Good morning everyone, happy Wednesday! Sorry for not writing during the last few days, I was in Pismo Beach riding ATVs on the sand dunes over the weekend and busy earlier this week. Sneak peek: I have a great upcoming blog post about what to do with 50,000 JetBlue TrueBlue Points that doesn’t involve flying on JetBlue – stay tuned! In this post, I will share some interesting pieces of info about 3 of my new credit cards that I was recently approved for during my June App-O-Rama. If you haven’t done so already, please read the first credit card post: Bank of America Amtrak, Alaska Airlines Biz & Barclays Lufthansa Credit Card Art and Info. Here is a look at these 3 new credit cards:

- Citi AT&T Access More World MasterCard

- US Bank Korean Air SkyPass Visa Signature Credit Card

- Comenity Virgin America Visa Signature Credit Card

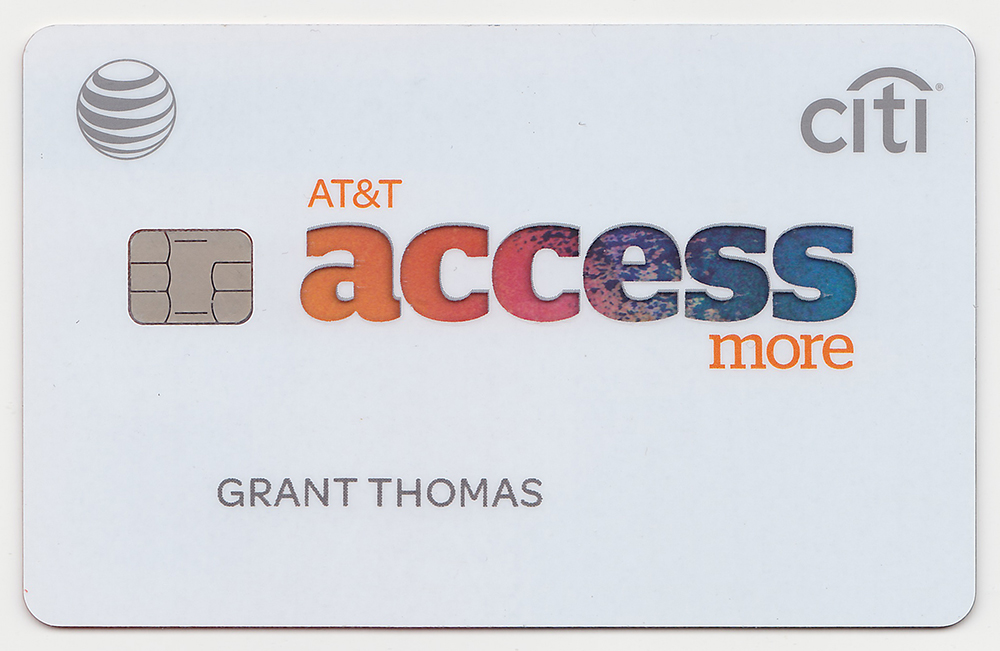

Here is the front and back of my Citi AT&T Access More World MasterCard. The word “access” is somewhat transparent and allows light to travel through the credit card. Like most Citi credit cards, the card number is on the back of the card and there are no raised letters or numbers.

