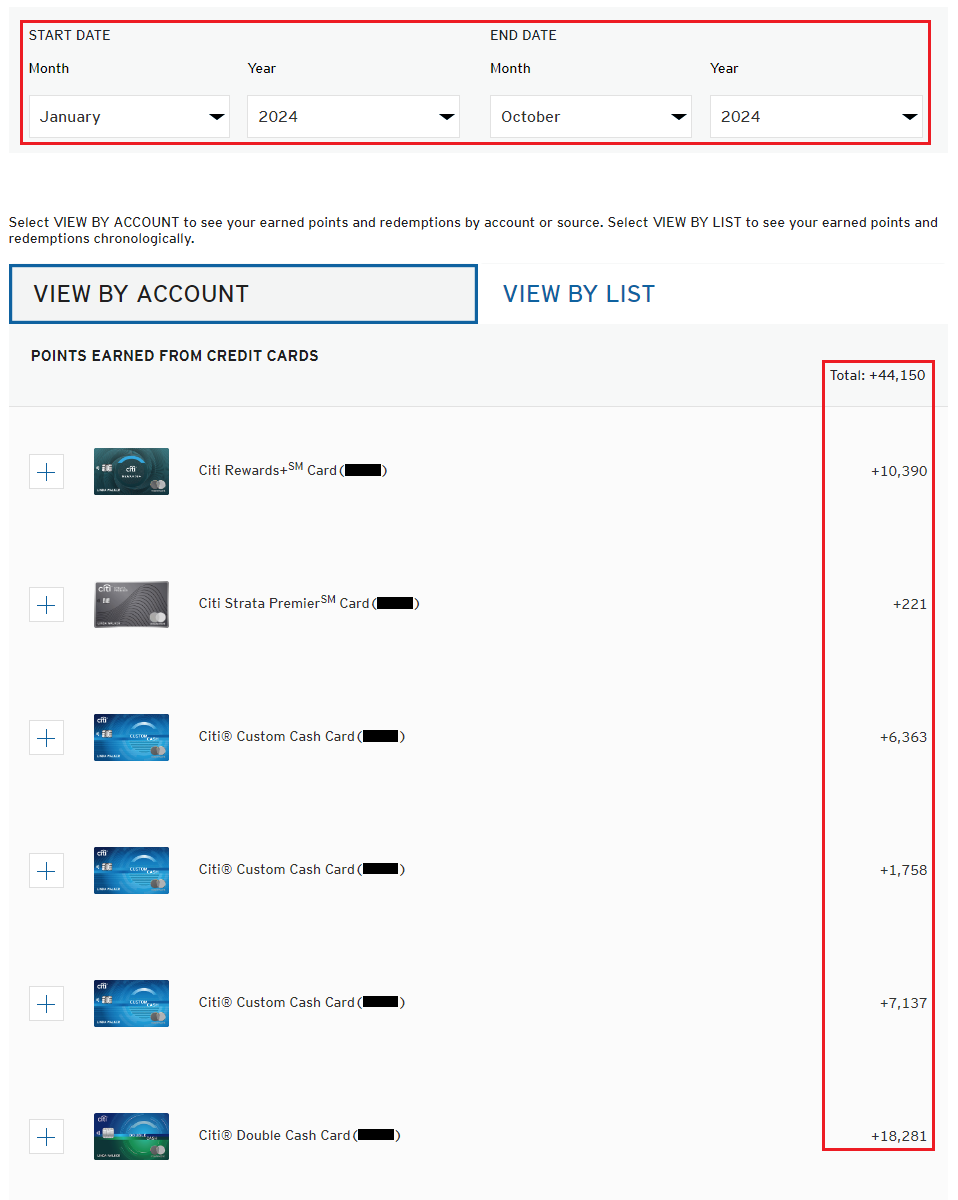

Good afternoon everyone, I hope you had a great weekend. I thought it would be interesting to share how I earn and redeem my Citi ThankYou Points (TYPs), in case any readers were interested in my strategy. From January 2024 through October 2024, I earned 44,150 TYPs from my Citi credit cards – here is the breakdown:

-

- 41% came from my Citi Double Cash Credit Card, which is my go to 2% cash back everywhere card

