Good morning everyone. I hope you enjoyed my post from yesterday: Keep, Cancel or Convert? Chase Sapphire Reserve & Chase Ink Plus. All this week, I am going to review my credit cards that had annual fees post in March. As a reminder, here are all the credit cards and their annual fees. In today’s post, I am going to cover both the American Express Hilton Honors Ascend Credit Card and the American Express SPG Business Credit Card. Are they worth keeping, should I close them, or should I convert them to another credit card?

- Chase Sapphire Reserve – $450 (posted 4/1)

- Chase Ink Plus Business – $95 (posted 4/1)

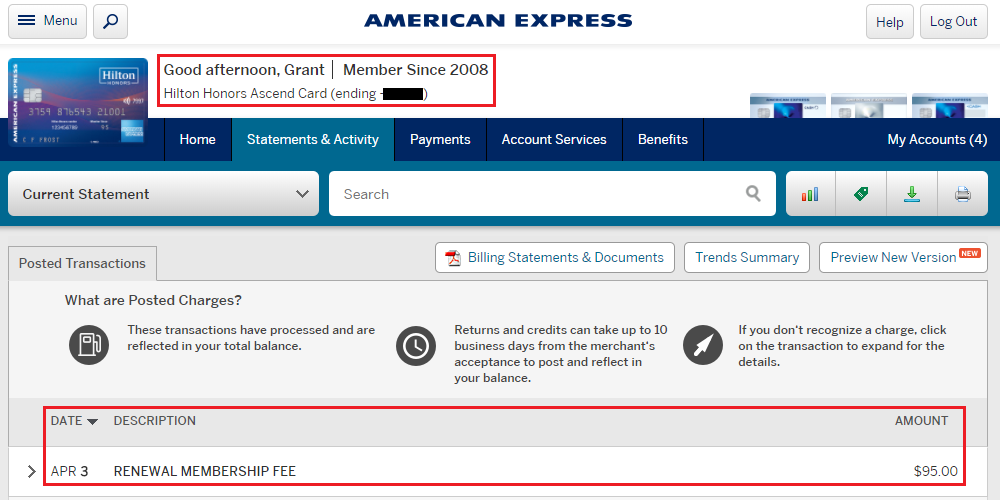

- American Express Hilton Ascend – $95 (posted 4/3)

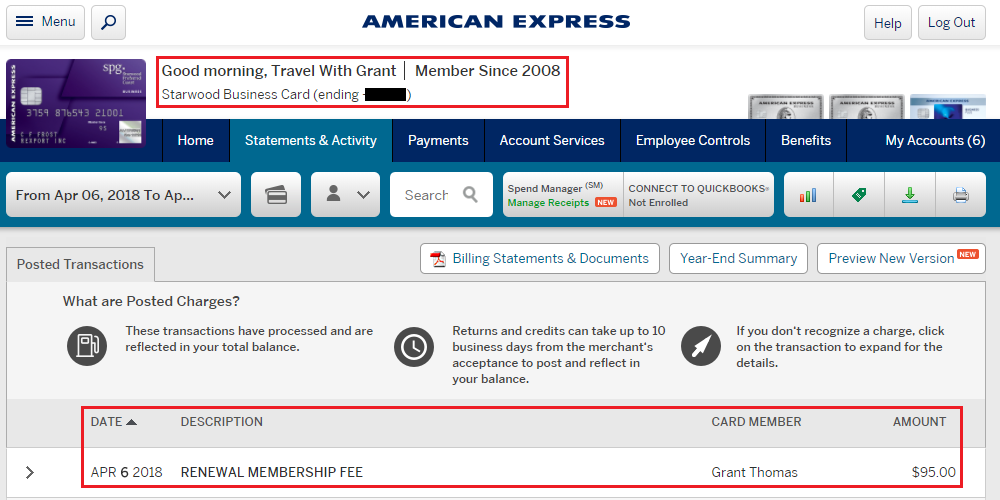

- American Express SPG Business – $95 (posted 4/6)

