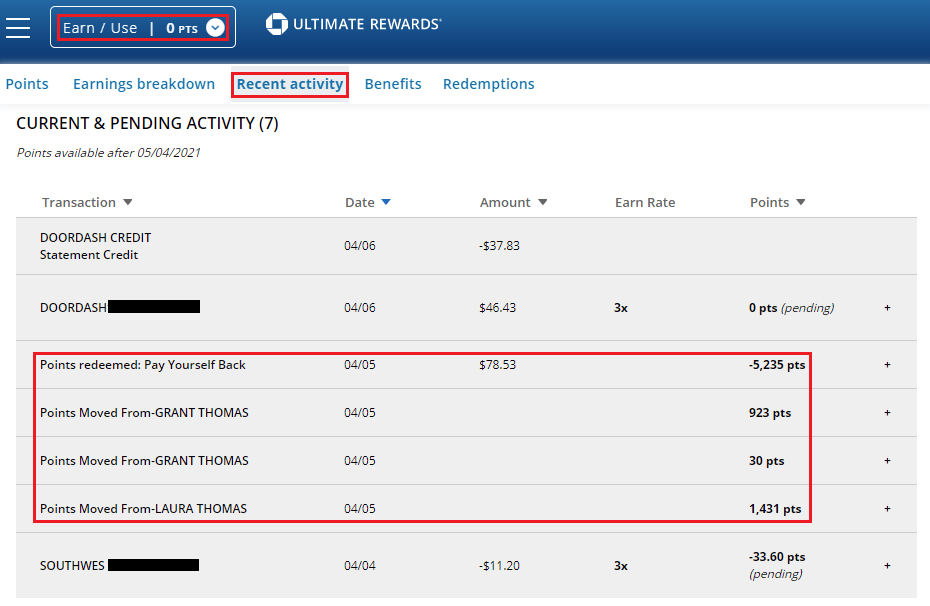

Good afternoon everyone, I hope you had a great weekend. I had a fun time watching the latest FTU Virtual Seminar on Saturday (April 10) and am looking forward to attending the next FTU Virtual Seminar on May 22. In other news, I officially redeemed all my Chase Ultimate Rewards Points last week. Yes, you read that correctly, I now have 0 Chase Ultimate Rewards Points across all my Chase credit cards. Every month when our credit card statements would close, I would transfer the points from my Chase Ink Plus, Chase Ink Bold, and Laura’s Chase Freedom to my Chase Sapphire Reserve. I would then redeem the points via Pay Yourself Back toward recent grocery and restaurant purchases.

Since it has been more than 4 years since I last got a sign up bonus on the Chase Sapphire Preferred Credit Card or Chase Sapphire Reserve Credit Card, I plan on applying for the Chase Sapphire Preferred soon to get the increased sign up bonus. Before I apply for the CSP, I redeemed all my points and converted my CSR to a Chase Freedom Flex Credit Card. In this post, I will show you what happened next.

