Good afternoon everyone, I hope your week is going well. 2 days ago, I wrote Capital One Spark Miles Business Credit Card Application Process & Welcome Documents. 2 weeks ago, I also applied for the US Bank Business Triple Cash Credit Card. My application was not instantly approved, so I called the US Bank business credit card application status / reconsideration department and asked if I could move some credit from my existing US Bank business credit cards in order to be approved for my new credit card. The rep said that US Bank did not reallocate credit limits and when I called on October 7, the rep said the credit department was still working on applications from October 1, so 6 days behind. 6 days later, on October 13, my application was approved.

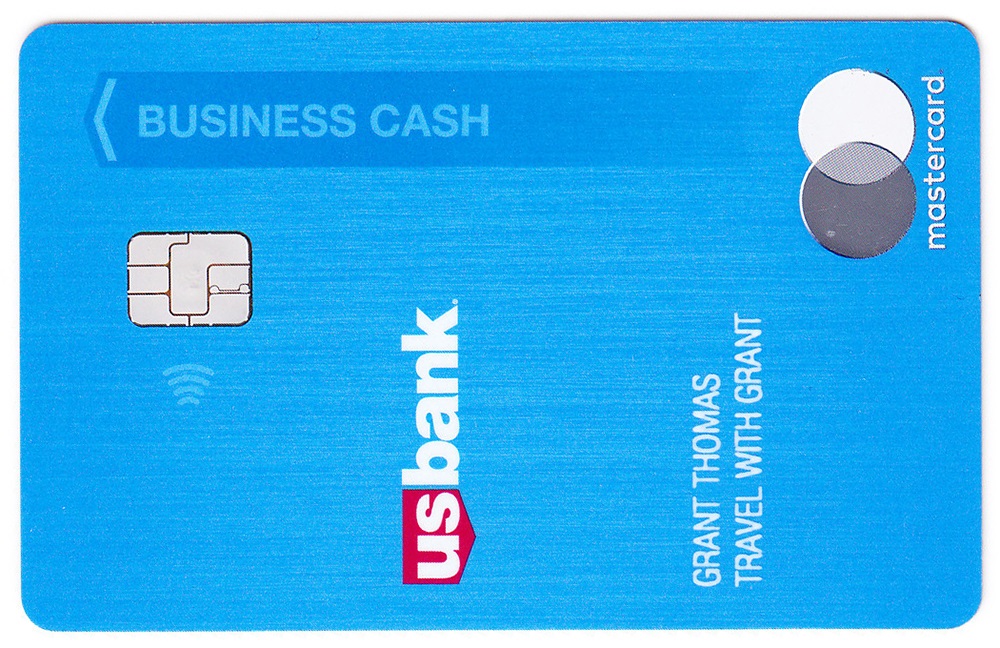

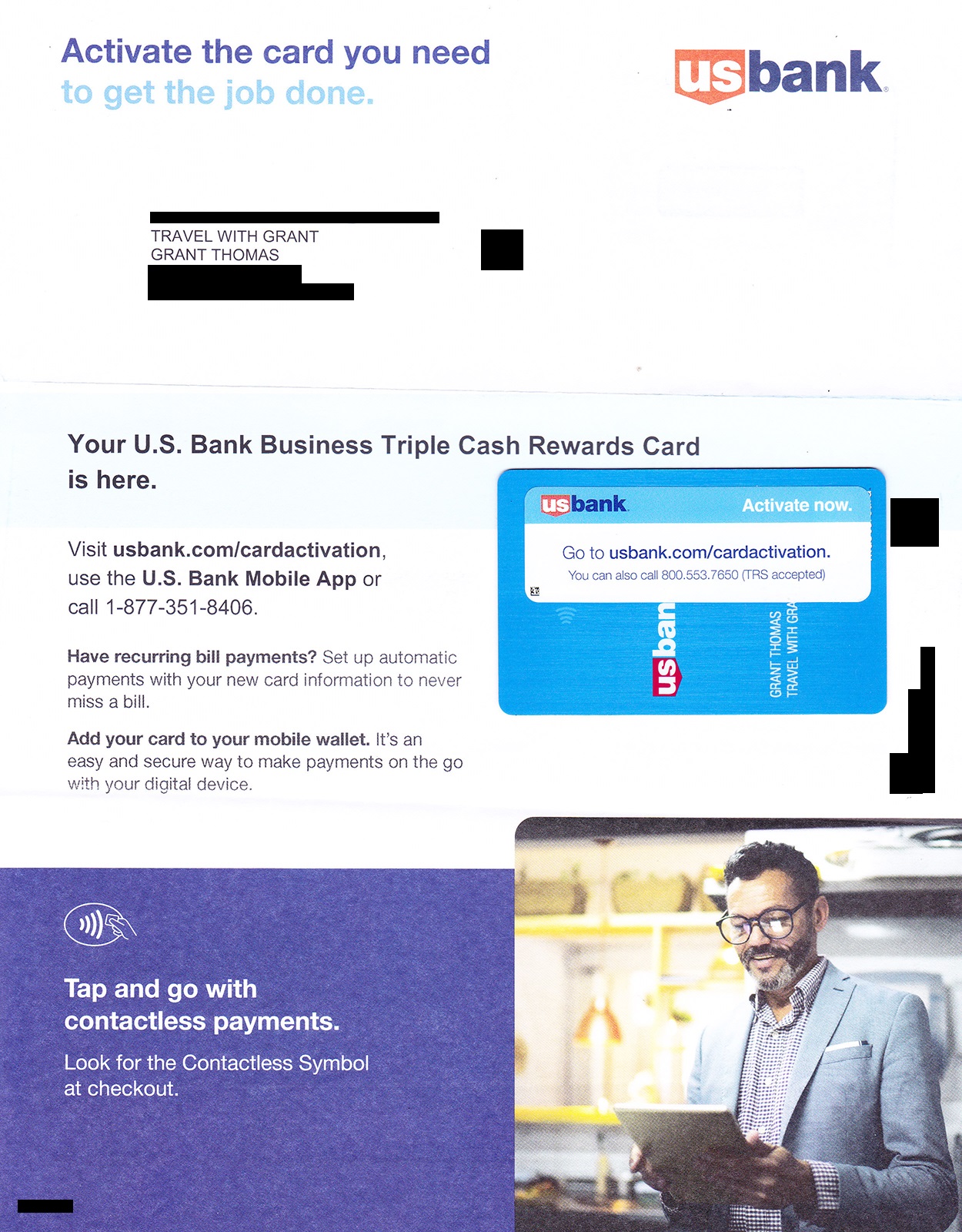

Here is what the front and back of the credit card looks like. I am not a fan of the mixture of vertical and horizontal elements on the front of the card; and the back of the card looks to simple and a little boring. It also looks like there is something missing from the bottom left corner on the back. In this post, I will share details of the application process and the welcome documents I received from US Bank.

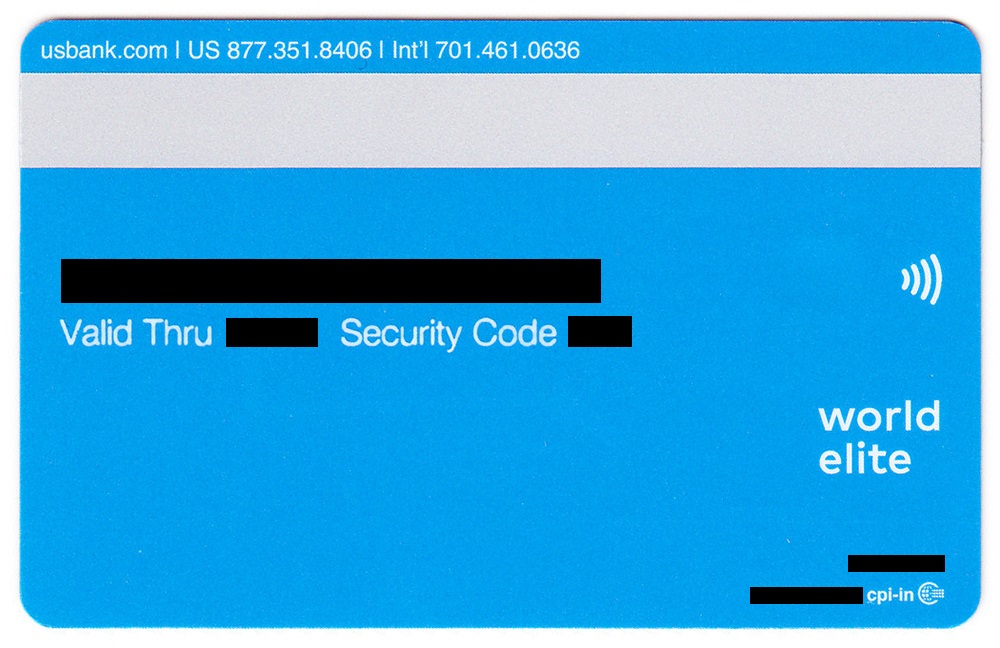

As of October 19, the current sign up bonus for the US Bank Business Triple Cash Credit Card is $500 cash back after spending $4,500 in 5 months and there is no annual fee.

