Good evening everyone. Earlier this week, I reviewed my Wells Fargo credit card statements and spotted some changes to the terms. I wrote about those changes here: Changes to Wells Fargo Credit Card Go Far Rewards Terms (eGC, Forfeiture at Death, Misuse / Gaming & ATM Limits). For today’s post, I reviewed my recent American Express statements and compiled all the changes I saw on my cards. Nothing super interesting stood out to me, but I did see mentions of Ameriprise, third party purchases, paying in foreign currency, cash advances, and a few other things. Here is my attempt to provide some insight about these changes. Just a heads up that American Express likes to repeat the same information in different places. This first section covers Ameriprise cards, earning points with third party purchases, and the arbitration process.

In October 2019, American Express stopped accepting applications for the American Express Ameriprise Platinum Card and American Express Ameriprise Gold Card. Cardmembers were converted to the regular American Express Platinum Card and American Express Green Card, respectively. American Express is removing any mention of Ameriprise going forward (seems like a bad break up when you delete all your ex’s photos from your Facebook account).

American Express is making changes to the way we receive additional points for shopping at merchants who use a third party to sell or process an order or if an order was made with a mobile wallet (like Apple Pay or Google Pay). This could be bad news if you buy something from a merchant who codes as a bonus category but the charge is processed by a third party. It would be a shape to miss out on a bonus category when using a mobile wallet.

American Express provides an update if you are going through the arbitration / claims resolution process.

