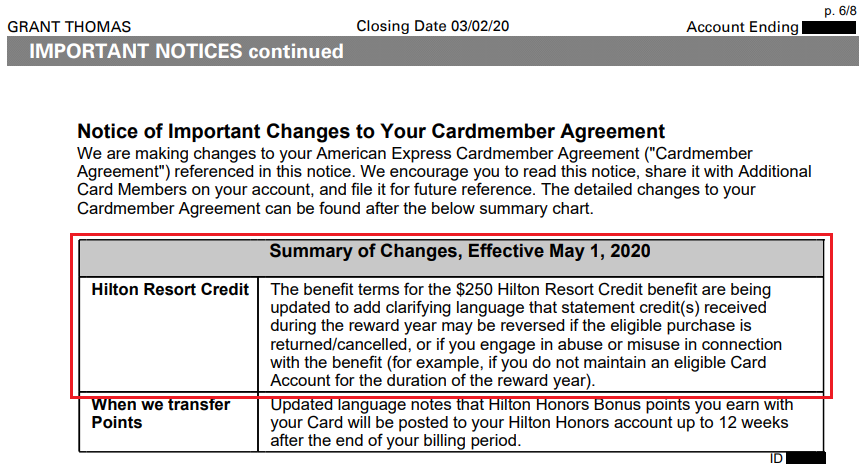

Good afternoon everyone. I was just going through my recent American Express credit card statements and stumbled upon this upcoming change to the $250 Hilton Resort Credit and point transfers for the American Express Hilton Aspire Credit Card. Effective May 1, 2020, American Express may reverse statement credits earned if your eligible purchase is returned / cancelled (aka, if you book a refundable hotel reservation to earn the credit, then later cancel the hotel reservation). American Express may also reverse the statement credit for “abuse” or “misuse” of the benefit and if you do not maintain the eligible card for the entire year (aka, if you downgrade or close your card before the year is over). These are some pretty specific warnings from American Express.

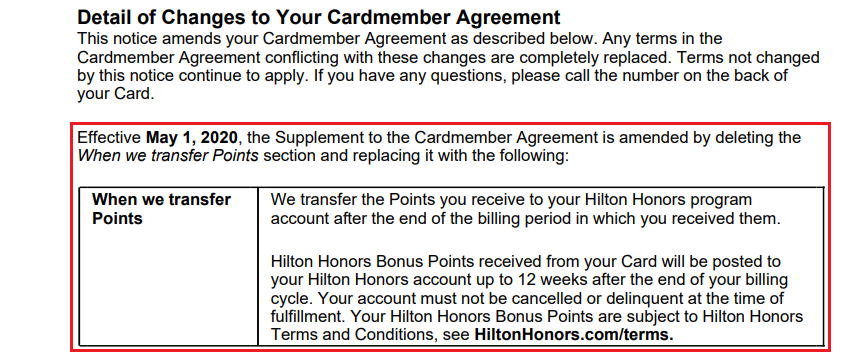

In addition, American Express also announced changes that go into effect on May 1, 2020, regarding when your Hilton Honors points will be transferred from American Express to your Hilton Honors account. After May 1, 2020, you may have to wait up to 12 weeks for the Hilton points to post to your Hilton Honors account. That is an extremely long time to wait for Hilton points considering currently earned Hilton points show up within a week of your credit card statement closing.

These are both very negative changes to the American Express Hilton Aspire Credit Card, but we have almost 2 months until the changes go into effect. If you have any questions about these changes, please leave a comment below. Have a great day everyone!

Pingback: American Express Updates Terms On Hilton Aspire $250 Resort Credit To Prevent Abuse - Doctor Of Credit

Amex has certainly been on a roll lately.

Yes, sadly, they are steamrolling all their great benefits :(

How exactly is this VERY NEGATIVE? If you want to commit fraud, then yeah I guess it is negative. Otherwise, I have no issue with the changes.

“Commit fraud” seems a bit harsh here. Imagine a world where you booked a Hilton resort months in advance with the intention to stay at that resort, but then some mysterious disease (aka coronavirus) comes around and you decide to cancel your stay at the resort. There are legitimate reasons why you might need/want to cancel a hotel reservation.

Umm, then the resort (or the insurance) is supposed to refund your money. If you didn’t have travel insurance, well, you *know* you will lose that money if something bad happens.

