Good morning everyone, I hope your weekend is off to a great start. A few months ago, I applied for the US Bank Business Leverage Visa Credit Card. The credit card offers $750 cash back after spending $7,500 in 4 months. I had a large bill to pay via Plastiq and used this credit card to meet the minimum spending requirement. (FYI, there is also a US Bank Business Cash Rewards Mastercard Credit Card that offers $500 cash back after spending $3,000 in 3 months – I will probably get this business credit card next.)

The sign up bonus posted on my first credit card statement and posted as US Bank Rewards Points (kind of like Altitude Reserve Points on the US Bank Altitude Reserve Credit Card, but these points are worth 1 cent each for all rewards). Instead of redeeming my points for cash back, I enrolled my new credit card in US Bank Real Time Rewards (RTR) and made 2 purchases to redeem the bulk of my US Bank Rewards Points. Here is what I learned about my new credit card and the RTR process.

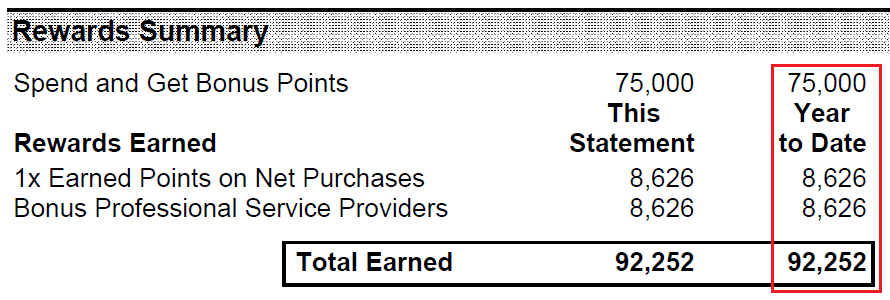

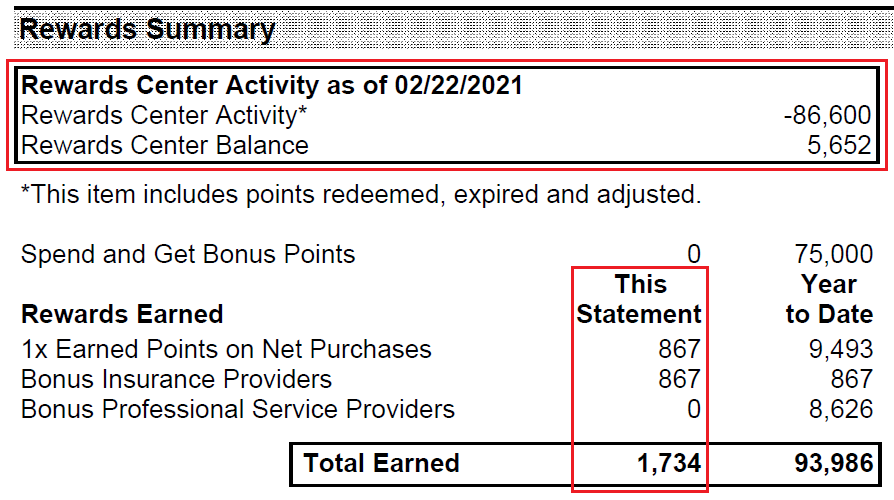

After my first credit card statement closed, I had a total of 92,252 points (worth $922.52) with 75,000 points coming from the sign up bonus and the remaining 17,252 points coming from my purchase (you earn 2x points on your top 2 categories every statement period).