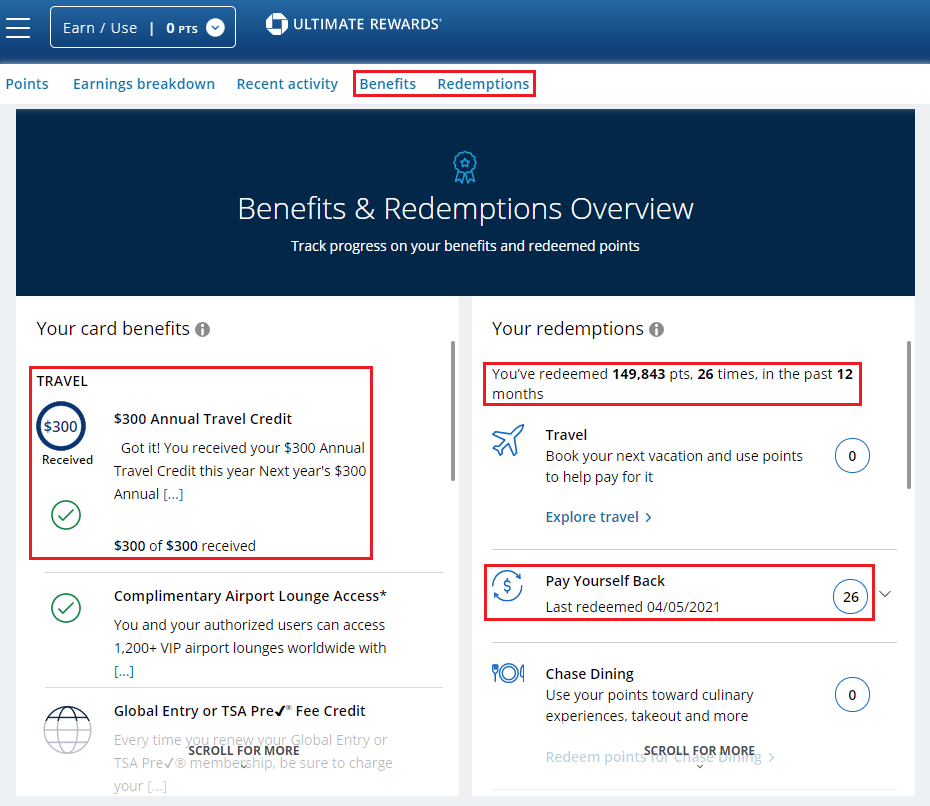

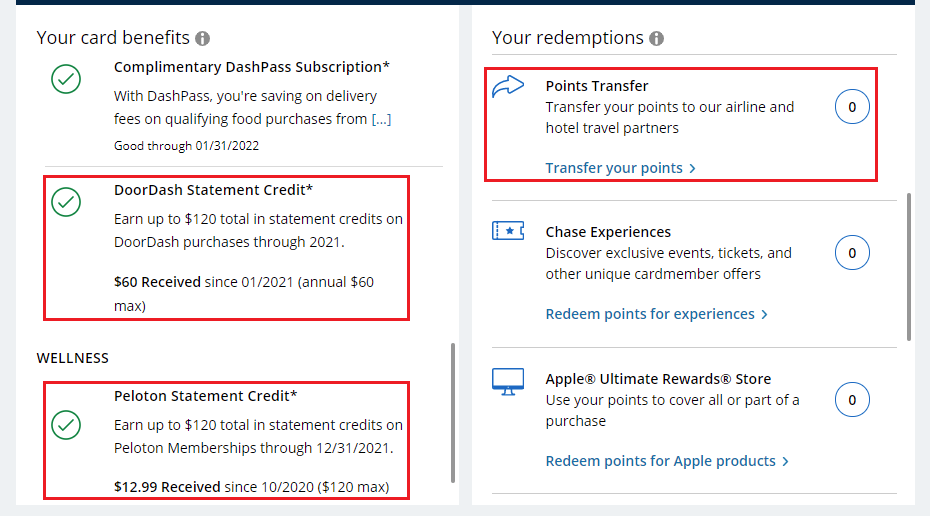

On the CSR Benefits and Redemptions Overview page, I can see that I used up my full $300 annual travel credit and redeemed ~150K points during the last 12 months. All 26 of those transactions were with the Pay Yourself Back feature (149,843 x 1.5 CPP = $2,247.65 statement credit).

During the last few days, I made sure to use up the $60 DoorDash credit and even used a small portion of the $120 Peloton credit. I also made 0 transfers to airline partners in the last 12 months.

