Good afternoon everyone, I hope you all had a great weekend. I really enjoyed the Virtual Chicago Seminars and the virtual networking events – I look forward to seeing everyone in person next year in Chicago. In other news, I was reviewing my recent Chase Savings Account statement and saw this announcement. A few things are strange and stand out to me. First, these changes affect Chase Checking Accounts, not Chase Savings Accounts, so I am not sure why this appeared on my recent savings statement and not my recent checking statement. Secondly, the changes went into effect on September 13 and this statement covers the time period of September 17 through October 16, so I would have expected this announcement on my previous statement. But enough about those details, let’s cover the changes in the announcement.

Effective September 13, Chase will include additional electronic payments that post to your checking account to qualify for the monthly service fee waiver. I will go into those changes in the next section.

Effective December 1, Chase debit card holders will no longer have access to benefits in the Visa Benefits Package. I couldn’t find a link to what is included in the Visa Benefits Package, but I found a link for Chase Business Checking Accounts that mentions Purchase Security, Extended Protection, Auto Rental CDW, and Travel and Emergency Assistance. I assume most / all of those benefits are included in the personal / consumer version of the Visa Benefits Package, so it is sad to see those benefits ending on November 30 for Chase debit card holders.

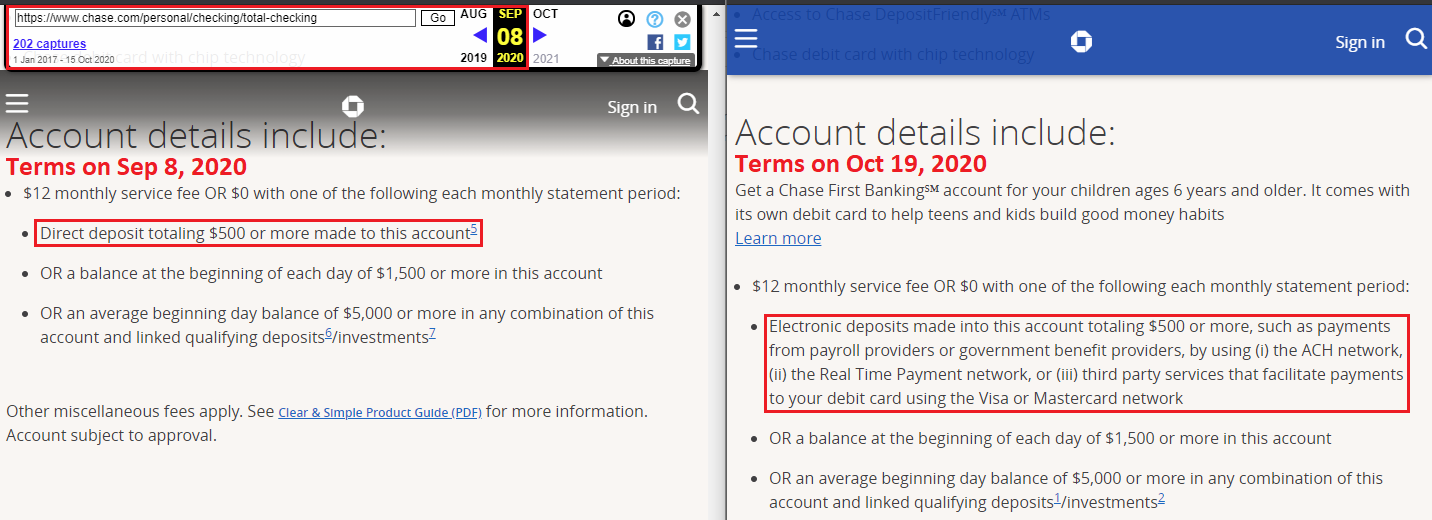

Since I couldn’t remember the exact details of the previous terms for what qualified for a monthly service fee waiver for Chase Total Checking accounts, I used Archive.org to find the Chase Total Checking account terms from before September 13.

Before September 13:

- Direct deposit totalling $500 or more made to this account

Effective September 13 (current link):

- Electronic deposits made into this account totaling $500 or more, such as payments from payroll providers or government benefit providers, by using (i) the ACH network, (ii) the Real Time Payment network, or (iii) third party services that facilitate payments to your debit card using the Visa or Mastercard network

All of the other terms remained the same, so the only part that changed was the $500 direct deposit requirement. Based on the new wording, it looks like more electronic deposits will count toward the $500 direct deposit requirement. If you receive a payment via the ACH network (transfers from 1 bank / financial institution to another), Real Time Payment Network (if you do instant cash out with Uber, Lyft, or PayPal), or third party services that facilitate payments to your debit card (like insurance claim payouts). These changes are positive and should allow many more checking account customers to waive their monthly fee.

This announcement has some positive and negative aspects, so keep these changes in mind if you are considering opening or keeping a Chase checking account. If you have any questions about this announcement, please leave a comment below. Have a great day everyone!

I called Chase and they insisted that – despite the seeming implications of “such as” – the deposits must be made by a payroll provider or government benefits provider.

(Of course we all know that what the agents say and what the computer actually counts aren’t the same.)

What kind of direct deposit were you trying to do?

I was really hoping for an expansive definition of “Electronic deposits … using the ACH network” – and that ACH Pulls from the Chase side would count. Seems that they don’t. That would be easy to automate and free up a Direct Deposit slot for other opportunities.

I haven’t tried experimenting with ACH Pushes from other banks; the existing data-points are not encouraging, and paying for my own payroll system is just as expensive as the Chase fees.

I guess I’ll just park $1,500 instead, until I’ve finished with the other opportunities.

(Sorry I wasn’t more informative or helpful)

If you don’t have any free slots for a standard direct deposit, I think leaving $1,500 in the account to waive the monthly fee is the next best option. Hopefully you get the bonus soon :)

A deposit from another Chase account, does not qualify Only a deposit from a different bank? They are encouraging us to use another bank? My husband does an automatic deposit from his Chase business account to his Chase personal account and has been getting the fee waived every month he doesn’t meet the $1500 limit. They are not going to do that anymore.

Hi Cathleen, it is a bummer that moving funds from a Chase business checking account to a Chase personal checking account does not waive the fee. If you are not able to meet the $500 monthly deposit requirement or the $1,500 minimum account balance requirement, you may want to look for another checking account from a different bank or credit union that has easier requirements to waive the monthly fee.