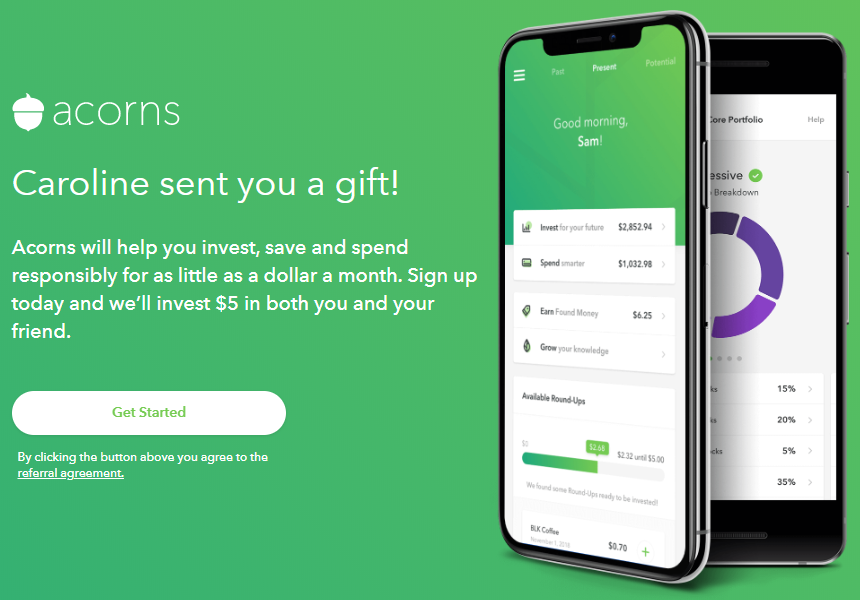

Acorns (also known as Raiz) is a simple, easy to use app that demystifies micro-investing for beginners. Within the Acorns interface, you can start investing spare change without even thinking about it; it’s a set-it-and-forget-it type of environment that can track your purchases, round them up to the next dollar, and throw those extra coins into a separate account.

How it works is easy. Simply link your bank account and/or any credit cards that you’d like to securely attach to your Acorns account, and Acorns does the rest. Every time you make a purchase with those cards, Acorns will round up that purchase and set aside that extra money. Every time your round-up change adds up to $5, it’s officially invested into your Acorns account. To speed things up, you can even multiply the round-ups by 2, 3, or even 10.

In addition to round-ups, you can make a monthly investment from your bank account and put it directly into your Acorns account. This makes it even easier to grow your account; it happens quicker than you may think.

For me, the coolest thing about Acorns is that your Acorns account is truly an investment account. Acorns doesn’t use the term “investment” lightly, as simply setting aside extra cash is closer to a checking account. Instead, Acorns invests your change in a variety of ways, from large and small company stocks to government and corporate bonds. It’s up to you whether you’d prefer a conservative, moderate, or aggressive profile; each profile type weighs your investments into different percentages depending on the category that piques your investment interest. That way, you can see your account ebb and flow with the market, and explore different investment strategies with little risk.

If you’re excited about your Acorns account, Acorns wants you to tell your friends about it! Several times per year, Acorns runs bonuses and referral promotions that benefit you when you convince your friends to sign up. This month, getting three friends to sign up and make an investment by the end of September can get you an extra $150 in your account. That isn’t bad, considering that it comes out to $50 per friend.

If you were looking for an invitation to join the world of micro-investing, this is it. Join today for a $5 sign-up bonus, then get your friends to join too so that you can snag that great referral bonus!