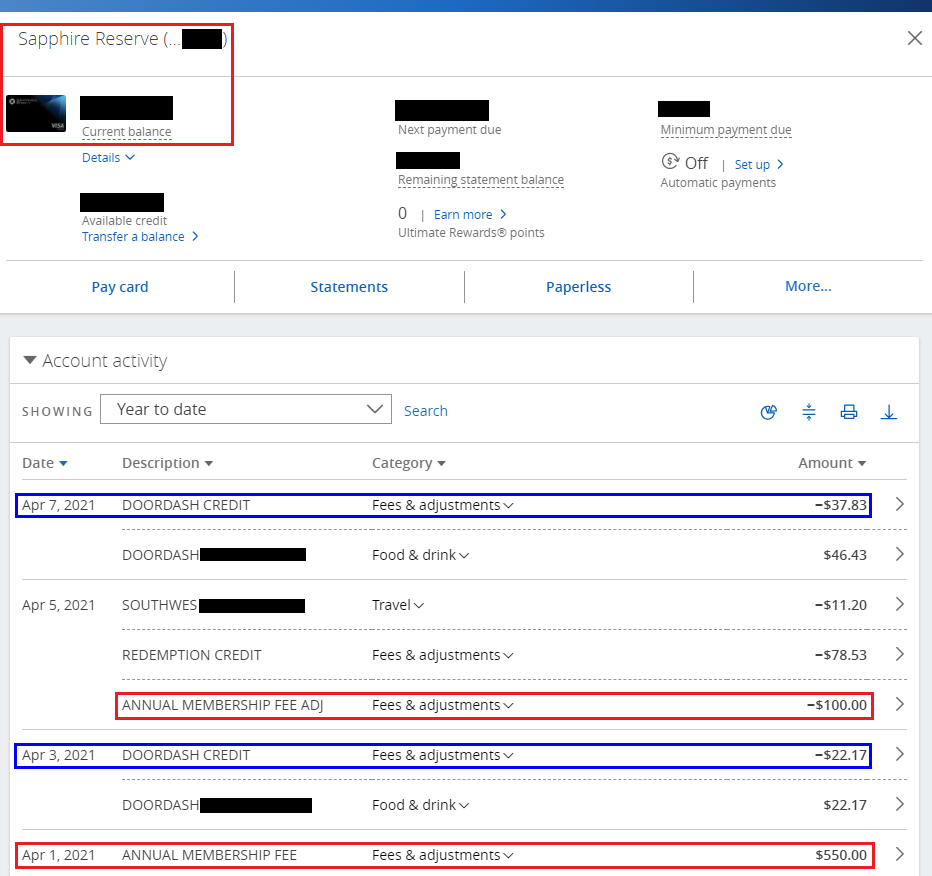

Here is what my CSR account activity looked like before I product changed to the Freedom Flex. The $550 annual fee posted on April 1 and the $100 “Annual Membership Fee Adjustment” posted on April 5. I used the $60 DoorDash credit on 2 purchases and the second credit posted on April 7.

I called Chase around 12:30pm on April 8 to product change / downgrade from the CSR to the Freedom Flex. The conversion process was quick and the agent read a few disclaimers before completing the process. ~30 minutes later, I received cancellation emails from DoorDash DashPass and Grubhub Grubhub+. This is a good reminder that these card benefits will disappear very quickly after you close or product change your CSR. I didn’t really get much value out of these 2 benefits, so I am not sad to see them go.

