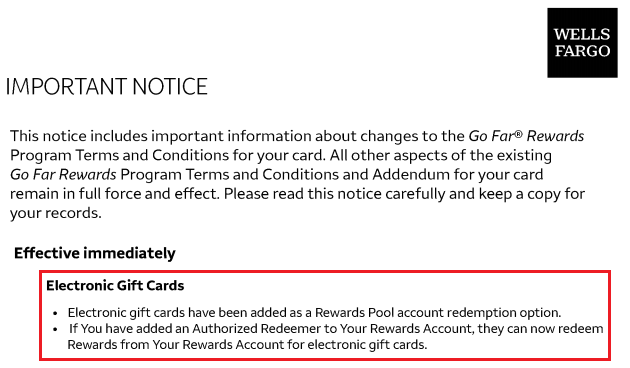

Good afternoon everyone. I was reviewing my recent Wells Fargo Propel World Elite Credit Card statement and noticed a few changes regarding Go Far Rewards. There are 4 changes that affect electronic gift cards, forfeiture of points at death, misuse / gaming, and daily limits on cash redemptions. I’m not very familiar with the Go Far Rewards program, but I will attempt to provide some insight about these changes. The first change is positive. You can now use points from a Rewards Pool (similar to a family share account) to redeem for an electronic gift card (eGC). I must really be out of the loop since I did not know you could pool Go Far Rewards or redeem points for eGCs.

You first need to set up a pool or join a pool. To do that, log into your Go Far Rewards account and click the Share Rewards link at the top of the page. From here, you can create a new pool or enter the details of an existing pool to join that pool.

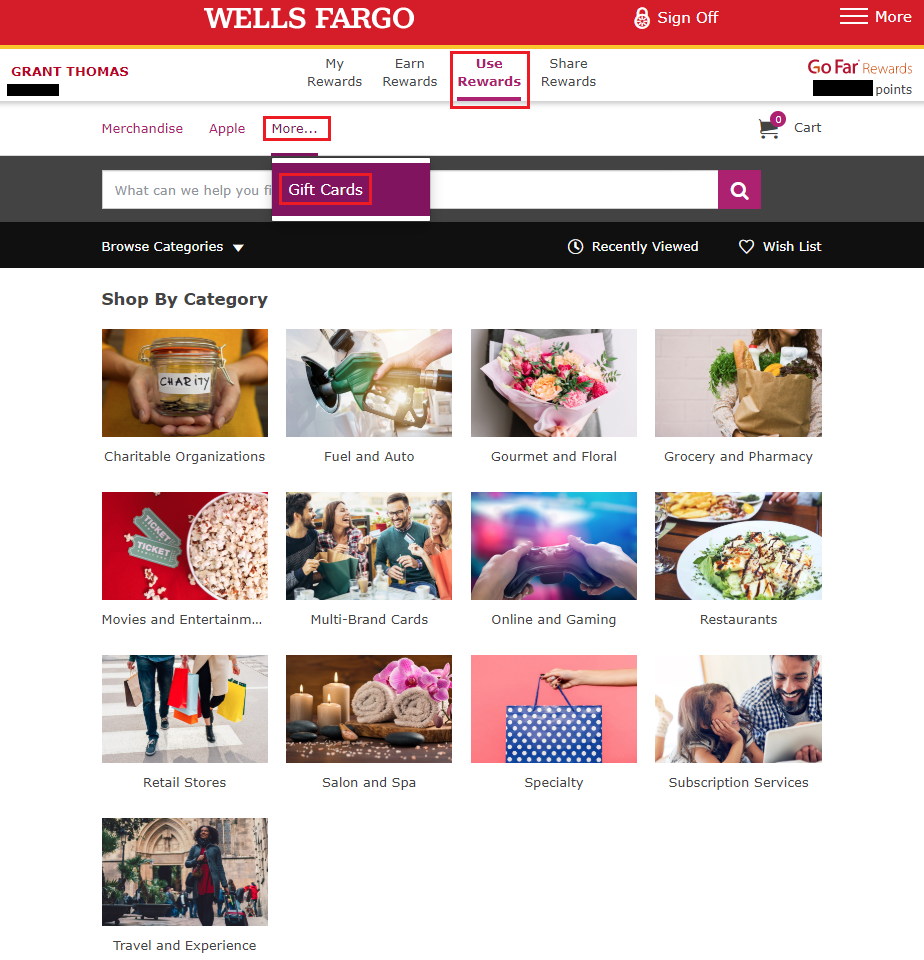

To redeem Go Far Rewards for eGCs, click the Use Rewards link at the top of the page, then click the More link, and then click the Gift Cards link. There are several gift card brands available from a wide variety of categories.

