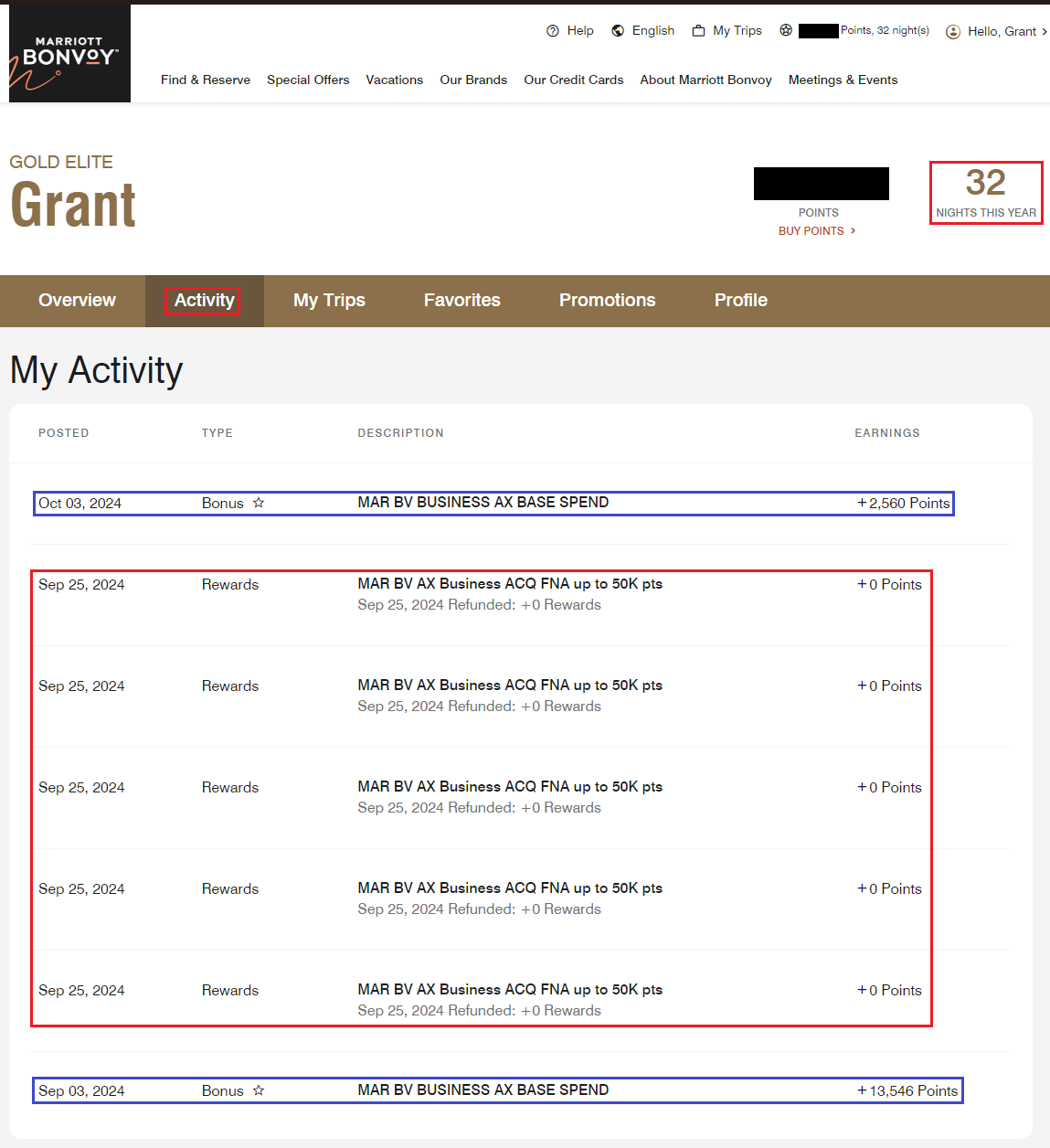

Updated at 8:30am on 10/9/24: I updated this post after the sign up bonus posted a few days ago.