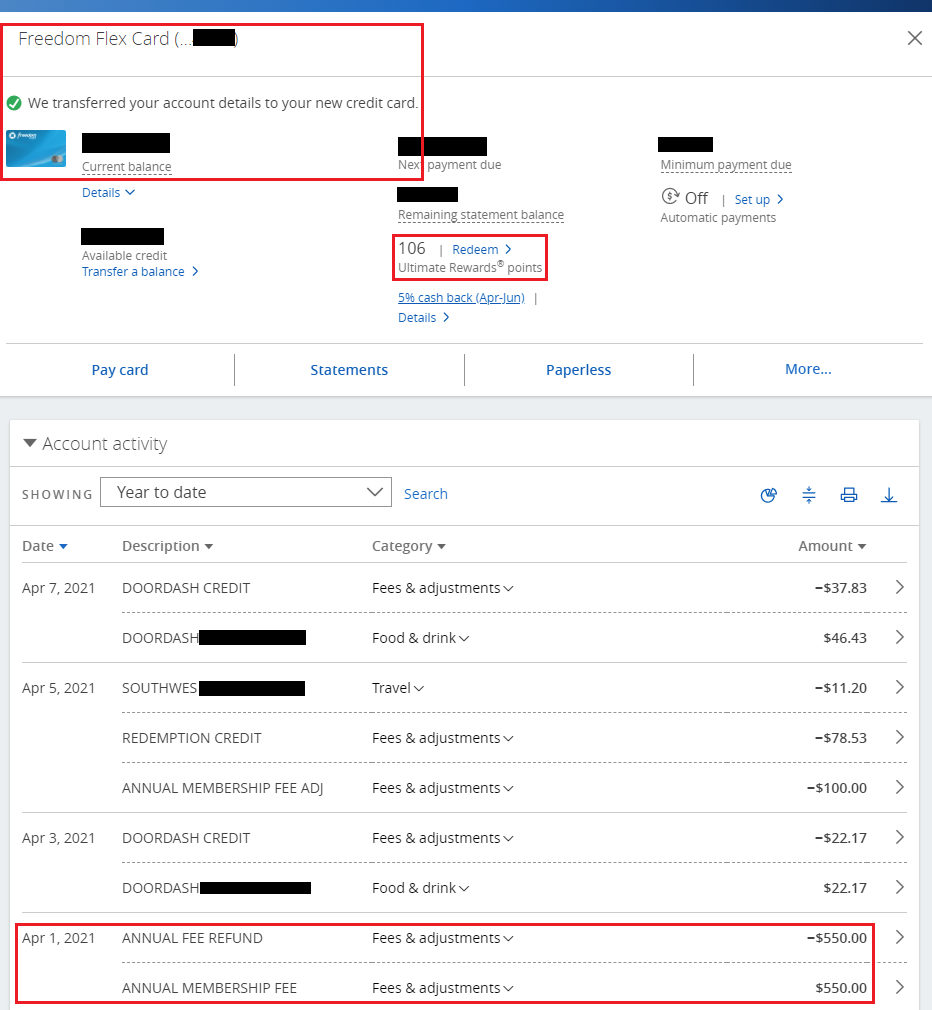

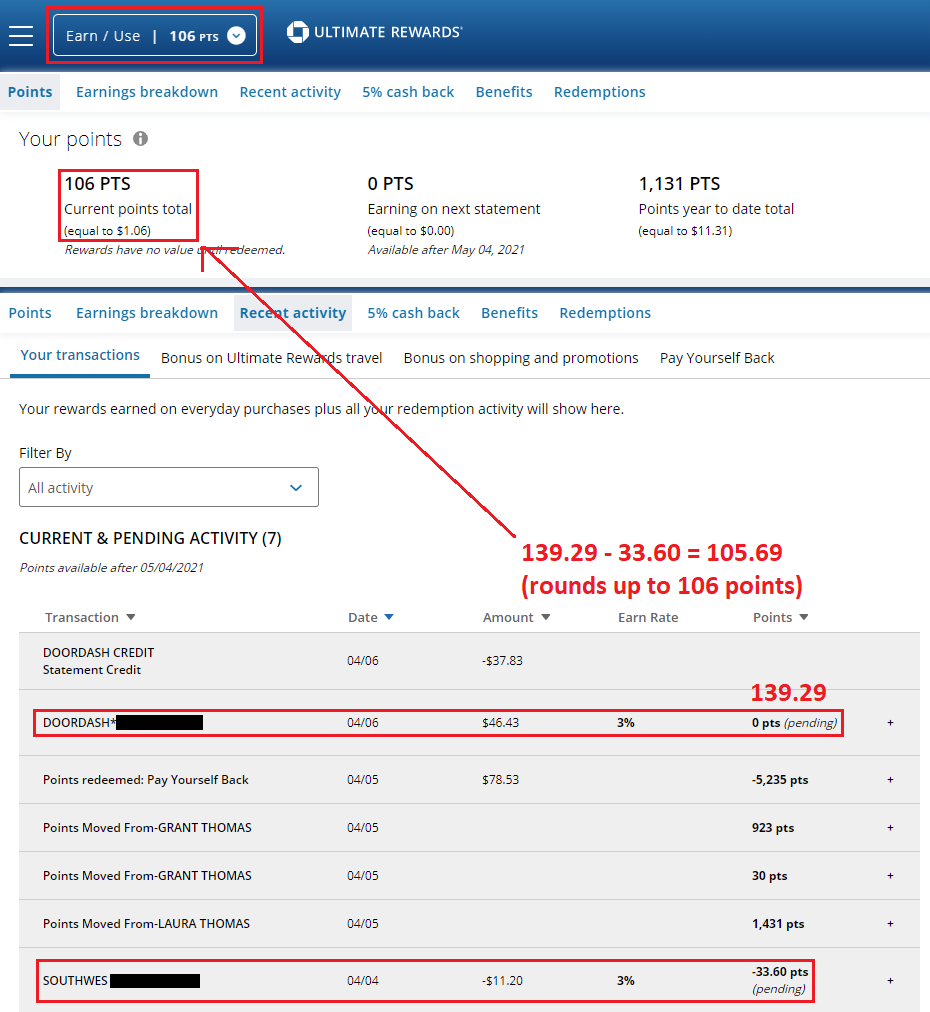

The following day when I signed back into my Chase online account, I noticed the Freedom Flex card automatically appeared in my account. The $550 annual fee was reversed and backdated to April 1. The $100 adjustment is still there, but I assume that will be reversed too in the coming days. The strange thing that I noticed was that I now had 106 points in my account.

I think I figured out where those 106 points came from. My most recent DoorDash purchase was pending and the points did not post yet. If I earned 3x on that pending purchase, I would earn 139.29 points. There was also a recent Southwest Airlines refund that was pending which would be -33.60 points. When I combined those 2 numbers (139.29 – 33.60), I ended up with 105.69 points, which rounds up to 106 points. Mystery solved, I think.

I am excited to receive my new Freedom Flex and look forward to maxing out the 5% cash back categories of gas and home improvement stores this quarter. If you have any questions about the product conversion process, please leave a comment below. Have a great day everyone!

Why did you pick Flex instead of a regular Freedom?

Hi Alex, the regular Chase Freedom is no longer available, I could only pick from the Chase Freedom Unlimited and Chase Freedom Flex.

How long do you need to wait before applying for a CSP?

Hi David, I think you need to wait at least 48 months from the day you last got the sign up bonus. It’s been well over 48 months for me, so I could apply anytime.