This credit card offers 3% cash back at gas stations, but according to the terms below, you will not earn 3% cash back at gas stations if you spend more than $200 in a single transaction. Perhaps US Bank is discouraging cardholders from buying more than $200 in gift cards at gas stations. If you really need to buy more than $200 worth of gasoline at one time, I would recommend making 2 purchases under $200 to earn 3% cash back.

2 U.S. Bank Triple Cash Rewards Visa® Business Card members may earn three percent (3%) cash back on Net Purchases (purchases minus credit and returns) at restaurants/restaurant delivery, gas stations, office supply stores and cell phone service providers. All other Net Purchases may earn one percent (1%) cash back. Transactions qualify for cash back based on how merchants classify the transaction. U.S. Bank cannot control how merchants choose to classify their business and reserves the right to determine which Purchases will qualify. Purchases of gasoline greater than $200 will not be deemed to be a purchase of automotive gasoline and as such will earn a reward of 1%. Not all transactions are eligible for cash back, such as Advances, Balance Transfers and Convenience Checks. You may not redeem cash back, and you will immediately lose all of your earned cash back rewards, if your account is closed to future transactions (including, but not limited to, due to Program misuse, fraudulent activities, failure to pay, bankruptcy, or death). Cash back may be redeemed as a statement credit, U.S. Bank Rewards Card, or deposited to your U.S. Bank business checking, savings or money market account. The amount of Rewards that may accumulate for your Account is unlimited. Rewards accumulated are non-expiring, subject to conditions set for herein. Refer to your cardmember agreement for full details.