Good morning everyone, I hope your week is going well. This post has been a work in progress for several months since March 2024. Let me explain. Back in March 2024, American Express had an increased sign up bonus on the American Express Marriott Bonvoy Business Credit Card that offered 3 Marriott 50K Free Night Certificates (FNC) after spending $6,000 in 3 months. That was a great offer, but due to Marriott’s Eligibility Matrix (see Frequent Miler’s awesome chart), I wasn’t eligible for the AMEX Marriott Bonvoy Business Credit Card because I currently had the Chase Marriott Bonvoy Premier Plus Business Credit Card. I would need to close my old Chase card, wait 30 days, and then apply for the new AMEX card.

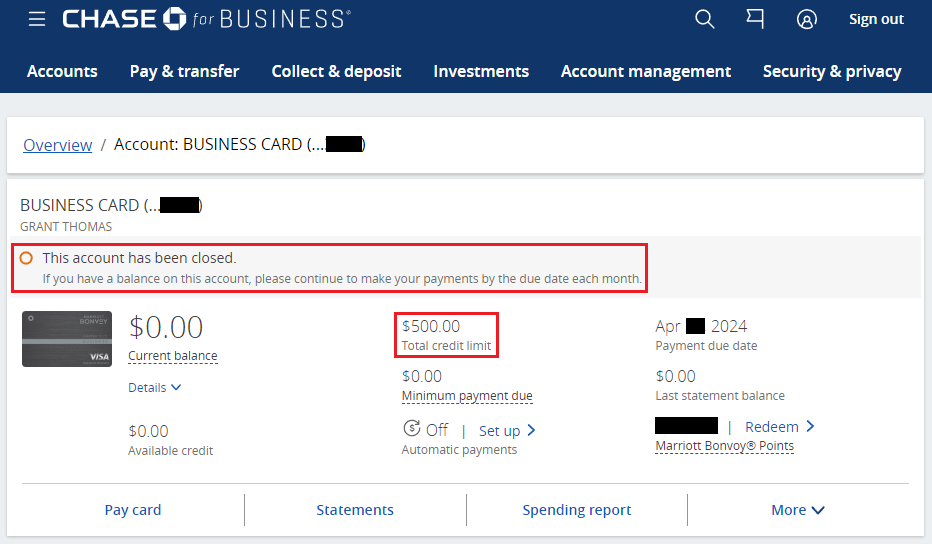

This was a big gamble because there was no guarantee that the AMEX card would have a decent sign up bonus again in the future and because my Chase card was no longer available, so once I closed that card, I could never get it back. I strongly prefer to hold onto cards that are no longer available, like my Chase Ink Plus and my JPMorgan Chase Ritz Carlton.