Would love to read about your journey on getting the CSP after doing this. I’m thinking of doing the same thing with my CSR and taking advantage of the new CSP offer.

Hi Aldrich, I’m also considering going for a new Chase Ink CC too, but I’ll share what I decide to do.

What happens if you use your chase reserve for the $ costs of an award ticket then downgrade to the flex? Will the travel insurance etc you had on the chase reserve still be in place for your trip, or are you in deep doo-doo at that point? I have (hopefully) a cruise in the fall which I used my sapphire reserve card. I would like to downgrade this summer to the flex and apply for a sapphire preferred–but obviously don’t want to do this if charges (and presumed travel insurance etc) made for future travel are not honored…?

Hi Gina, I’m not really sure what would happen. I would probably play it safe and keep your CSR until after your cruise. I don’t have any flights booked where I used the CSR. I plan on using my US Bank Altitude Reserve CC for all travel and rental cars (primary coverage).

Well that was a dumb idea. You basically have up travel and a ton of other benefits for grocery stores.

Hi Bob, I have several other CCs that I can use at grocery stores, restaurants and for travel. I can use my AMEX Gold, US Bank Altitude Reserve, and use 5x Chase Freedom at Lowe’s to buy grocery store gift cards.

I literally did the exact same thing last week. Just waiting for the statement to close on my new Flex. How long do you think it takes for Chase to show that I don’t have a CSP? I’d be curious if there are any other data points on how long to wait before applying.

