Good morning everyone, I hope your weekend is going well. A few days ago, I wrote My October 2020 Credit Card App-O-Rama Results. In that post, I wrote about my experience applying and getting approved for 2 business credit cards: Bank of America Alaska Airlines Business Credit Card and American Express Delta SkyMiles Gold Business Credit Card. In today’s post, I will talk about my wife’s application and approval process for the Chase Marriott Bonvoy Boundless Credit Card. When Laura applied 2 weeks ago, the sign up bonus was for 5 free night certificates (up to 50,000 Marriott Bonvoy Points per night) after spending $5,000 in 3 months. Unfortunately, that offer ended on October 28.

According to my calculations, Laura had a Chase score of 3/24, so I assumed she would be instantly approved for this credit card. Unfortunately, that was not the case. Here is what I learned about the approval process and how she was able to get approved for the new credit card.

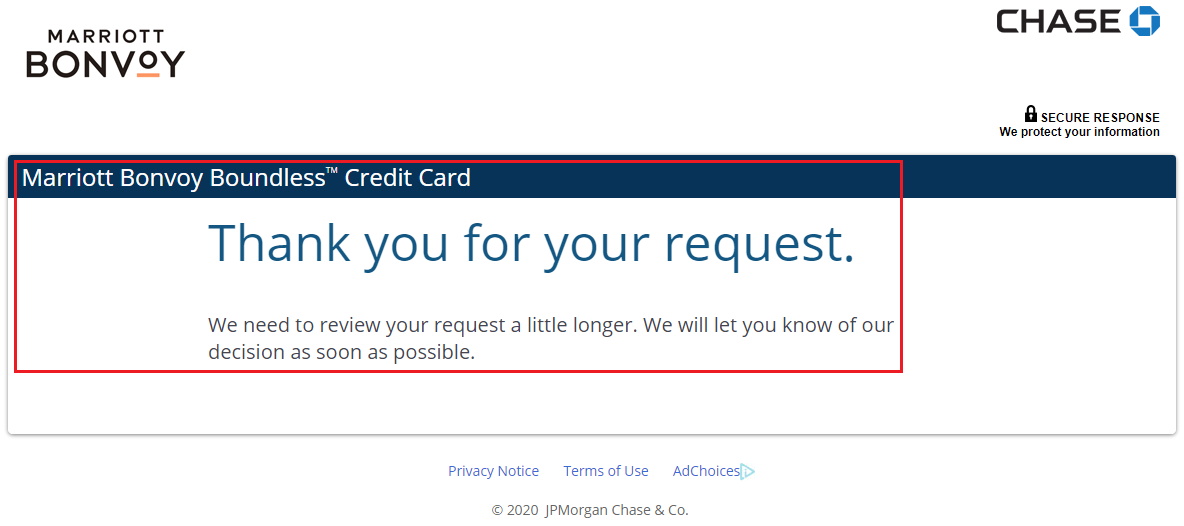

When Laura submitted her credit card application, she received this pending response. Uh oh…

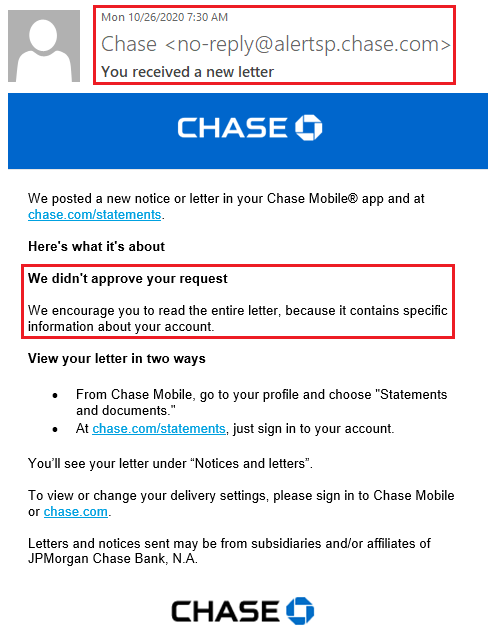

The following day, she received an email from Chase with a very nondescript subject line that said “You received a new letter.” Unfortunately, the short version was that she wasn’t approved for the credit card. She logged into her Chase online account and went to the Statements and Documents section to view the entire letter.