- Bank of America Alaska Airlines Business – $75 (posted 4/2)

- Citi AT&T Access More – $95 (posted 4/4)

- US Bank FlexPerks Gold – $85 (posted 4/3)

- Wells Fargo Propel World – $175 (posted 3/31)

American Express Hilton Honors Ascend Credit Card

I’ve only had this credit card since January, before then, it was a Citi Hilton Honors Reserve Credit Card. I received the annual free weekend night certificate for spending $10,000 on the credit card when it was a Citi credit card. MSing on the Citi credit card was much easier than MSing on the new AMEX credit card. I also dropped from a Hilton Honors Diamond Elite Member on April 2 when the new Hilton Honors program changes went live, which was terrible timing since I checked into the Hilton Garden Inn on Kauai on April 2 as a Hilton Honors Gold Elite Member. Should I pay $95 to keep this credit card? Having this credit card gives you Hilton Honors Gold Elite Status, but I can already get that for free with my American Express Platinum Business Charge Card. I don’t pay for Hilton stays very often, so if I no longer had this credit card, I would miss out on earning extra bonus points for Hilton stays.

I have had my eyes on the new American Express Hilton Honors Aspire Credit Card that comes with 100,000 Hilton points, Hilton Honors Diamond Elite Status, a free weekend night certificate, and $250 Hilton resort credit. The $450 annual fee is steep, but I think the card is wroth it for the first year. I have a credit card App-O-Rama coming up, so I plan on applying for the new American Express Hilton Honors Aspire Credit Card. If I do not get instantly approved, I plan on calling American Express and asking them to move my credit line from the American Express Hilton Honors Ascend Credit Card to the new card. If that is not possible, I will downgrade to the no annual fee American Express Hilton Honors Credit Card and use that card for the occasional AMEX Offer.

Decision: American Express Hilton Honors Ascend Credit Card will be a sacrificial lamb when I apply for the American Express Hilton Honors Aspire Credit Card. Plan B is to downgrade to the no annual fee American Express Hilton Honors Credit Card.

American Express SPG Business Credit Card

The $95 annual fee just posted and I don’t know what to do with my American Express SPG Business Credit Card. This credit card is not long for this world with the impending Marriott / SPG merger. This credit card gives you 2 stays and 5 nights toward elite status, but that doesn’t excite me. The only tangible benefit of this credit card is the Sheraton lounge access. That is only useful at Sheraton hotels, so I don’t think I get enough value out of the occasional Sheraton hotel stay to justify the annual fee. I already called American Express to ask about retention offers but I got nothing, since I barely put any spending on the credit card after meeting the minimum spending requirement. Part of me wants to see what the news will be about the Marriott / SPG merger and see what the future is for this credit card. Will it become a Chase Marriott Rewards Business Credit Card? I have until May 5 to decide what to do with this credit card.

Decision: American Express SPG Business Credit Card will probably be cancelled unless there is news about this credit card becoming a Chase Marriott Rewards Business Credit Card.

Do you agree with my credit card decisions? What do you think I should do with my American Express SPG Business Credit Card? If you have any questions, please leave a comment below. Have a great day everyone!

Is it true that the AMEX SPG Biz card grants you SPG Gold Status as you have written?

Also I forgot to ask if I cancel the Hilton Ascent card, do I lose my free one night? I received an email with the REWARD ID number to call to redeem my free night. My card was originally the AMEX Hilton Surpass with the annual one free night.

I checked about SPG Gold Elite Status from this card and this is what the website says: SPG® Gold Status – Get SPG® Gold status after spending $30,000 or more in eligible purchases on your Card in a calendar year.

Looks like SPG Gold Elite Status is not included with this credit card. I’ve had SPG Gold Elite Status for so long from my American Express Platinum Business Charge Card, so I forgot if it was included or not. Let me update the post.