Hi Jeff, I think the change is effective immediately, but if you want to play it safe, I think if you wait 1-2 months for 1-2 Freedom Flex statements to be generated, you would be in the clear.

“I also made 0 transfers to airline partners in the last 12 months” gasp lol

Any chance Chase will allow a “roundabout” PC to regular Freedom after going Flex???

How long to wait after PC to apply for Sapphire??? 30 days???

Thx G!

Hi Cap, I am not sure if there is a roundabout way to go from Freedom Flex to regular Freedom. I could try calling Chase to ask if that is possible, but I don’t think it is.

I do not think you need to wait a certain amount after the product change, but if you want to play it safe, I would say wait 1-2 months for 1-2 statements to be generated as Freedom Flex and you should be fine.

How were you able to do this? They’re told me I can’t change since the FF is a MC.

Hi Patrick, I didn’t do anything fancy, I just called the number on the back and said I didn’t want to pay the annual fee and asked if I could downgrade to a no annual fee credit card. The rep suggested that I product change to the Freedom Flex and then read off a disclaimer about the changes in terms. That was all I did. I would suggest calling back again and see if the new rep can help you change to the Freedom Flex.

I did the same thing today! I canceled chase sapphire reserve (CSR) so that I can get the chase preferred (CSP) 80k bonus. How long do you think I need to wait before I try to apply for CSP? I want to make sure that Chase doesn’t consider me a holder of CSR and everything is cleared out in their system.. however, I am also afraid that CSP 80k offer might go away if I wait for too long.

I would wait 30 days to be safe before applying for the CSP.

why did you have to spend all your UR pts? Wouldn’t they have just transferred to your Freedom Flex? Were you mitigating risk of not being approved for the CSP thus making your points less valuable?

Hi Aram, I didn’t have to spend all my Ultimate Rewards Points, but I felt that the 1.5 cents per point value for Pay Yourself Back was a good use of the points. If I did nothing, the points would have automatically moved over to my new Chase Freedom Flex.

You could move the points back onto your new CSP once you’ve signed up for it though, right? I’m debating on doing the same thing but wondering if I should use up all my points as well

Hi L, yes, you can move your Chase Ultimate Rewards Points back and forth to any Chase UR earning CC.

Would I be able to switch back from the freedom flex to the sapphire reserve in the future?

Yes, you should be able to, just contact Chase to switch back to the CSR.

Hi Grant, is converting from reserve to FF considered as a continuation of the credit history? Like, I don’t want to close the reserve where I have years of history, and open a new FF account which would bring down the average credit history. Since FF is a MasterCard, I’m wondering if the conversion or downgrade is just as same as converting to freedom unlimited which is a visa. Thanks!

Hi Toby, converting from CSR to FF does not show up as a new account. The age of your account keeps growing after the product change.

Hi, I am about to downgrade and the representative told me that changing to Chase freedom flex would change my credit card number and switch from a visa to mastercard. Does switching to a mastercard affect your credit score at all out of curiosity?

Hi Liz, good question. Converting from a Visa to a MasterCard does not affect your credit score. You should be fine with the product change.

Thanks for the information! I was debating between the chase freedom unlimited and flex. The flex seemed slightly better for me.

I agree, the Chase Freedom Flex 5% bonus categories are pretty good.

Hi, will the credit card number change after production change from a Visa to a MasterCard?

Yes, the credit card number will change when you product change any credit card from one network to another (Visa to MC or vice versa).

Hi Grant, since the $300 travel credit would have reset in April, did you consider using up the credit before the downgrade. Are there any data points that you are aware of in this context?

Hi Paul, my CSR annual fee posted April 1, 2021, but my $300 travel credits are tied to a different date due to product changing to the CSR years earlier. I didn’t want to wait for my $300 travel credit to reset and miss out on applying for the CSP. Plus I got the full $550 annual fee refunded, so it was a no brained for me to downgrade to a Chase Freedom Flex.

Pingback: Have you Read my Most Popular Posts of 2021?