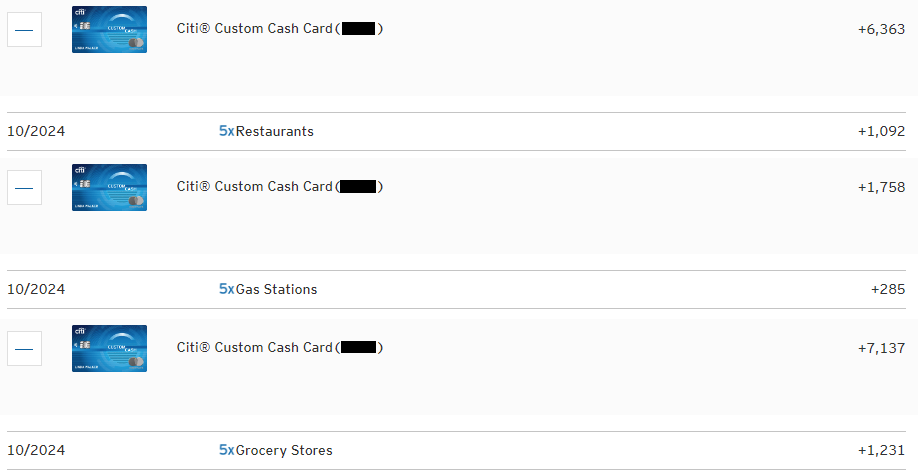

- 35% came from my 3 Citi Custom Cash Credit Cards, which I use each card only in a specific bonus category

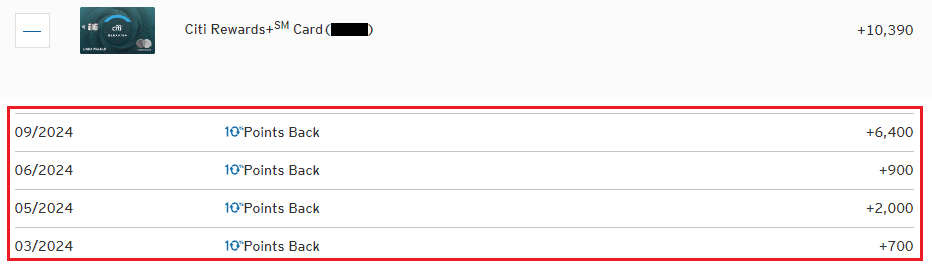

- 24% came from my Citi Rewards+ Credit Card, which I use for my sub $5 purchases and keep around for the 10% rebate on redeemed TYPs

- 0% came from my Citi Strata Premier Credit Card, which I only keep around for the ability to transfer TYPs to transfer partners

Several years ago, I had 3 Citi AT&T Access More Credit Cards, but I was tired of keeping track of which online purchases earned 3x TYPs. I also figured that spending $10,000 on each card in order to earn 10,000 bonus TYPs wasn’t worth it after paying the $95 annual fee for each card. Once I had that revelation, I converted all 3 cards into 3 Citi Custom Cash cards. I tend to use 1 card only for restaurants (I keep this card in my wallet), another card only for grocery stores (I keep this card in my Apple Wallet), and then I reserve the third card for whatever category I have a big expense in that month. Some months it is Live Entertainment, other months it is Home Improvement Stores, and occasionally Gas Stations when there is a linked Citi Merchant Offer.

The conventional wisdom from my friends Greg and Nick at Frequent Miler is to take your card to your local grocery store once a month and buy a $500 grocery store gift card (or some other gift card). Between my wife and I, we don’t usually spend more than $500 a month at 1 grocery store, instead we divide our shopping between Costco, Safeway, and Trader Joe’s, and I don’t want to keep track of Safeway and Trader Joe’s gift cards.

