Good afternoon everyone, I hope your week is going well. I just received this email from US Bank letting me know that I could upgrade my US Bank Cash Plus Credit Card to the US Bank Altitude Go Credit Card. You might get a targeted email like the one below, but if you do not, you can always call the phone number on the back of your US Bank Cash Plus and ask to product change to the US Bank Altitude Go. Let’s see if the upgrade makes sense.

Here are the complete terms and conditions from the US Bank email:

1 Offer is valid based on an Account review as of September 21, 2021. Your account must be open, current and have available credit (no minimum payment past due) at the time of your request to receive this upgrade offer. Offer may not be valid if account status has recently changed. Delinquent accounts are not eligible for this offer. When your new card is received in the mail, please destroy your current card(s). This upgrade is valid only for the cardmember who receives it and is non-transferable. This Invitation to Upgrade ends October 21, 2021.

2 Cash back is redeemed in the form of a statement credit or a deposit made to your U.S. Bank savings or checking account (2,500 Points minimum redemption).

3 Rewards are earned on eligible Net Purchases. Net Purchases are Purchases minus credits and returns. Not all transactions are eligible for rewards, such as Advances, Balance Transfers and Convenience Checks; please refer to the materials received with your new card and the Program Rules in the online Rewards Center by logging in to usbank.com for additional information. Account must be open and current (that is, no Minimum Payment is past due) on the closing date of the billing cycle in order to earn and redeem Points. Merchants identify their business by selecting a merchant category code established by Visa. A Purchase will not earn additional Points if the merchant’s selected code is in a category that is not eligible for additional Points earning. U.S. Bank does not determine the category codes that merchants choose and reserves the right to determine which Purchases qualify for additional Points. We reserve the right to adjust the number of Points for Purchases or to stop issuing Points for Purchases on the Account, upon notice to you. Use of the Card is subject to terms and conditions of the U.S. Bank Altitude Go Visa Signature Cardmember Agreement, which may be amended from time to time. U.S. Bank Altitude Go Visa Signature Cardmembers will earn one (1) Point for every $1 in eligible Net Purchases. In addition, you will earn additional Points for the following Net Purchases: You will earn three (3) additional Points for every $1 in eligible Net Purchases during each billing cycle for any merchant classified as a restaurant, fast-food restaurant or bar. You will earn one (1) additional Point for every $1 in eligible Net Purchases during each billing cycle for any merchant classified as a gas station, grocery store, supermarket or qualifying streaming subscription service. Refer to Program Rules or usbank.com/AltitudeGoBenefits for official list of qualifying streaming services merchants. Purchases at discount/retail stores that sell groceries may not qualify for the grocery store category.

4 An automatic statement credit of $15 per 12-month period will be applied to your U.S. Bank Altitude Go Visa Signature Card Account within 2 statement billing cycles following 11 consecutive calendar months of eligible streaming service purchases, such as Netflix, Hulu, Apple Music, if the Account is in good standing (open and able to use). Refer to Program Rules or usbank.com/AltitudeGoBenefits for official list of qualifying streaming services merchants. We reserve the right to adjust or reverse any portion or all of any streaming services credit for unauthorized purchases or transaction credits.

