Good morning everyone, I hope you had a great weekend. First off, the title is not a typo, I have started using my Citi Thank You Points instead of my Chase Ultimate Rewards Points to book a few recent flights. Secondly, the title is true for me now, but could change down the road. And lastly, you are totally right to disagree with me and prefer using your Chase Ultimate Rewards Points. But, let me share my perspective and reasoning with you so that you can see where I am coming from.

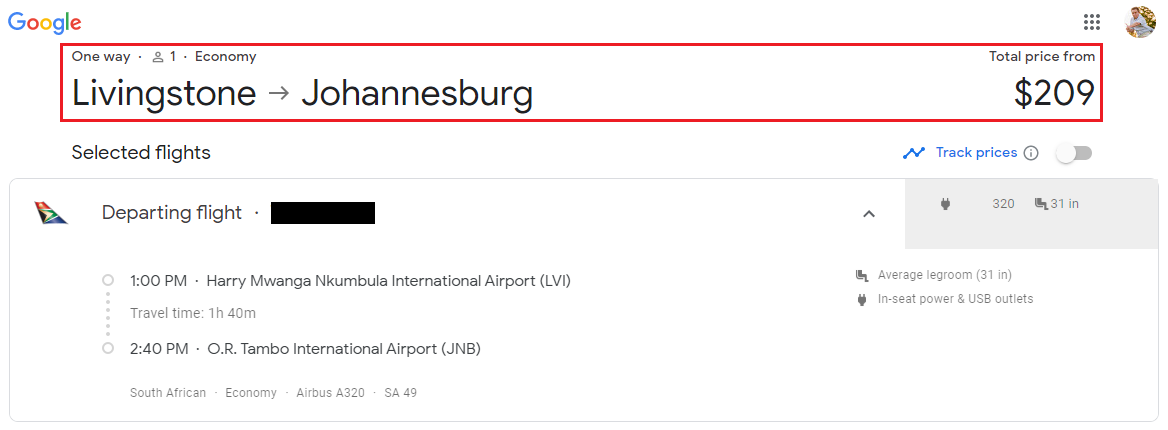

Long story short, I am planning an upcoming trip to Africa and will visit a few countries near South Africa. After checking schedules and prices, I decided to book a South African Airways flight from Livingstone, Zambia (near Victoria Falls) to Johannesburg, South Africa. Now the question was, should I book it directly with my credit card, or should I use my Citi Thank You Points or Chase Ultimate Rewards Points to pay for the flight?

On the Chase Ultimate Rewards travel portal, the flight is available for 13,905 Chase Ultimate Rewards Points or $208.58. Since I have the Chase Sapphire Reserve Credit Card, I am able to redeem Chase Ultimate Rewards Points for paid travel at 1.5 cents per point (CPP) ($208.58 / 13,905 = 1.5 cents).

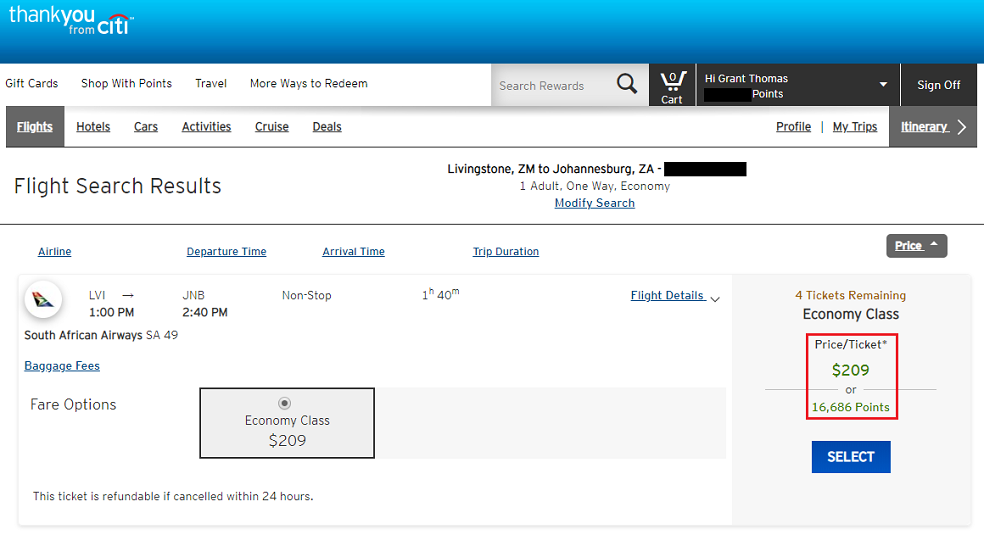

On the Citi Thank You travel portal, the flight is available for 16,686 Citi Thank You Points or $208.58 (shown as $209 on this screen). Since I have the Citi Premier Credit Card, I am able to redeem Citi Thank You Points for paid travel at 1.25 CPP ($208.58 / 16,686 = 1.25 cents).

