Good afternoon everyone, I hope your week is going well. I wanted to share my experience with the US Bank Business Triple Cash Rewards Credit Card regarding earning the $750 sign up bonus and how I redeem the rewards. If you currently have this credit card or have had this credit card in the past, please read to the end of the post to see how you can earn the sign up bonus again. To get started, the US Bank Business Triple Cash Rewards Credit Card doesn’t get talked about much because there is no affiliate link, no referral link, and has no transferrable points, but it is a great option if you are looking for a juicy sign up bonus. The current sign up bonus is $750 cash back after spending $6,000 in 6 months and has no annual fee, which is a 12.5% return on the first $6,000 spent.

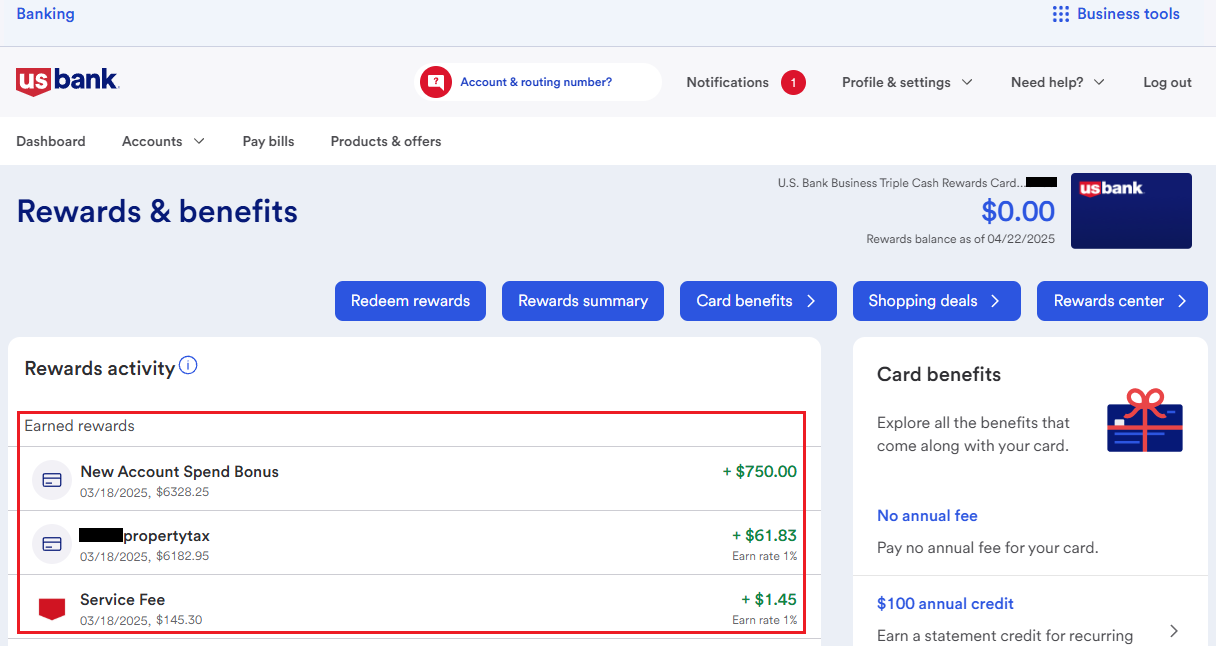

Last month, I paid my property taxes to complete the $6,000 minimum spending requirement in a single purchase. My county charged a 2.35% credit card processing fee, but I did earn 1% cash back on the fee. A few days after the property taxes and service fee posted, I could see that the $750 sign up bonus was showing in my Rewards Activity page, but was not available until my credit card statement closed a few weeks later.

