Good afternoon everyone, I hope your weekend is off to a great start. 2 weeks ago I applied for the Capital One Spark Miles Business Credit Card. I haven’t had a personal or business Capital One credit card in many years (despite submitting a few credit card applications over the years). I decided to give Capital One another chance since they recently improved the transfer ratios to almost all of their transfer partners to 1:1 (1,000 Capital One Miles = 1,000 airline miles). This time, my Capital One application was instantly approved! In this post, I will share details of the application process and the welcome documents I received from Capital One.

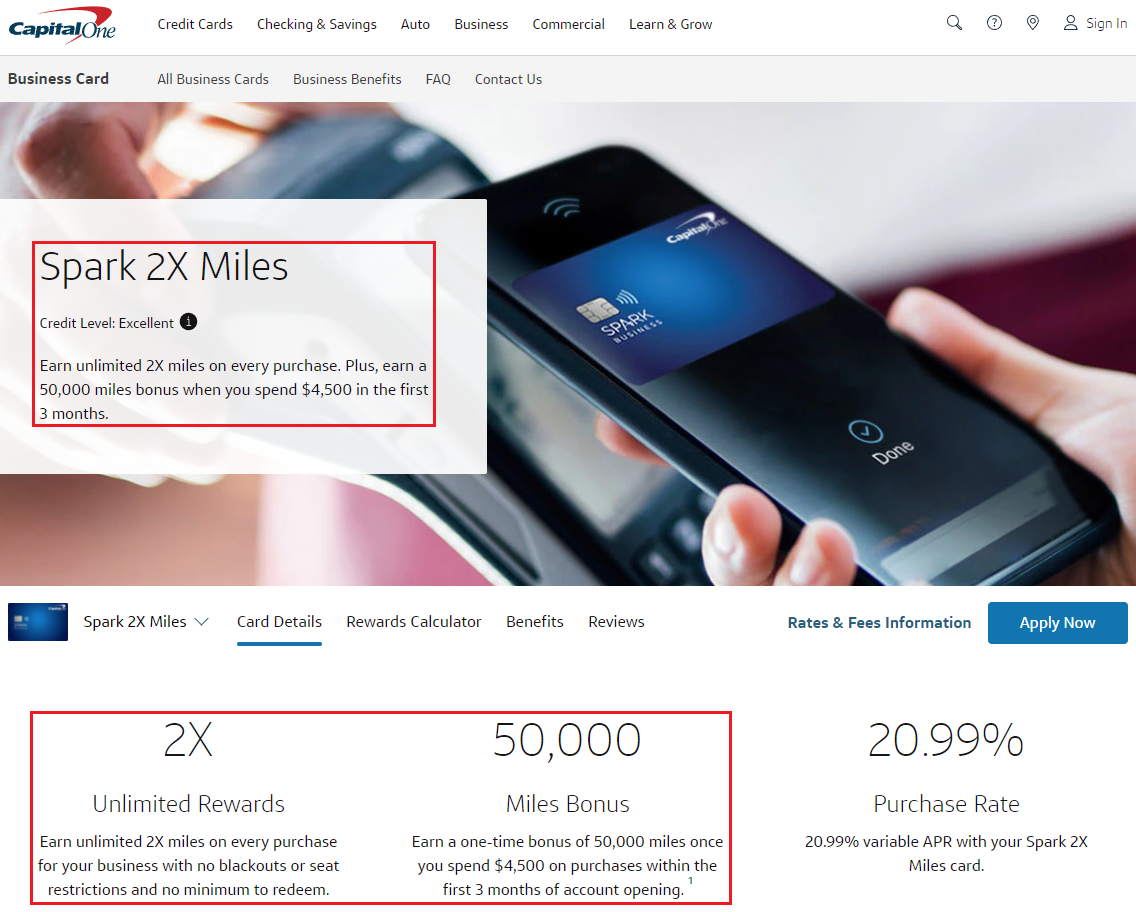

As of October 16, the current sign up bonus for the Capital One Spark Miles Business Credit Card is 50,000 Capital One Miles after spending $4,500 in 3 months. There is also no annual fee the first year.