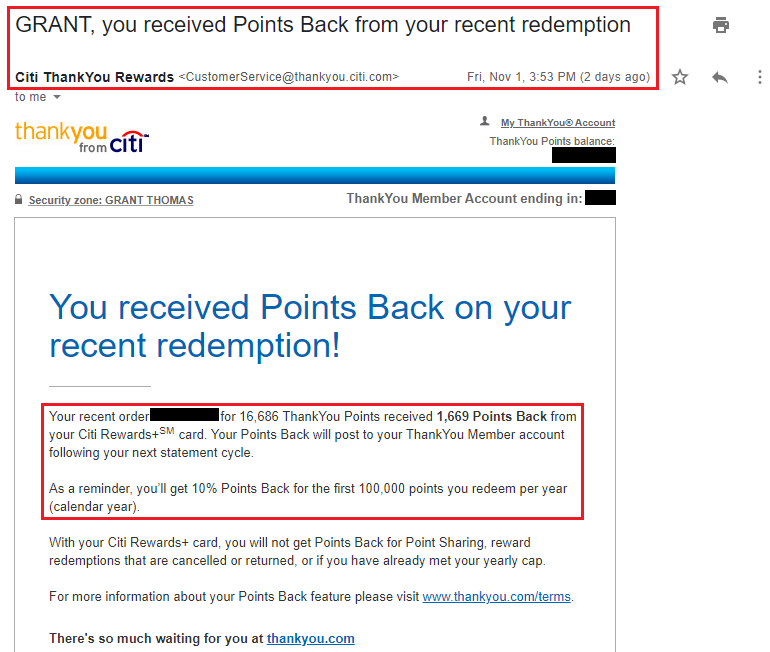

If you also have the Citi Rewards+ Credit Card, you get 10% of your redeemed Citi Thank You Points back (up to 10,000 Citi Thank You Points per calendar year – and the calendar year has less than 2 months left).

In the above example, the flight cost 16,689 Citi Thank You Points, but I would get 10% of those Citi Thank You Points back (1,669 Citi Thank You Points). Let’s do some math. 16,689 – 1,669 = 15,020, then divide that by the $208.58 cost of the flight = 1.39 CPP ($208.58 / 15,020 = 1.39).

As you can see, 1.39 CPP for Thank You Points is still less than the 1.5 CPP for Chase Ultimate Rewards Points. The next 3 things I took into consideration are:

- The number of Citi Thank You Points and Chase Ultimate Rewards Points in my accounts

- The MS costs to generate more Citi Thank You Points and Chase Ultimate Rewards Points

- The potential value I could get out of Citi Thank You Points and Chase Ultimate Rewards Points in the future when I redeem the points

#1 is easy to figure out, just log into your accounts to look at your current points balances. As I wrote about a few weeks ago, I received a huge stash of Citi Thank You Points that I wasn’t expecting (Huge Score! Citi AT&T Access More Credit Card Thank You Points Adjustments Posted) which resulted in me having about twice as many Citi Thank You Points as Chase Ultimate Rewards Points. For #2, I calculated the costs to MS Citi Thank You Points and Chase Ultimate Rewards Points. As of today, I can generate Citi Thank You Points for about half the cost of Chase Ultimate Rewards Points. In other words, Chase Ultimate Rewards Points are twice as expensive to generate compared to Citi Thank You Points. Lastly, #3 is hard to calculate because it is based on an estimate of future redemptions that haven’t been booked or thought of yet. Both Citi and Chase have transfer partners that have some overlap, so it’s possible to get the same value if I transferred points into the same airline loyalty program.

Therefore, based on the large number of Citi Thank You Points I currently have and the lower cost to MS more Citi Thank You Points, it made sense for me to redeem my Citi Thank You Points for flights. If your answers to the above 3 considerations are different than mine, you may come to a much different conclusion than I did. I would love to hear your view on this discussion and please let me know if you agree or disagree with my rationale. Thanks for reading and have a great week.

Why is this?

“of today, I can generate Citi Thank You Points for about half the cost of Chase Ultimate Rewards Points. “

Because of my MS techniques, I can generate Citi TYPs much cheaper than Chase URs.