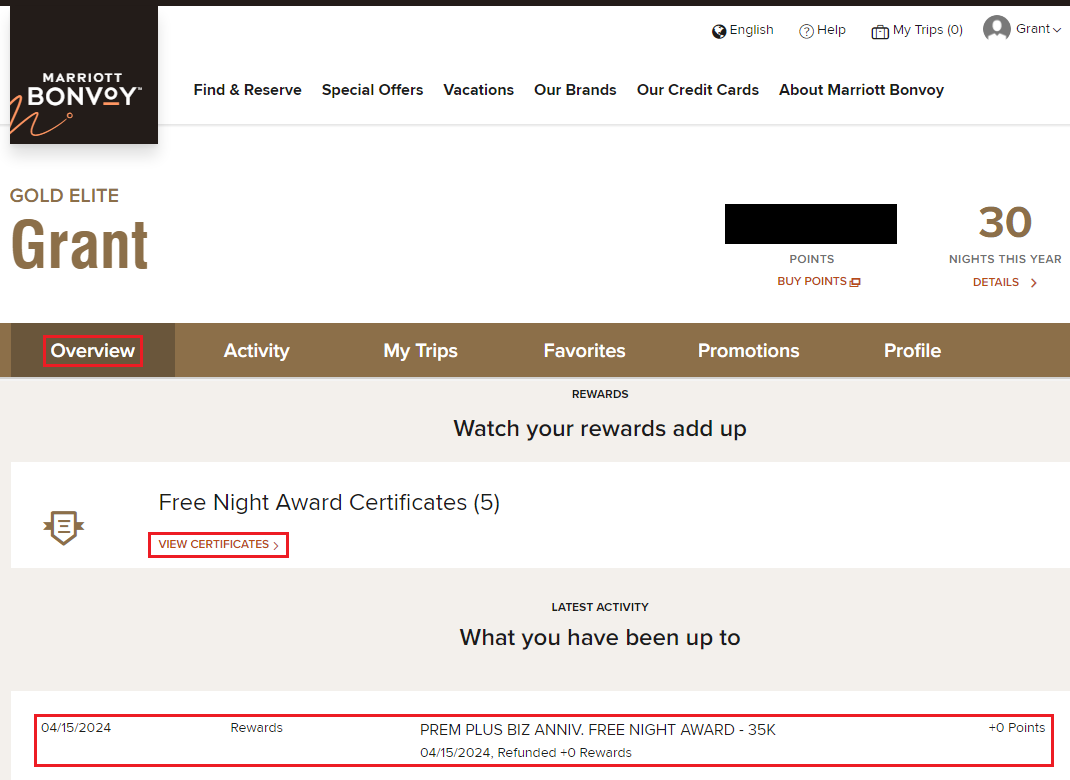

The increased sign up bonus on the AMEX card ended on March 20, 2024, and my Marriott 35K FNC from the Chase card would post the following month in April 2024. As expected, the FNC posted to my Marriott account on April 15, 2024, and now was the time to proceed with my plan.

A few days after my Marriott 35K FNC posted, I called Chase and closed my Chase card. I had hoped that I would magically get a decent retention offer to keep my card open, but no offer was available. The 30 day waiting period began and I was hopeful that a decent AMEX card sign up bonus would become available after mid May.

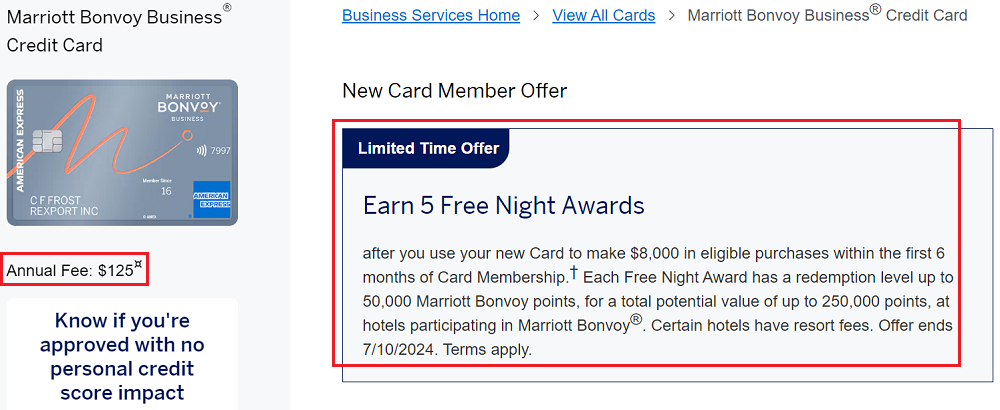

On May 23, 2024, my wishes came true and the AMEX card had a better sign up bonus of 5 Marriott 50K FNCs after spending $8,000 in 6 months (see this Frequent Miler post for more details). The increased sign up bonus for this card had an expiration date of July 10, 2024, so I had about 1.5 months to apply. I didn’t have any large purchases to make immediately, so I planned on waiting toward the end of the expiration date to apply.