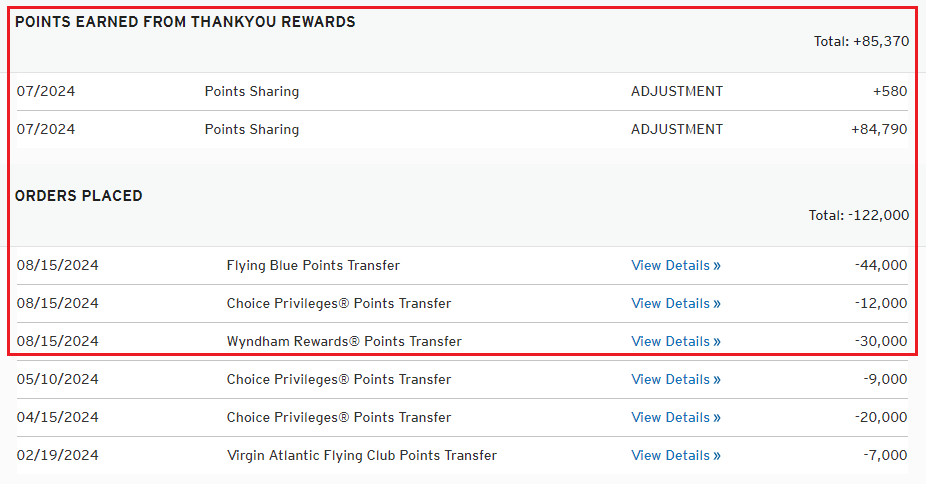

2 months ago, I wrote What Should I do with 85K Expiring Citi ThankYou Points? [TYP Transfers Completed 8/15]. In that post, I shared that Laura transferred 85K TYPs from her Citi Strata Premier to me before she downgraded her card to a Citi Double Cash. I transferred those 85K TYPs out to Air France / KLM Flying Blue (with a 25% transfer bonus), to Wyndham Rewards (with a 20% transfer bonus) and to Choice Hotels to top up for a hotel stay. Earlier this year, I did a few transfers to Choice Hotels for our 2 Ascend Hotel Collection Stays in Helsinki and Stockholm. All in all, I have redeemed 122K TYPs this year…

…which allowed me to max out the 10K rebated TYPs on my Citi Rewards+ card. This is an awesome card to have if you redeem large quantities of TYPs each year. If I could offer Citi one more suggestion, remove the 10K yearly limit or at least raise it to 20K. #ThankYou :)

If you have different strategies for your TYP earning and redeeming, please share the details in the comments section. If you have any questions about my strategy, please leave a comment below. Have a great day everyone!

How many sub $5 purchases do you make? I don’t use the card alot, but I’m wondering how often I can abuse that.

Probably only 2-3 times a month, mostly for iCloud 200GB Storage which is $2.99 for myself and Laura. I might have a 99 cent purchase here and there too.

Good afternoon! I appreciate you sharing your strategy for earning and redeeming Citi ThankYou Points. It’s always helpful to see how others maximize their rewards. Earning 44,150 TYPs in such a short period is impressive! I’m looking forward to seeing your breakdown and learning more about your approach. Thanks for sharing!

I have almost identical setup with Citi. I also did not find the advice to buy grocery store gift cards really helpful for me.

Since I spent at least $250-$300 a month on gas, my third card is locked to these expenses. Unless there is a 5% category on Chase Freedom card that I still prefer (don’t know why) :)

Hi Alex, thanks for sharing your strategy for earning TYPs.

Q4 has been good for the Chase Freedom / Flex (5% cash back at PayPal) and the Discover It (5% cash back at Amazon and Target).

Hi Grant, thanks for this great article. I always love hearing about your strategies. It’s super-nice that you share things in granular detail and analyze all the nuance. Your article caused me to take a look at my TYP earning for the year. I really think this program has gotten so much more valuable in the past few years, and I’ve actively been trying to shift spend over to Citi cards where I can (although Amex keeps reeling my spend back in with big sign-up and upgrade bonuses!!!).

I have a bit of a unique TYP situation as I have 2 ThankYou accounts. Over the course of about 5 years, I built a portfolio of Citi cards and carefully assigned them to 2 ThankYou accounts to achieve what I think is maximum benefit. The biggest benefit of structuring things this way is that I have achieved your dream of having an effective 20k cap on Rewards+ rebates :-) The downside is that it requires holding 2 Premier cards, each with a $95 annual fee – but this is largely mitigated by retention bonuses and/or bonus point promotions.

My TY account line-ups are:

TY Account #1 consists of: Rewards+ #1, Premier #1, Custom Cash #1, and Double Cash.

TY Account #2 consists of: Rewards+ #2, Premier #2, Custom Cash #2, and AT&T Access More (ATTAM).

I have earned a total of 58,200 TYPs this year, broken down as follows:

TY Account #1 (14,163 TYPs): Rewards+ (300); Premier (6,612); CC (6,183); and DC (1,068).