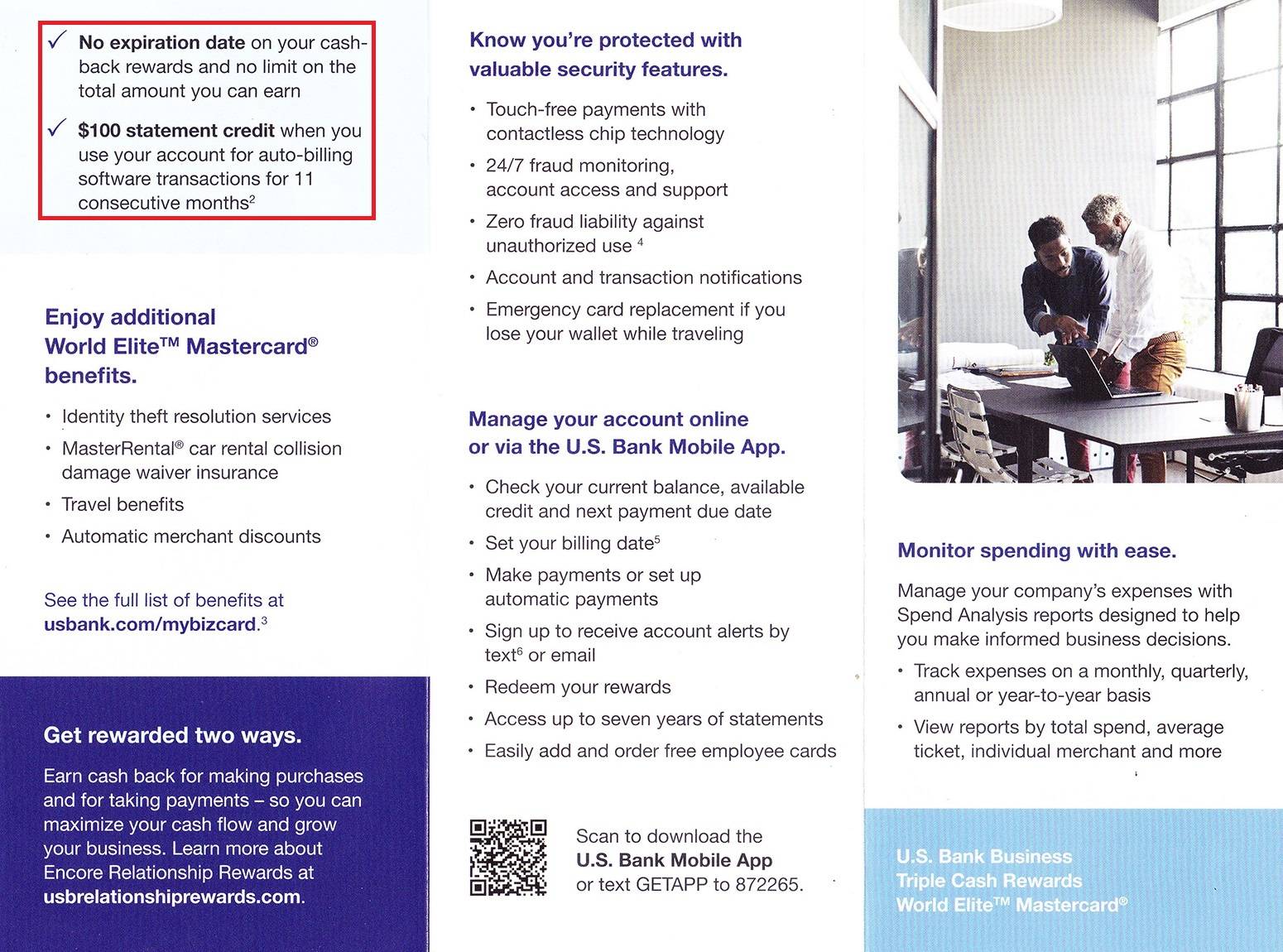

This credit card also offers a $100 statement credit when you make 11 consecutive purchases at eligible software service providers, based on their MCC:

3 An automatic statement credit of $100 per 12-month period will be applied to your Account within two (2) statement billing cycles following 11 consecutive months of eligible software service purchases made directly with a software service provider. Eligible software service providers are identified by their Merchant Category Code (MCC) and purchases made at discount/retail stores or online retailers may not qualify. We do not determine the category codes that merchants choose and reserve the right to determine which Purchases qualify. We reserve the right to adjust or reverse any portion or all of any software services credit for unauthorized purchases or transaction credits. Account must be in good standing (open and able to use) to receive the credit.