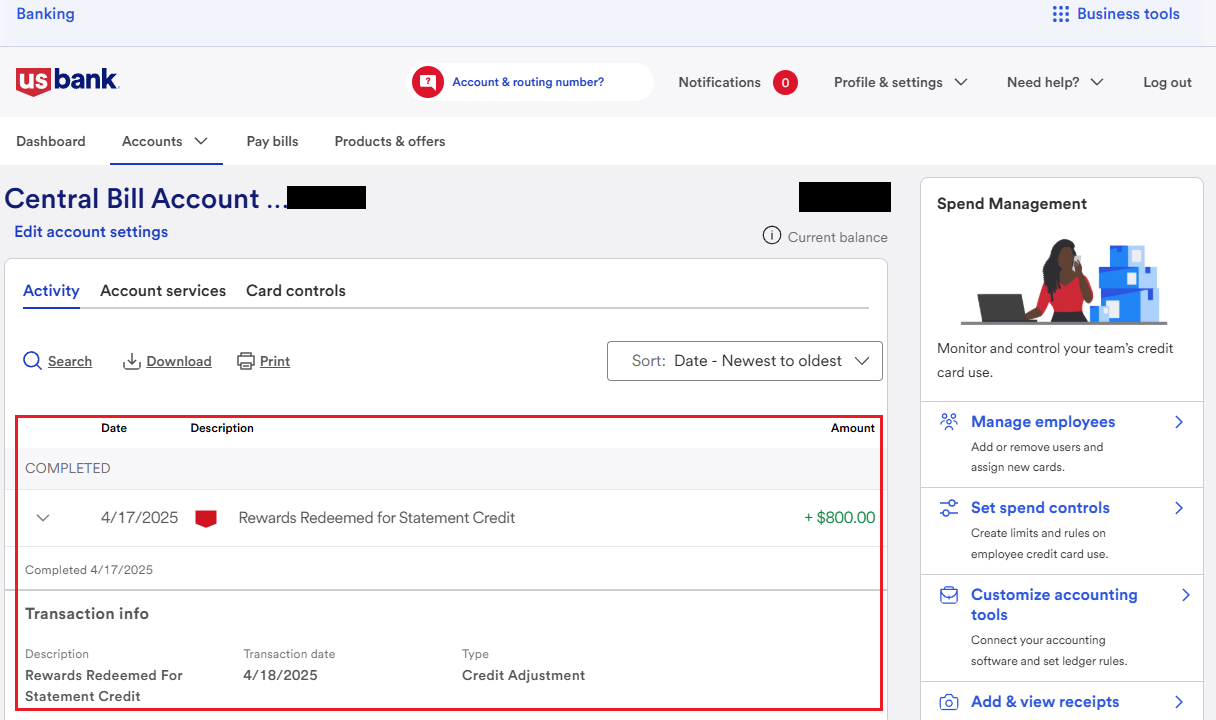

My statement closed on April 16 and the $813.28 cash back rewards posted to my account. You can redeem cash back as a statement credit in $25 increments, so I redeemed $800 toward a statement credit. I then used the remaining $13.28 rewards on Amazon.

The $800 statement credit posted to my account 1-2 days later and then I paid off the remaining balance of the credit card. Also, since this is a business credit card, I had to create a second US Bank online account to view my business credit card and central billing account, which was easy, but annoying.