As for the Hilton free weekend night certificate, if you sign into your Hilton account and look st your account history, you should see a line item that says free weekend night certificate. Once it is in your Hilton account, you don’t need the credit card anymore. Check out this post for more info: http://travelwithgrant.boardingarea.com/2018/02/12/hilton-free-weekend-night-certificates-posted-from-my-citi-hilton-reserve-credit-cards/

In this other article on the free night certificate, you mention “You have to make a reservation before the expiration date listed in the email. I believe your reservation can be anytime after that though.”

Most of the advice i’ve seen from web searches contradicts this and suggests you need to both book and complete stay by the expiration date. How confident are you in that claim? I have one expiring in a couple months and would be great to have extra time to complete the stay.

Thanks!

I’m not 100% confident. I would suggest calling Hilton to confirm if you can use your certificate after the expiration date if you make a reservation before the expiration date. I could be wrong.

Are SPG cards still convertible to any other AMEX products? I know a few years ago you could convert to Delta but haven’t heard of any DPs if that is still the case. I too wonder what is going to happen with the upcoming Marriott/SPG changes as I have an 18 year old SPG personal card that I want to make sure I can keep on the books for AAoA purposes.

I believe there is an SPG and Marriott announcement coming later this month, so we should know more by then.

Yeah I’m sort of on the fence about the Hilton Ascend card. I’m going to try to finish up the $15k spending so I can double dip the free night certificate. But after that, I’ll probably jettison the card. I also might try for the Aspire card just because of the huge bonus. But at this point, I think I really just want to focus on Citi Thank You pts and Chase UR and maybe Amex MR next year if some good offer presents itself. I don’t find myself even really wanting to use my AAdvantage cards or SPG since I’m afraid of the after effects of the merger.

The only reason to keep the SPG card might be for the increased bonus pts for staying at a Marriott. Isn’t it 6 pts instead of 5 for the Marriott card? Probably not worth it for most ppl unless they stay at a Marriott a lot. But even then, still almost worth it to just use the Chase CSR card

I appreciate your thoughts. If my annual fee was farther out, I would have tried for the $15K spend to get the other Hilton free weekend night certificate. I don’t stay a Marriott hotels very often, but I do have a Chase Marriott Rewards Credit Card, so I would be earning 2x SPG or 5x Marriott, which is almost the same thing. Not worth keeping a $95 annual fee credit card for an extra 1x Marriott point.

AMEX Sync offers made me keep my SPG Biz Amex. I made $320 after subtracting the $95 annual fee last year.

Nice job, I haven’t had that many good Amex Offers in the last year.

How are you generating SPG points if you don’t have the card? Or maybe you’re not..?

I don’t generate SPG points. I focus on other points, mostly Chase Ultimate Reward Points.

I was gonna say this would be like a cute recurring article and you could call it Keep/Kancel/Konvert but then … yeah… that’s no good lol #hangover b

Too bad I couldn’t find a ‘c’ word that was similar to keep, then it would be C / C / C :)

Maybe Continue / Cancel / Convert to get the 3 C’s…I looked up the thesaurus for possibilities. That’s the only one that could possibly work.

Continue would work, good find Danny :)

I have another K/C/C post tomorrow and Friday scheduled.

Hey Grant,

I think Hilton Aspire is a great card if you want to stay at a hilton property even once a year (outside of the US especially). The $250 airline credit is easy to use (you know what i mean). The $250 resort credit is easy to use too because you’d be staying at a resort atleast once a year. So effectively they’d pay YOU $50 to have diamond and to have a free night. Plus for that stay you’ll get a nice boost to your hilton points.

As for ascend, it’s only worth keeping if you spend a lot at grocery stores. I use other cards there too but sometimes I need to use yet another so I can keep spending (ascend is that yet another card). This gets me a week every year in either one of the great Waldorf or Conrad resorts (Maldives, Koh Samui, etc).

That is a great game plan. I like the way you think :)