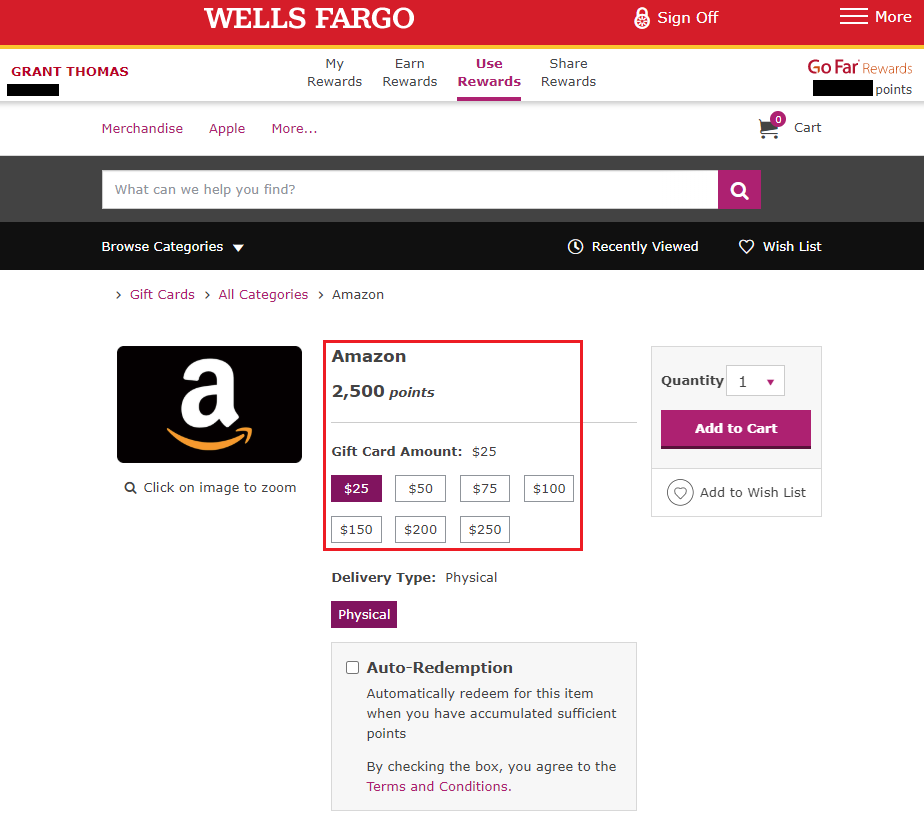

I didn’t look through all the GC options, but I did see that you could redeem 2,500 Go Far Rewards Points for a $25 Amazon eGC. There was no discount for purchasing a large eGC, the ratio was always the same (1 point = 1 cent).

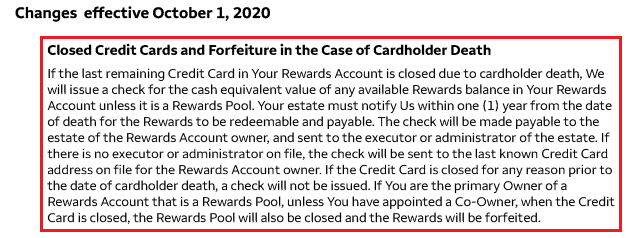

The next change is regarding forfeiture of points in the case of cardholder death. If the cardholder has Go Far Rewards Points and dies, the estate can contact Wells Fargo and have a check sent to the estate. If the credit card is closed before the cardholder dies, you will forfeit any Go Far Rewards Points. Lastly, if the cardholder dies and has shared their points with the pool, the pool will control the points. This is a little tricky to understand, so hopefully I interpreted the terms correctly.

This third change should be very worrisome to cardholders. Wells Fargo has provided more information about misusing your card or gaming the rewards. Basically, if you do not act like a typical customer in the way you earn or redeem rewards, or if you have multiple credit card account applications and openings, you should be concerned that Wells Fargo may close your account or take back points.