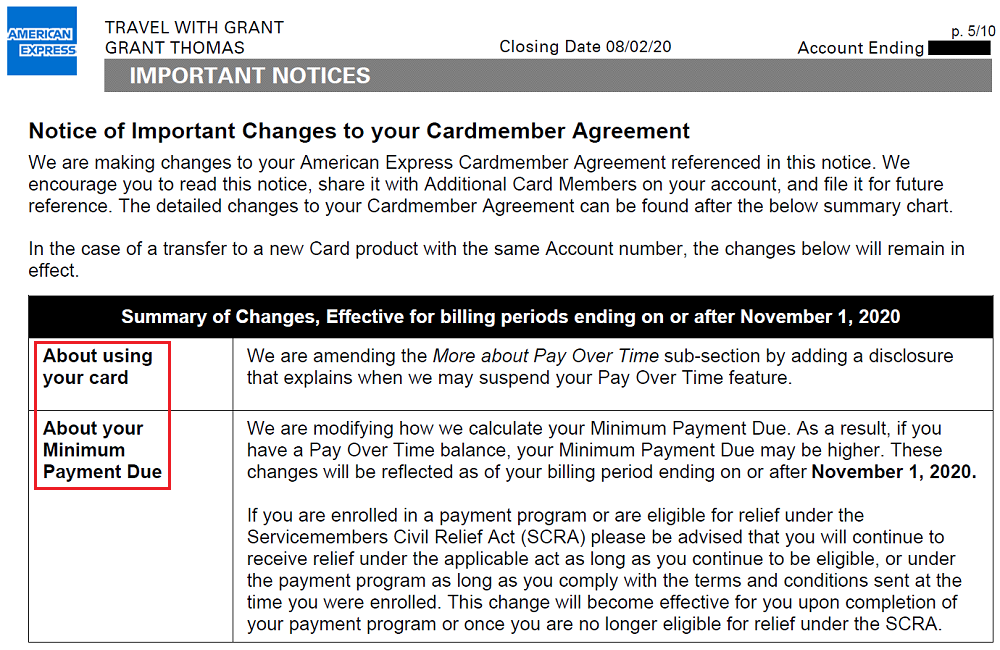

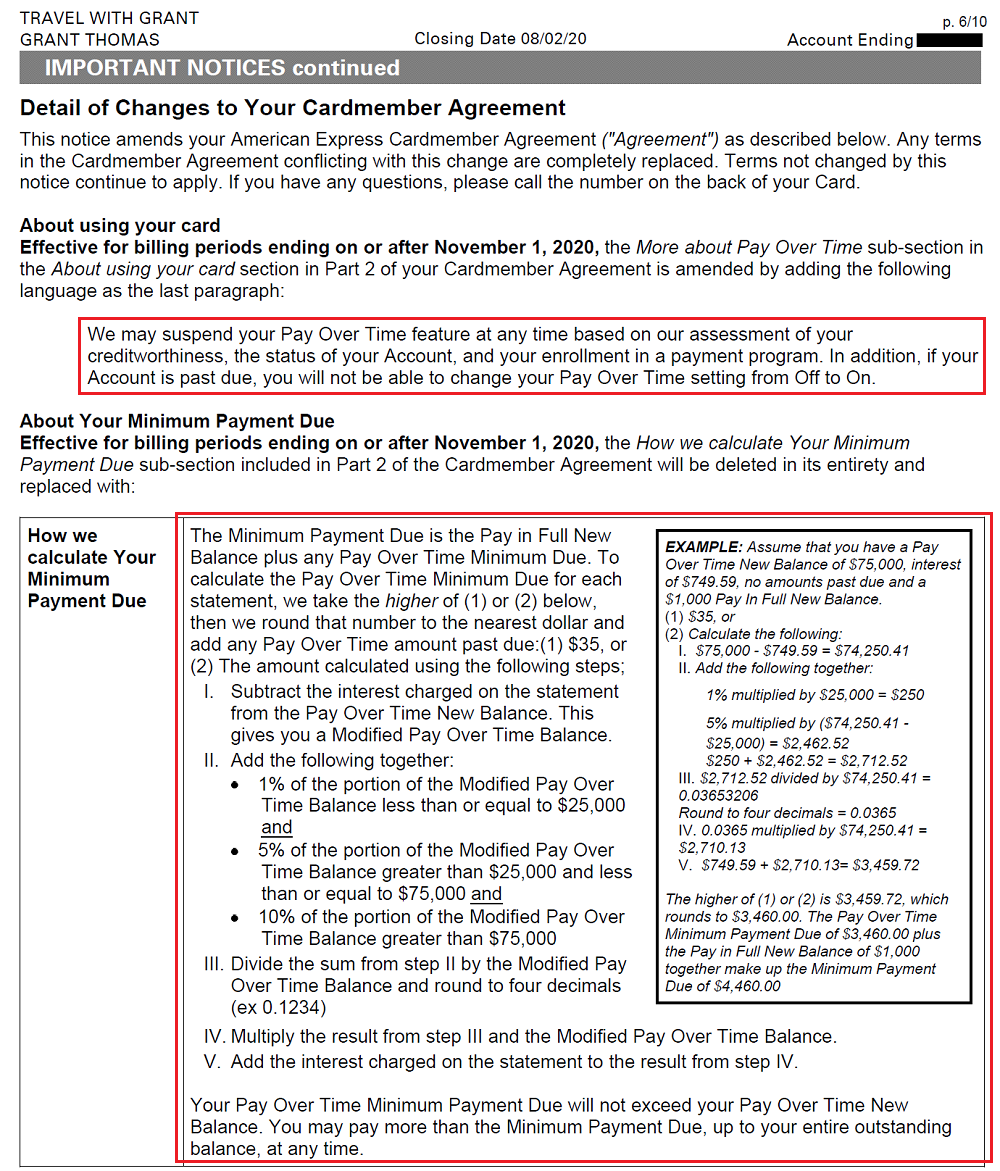

This next section covers the Pay Over Time feature and how American Express calculates your minimum payment amount.

American Express may suspend your Pay Over Time feature at any time based on changes to your creditworthiness, status of account and payment program. If your account is past due, you cannot turn on the Pay Over Time setting.

This next part is too complicated for my brain to understand, but American Express is making changes to the way they calculate the minimum payment amount.