I decided to apply for the AMEX card on Friday, July 5, 2024. Before filling out the credit card application, I checked my AMEX account and saw that I had 5 existing AMEX credit cards. AMEX has a limit of 5 credit cards, so I needed to close 1 credit card before applying for the new AMEX card. I used AMEX Chat and closed my American Express Blue Cash Everyday Credit Card that I was no longer using.

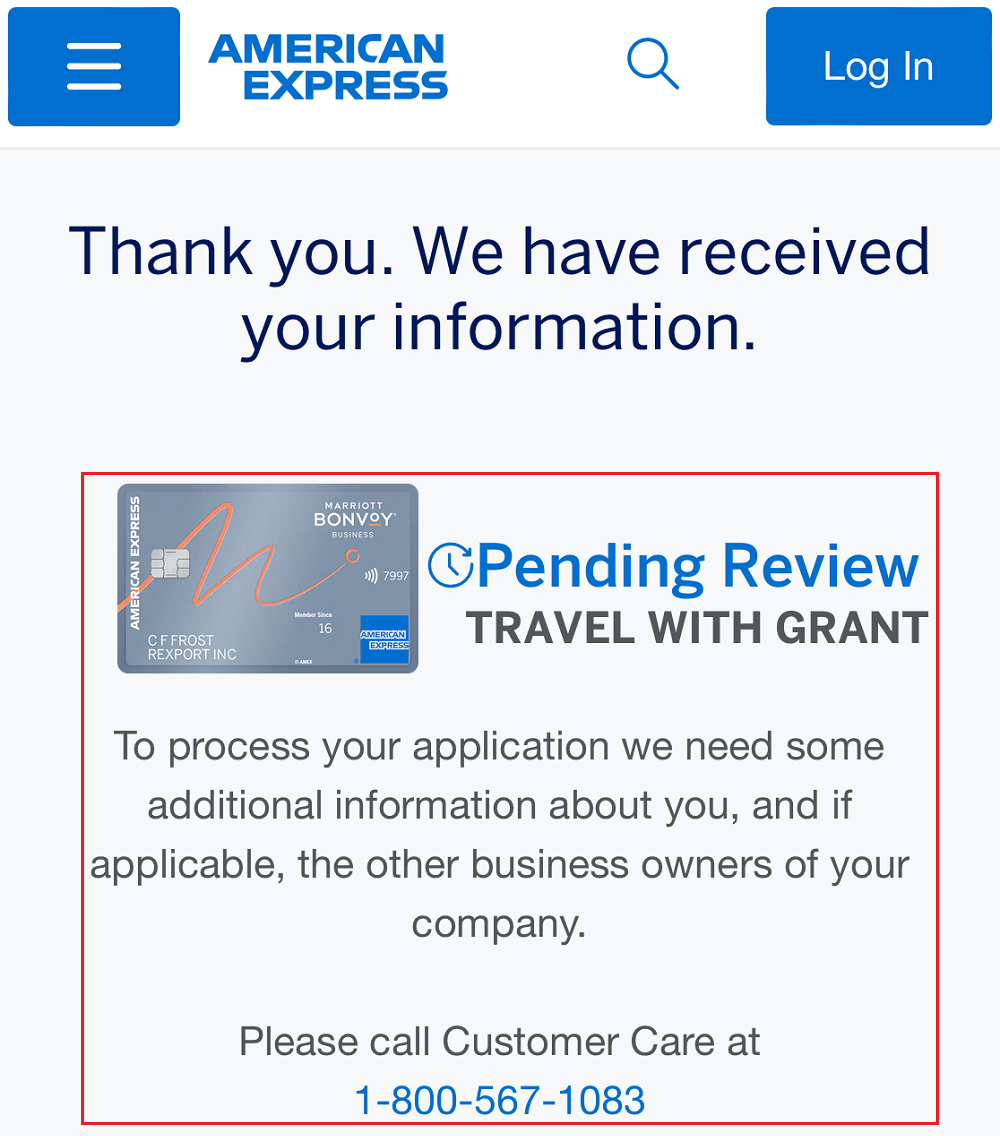

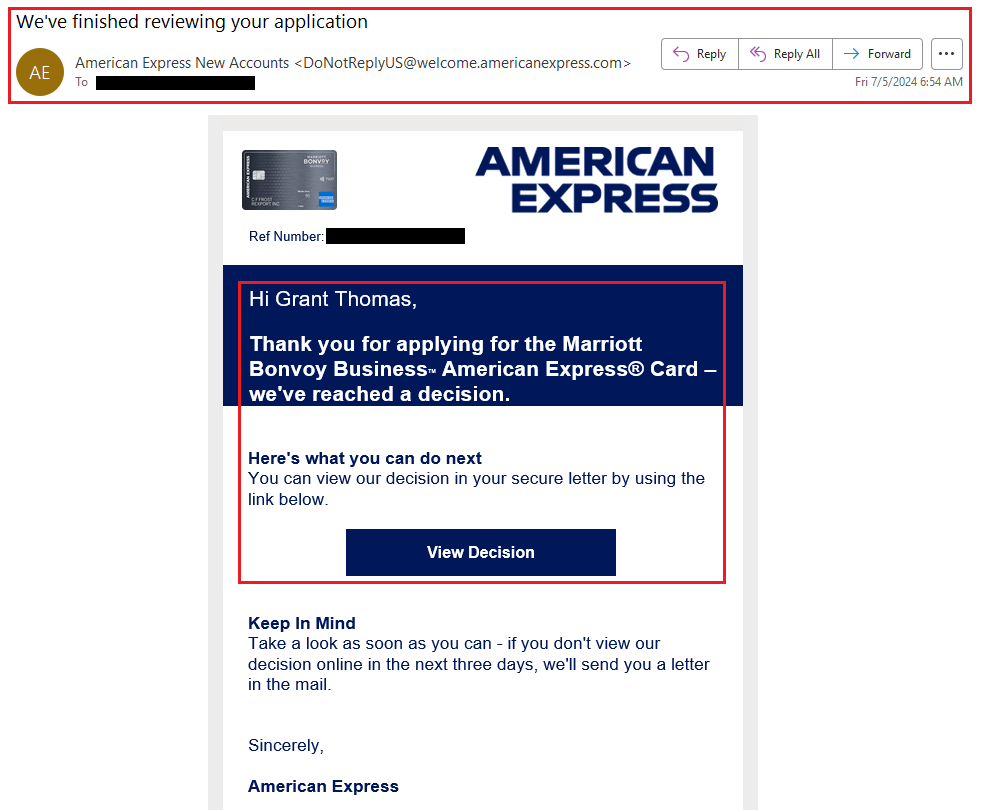

I then submitted the credit card application and got a pending response. I called the phone number listed below and talked to a rep in the credit card reconsideration department. The rep informed me that my application was declined because I already had 5 credit cards. I told the rep that I just closed a credit card that morning and the rep put me on hold for a few minutes to check. The rep agreed that I only had 4 credit cards open at the time of the application, so the rep forwarded my application to a different department for review. I was hopeful that I would get approved after this secondary department reviewed my application and saw the number of credit cards I had open.

Here was the initial email I received after applying for the AMEX card.