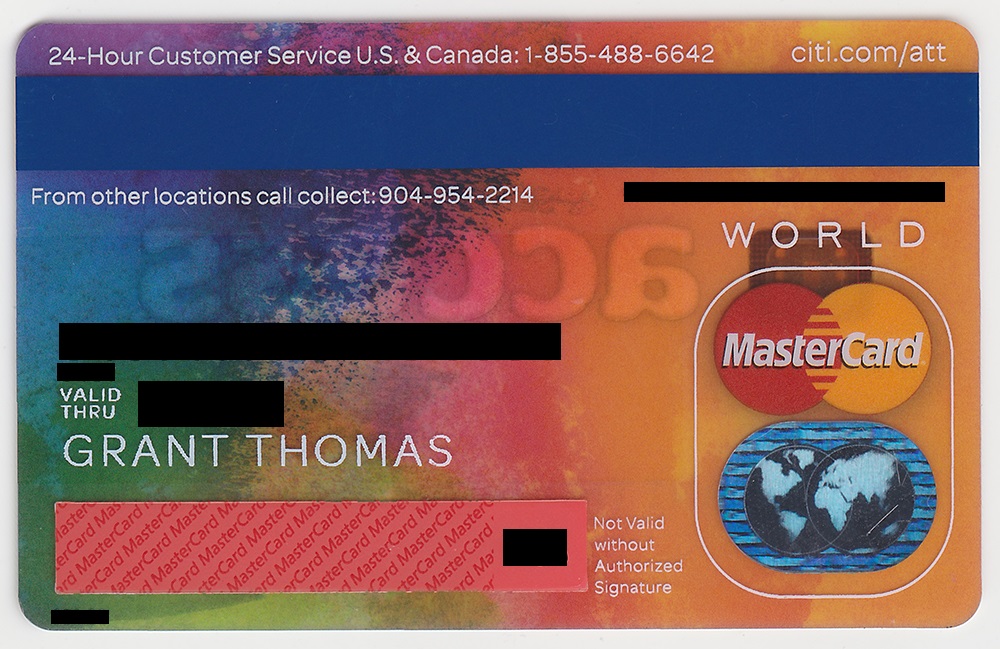

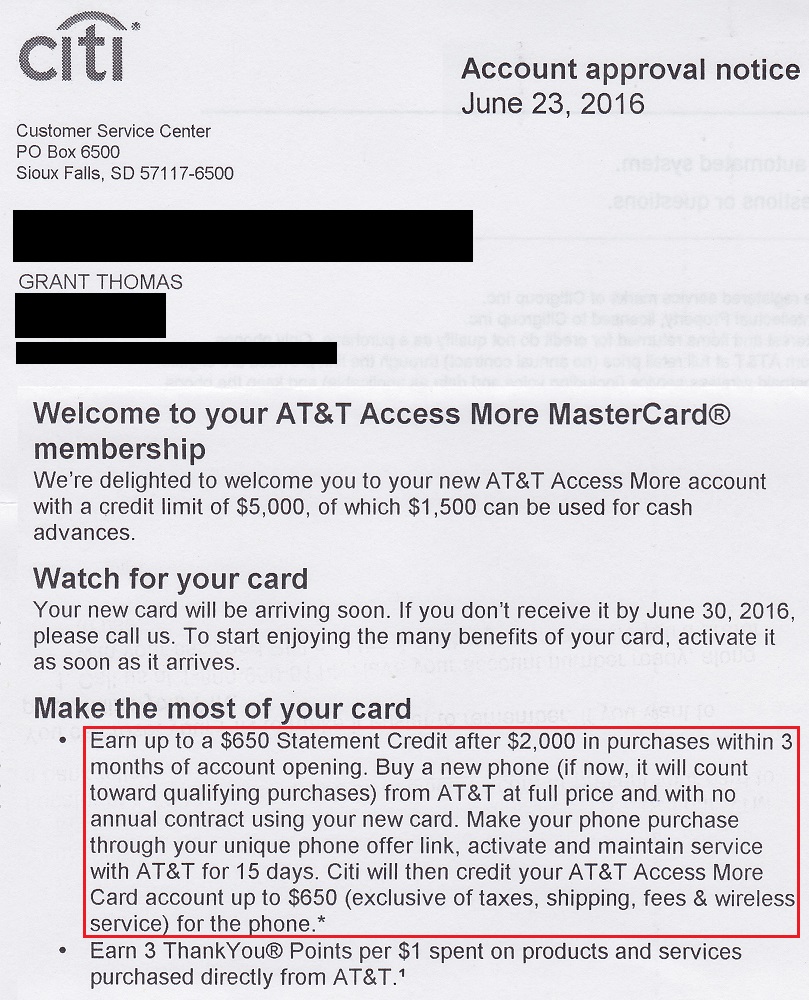

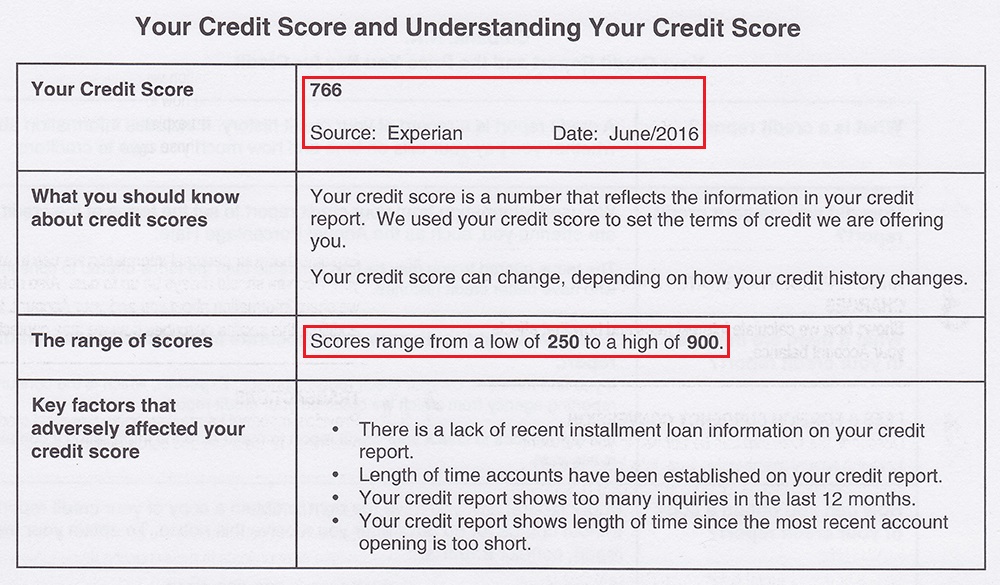

Here is the approval letter that came with the credit card. The letter covers the sign up bonus details and says my Experian credit score is 766 (which is slightly higher than my Experian credit score of 759 that came with my Bank of America welcome letter).