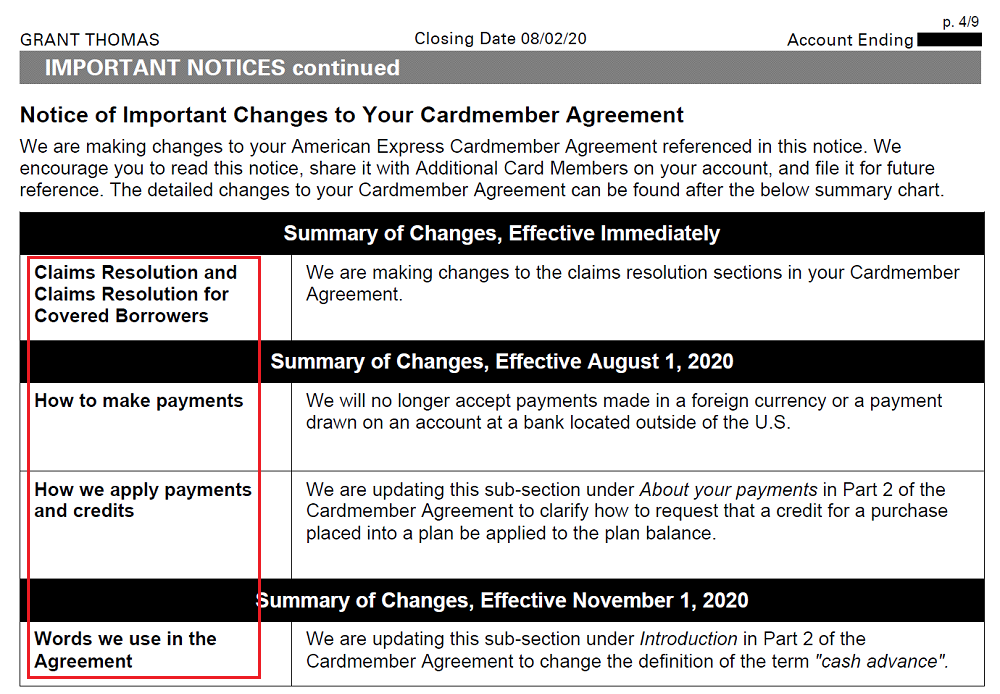

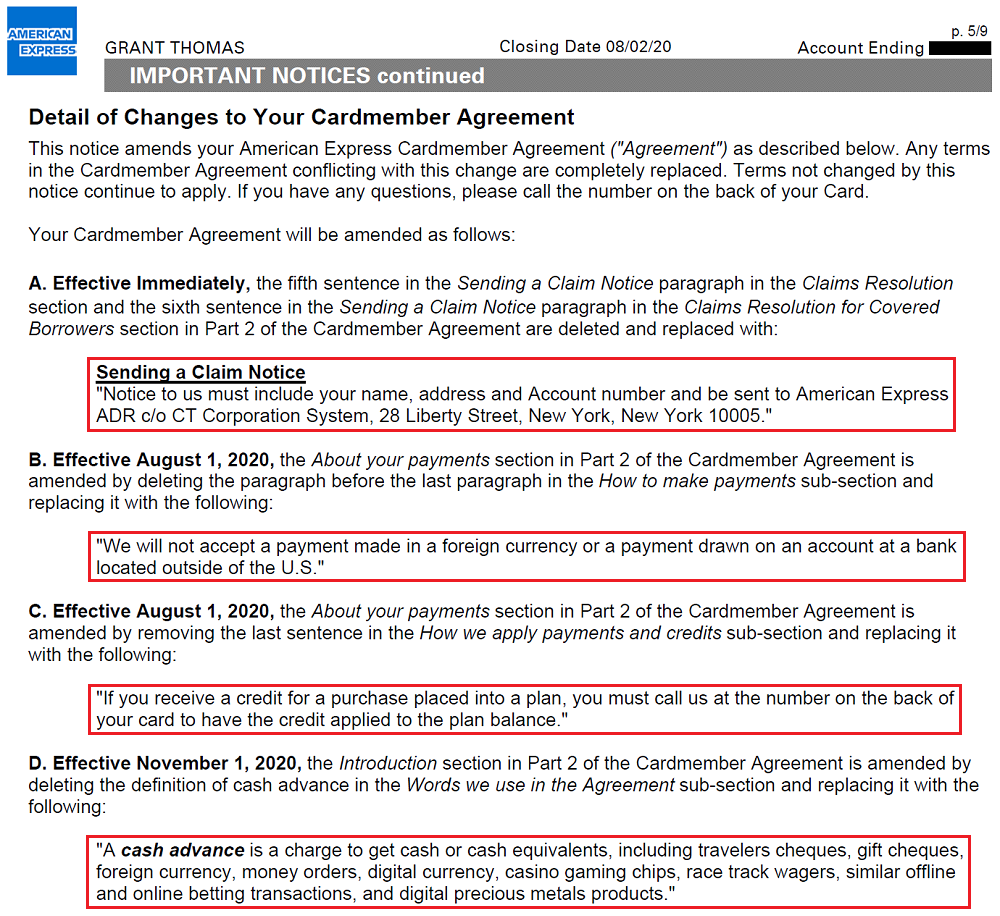

This next section covers the claims resolution process, foreign currencies and foreign banks, Plans, and cash advances.

As mentioned before, if you are in the claim resolution process, there is new step.

I had no idea that American Express used to accept foreign currency as payment, but that ended a few days ago. American Express will no longer accept payment in foreign currency or from a foreign bank (this sounds like bad news for people living outside the US).

If you currently have a Plan with American Express, if you receive a credit refund, you need to call American Express so that they can include that credit as a payment toward your Plan.

Lastly, American Express is updating their definition of cash advance. I believe digital precious metals products is new and I have no idea what digital precious metals are.