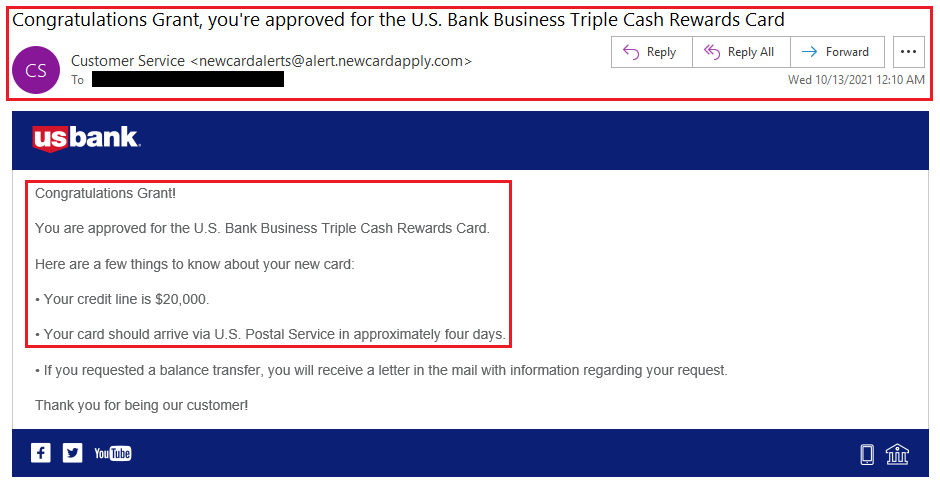

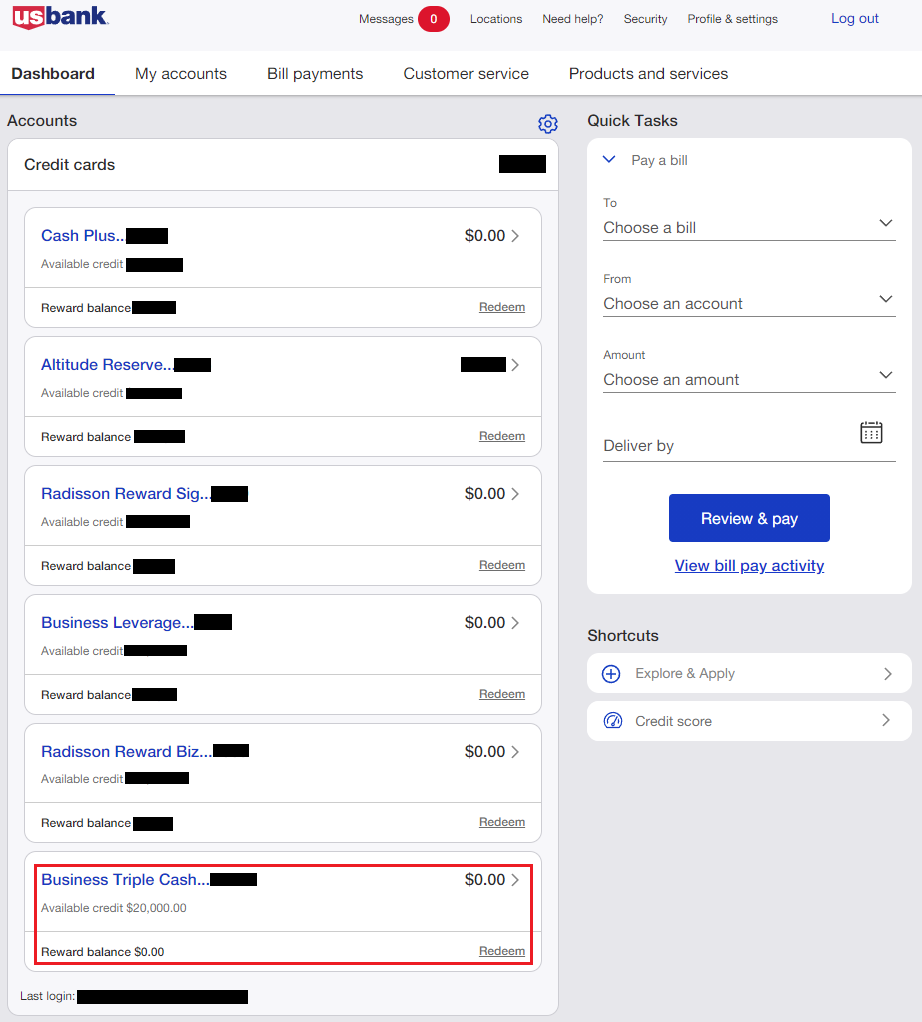

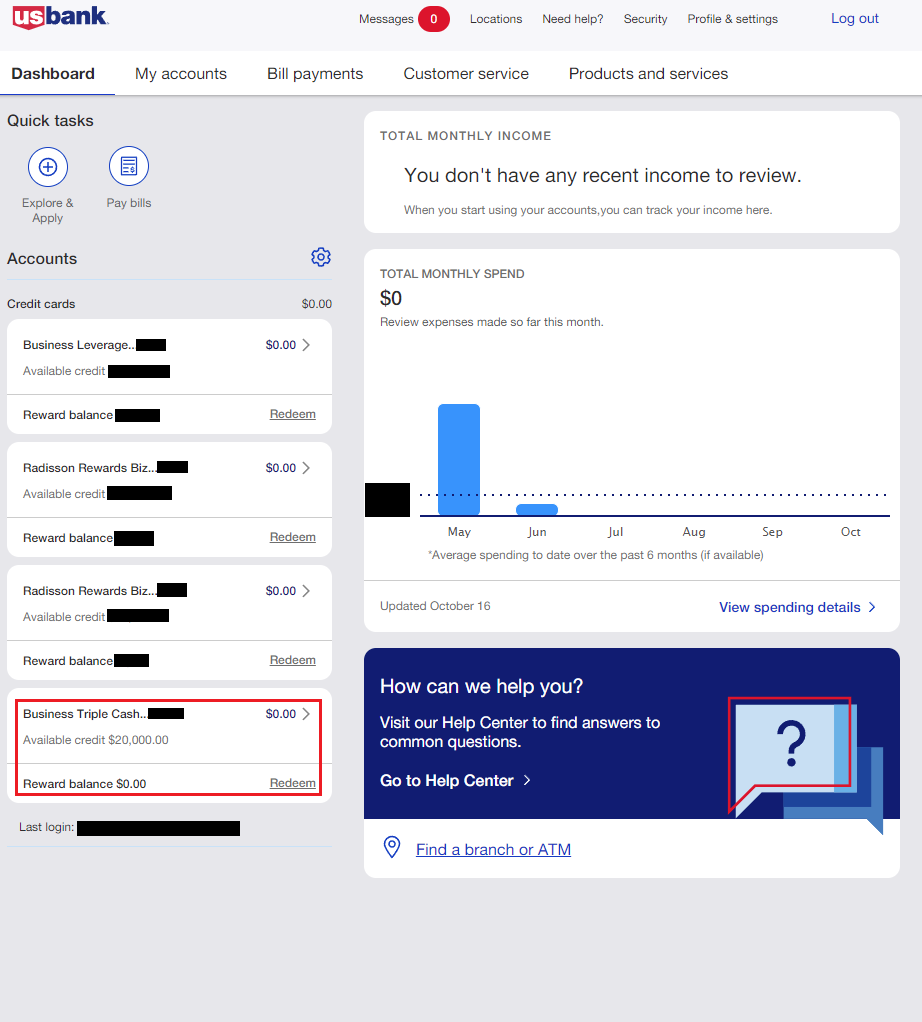

As I mentioned earlier, 6 days after applying, I was approved for the credit card on October 13. I was approved with a $20,000 credit limit and the email said my new credit card should arrive in 4 days.

5 days later, on October 18, I received this email from US Bank telling me that I was approved for the new credit card. As I mentioned in my Capital One post, my small pet peeve is when credit card companies send you letters that you are approved faster than the actual credit card in the mail.