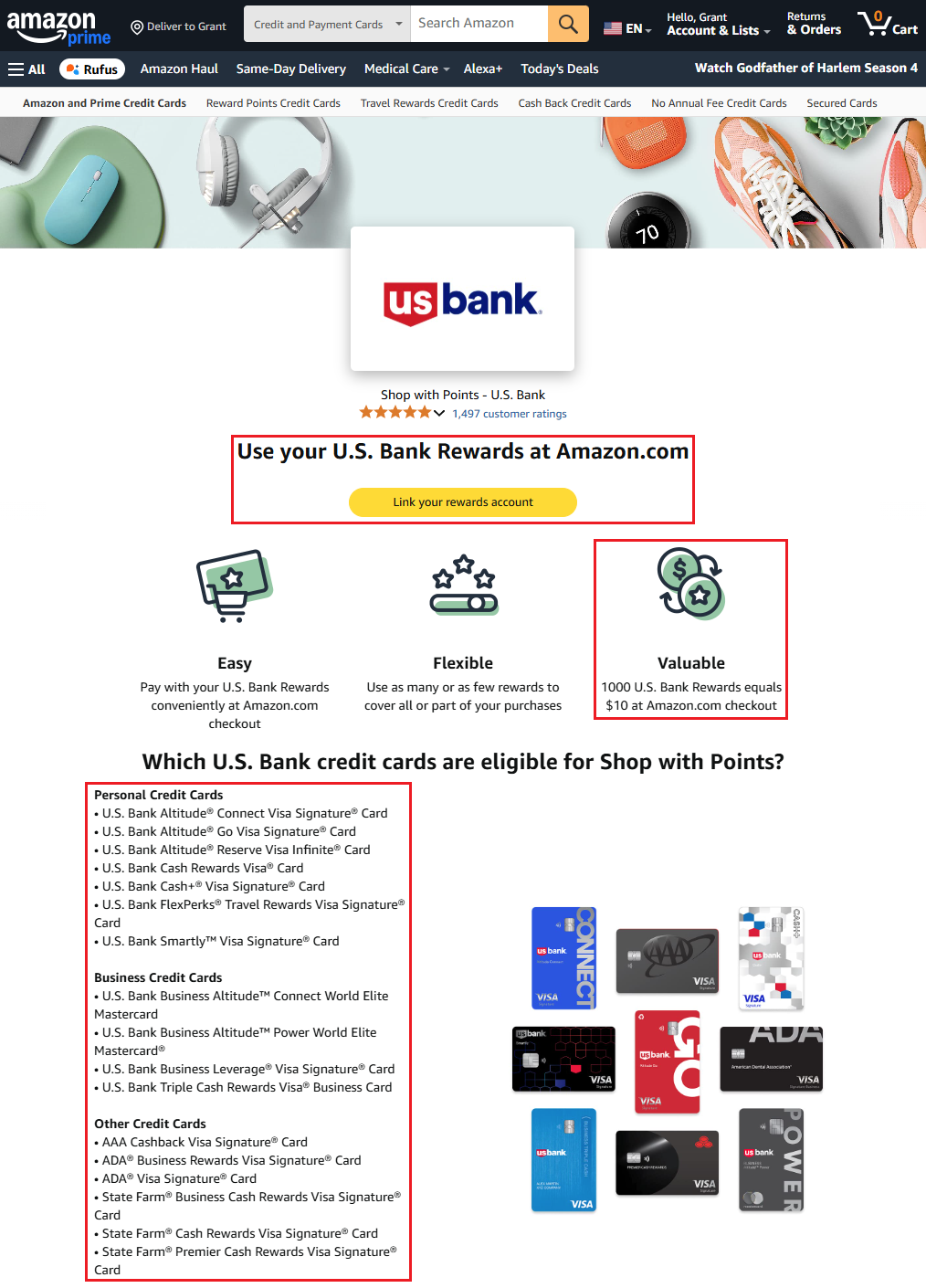

To redeem every last cent of rewards, I went to the Shop with Points – US Bank page and linked my business credit card. I then went through the process of reloading my Amazon Gift Card Balance with a $13.28 reload and paid with the $13.28 in US Bank rewards. After the purchase was processed, I unenrolled in the Shop with Points – US Bank program and removed my business credit card from my Amazon account. This program works with almost all US Bank personal and business credit cards and is an easy way to get 1 cent per point value from your US Bank rewards, especially when you do not have enough points to qualify for other rewards.

Lastly, I looked through my credit card spreadsheet and noticed that this was my 3rd time applying for this business credit card and receiving the sign up bonus. Based on the information below, it looks like you can keep this credit card open for a year, then close it, and reapply a few months later. As long as you are approved for this credit card, you should be eligible for the sign up bonus, but I cannot guarantee that you will get the bonus – that is up to US Bank.

| Credit Card | Card Opened | Sign Up Bonus & Posting Date | Card Closed |

| US Bank Business Triple Cash Rewards 1 | Oct 2021 | $500 Cash Back (Nov 2021) | Oct 2022 |

| US Bank Business Triple Cash Rewards 2 | Dec 2022 | $500 Cash Back (Mar 2023) | Dec 2023 |

| US Bank Business Triple Cash Rewards 3 | Mar 2025 | $750 Cash Back (Apr 2025) | NA |

If you have any questions about this business credit card, the sign up bonus, or redeeming the rewards, please leave a comment below. Have a great day everyone!

Does US BANK Business card hit personal credit report and how long did it take to get card?

Hi Carrie, good questions! I see the US Bank business credit card inquiry, but I do not see the new credit card on my credit report. It looks like it took about 10 days from applying online and making my first credit card purchase. Let me know if you have any other questions.