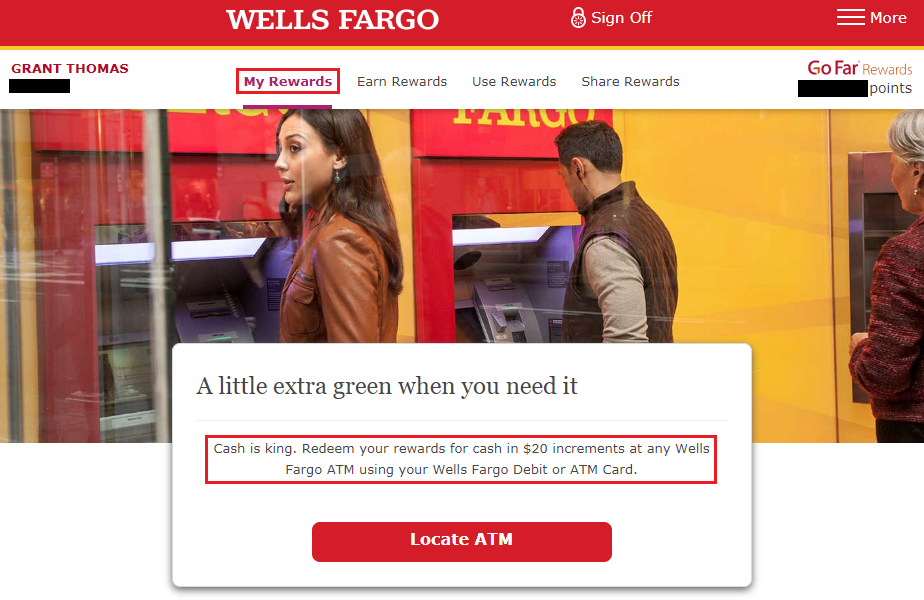

Lastly, Wells Fargo may put a daily limit on the amount of cash or cash redemptions you can make at an ATM. I was not aware you could redeem your Go Far Rewards Points for cash and withdraw the cash from an ATM (presumably just Wells Fargo ATMs), but if you are taking large amounts out, Wells Fargo may limit your daily limit.

You can cash out Go Far Rewards at Wells Fargo ATMs in $20 increments.

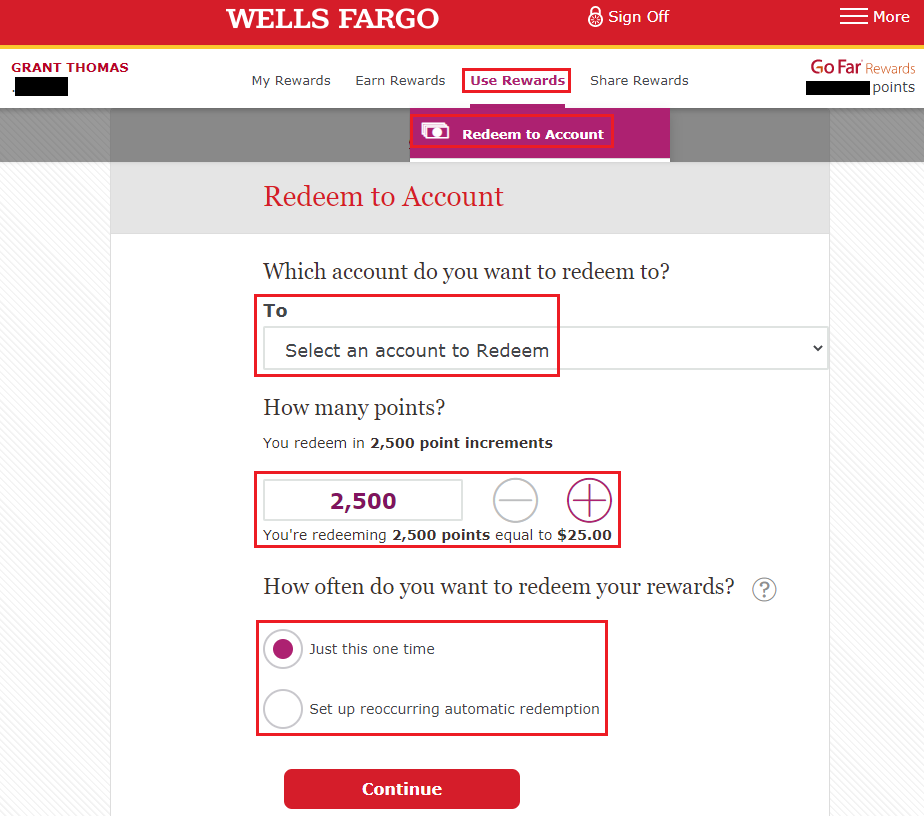

Instead of going to an ATM, you can also redeem your Go Far Rewards Points for statement credits applied to your credit card or a cash deposit to a linked Wells Fargo account. To do this, click the Use Rewards link at the top of the page and click the Redeem to Account link. Select the account you want the funds to go to, select how many points you want to redeem (2,500 point increments), decide how frequently you want to cash out and click the Continue button.

Hopefully these 4 changes to the Go Far Rewards program do not greatly affect you. If you have any questions about these changes, please leave a comment below. Have a great day everyone!

Pingback: Wells Fargo Adds Terms Against Credit Card Gaming & Misuse - Doctor Of Credit

Pingback: Changes to American Express Credit Card Terms (Bye Ameriprise, Third Party Purchases, Foreign Currency & Cash Advances)

WELLS FARGO??? Good Grief !! Given the bank’s ongoing history for chicanery, misrepresentation, and slimy business practices..to say nothing of their settlements with the Governent, why in the world would you want a credit card with them. If you have one, read ALL the fine print with a microscope and also have your attorney (and maybe the nearest US Attorney) review it as well. And Good Luck !!!