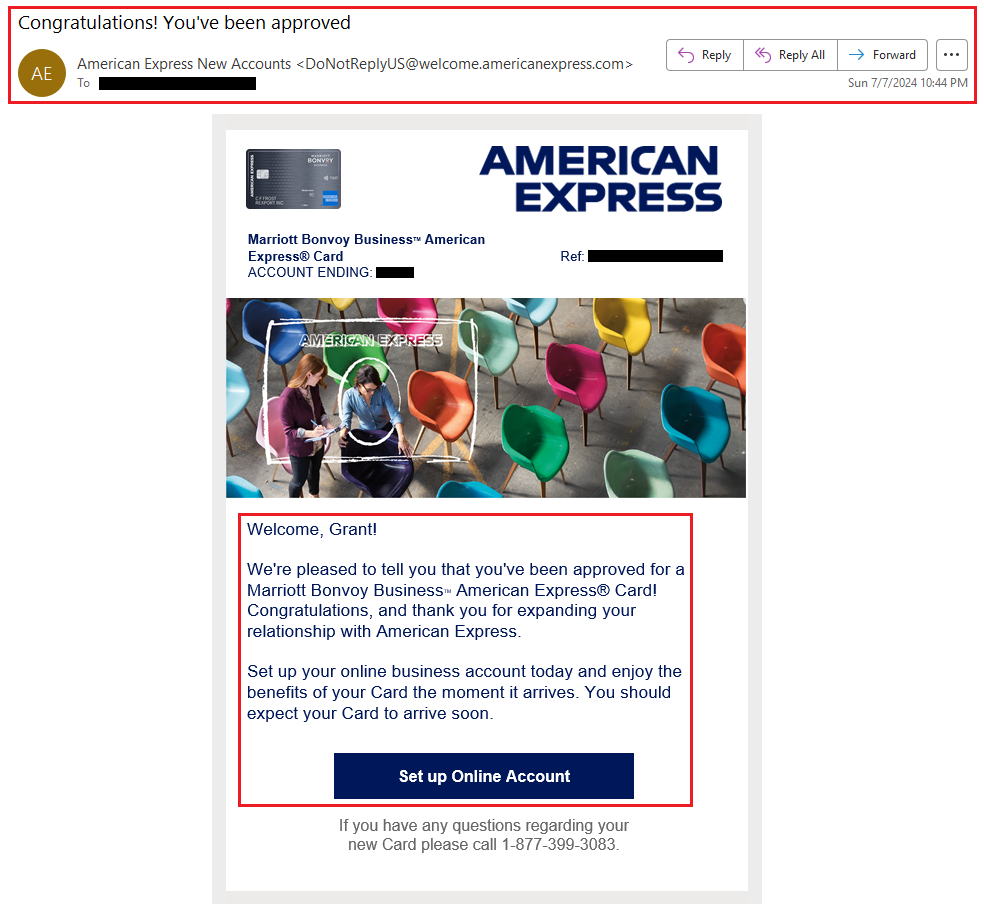

2.5 days later, at 10:44pm on Sunday, July 7, 2024, I received the approval email. Woo hoo! I didn’t see the email until Monday morning, but I was able to add this card to my existing AMEX online account.

