What’s on My Mind: US Bank FlexPerks FlexPoints, Experian Credit Score, Using Square for Restaurant Bills, Screening Exchange, and my Upcoming App-O-Rama

I know, I know, we are all devastated by the United Airlines revenue-based frequent flyer mile announcement, but hopefully some of these random credit card and news stories will take your mind off of that for a few minutes…

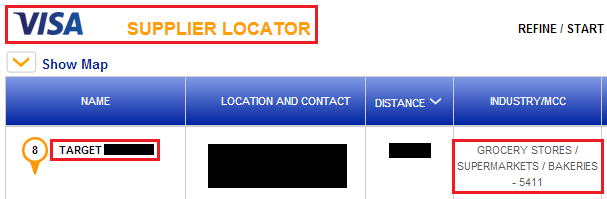

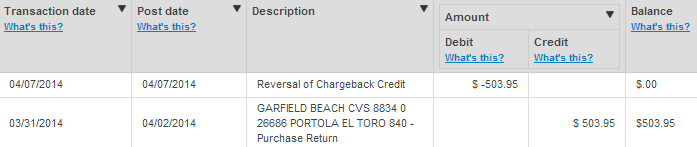

I did a little experiment last month with my US Bank FlexPerks Credit Card and Target (link). Since my credit card is a Visa and since my local Target is classified as a grocery store by Visa, I wanted to see if I could load $1,000 onto my Target AMEX with my US Bank FlexPerks Credit Card and see if it counted as a “grocery store” purchase, therefore earning 2x FlexPerks. You can use the Visa Merchant tool by reading this post.

After a “few” grocery store purchases, that sounds like I bought grocery stores. Let me rephrase that. After a “few” purchases at grocery stores, I racked up $5,000+ in charges. I have mostly Ralphs and Pavillions grocery store purchases and 1 large purchase from Target (in the middle). Continue reading