Update: Great Bridge Group Breaks Hearts (More Info)

It was fun while it lasted…

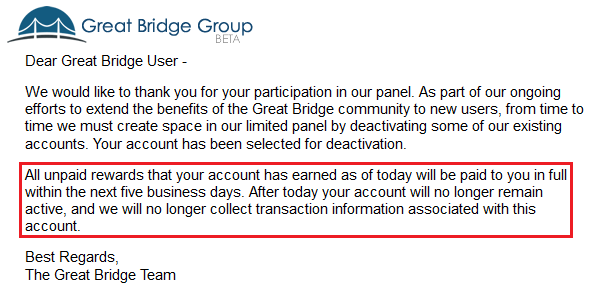

Great Bridge Group has started sending emails to users telling them their accounts are being closed. Here is the email that they sent me:

I have heard from several readers who received the same email this weekend. I wanted to find out more, so I sent them an email. Here is what I found out:

Grant: Why was my account closed and when will I be receiving my unpaid rewards? Thank you.

Kristin: Hi Grant, we must keep panel data optimized by periodically rebalancing our user base to produce the most accurate research. As stated in the email, you will receive your final payout within the next five business days. Thanks, Kristin

Grant: Thank you Kristin, I appreciate the quick response. Should I try to create a new Great Bridge Group account in a few months? I really liked using the service. Have a good weekend.

Kristin: Hi Grant, no problem! We enjoyed having you as a user. Currently, we do not have plans to invite our former users to rejoin. As with anything else, this could change. If space in our panel does become available for you again, we will definitely let you know! Hope you’ve had a great weekend as well, Kristin

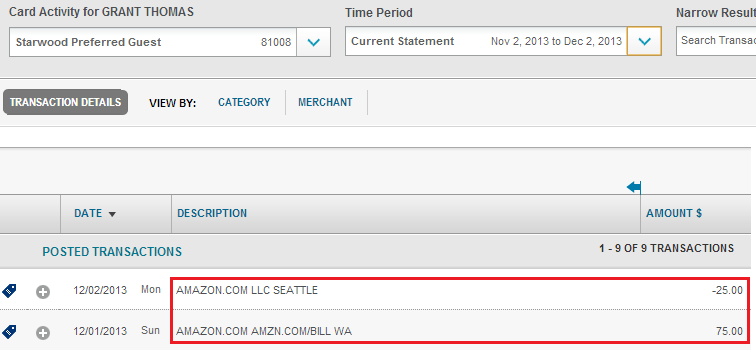

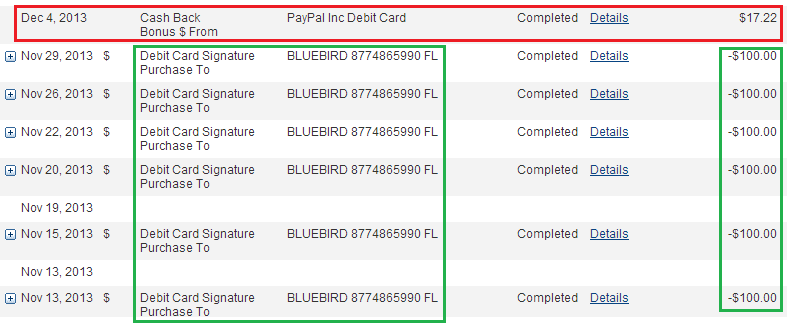

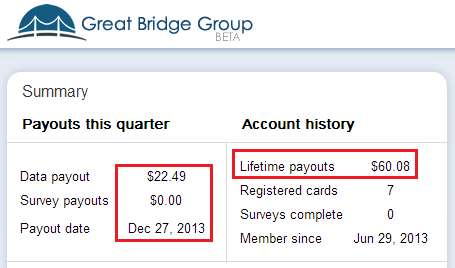

According to Kristin, I should be receiving my final payout (around $20) within 5 business days (before Friday, December 13, 2013). I am skeptical but optimistic about receiving my final payout by Friday. I will keep you guys posted.

If you have any questions, please leave a comment below.