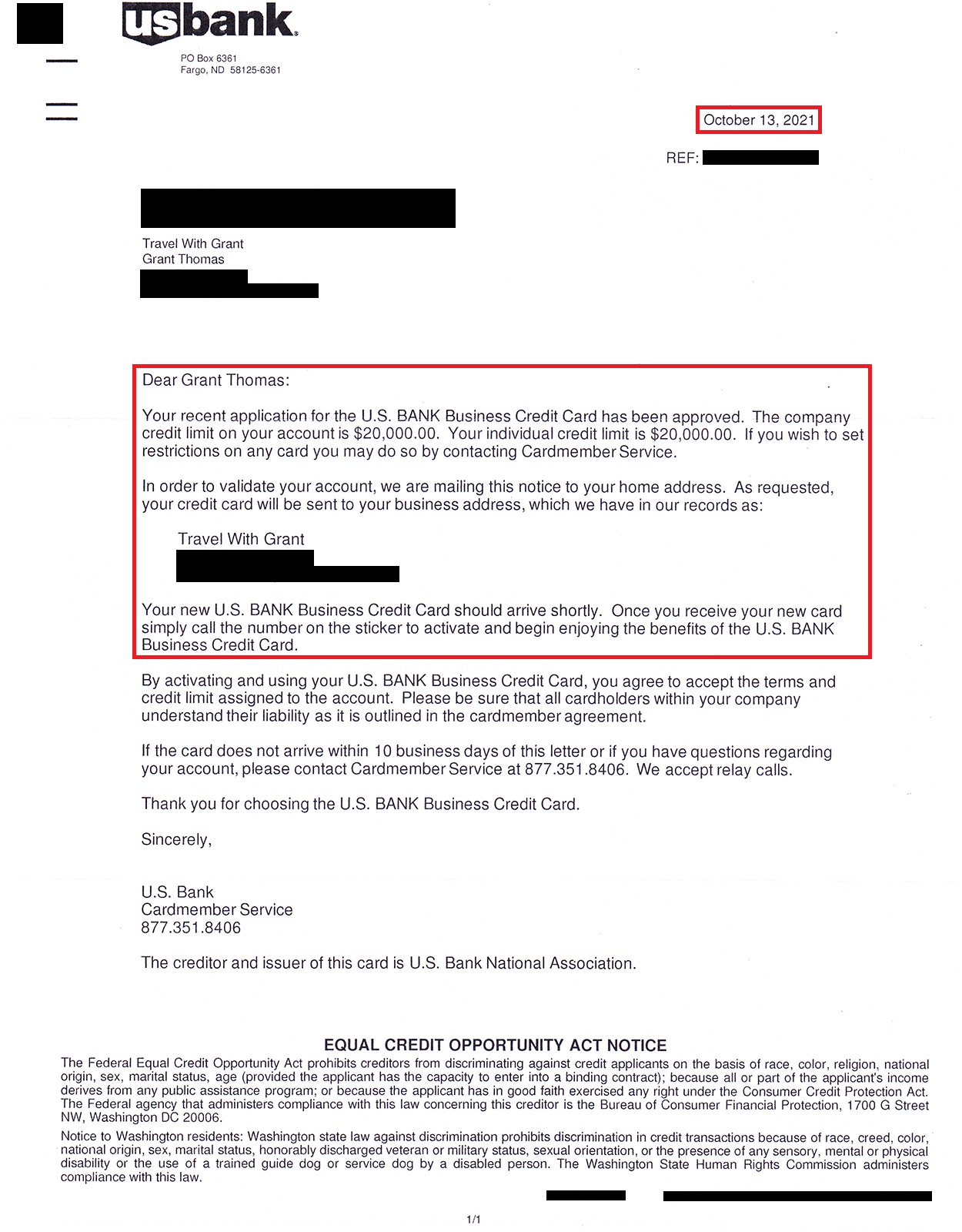

The next day, on October 19, I received my new credit card in the mail. Here is the welcome letter that came with my new credit card.