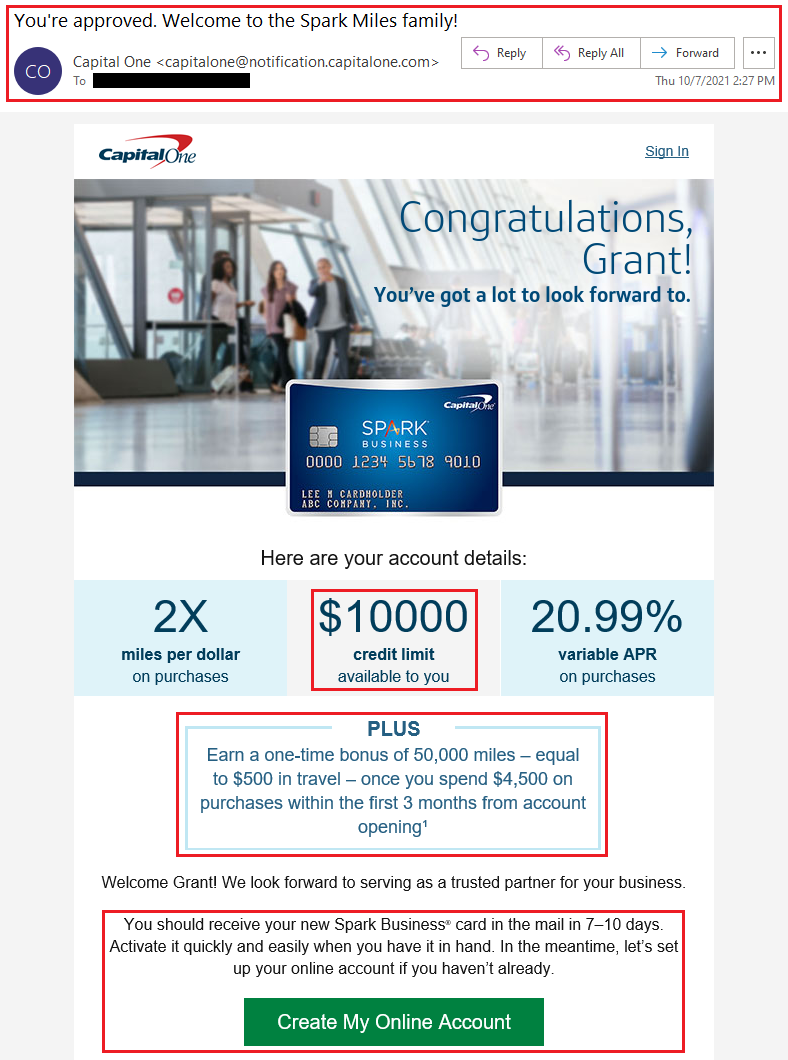

After I submitted my application, I received the approval email right away on October 7. According to the email, I should received my new credit card in 7-10 days. I had an existing Capital One online account from a previous Capital One checking and 360 money market account, so I was able to sign into that account and view my new credit card.