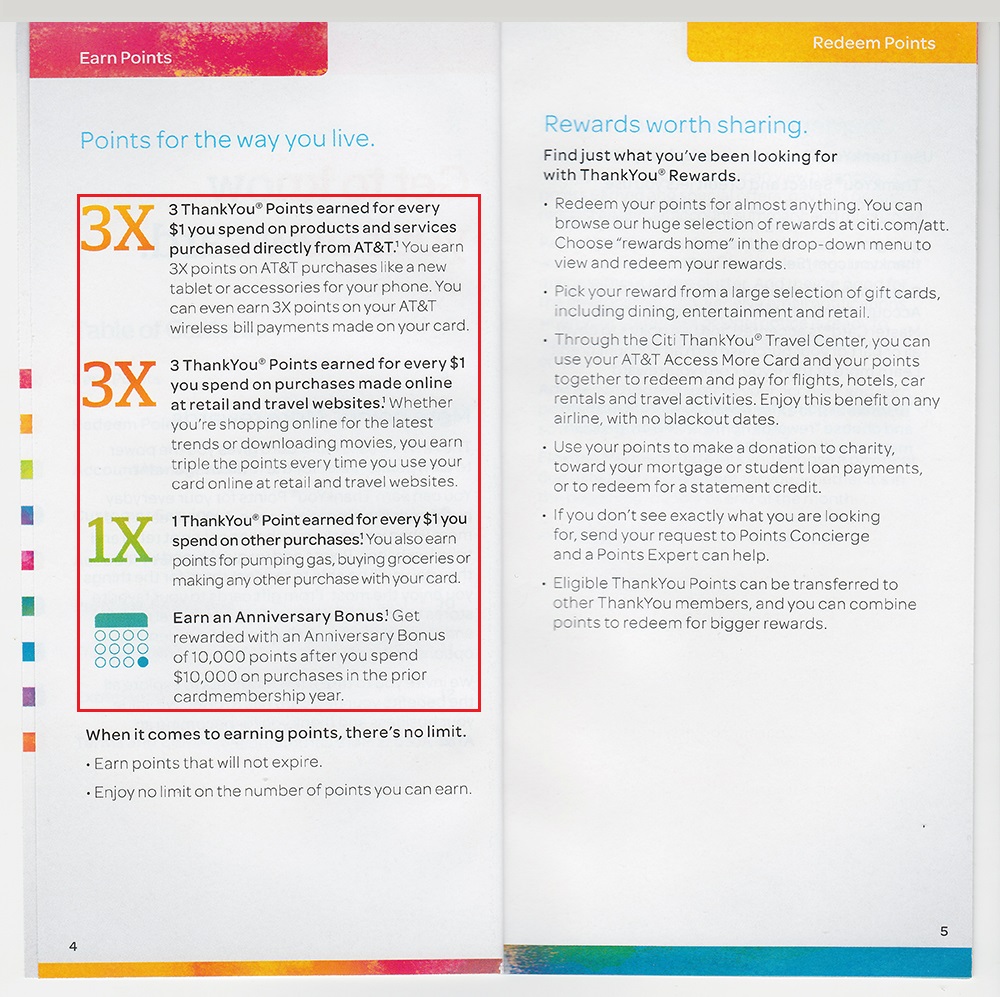

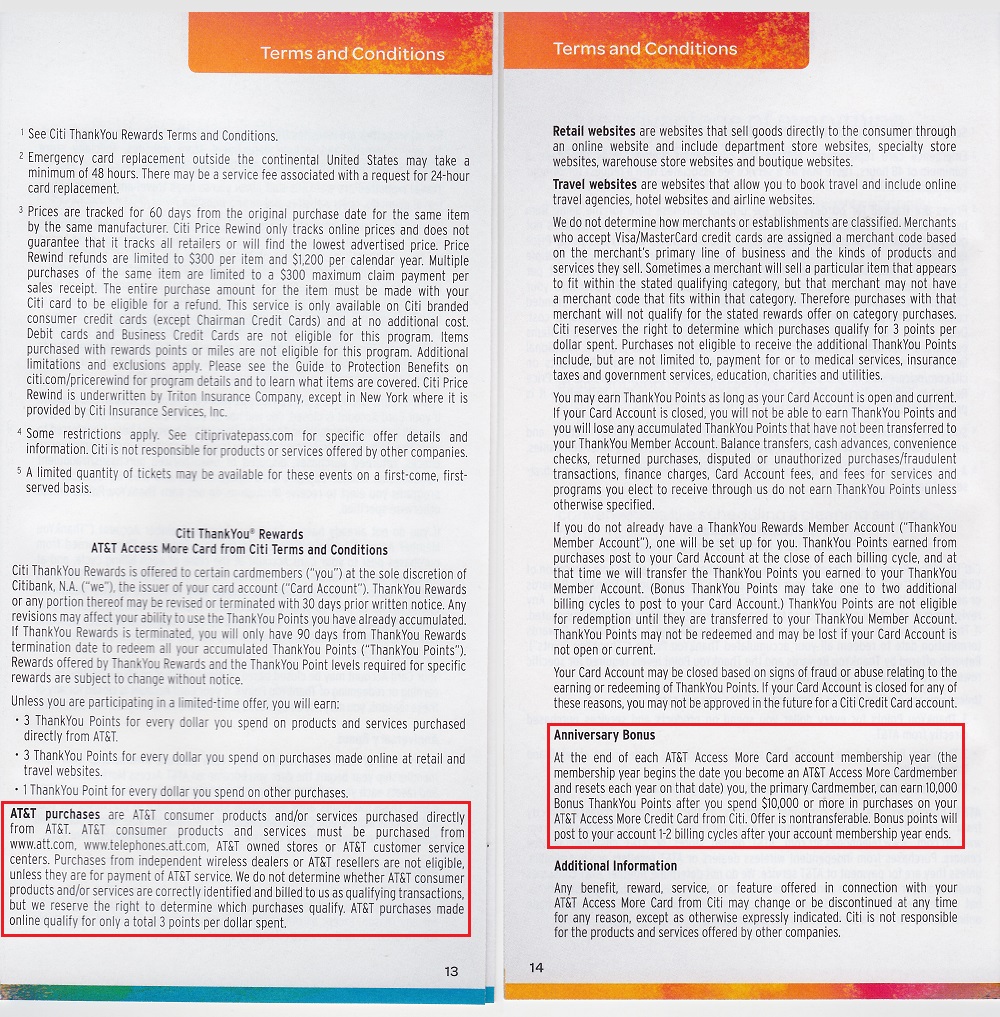

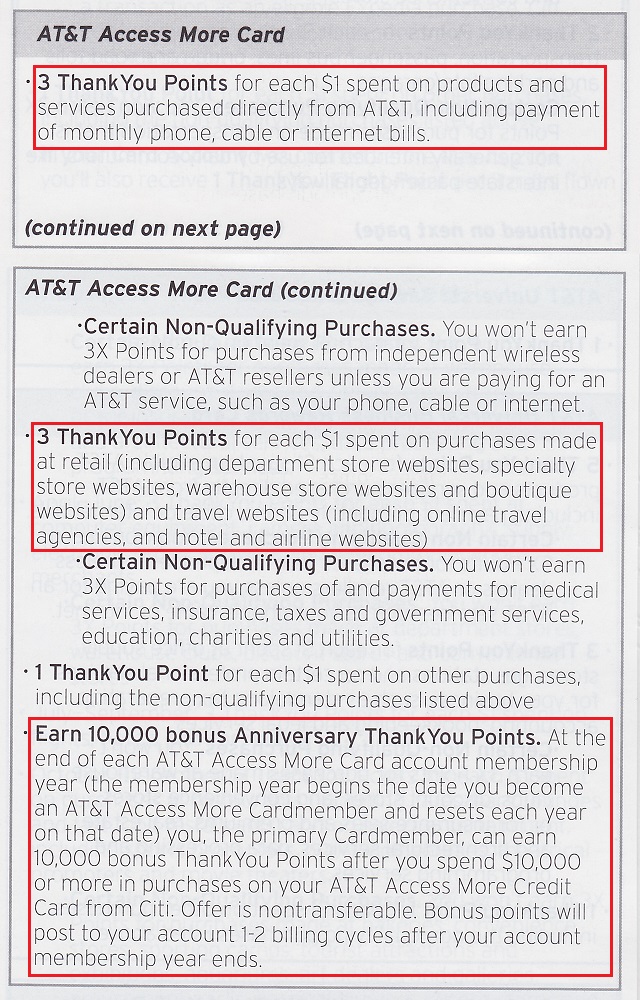

Here is the earning structure of the credit card, showing which categories earn 3x and 2x Citi Thank You Points. The 10,000 anniversary bonus Citi TYPs after spending $10,000 looks good too.