The letter said that she wasn’t approved for the new credit card because she had “Too many credit cards opened in the last two years associated with you.”

Laura went to the Chase Credit Journey page and looked at the Credit Checks section. There were 5 credit inquiries, including the October 25 inquiry for the new credit card. There was also a credit inquiry on May 4 from our recently refinanced mortgage. Best case scenario, she only had 3 credit inquiries related to credit cards in the last 2 years and worst case scenario if they included the refinanced mortgage, that would be 4 credit inquiries in the last 2 years.

Laura called the Chase reconsideration department (1-888-270-2127) and spoke with a rep. The rep reviewed the application and then repeated what the above letter said: “Too many credit cards opened in the last two years associated with you.” Laura told the rep that according to the Chase Credit Journey page, there were only 3 credit card inquiries and an inquiry about refinancing our mortgage. She asked the rep if the refinance inquiry affected her application. The rep said no, but also said that according to her credit report, there were 2 other American Express credit cards in her name. A lightbulb went off in my head. I reminded her that she was an authorized user on my American Express Gold Card and American Express Blue Business Plus Credit Card and she passed that info onto the rep. The rep asked her is she was responsible for paying those credit cards and she said no (she is only an authorized user, I am the primary account holder who is responsible for paying those credit cards). Laura also mentioned that she wasn’t looking for more credit and was happy to move some credit from her existing Chase credit cards, if that would help with the application. The rep took that information into consideration and put Laura on hold to review the remainder of the application.

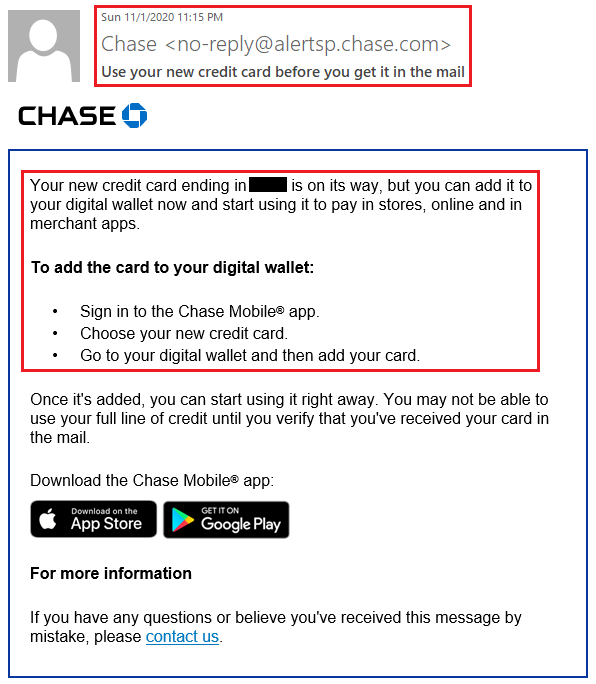

When the rep returned, he had good news, Laura was approved for the new credit card! Strangely, she never received an email from Chase saying she was approved or an email from Marriott welcoming her as a new cardholder, but she did receive this email from Chase stating that she could start using her new credit card by adding the credit card to her digital wallet (like Apple Pay and Google Pay).

A few days later, her new credit card arrived in the mail. Laura now has the trifecta of Chase hotel credit cards (Hyatt, IHG, and Marriott) along with a Chase Freedom and Southwest Airlines Priority.

Long story short, keep track of your Chase 5/24 score and don’t be afraid to call into the reconsideration department to review the application. Sometimes the system incorrectly calculates your Chase 5/24 score and a rep can override the system if you provide enough information about the other credit cards on your credit report. If you have any questions about the Chase Marriott Bonvoy Boundless Credit Card or about the reconsideration process, please leave a comment below. Have a great weekend everyone!

P.S. Stay tuned for my upcoming post about the reconsideration process I went through to get approved for the Barclays Wyndham Rewards Earner Business Credit Card.

Pingback: Barclays Wyndham Rewards Earner Business Credit Card Application & Reconsideration Process

Pingback: How to Redeem Marriott Bonvoy 50K Point Free Night Certificates (Some Issues, Then Success) | Travel with Grant