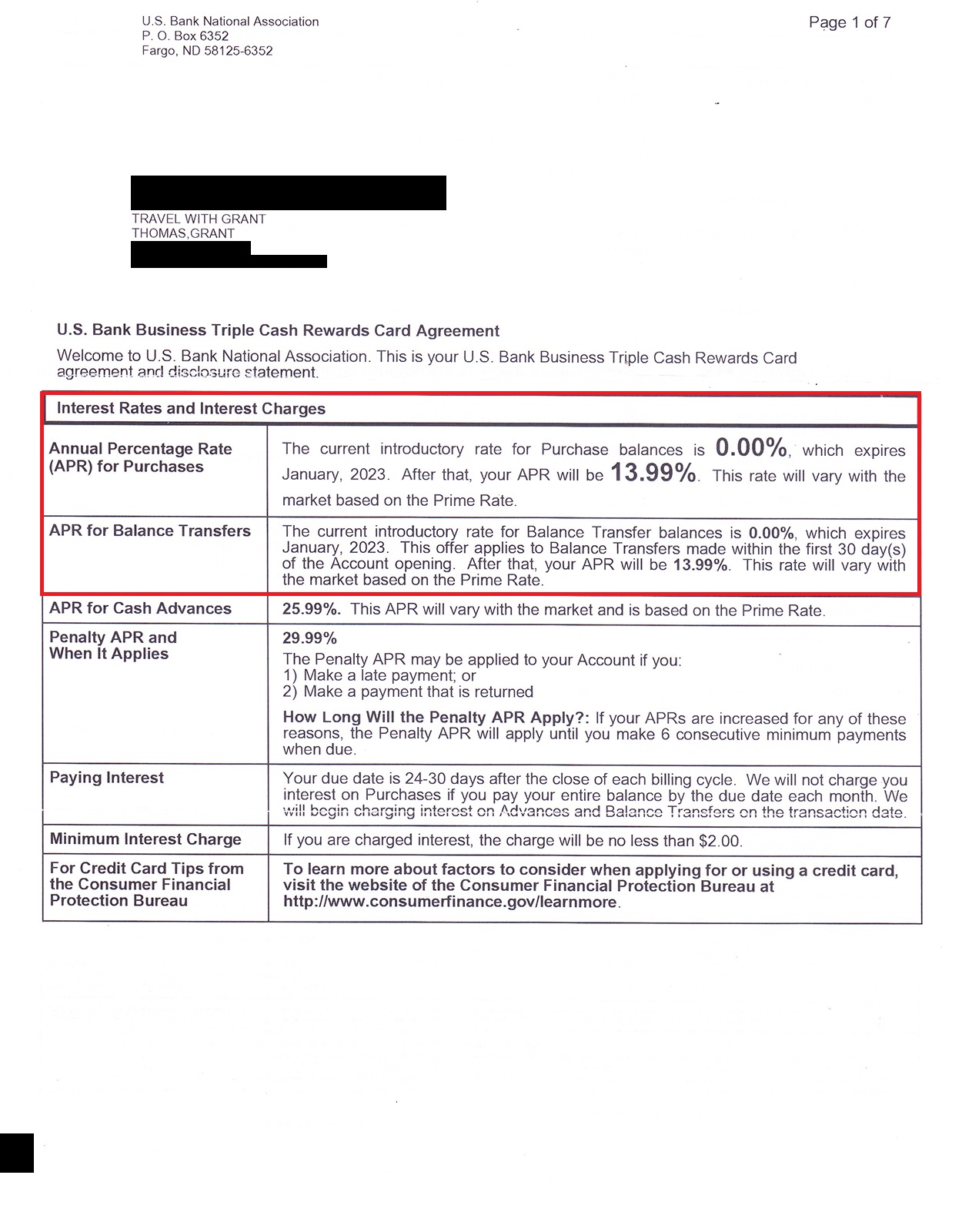

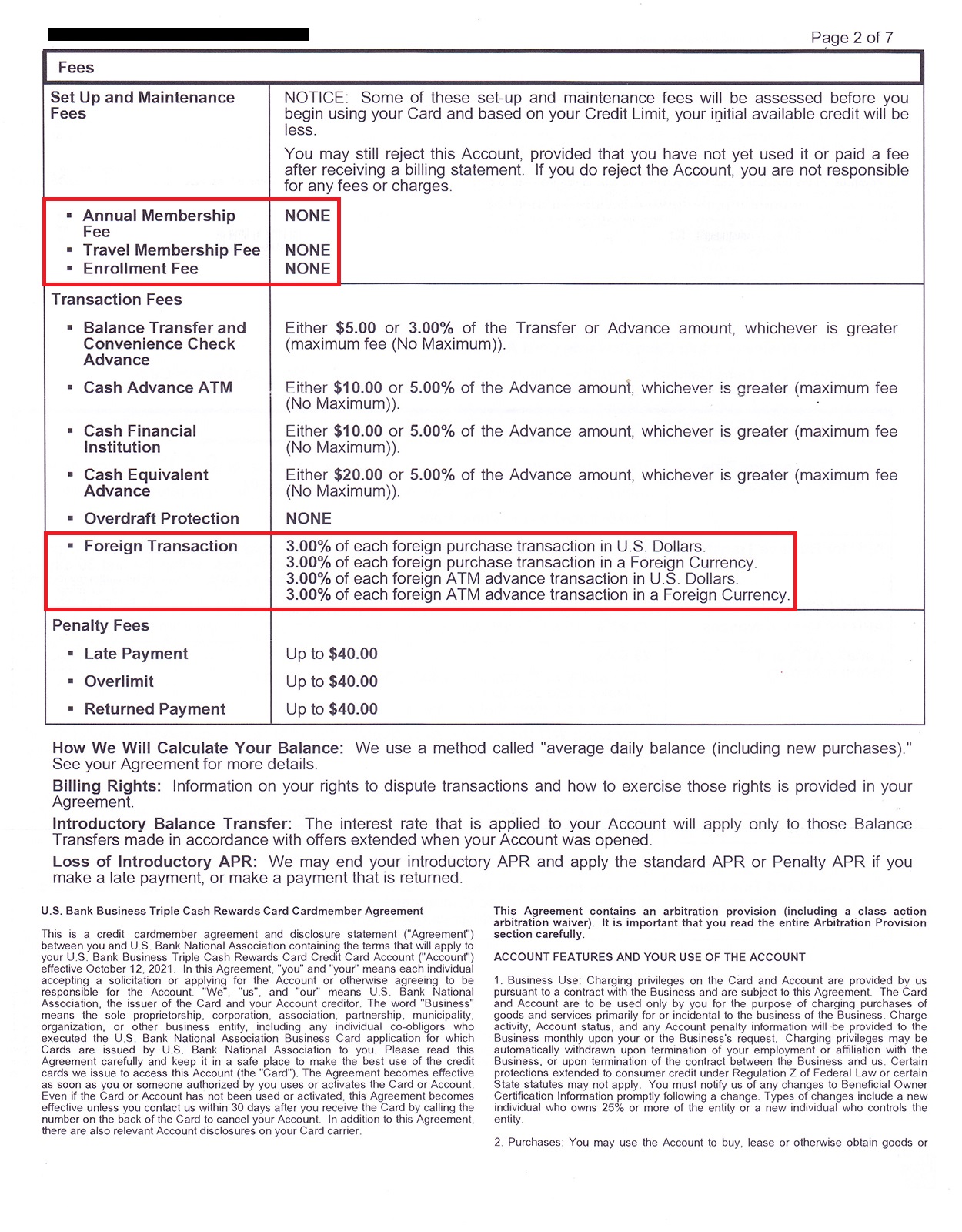

Here are the first 2 pages of the credit card agreement. This credit card comes with 0% APR for purchases and balance transfers until January 2023 (15 months). There is no annual fee, but there is a 3% foreign transaction fee for all international purchases and purchases made in a foreign currency.

Here is the credit card brochure that summarizes the benefits.

Like all other US Bank business credit cards, this new business credit card shows up in my personal US Bank online account (left) and my business US Bank online account (right).