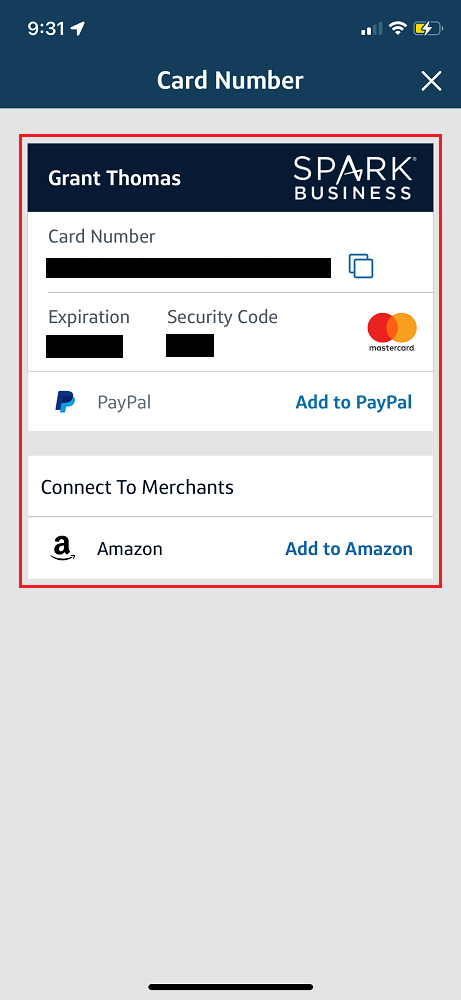

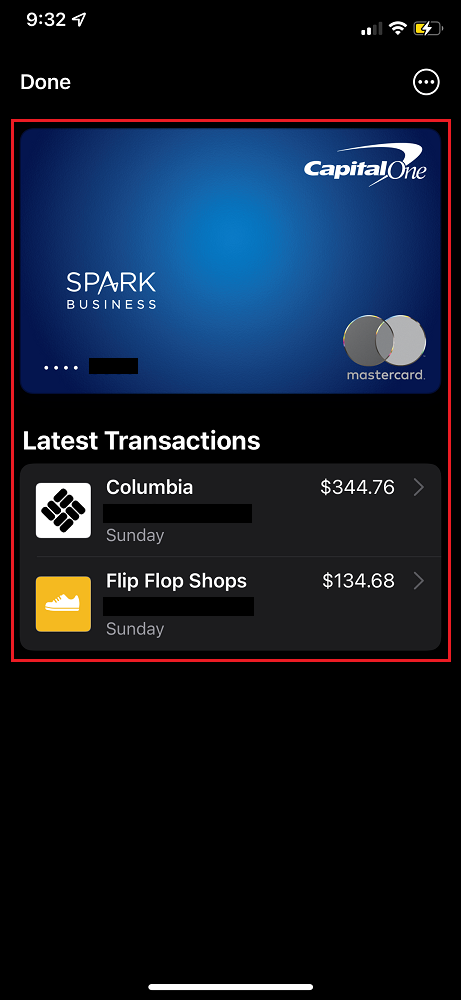

A few days after I was approved, I signed into my Capital One app and was able to view the credit card number. I then added this credit card number to my ApplePay Wallet and used it a few times last weekend. I didn’t need to receive or activate the physical credit card before I could add the credit card to my ApplePay Wallet. I could also add the credit card number to PayPal or Amazon.

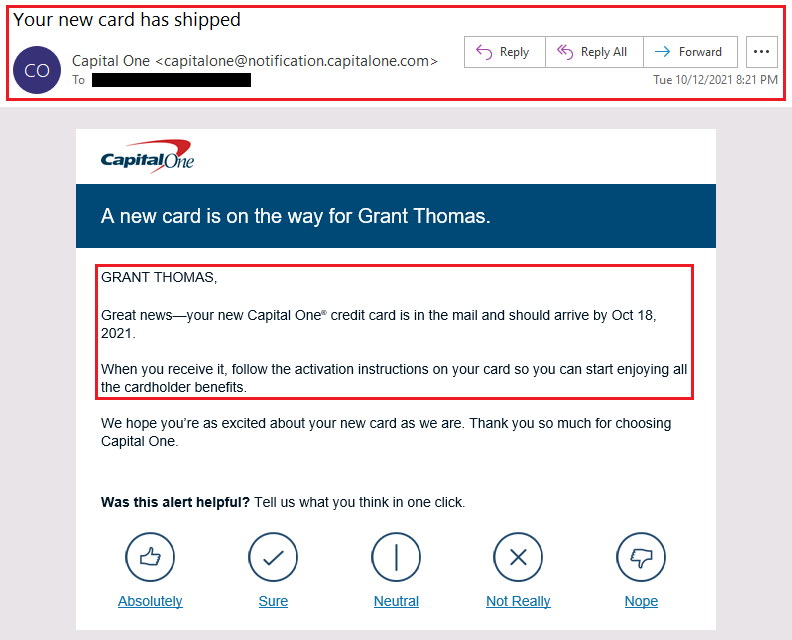

5 days after approval, I received an email on October 12 that my credit card was shipped and that it should arrive by October 18.