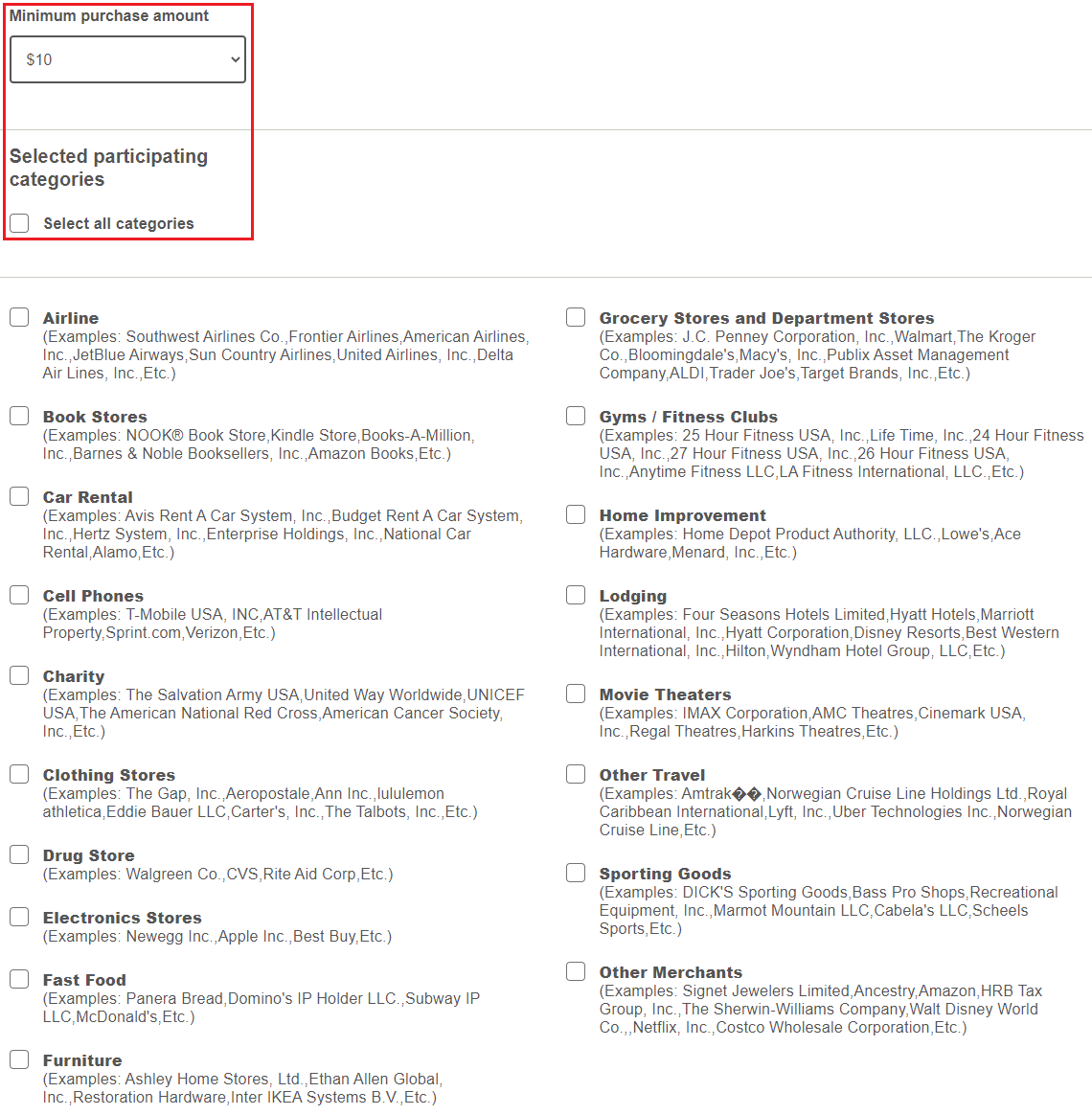

I then made sure to enroll in RTR, set my minimum purchase amount to the lowest option ($10) and then checked the box for “Select All Categories.” For display purposes only, here are the categories and some sample merchants for each category. Don’t worry if you don’t see the category or merchant you want to use, the “Other Merchants” category catches everything else. For example, my 2 purchases were with Allstate (insurance) and Comcast (utility), both of which are not specific categories but got picked up by the “Other Merchants” category.

