MSing (not to be confused with PMSing) is one of my specialties. When I tell people that I have to spend $2,000, $5,000, or $10,000 on credit cards, they look at me funny. “Wow, that is a lot of money, how are you going to do that?” I do a quick calculation in my head; 4 stops at CVS, a quick trip to Albertson’s or Ralph’s, 2 visits to Walmart, carry the thousand, “I’ll be done with that later this week.” I’m sure I’m not the only one who thinks like that. Since I do not have any real bills to pay (no mortgage, student loans, auto payments, etc.) I would say 95% of my spending is MS, and the other 5% comes from restaurants (I <3 food).

Anyway, enough about me. My Hilton HHonors account has been dwindling as of late thanks to stays at the Hilton San Francisco Airport and Hilton Vienna in January, the Hilton Copenhagen Airport and the Hilton Seattle Airport in April, the Hilton Los Cabos Resort and the Hilton Portland next month, and my DoubleTree Scottsdale reservation for #westcoastdo in November. Needless to say, it is time to replenish my stash of Hilton Honors Points.

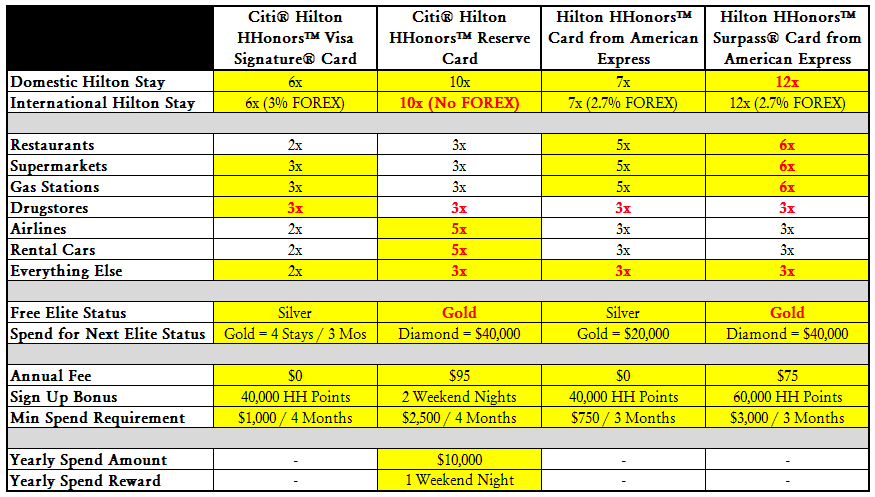

Over the weekend, I compared the perks and category bonuses of my Citi® Hilton HHonors Reserve Card and my Hilton Honors™ Surpass® Card from American Express. After I finished analyzing those credit cards, I decided that I would also include the other 2 Hilton HHonors credit cards that have no annual fee. It is unfortunate that the transfers from Hawaiian Airlines and Virgin Atlantic are no longer 1:2 (they are now 1:1.5). That was a quick way to get a ton of easy Hilton HHonors Points.

With that said, here is the master chart (please let me know if you spot any mistakes and I will fix them right away). The yellow boxes represent the information given on the credit card information pages. The white boxes are inferred values based on the “Everything Else” category. The red font represent the best deal(s) for each type of transaction. For example, the best credit card to use for stays at a Hilton property depends on whether the hotel is in the United States or abroad. Since only the Citi® Hilton HHonors Reserve Card has no foreign transaction (FOREX) fees, that is my go to card for international stays. If I am staying in the United States, I use the Hilton Honors™ Surpass® Card from American Express.

Continue reading →