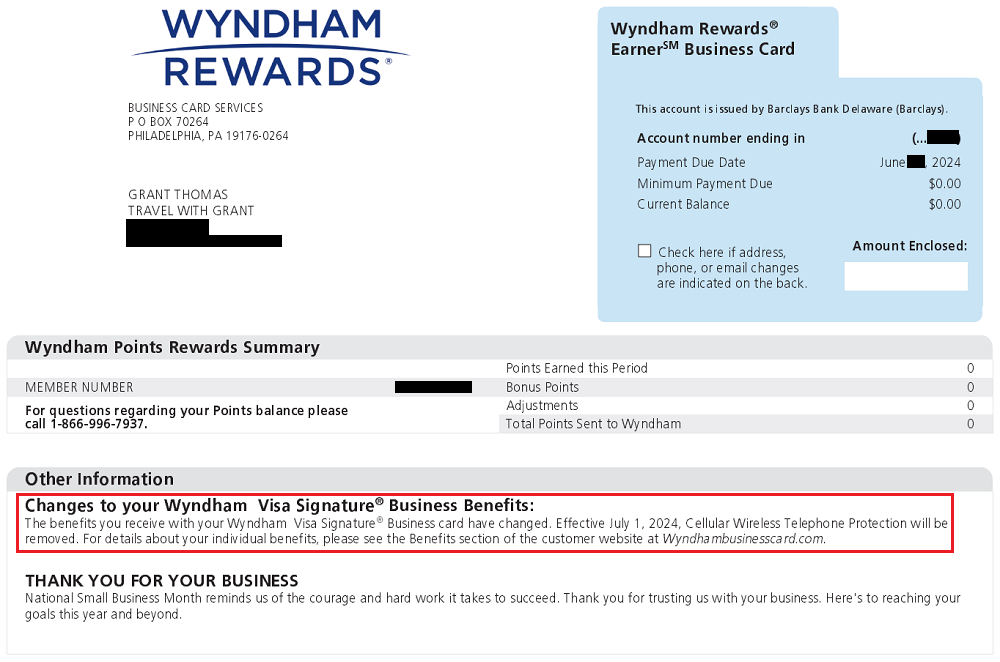

Good afternoon everyone, I hope your week is going well. I just downloaded my recent Barclays Wyndham Rewards Earner Business Credit Card statement and noticed that there is an upcoming change to one of the card benefits:

“Effective July 1, 2024, Cellular Wireless Telephone Protection will be removed. For details about your individual benefits, please see the Benefits section of the customer website at Wyndhambusinesscard.com.”

I was not even aware of this benefit, but wanted to do some digging to learn more.

On the Barclays Wyndham Rewards Earner home page, there is the “Cell Phone Protection: Provides supplemental coverage for eligible damage or theft of your eligible cellular wireless telephone.” I then clicked on the link to go to the Cellular Wireless Telephone Protection website.

Here is a small subset of the terms and conditions of the Cellular Wireless Telephone Protection:

C. Coverage limitations:

Coverage for a Stolen or damaged Eligible Cellular Wireless Telephone is subject to the terms, conditions, exclusions, and limits of liability of this benefit. The maximum liability is $600 per claim, and $1,000 per Covered Card per 12 month period. Each claim is subject to a $50 deductible. Coverage is limited to two (2) claims per Covered Card per 12 month period. Coverage is excess of any other applicable insurance or indemnity available to you. Coverage is limited only to those amounts not covered by any other insurance or indemnity. In no event will this coverage apply as contributing insurance. This “noncontribution” clause will take precedence over a similar clause found in other insurance or indemnity language.

With this benefit, you can make a claim for up to $600 if your phone is damaged or stolen and there is a $50 deductible. You can make up to 2 claims per 12 month period and receive a maximum of $1,000. I have never used this type of benefit on any of my credit cards, but I know a few people who have made several claims from broken phones over the years. If that is you, you should be aware of this change. I wouldn’t be surprised to see this benefit end on other Barclays business credit cards and any personal credit cards that offer this benefit.

Were you aware of this benefit on the Barclays Wyndham Rewards Earner Business Credit Card? Have you ever used this benefit before? If you have any questions about this change, please leave a comment below. Have a great day everyone!