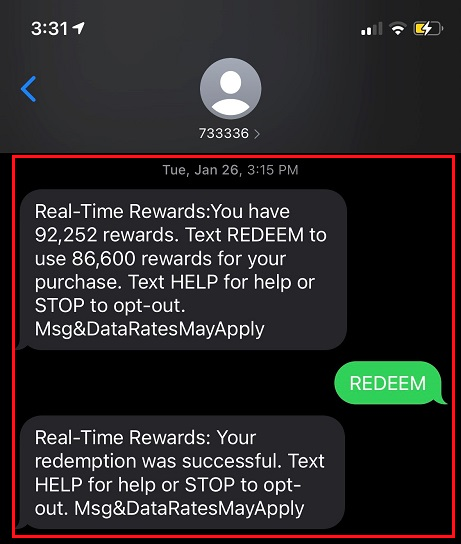

After I enrolled in RTR, I made a $866.95 purchase at Allstate. I expected to use 86,695 points to offset the $866.95 purchase.

When the RTR text arrived, I was only asked to redeem 86,600 points (95 points lower than expected). I responded with “REDEEM” to complete the redemption.

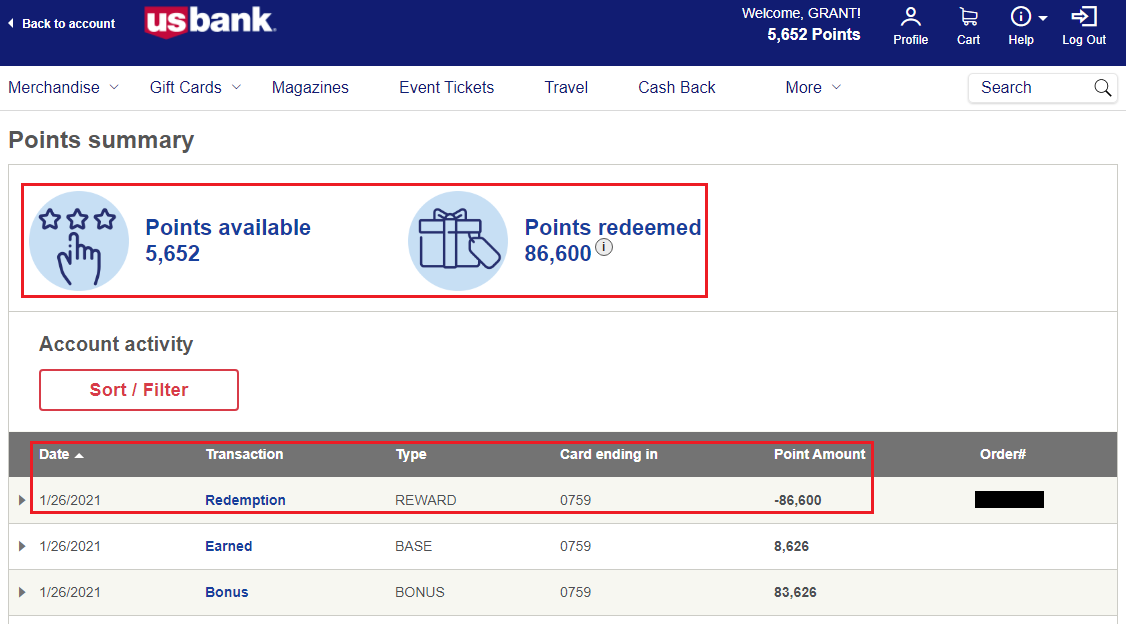

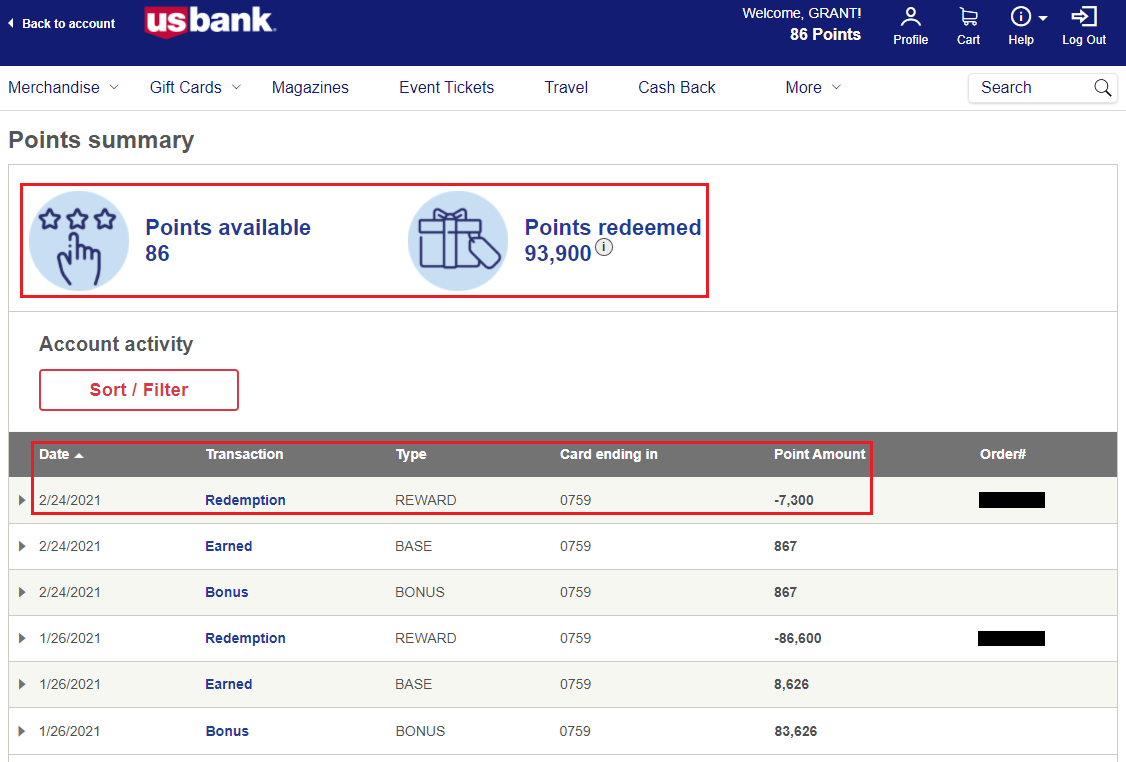

I went to the Points Summary section for my new credit card and saw all the recent activity. After redeeming 86,600 points, I had 5,652 points remaining (worth $56.52).