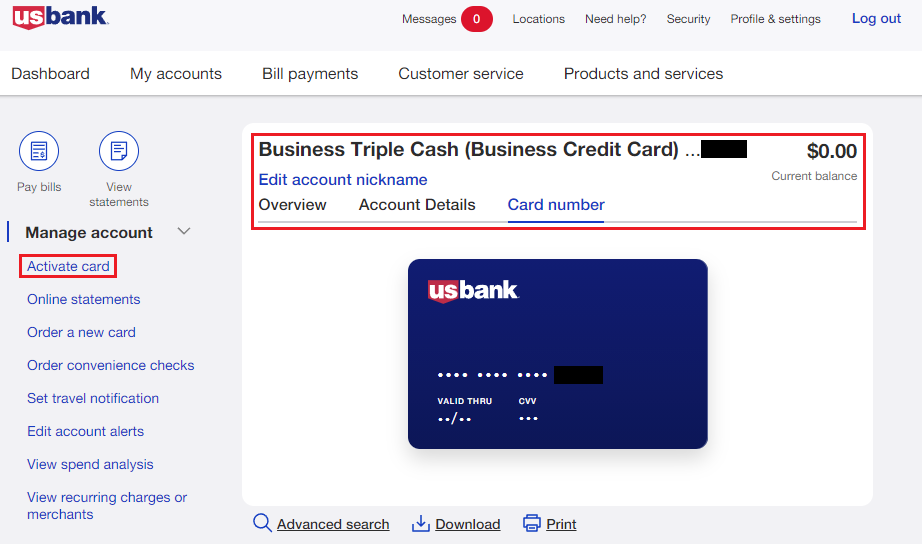

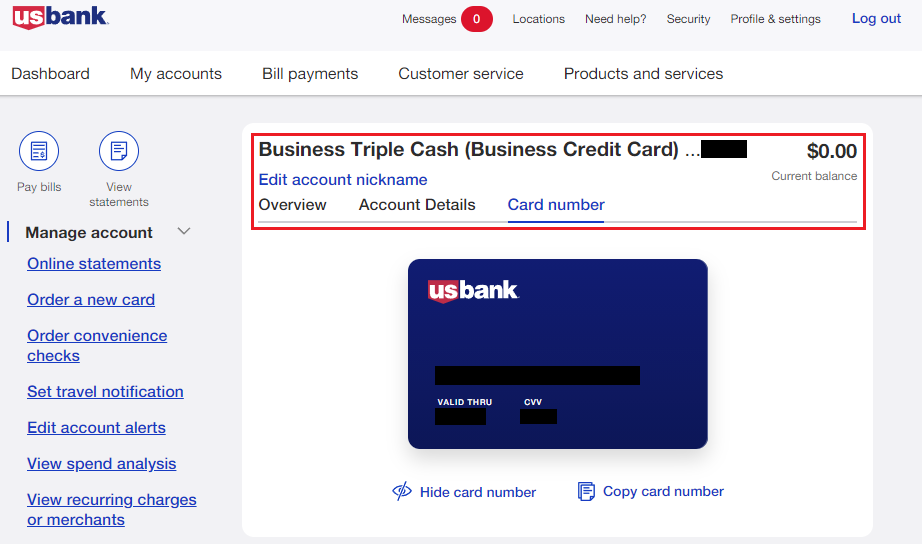

As I mentioned in my Capital One post, Capital One allows you to see your credit card number before your physical credit card arrives in the mail. US Bank allows you to see your credit card number online, but you need to activate your credit card first, which means you need to wait for your physical credit card to arrive in the mail.

I’m on my way to meeting the $4,500 minimum spending requirement. I need to figure out if the $500 statement credit will automatically post to my credit card account or if I need to redeem my $500 cash back as a statement credit. I’m guessing I will need to manually redeem the $500 cash back as a statement credit. I will update this post when I find out. If you have any questions about the application process, approval process, or welcome documents for the US Bank Business Triple Cash Credit Card, please leave a comment below. Have a great day everyone!

“my small pet peeve is when credit card companies send you letters that you are approved faster than the actual credit card in the mail “- It. seems to me I have always gotten and email saying I was approved and the card was on its way before getting the card. Same for USPS approval letter. Why is that a pet peeve? You’d rather they delay the approval mail/email (and just surprise you with the card)?

USB not reallocating limits is my irritation. I had two cards with them with limits totally about $30K. Then I was approved for the Altitude Connections with a $500 limit. It makes it a balancing game to hit $3K spend in four months and not show a high utilization rate. I’ve made four payments and the first statement still has a week before it will hit. Luckily I have a checking account there and payments post instantly.

Hi Carl, I know my pet peeve is kind of silly. I don’t mind getting an approval email and then getting the physical credit card in the mail. I think years ago, I would get an approval letter in the mail and then several days later, the physical credit card would arrive in the mail. I’m not very patient when I’m excited for a new credit card sign up bonus :)

Grant, any idea how to get the software service credits without buying software that we can’t use?

Hi Dan, I looked up the MCC number for software with Visa and MasterCard and it looks like the number is 5045: Computers, Computer Peripheral Equipment, Software. If you know other merchants that fit in that category, that should trigger the $100 credit. The problem is that you need to make 11 monthly purchases before you know if it will work. Any ideas?

The bonus will post to your rewards account for you to redeem however you want (statement credit, VGC, or cashback in your US bank deposit account). Must redeem in $25 increments though (i.e. if you have $545 available to use, you can redeem $525 now or wait until you have $550 available).

Hi Vanson, thanks for the info, that is good to know. I think I saw that real-time rewards were available, have you used that as a redemption option on this credit card?