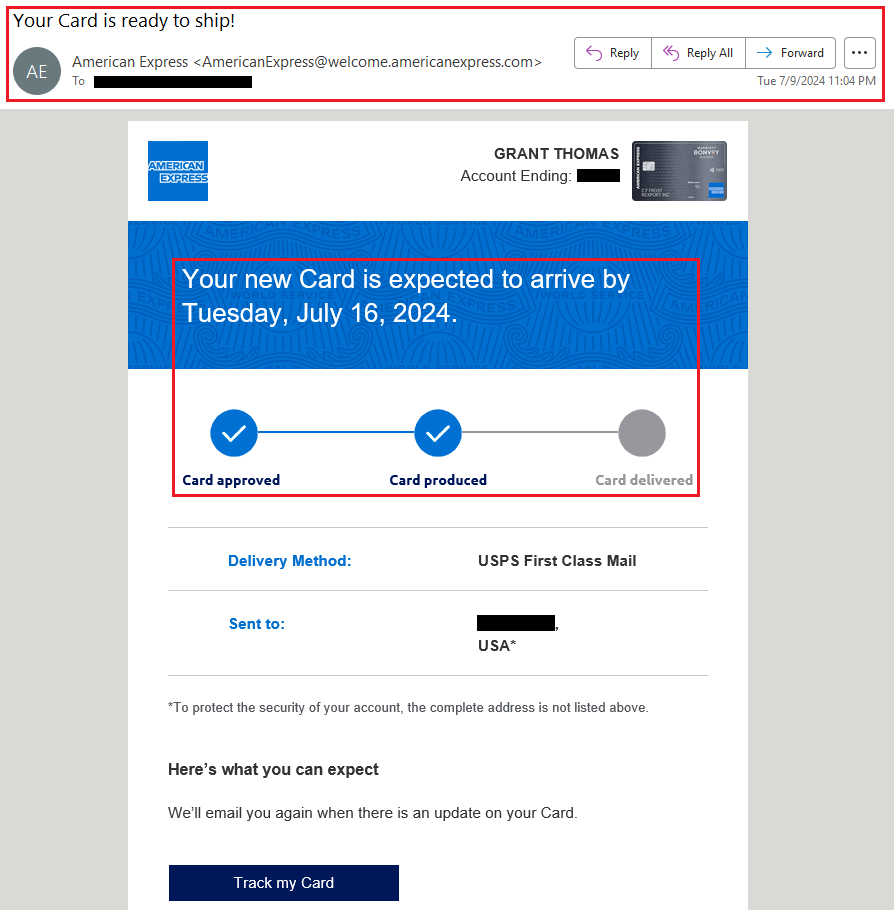

2 days later, on July 9, 2024, I received an email that my new AMEX card had shipped.

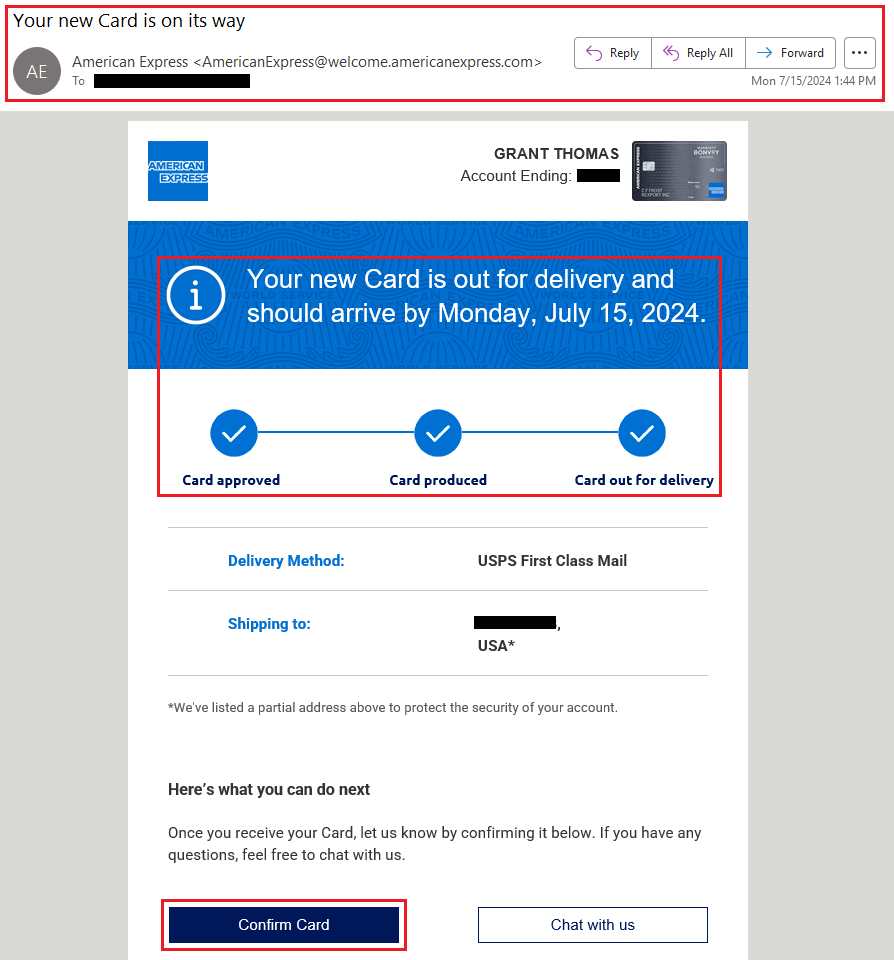

About a week later, on July 15, 2024, my new AMEX card was out for delivery and showed up in my mailbox that same day.