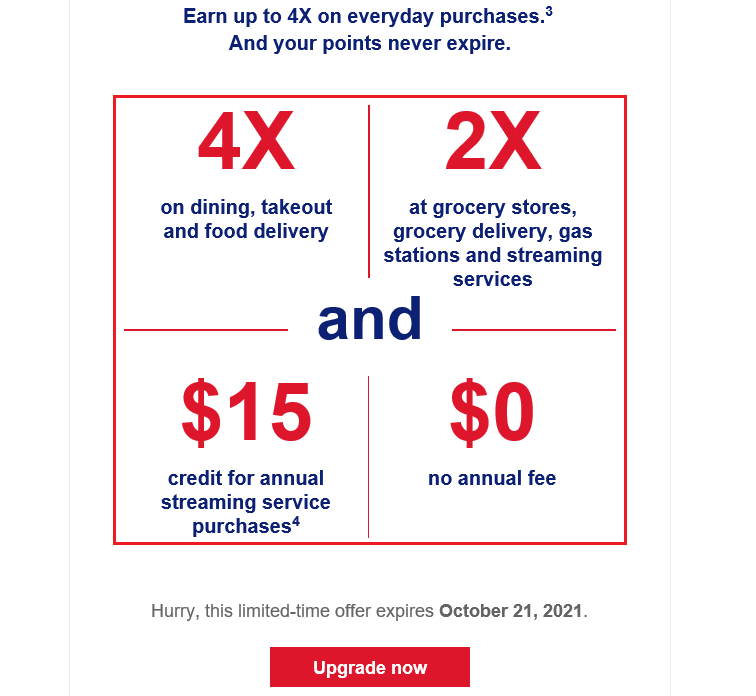

Here are the 4 main highlights in the email for the US Bank Altitude Go:

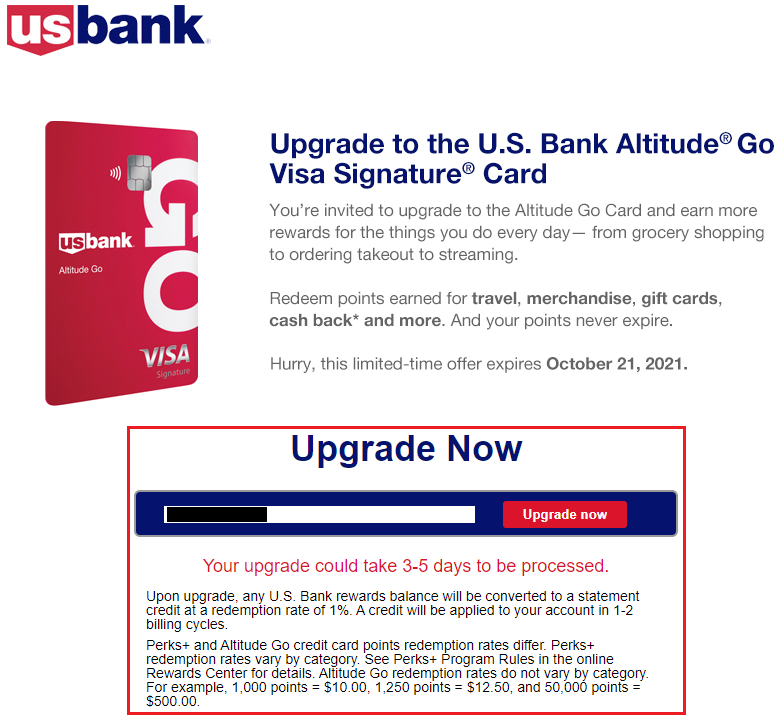

Clicking on the Upgrade Now button in the email takes me to this page asking me to accept the upgrade. As stated, the upgrade process could take 3-5 days. Any existing cash back rewards on my US Bank Cash Plus would be converted to a statement credit and post to my account in 1-2 statements. I’m honestly not sure why this is a limited time offer since I think you could product change to the US Bank Altitude Go at any point, assuming your US Bank Cash Plus is at least 1 year old.