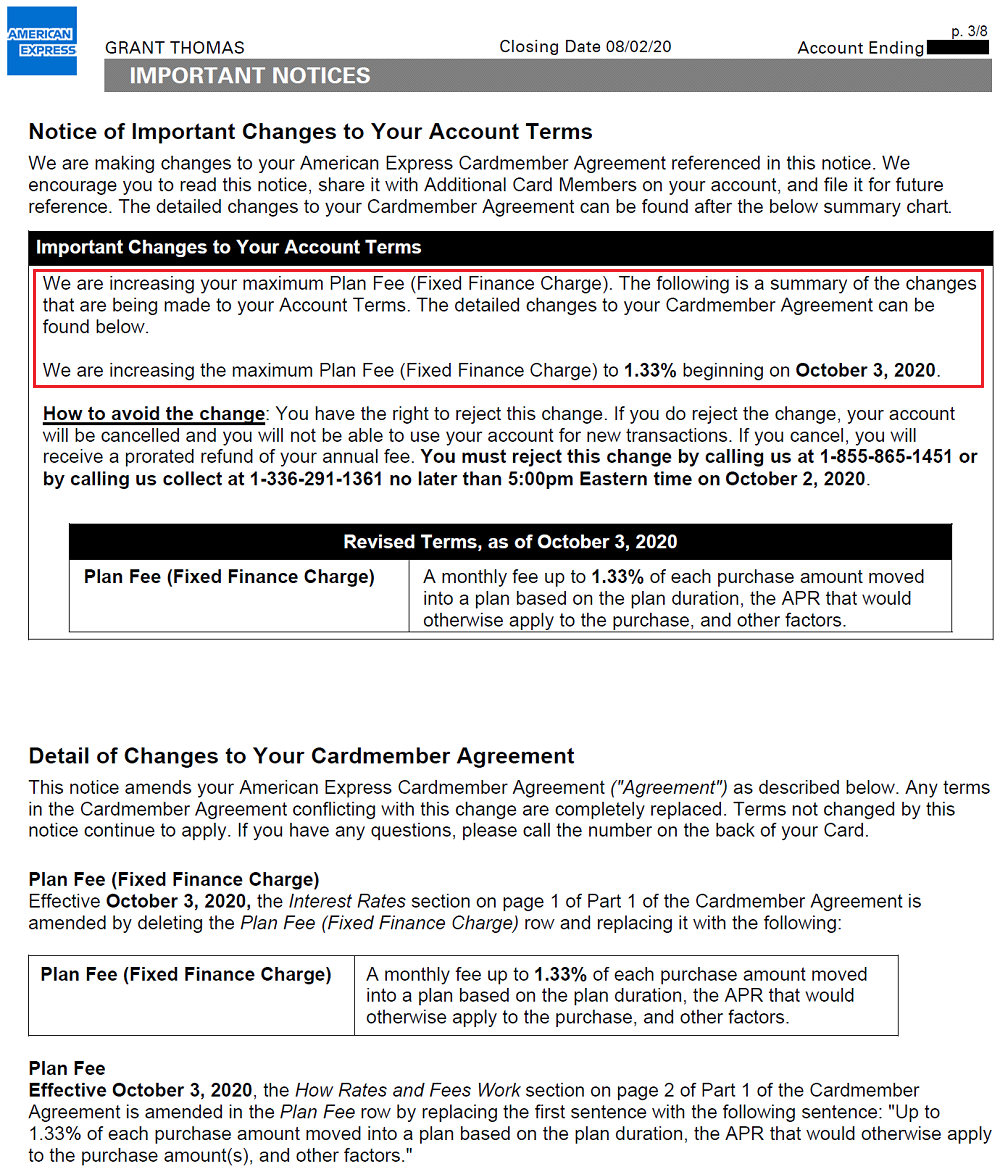

Lastly, American Express is increasing the maximum Plan Fee to 1.33% beginning on October 3. I’m not sure what the current plan fee is, but 1.33% x 12 months = 15.96% APR.

Those are all the changes I noticed on my American Express statements. If you have any questions about any of these changes, please leave a comment below. Have a great evening everyone!

I think it may be the end of all of “Ameriprise” their insurance efforts for Auto Life and Home Owners have been spun off … As have other aspects savings accounts… Shame though

Really? I hadn’t heard about that. I wonder what happened to them.

At one point American Express had hoped to be a one-stop shop for finances, in fact offering a “ONE” account that linked together investments, checking, savings, insurance, and credit cards, all under the “American Express” name. The investments and insurance were spun off into Ameriprise. It’s really just been a matter of time, because Ameriprise offered credit cards that were backed by Barclaycard. As I realized what “Fiduciary Duty” meant, I started to question the combination of annual advising fees, account fees, and investment fees/performance, and I took my business elsewhere, with the one exception being a Long Term Disability policy that doesn’t make sense to move elsewhere. I keep receiving emails and letters about bringing my investments back on track (they’re elsewhere), which I ignore, because their annual fees started at $700.

This is great info, I did not know that AMEX was trying to be a one stop shop for everything finance. I guess that plan didn’t work out as well as they had hoped.

Pingback: Changes to American Express Credit Card Terms (AMEX Send Account, Cash Advances, AU AF Refunds, Bye El Al & More)