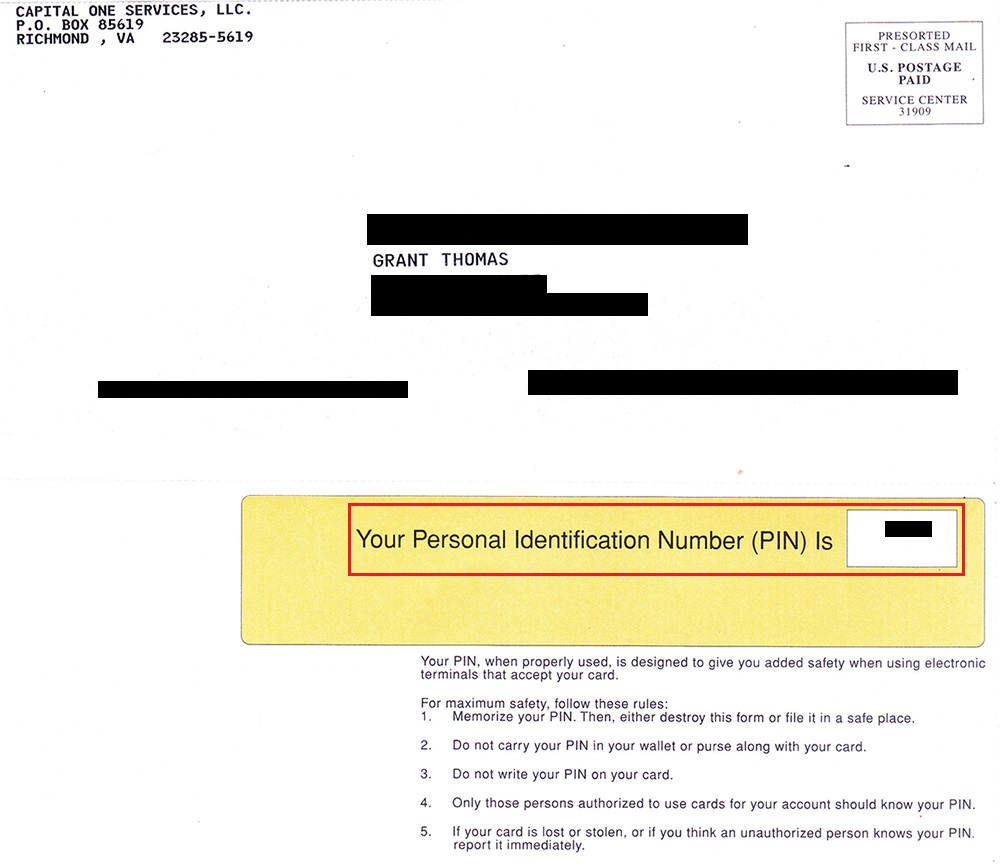

The next day, on October 13, I received this PIN mailer to use my credit card for cash advance purchases and at certain electronic terminals (maybe at automated European kiosks).

I also received a letter from Capital One telling me that my application was approved (I already knew that from the 2 previous emails). This is a small pet peeve of mine when credit card companies send you letters that you are approved faster than the actual credit card in the mail. In the letter, it says that my Equifax credit score was 775 on October 7. I did received credit monitoring alerts from all 3 credit bureaus when I applied, so I’m not sure why Capital One showed my Equifax credit score – maybe that was my highest or lowest credit score at the time of my application.