The point is, if you get your money back, then Amex should get *its* money back. The money is supposed to be spent on Hilton resort, not cash in your pocket.

I totally agree, if you don’t deserve the credit, you shouldn’t receive (and keep) the credit.

OK, but why do you think you should receive the credit?

I don’t think you deserve the credit if you cancel the resort reservation. You only deserve it if you complete your stay at the resort.

Dude, Grant. At least half of the words in all your recent articles have been SEO keyword stuffing. Can you please try writing like a person?

In 3 sentences, you managed to stuff “hilton” in six times and “points” four times. It’s like how I used to write in middle school when I was trying to reach the teacher’s 500 word requirement.

Hi Mike, I’m sorry if it sounds like I am keyword stuffing, that is the way I type and speak. I hope you enjoyed the rest of the article. Have a great day.

thx Grant for the heads-up; earlier was the airlines cr, and now this…. won’t likely keep any amex premium or high-fee cards anymore

It is harder and harder to get all the value out of premium AMEX CCs these days :(

Will they reset the credit counter if you happen to get a refund or are they just going to shaft people like that did with the airline credit reversals? I know there will be some cases where people try to game the system but there are plenty of times where people will legitimately cancel plans resulting in a refund.

It is too early to tell. I think if you have a legitimate issue, you can contact AMEX and they will make it right and give you the credit.

Pingback: American Airlines Targets The Aspire Credits Next - Adds New Terms

I’m surely one of the folks they are targeting as I (inadvertently and prematurely) received the $250 Resort credit in January. How it happened:

1. Had tentative plans to attend an IT conference in Las Vegas, and booked (online) a night at the Waldorf Astoria. (Was looking forward to receiving $250 back on my Aspire after staying there.)

2. The Waldorf Astoria charged my Amex Aspire the FULL amount for the stay in advance. (I made a regular/standard reservation, *not* a pay-in-advance, non-refundable rate)

3. I was not a happy camper the Waldorf Astoria was getting a 7-month, interest free loan on my $300, and so cancelled my reservation (online).

4. Shortly after the charge posted to my Aspire, I received the $250 annual Resort credit to my account.

5. I called the toll-free number on the back of my Aspire to inform them I had received the $250 credit (with the expectation they would reverse it). Was told that once issued, they could not reverse the credit.

So I have received the $250 annual credit but haven’t yet stayed at a Resort. Have tentative plans to stay at another Hilton Resort property later this year, but will be interesting to see if Amex comes clawing back for it now. I don’t care if they take it back, so long as I can still use/earn it again during my cardmember term.

luke, will see it’s clawed back this yr or next; if the latter, the benefits is likely lost

Hi Luke, thank you for sharing your experience. I would recommend using your AMEX Hilton Aspire CC for that future Hilton resort stay and make sure at least $250 is charged to the card. If it does, then you should be fine. If AMEX decides to screw you over down the road, you can contact them, explain what happened, and show them the second qualifying charge. Good luck!

Yes, indeed, that’s the plan. We’ll see how it goes.

Keep me posted on how it goes :)

Hi Grant – Great observation on the new Amex language, and thank you for the article.

I can certainly see why Amex wants to stop people from making a reservation with a refundable deposit, collecting the credit, then cancelling the reservation – thereby turning the Hilton credit into cash without having spent money with Hilton.

I’m most concerned about the part where they talk about abuse/misuse and give the example, “if you do not maintain an eligible Card Account for the duration of the reward year.” This may seriously impact the ability to get the most out of benefits by upgrading and downgrading cards (as we’ve written about). We have always recommended that a person keep a card for at least a year after upgrading, so as not to run afoul of Amex rules. But the new language suggests that one might need to keep an upgraded card longer, through the end of the “reward year” (cardholder anniversary year), if they have used the resort credit.

What do you think? Thanks. ~Craig

When I read the terms about the upgrade / downgrade / cancellation, I thought of your posts. It seems like AMEX wants to put an end to all these games that we play with their CCs :(

Pingback: Amex 在条款中添加了防止滥用酒店报销的语句 - 美国信用卡指南

Pingback: Warren Buffett Sees Delta Air Lines As A Buying Opportunity - View from the Wing

Pingback: Amex adds "anti gaming" language to Hilton Aspire credit

Pingback: 【保存版】Hilton Aspireに付帯する「ヒルトン・リゾート・クレジット」(Resort Credit)の詳細解説 | アメリカ駐在員のカネとバラの日々