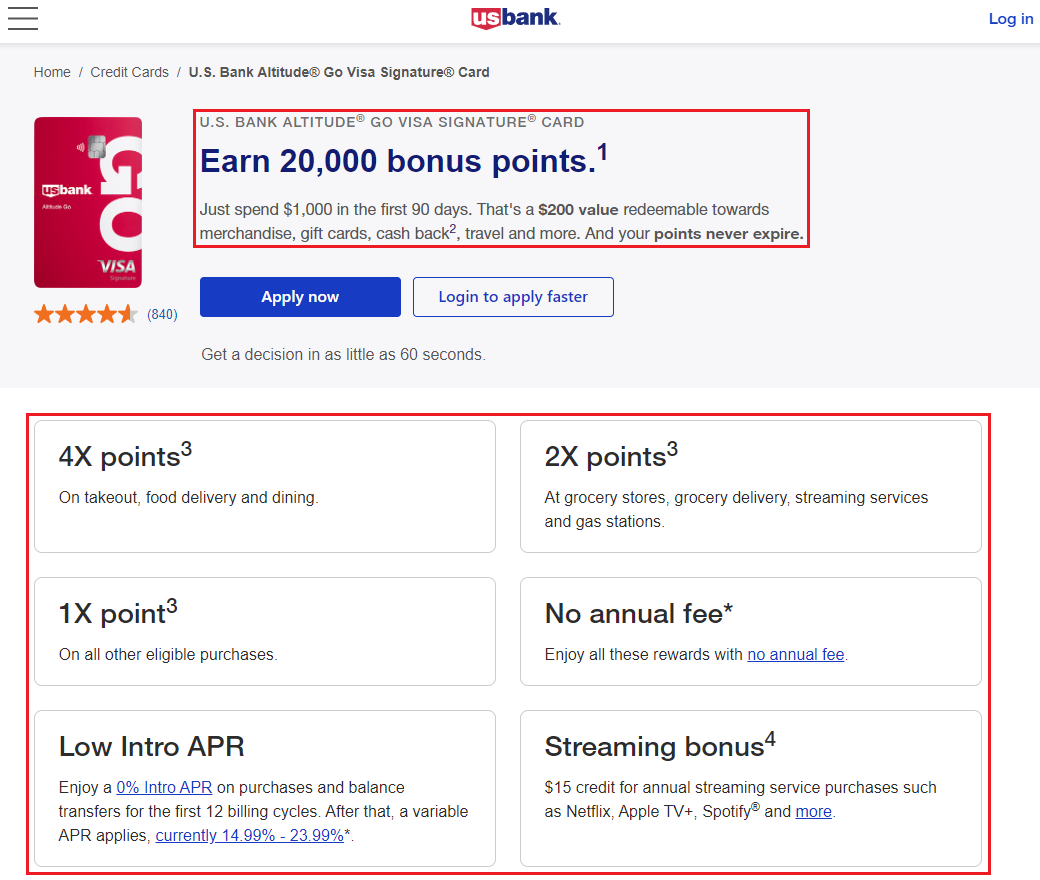

Before considering the upgrade, let’s look at the sign up bonus and perks for the US Bank Altitude Go Credit Card. There is a $200 sign up bonus after spending $1,000 in 3 months. You earn 4x at restaurants and food delivery services; 2x at grocery stores, streaming services, and gas stations; and 1x everywhere else. There is no annual fee and you can get a “$15 streaming service credit after 11 months of streaming service purchases.”