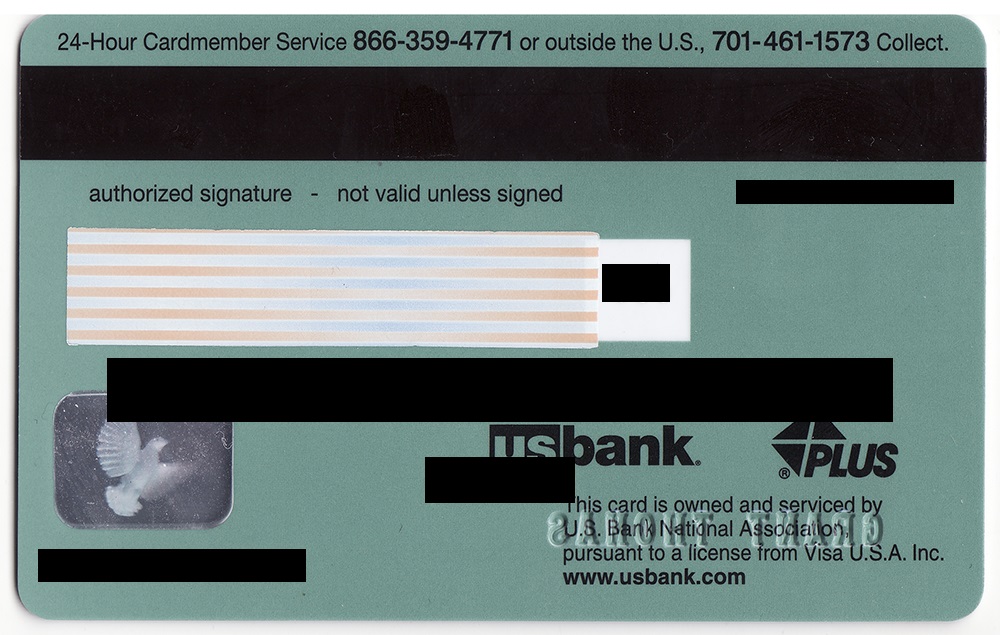

Here is the front and back of the US Bank Korean Air SkyPass Visa Signature Credit Card. Personally, this credit card is an ugly shade of green that does not stand out.

