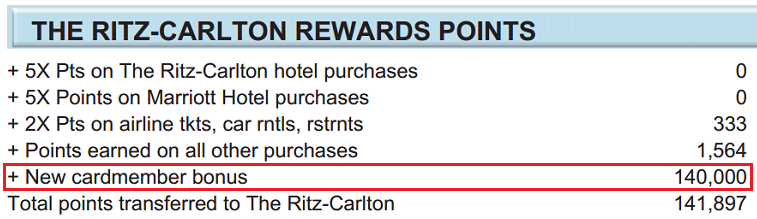

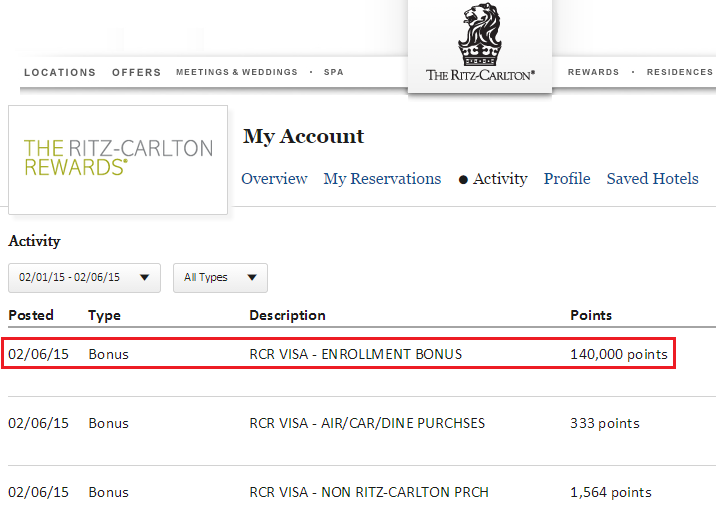

Good morning everyone, I just wanted to share some updates regarding my Chase Ritz-Carlton Credit Card. A few days ago, I received my 140,000 point sign up bonus after spending $3,000 in the first 3 months. I also received a few statement credits / courtesy adjustments toward my $300 annual travel credit.

It takes 1-2 days after your statement closes to see the points in your Ritz-Carlton account. I like how Ritz-Carlton (like Marriott and Hyatt) provide details on where the points came (enrollment bonus, air/car/dining purchases, and everyday spending). My balance now sits at around 145,000 Ritz-Carlton points :)

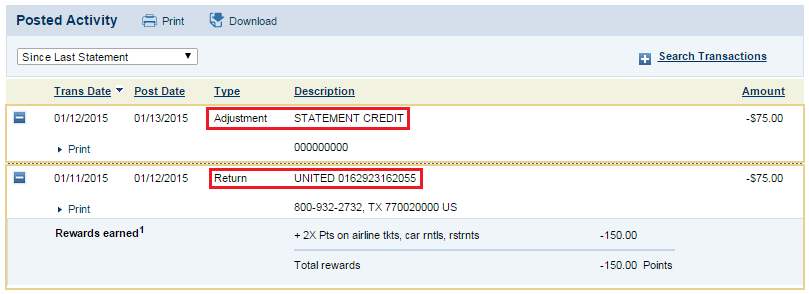

I thought I would also share some of the strange travel reimbursements I have received from the past month. I originally paid a $75 fee for an upgraded seat on United with my Chase Ritz-Carlton Credit Card. After a few schedule changes, United refunded my $75 seat upgrade fee, but I was able to call Chase and have them reimburse the seat upgrade charge before the refund posted. This was a fluke in timing and I would not be able to reproduce this series of events.