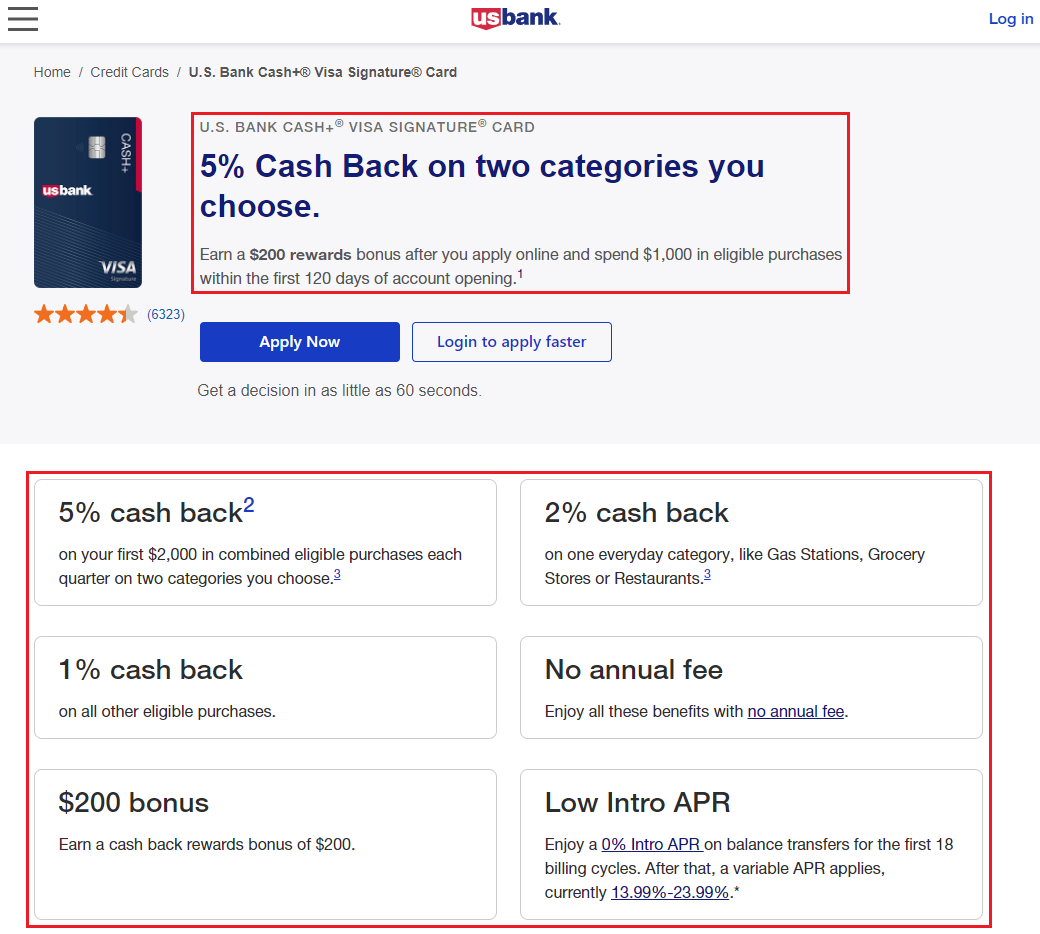

By comparison, let’s look at the sign up bonus and perks for the US Bank Cash Plus Credit Card. There is a $200 sign up bonus after spending $1,000 in 5 months. You earn 5% cash back at 2 selected categories; 2% cash back in 1 selected category, and 1% cash back everywhere else. The 5% categories are capped at $2,000 spend per quarter. There is no annual fee.

There are 2 fundamental questions you need to ask yourself:

- Would you get more value out of the US Bank Altitude Go vs. the US Bank Cash Plus?

- Would you rather sign up for a new US Bank Altitude Go and get the $200 sign up bonus?

For me, I think the 5% cash back categories on the US Bank Cash Plus are better than the 4x categories on the US Bank Altitude Go. I never exceed the $2,000 quarterly spend cap and like the ability to change my selected 5% cash back categories every quarter. Plus, I would rather sign up for a new account and get a $200 sign up bonus. With that said, I will not accept the upgrade. If US Bank were to add a $200 bonus for the upgrade, then I would most likely upgrade to the US Bank Altitude Go.

If you have any questions about either card or the upgrade process, please leave a comment below. Have a great day everyone!

I recently converted a US Bank TravelPerks to a Cash Plus Visa. I also had the option to convert it to an Altitude Go, but I picked the CashPlus Visa. The ability to earn 5X on utilities is the category I max out on. However I worry that one day the quarterly categories could change. Interestingly the Altitude Go card has no foreign exchange or foreign transaction fees and no annual fee. Other no annual fee US Bank cards have FTF/FEF’s

I think the US Bank Cash Plus Credit Card is better than the US Bank Altitude Go Credit Card. The 5% cash back on utilities is a great category, but I don’t get anywhere close to maxing out that category. Interesting that the Altitude Go has no foreign transaction fees, US Bank loves to add those fees to all their no annual fee and annual fee credit cards.

If the Cash Plus categories change, you can always product change to the Altitude Go.