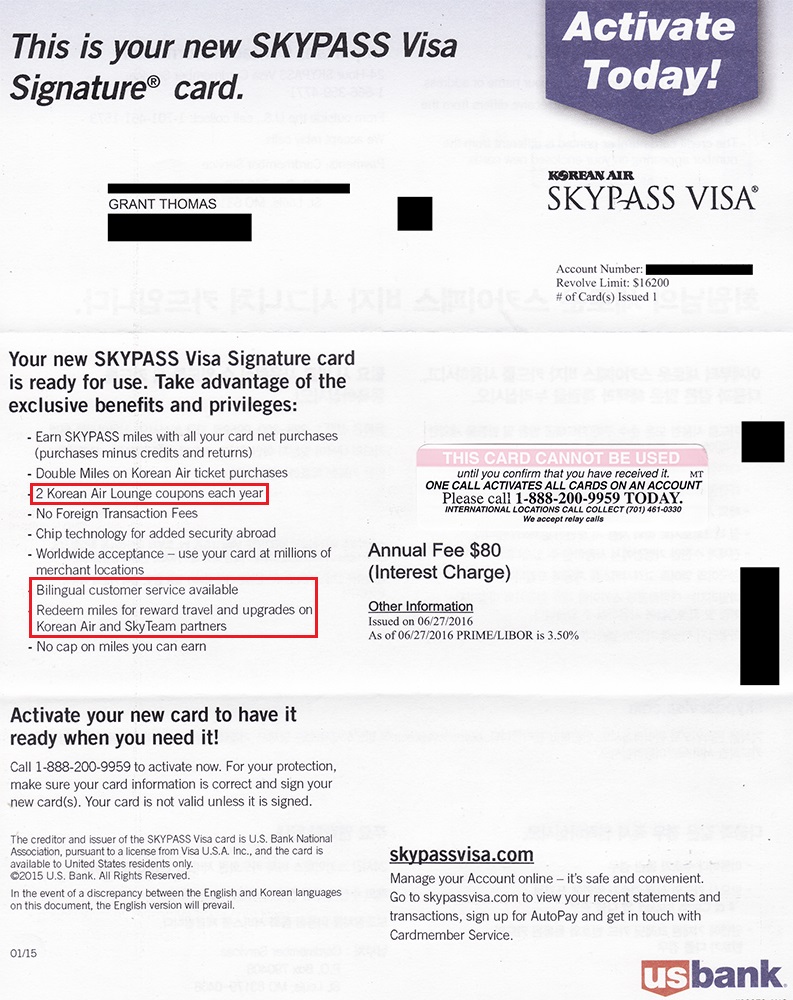

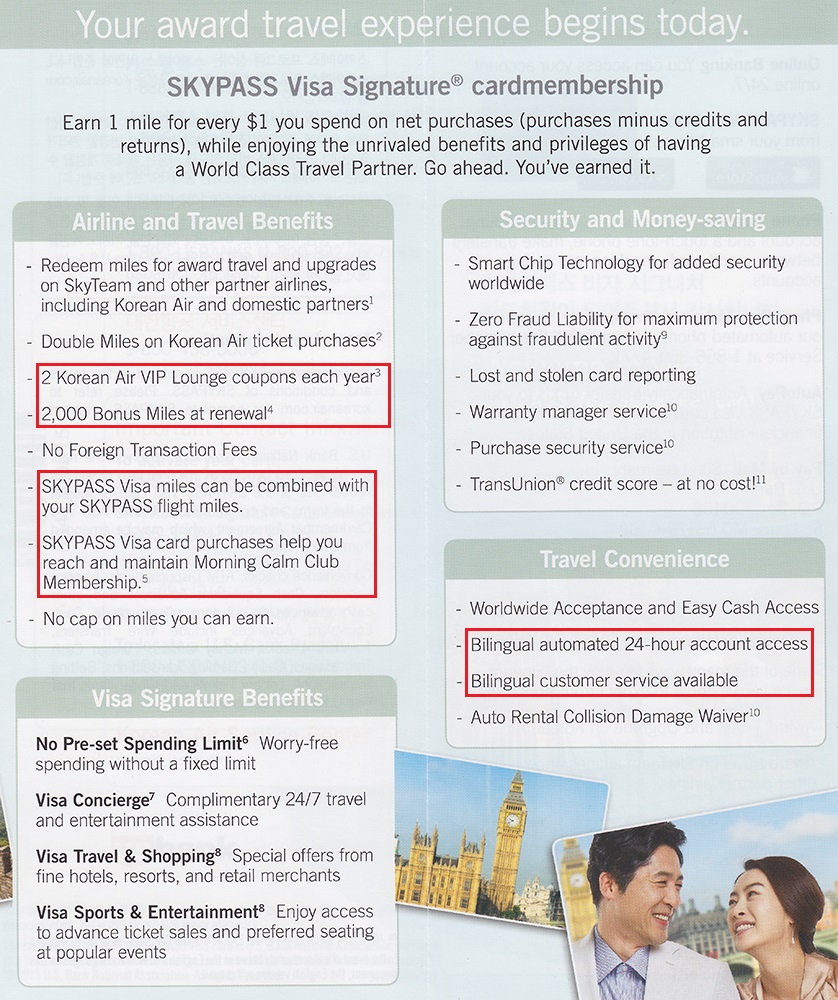

Here is the welcome letter with details of the credit