One of the nice things with RTR is that your purchases also earn points. On my next credit card statement, my $866.95 Allstate purchase earned 1,734 points (thanks to the 2x points on my top 2 categories every statement period). My new account balance was 7,386 points (worth $73.86). 5,652 old points + 1,734 new points = 7,386 total points.

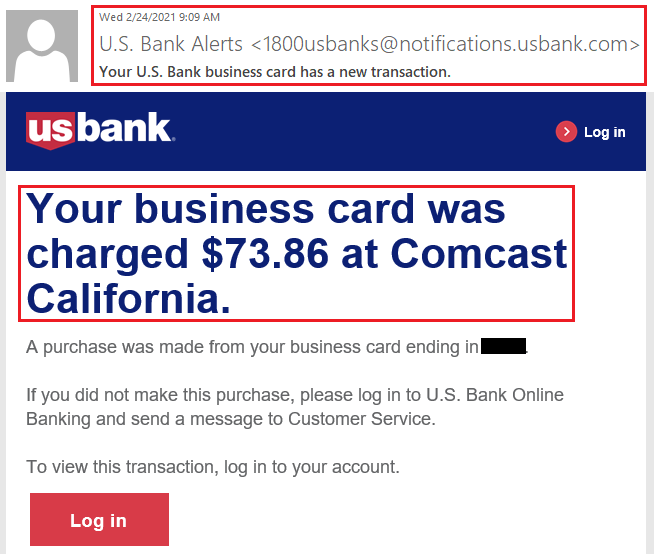

I then made a $73.86 payment to Comcast. I expected to use 7,386 points to offset the $73.86 purchase.