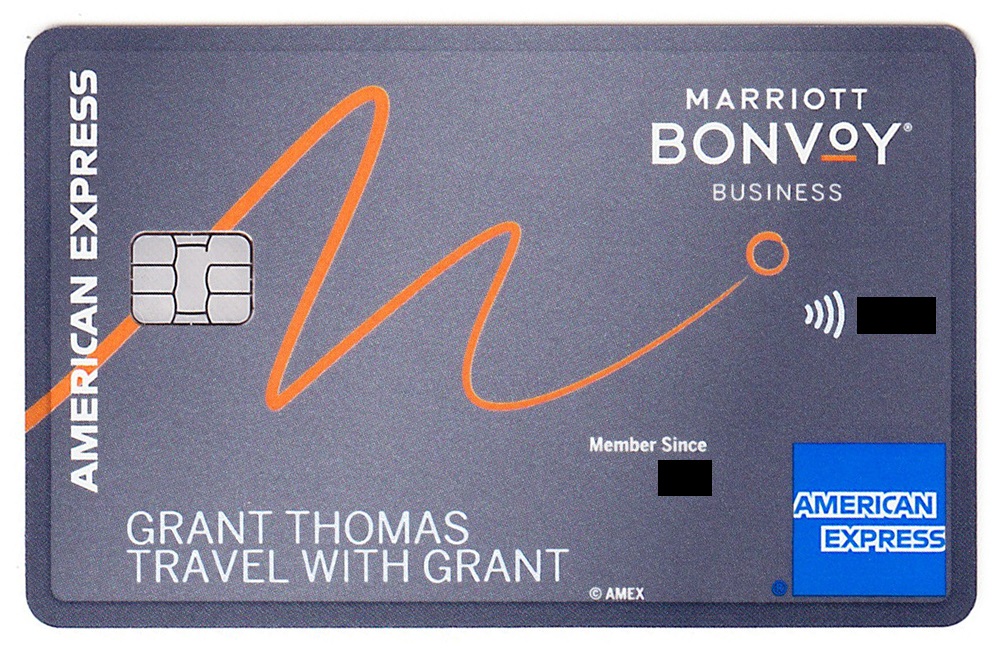

Here is the front and back of my new AMEX card.

A few weeks ago, I completed the minimum spending requirement ($8,000 in 6 months). Even though my statements closed on the 3rd of every month, the 5 Marriott 50K FNCs posted to my Marriott account on September 25, which looks like the day I crossed the $8,000 minimum spending threshold. This is good to know if you want the FNCs fast, you can meet the minimum spending requirement early in your statement period and they should post to your Marriott account before your statement closes. Before I applied for the AMEX business card, I had 30 elite nights (15 from the Chase business card and 15 from the JPM Ritz Carlton card), so I didn’t get 15 more elite nights from this AMEX business card.

My old Chase business card provided a Marriott 35K FNC each year after paying the $99 annual fee. My new AMEX business card will provide a Marriott 35K FNC each year after paying the $125 annual fee. Aside from paying $26 more for the annual fee, there are no major differences between these 2 cards. Even though I do not have definitive plans yet for what to do with the 5 Marriott 50K FNCs yet, I am sure I will find a good use for them in the coming 12 months.

If you have any questions about the American Express Marriott Bonvoy Business Credit Card, please leave a comment below. Have a great day everyone!