TYP Account #2 (44,039 TYPs): Rewards+ (530); Premier (11,251); CC (14,386); and ATTAM (17,872).

I have not yet redeemed TYPs to earn the Rewards+ rebates yet this year. I’m currently debating whether to take advantage of the current 25% transfer bonus to Leading Hotels of the World, or to cross my fingers and hope for another transfer bonus to Accor ALL before year-end (they had one in November 2023 and seem due for another). I love having these hotel transfer partners available via TYP, as they open the door to some unique aspirational redemptions. Note that I have a bank of Amex points to cover most airline redemptions, I cover Hyatt with Chase points, and I have Hilton & Marriott co-branded cards – so focusing TYPs toward LHW and ALL does a great job of rounding out my redemption options.

This year, I finally figured out how to use my Custom Cash cards in a way that works best for me. One is solely dedicated to Groceries, and one is solely dedicated to Transit (mostly Airport Parking & Tolls). Like you, we normally spend a little under $500/month at grocery stores, so that works well and I don’t have to keep up with those gift cards. And it turns out that the Transit category usually runs $200-500 a month for us. I was floundering for a while with how to best use the CC cards until I sorted it out into this largely set-it-and-forget-it system (again, much like yours).

Last – I have stubbornly held on to my ATTAM card. It has been such a good friend through the years that it’s been hard to part with it. I will say that the 3x coding has gotten much better and more consistent recently for some reason. I put most online shopping onto this card. As of late, GC.com has been earning 3x again (after not doing so for a while), and Pepper GC purchases also earn 3x on ATTAM. I’m not yet sure whether I’m going to hit the $10,000 spend mark this year (my cardholder year is close to the calendar year). I have about $6,000 to date. I wish some of the old ways to increase 3x spend on this card were still available!

Thanks for allowing me to hijack the comments with this long post! Hopefully it’s interesting and perhaps even helpful to some of your faithful TWG readers!!!

Hi Craig, I always love your detailed comments :)

I totally agree with you on AMEX’s “big sign-up and upgrade bonuses” – it’s hard to ignore all the AMEX MR Points that AMEX is throwing our way.

Theoretically, you should be able to transfer TYPs from 1 TY account to another TY account, if you hit the 10K cap on your Rewards+, but judging by your current balances, that may not be necessary this year.

If you don’t hit the $10K spend on your ATTAM to get the 10K bonus TYPs, I am not sure that card is worth the $95 annual fee. Would you come out ahead if you had a third Custom Cash with no annual fee?

Lastly, don’t forget about TYP transfers to Choice Hotels. The 1:2 transfer ratio has been great for some of the nicer Choice Hotel brands in Europe.

Yes on transferring TYPs from 1 TY account to the other – that does work to help maximize the 2 10k Rewards+ rebate caps. Good call-out.

On ATTAM – I agree with your analysis above – generally, not worth the $95 AF if you don’t hit the $10k spend threshold and a no-fee CC would be better. Like I said, I have some sentimental attachment to this card because of its historical value. And I keep hoping that another golden points-earning opportunity will pop up. Given that the ATTAM card will never be available again, I like keeping it just in case. And I’m reasonably close to $10k such that a spree on GC dot com and/or Pepper to hit the $10k mark wouldn’t be out of the question.

Also a great call-out on Choice. I have a decent balance of Choice points but have never used them. Philly & I clearly need to take a nice trip to Scandinavia!!! :) I’ve also noticed some nice Ascend Collection hotels here in the US that could work well.

Plus, Choice’s partnership with Preferred Hotels fits smoothly into the same bucket as LHW and ALL in terms of opening up additional aspirational redemption options.

I can understand the attachment to holding onto cards that are no longer available. I had that same thought about the 3 ATTAM CCs I had but decided that the math didn’t work out that great in my favor, so I product changed them all. I have no regrets about that decision.

I also close my Chase Marriott Bonvoy Business CC in order to get the AMEX Marriott Bonvoy Business CC with the 5 50k FNCs. No regrets on that plan either.

I’m hopeful that you can accumulate more TYPs this year and max out both Rewards+ 10k TYP rebates.

I’ve been very impressed by the Ascend Collection and would definitely consider staying at them in the US too.