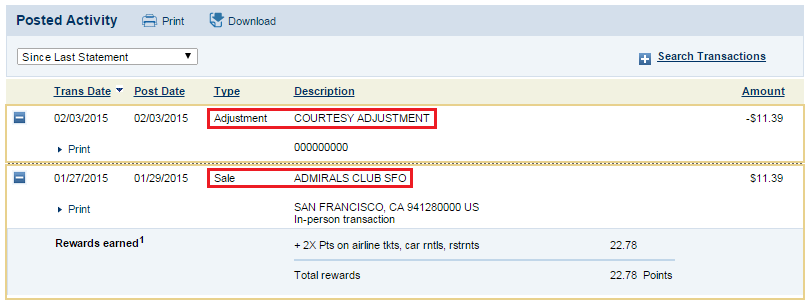

Last week, I spent a few hours at the SFO Admirals Club (I needed a break from the Centurion Lounge). The one downside of the Admirals Club is that there is no “free food,” just free snacks and chocolate chip cookies. I went to the bar and ordered a salad and used my Chase Ritz-Carlton Credit Card to pay the bill. Since the Chase Ritz-Carlton Credit Card is supposed to reimburse airline meals and lounge visits, I figured a meal purchased at an airline lounge would qualify. After sending in a Secure Message, I received a courtesy adjustment to offset the salad purchase. I believe courtesy adjustments are different from statement credits and do not affect your $300 airline travel reimbursements. That is just a theory at this point.

If you have any questions, please leave a comment below. Have a great Friday everyone!

I realize you need to find reimbursements for the card, but having to pay for food while you can get it for free at the Centurian lounge. sorry just the cheapness in me. I m sure you can find other creative ways to use the $300. you got the whole year to go

I’m getting tired of the food at the SFO Centurion Lounge. It is the same thing every time, they need to change the food more often!

Hey Grant,

I thought your readers might be interested in this. I applied for and received my Chase RC CC in early December, 2014. After $3K in MS, I received the 140K bonus points. I bought a physical SWA GC for $300 plus shipping and sent a secure message to Chase. It was reimbursed without incident. In January, 2015 I was eligible for another $300 reimbursement so I ordered another $300 SWA GC as before, but this time I was flatly denied reimbursement after sending the SM and several more follow up SM’s to Chase. They demanded a receipt proving it was for the allowable expenses. Apparently, Chase now has a way to know the difference, at least with SWA anyway and since SWA is also a Chase partner, that makes sense. Just sayin…..

Yes, Chase allowed SWA eGC to be reimbursed in 2014 but have really clamped down on allowing any SWA eGC to be reimbursed in 2015. I am slowly spending my way to $300 in airline fees over the course of the year, since I don’t need to rush it like I did in December.

I’m pretty sure courtesy adjustments count towards the $300 travel credit – I think its just the way the agent enters the credit.

Last year I bought various Delta e-gift cards, some of which got posted as statement credit and others as courtesy adjustment. When I called in to claim my last $50, the agent processed it and then confirmed I had used all $300 of my travel credit which is what I expected.

I see, well, that is a bummer then. Thanks for sharing your experience Ralph.

I agree with Ralph, last year I had two $150 courtesy and they told me that’s it for 2014.

Haha. Ya, no more easy statement credits in 2015

In 2015, I used $200 for Global Entry for me and my wife and we will have interview on Sunday at Philadelphia Airport at 3:00 PM and 3:15 PM. I also used $27 SW e-GC so now I have $73 left.

Why did you get a $27 SWA eGC? Pay taxes for a SWA flight?

Grant,

The reason is I try to use small number so I may get reimbursed easier and if not I can use it pay taxes and fees.

That is a good strategy. What do you say the charge is for when you ask Chase for a reimbursement?

Grant,

I just said travel incidents.

Sounds good. I’ll try that next time.

As the other poster has commented, I think small odd amounts like 47, 53, etc. might be better than round-figures. Also, why don’t you guys send a secure message asking for the reimbursement rather than calling (just curious, FYI, I don’t have this card)…

I do a secure message most of the time, but call Chase if it is a legit reimbursable expense.

Do you also have the marriott rewards visa card? i’ve been wanting to apply for the ritz carlton card but i’ve read that people have encountered issues having both cards. just curious.

I have had the Marriott card for almost 2 years and getting the Ritz-Carlton credit card was not a problem.

Last year had no issue with DL GCs, $50 each, this year first $100 was fine, next one got SM wanting documentation, I will try calling after it settles and hope it gets through.

Chase is really cracking down on gift card purchases. I hope you can get the charge to go through.

Pingback: My Week in Points: Delta Hates Us, I Don't - Rapid Travel Chai - Rapid Travel Chai

Pingback: What Triggers The Ritz-Carlton $300 Annual Travel Credit? - Doctor Of Credit

Pingback: Two Chase Ritz Carlton Updates - Doctor Of Credit