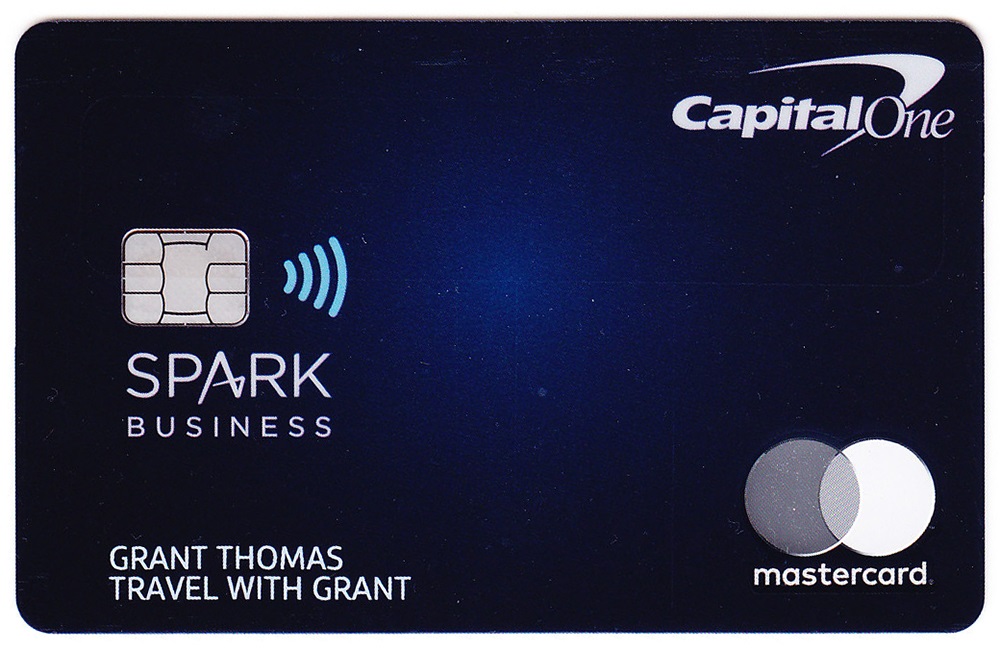

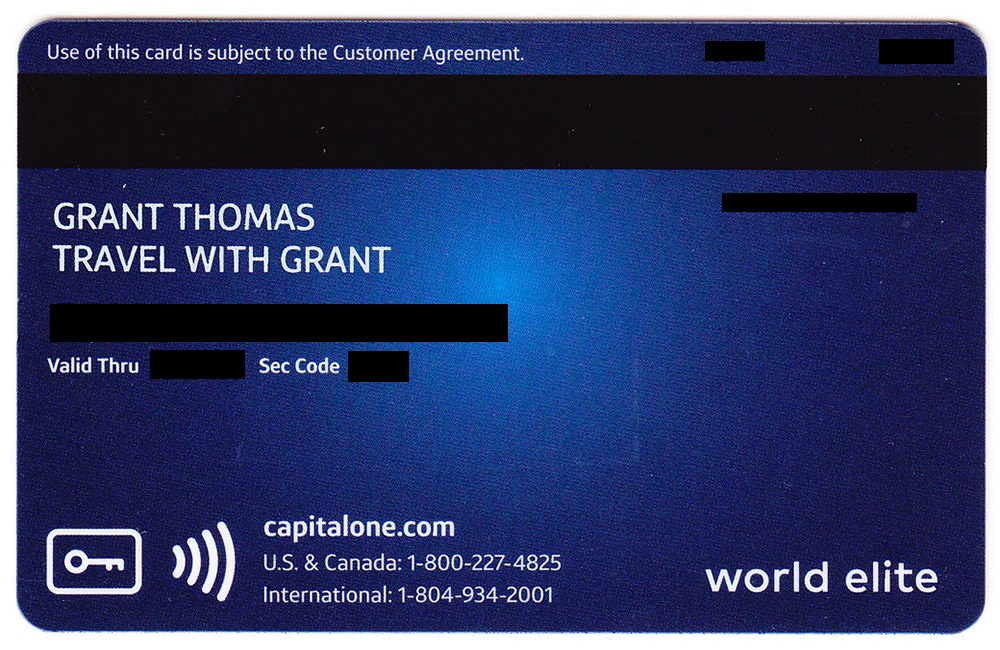

A few days later, on October 15, I received my new credit card. Even though the sticker on the credit card tells me to activate the credit card, my credit card was already activated since I was able to use this credit card in my ApplePay Wallet. I also changed the PIN from the random 4 digit number they sent me in the previous mailer.

I’m on my way to meeting the $4,500 minimum spending requirement. I’m not sure which transfer partner I will use, but I have my eye on transferring points to Wyndham Rewards in order to book another Vacasa vacation rental. If you have any questions about the application process, approval process, or welcome documents for the Capital One Spark Miles Business Credit Card, please leave a comment below. Have a great weekend everyone!

Thank you for sharing, Grant!

Everybody seems to be aware that Capital One reports business credit cards to credit bureaus, Do they also report your balances on business cards to credit bureaus?

Good question. I’m not sure yet, but I should know in the next few months.

Do you think it’s worth applying if a business did $0 last year and the year prior? I sold all of my rental units 2 years ago and am in the process of purchasing replacements. Otherwise it would be $125K in rev.

Hi Mike, that is a good question. Have you been able to get approved for other business credit cards with that business income? If yes, I think you have a good shot. During the application, it asks how often you plan on carrying a balance and I selected sometimes, so maybe that helped with my application getting instantly approved.

Grant, how many cards had you opened in the year prior to this approval?

Hi Dan, I’ve gotten a CSP a few months back, 1 business CC in January, and 2 business credit cards last October. Hope that helps :)

Yes, Capital One business credit cards appear on the personal credit report, as if they were a personal credit card, with balance, credit limit, and payment details. Amex has their business 2x card that doesn’t appear on personal credit reports, but using Amex can be more challenging than using MC.

Very good to know, thank you CardShark :)

Pingback: US Bank Business Triple Cash Credit Card Application Process & Welcome Documents