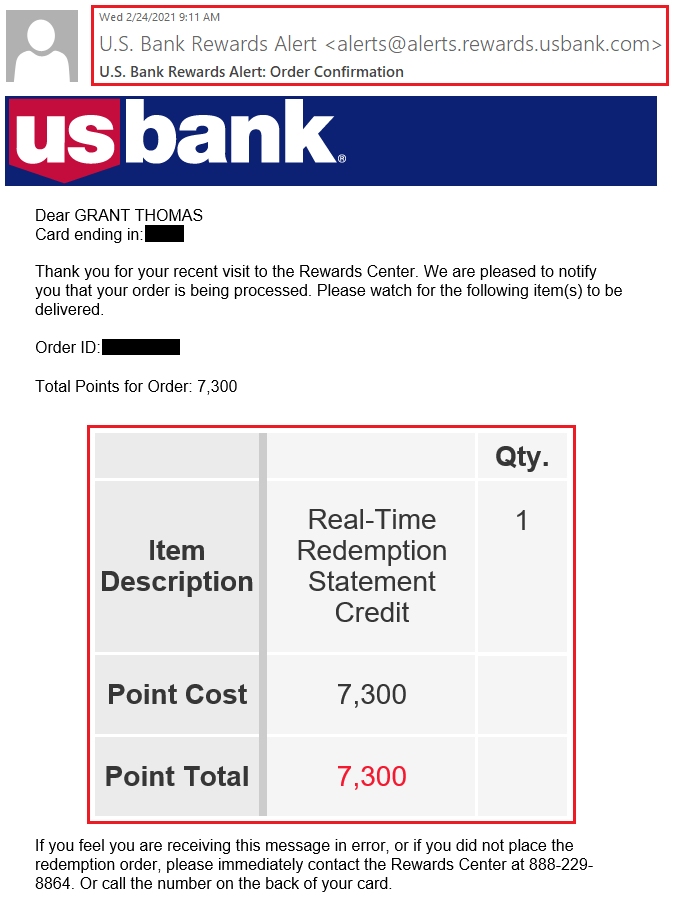

When the RTR text arrived, I was only asked to redeem 7,300 points (86 points lower than expected). I responded with “REDEEM” to complete the redemption.

I also received a confirmation email for my RTR redemption (I don’t remember getting this email after my first RTR redemption).

I went to the Points Summary section for my new credit card and saw all the recent activity. After redeeming 7,300 points, I had 86 points remaining (worth $0.86). Since the minimum RTR redemption amount is $10.00, I cannot redeem any more points right now.

As you can tell by my 2 RTR redemptions, the number of points required was rounded down to the nearest 100 points. For example, for $866.95, I only redeemed 86,600 points; and for $73.86, I only redeemed 7,300 points. From these 2 RTR transactions, I saved a total of 181 points (worth $1.81). I know that these numbers are small, but I think if you made several purchases of $10.99, you would only be asked to redeem 1,000 points (saving 99 points each time). If I went back in time and started with 92,252 points (worth $922.52), I think I could have made 92 purchases of $10.99 and redeemed a total of 92,000 points (leaving a leftover balance of 252 points). 92 purchases of $10.99 is $1,011.08, which is $88.56 more than the points were initially worth.

Unfortunately, I cannot test this theory since I don’t have enough points in my account. If anyone has this credit card, can you enroll in RTR and make a $10.99 purchase (an Amazon GC balance reload to payment to a utility should do the trick). Let me know if my theory works and if you have any other ideas on how to stretch these points.

If you have any questions about this credit card or about RTR, please leave a comment below. Have a great weekend everyone!

Thanks for this post. Am just about ready to jump on this particular card myself so good to know exactly what to expect.

The approval process wasn’t instant, but it was pretty fast. Decent earnings if you spend money in 1-2 categories every statement period. Good luck on your upcoming application :)

On 2/27/2021 I was able to redeem 1000 points with RTR on a $10.99 Amazon GC reload.

Awesome, thank you for confirming. Was that with this specific US Bank CC?

Yes

Awesome, thank you for confirming :)

Pingback: My Recent Retention Offers for AMEX Blue Business Plus & US Bank Altitude Reserve