card. This isn’t super useful to me, but Korean Air offers bilingual customer service reps.

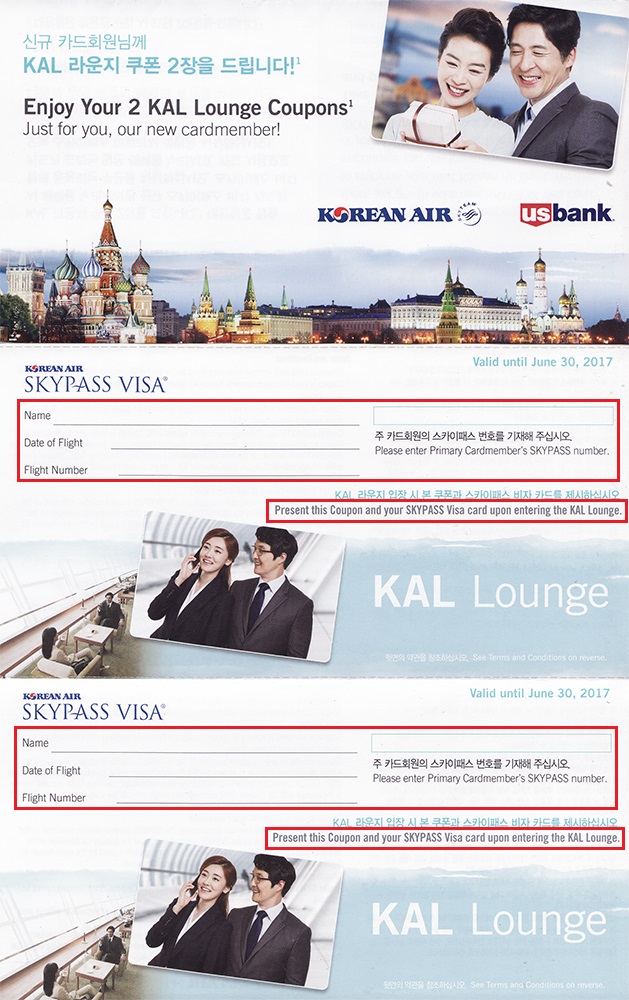

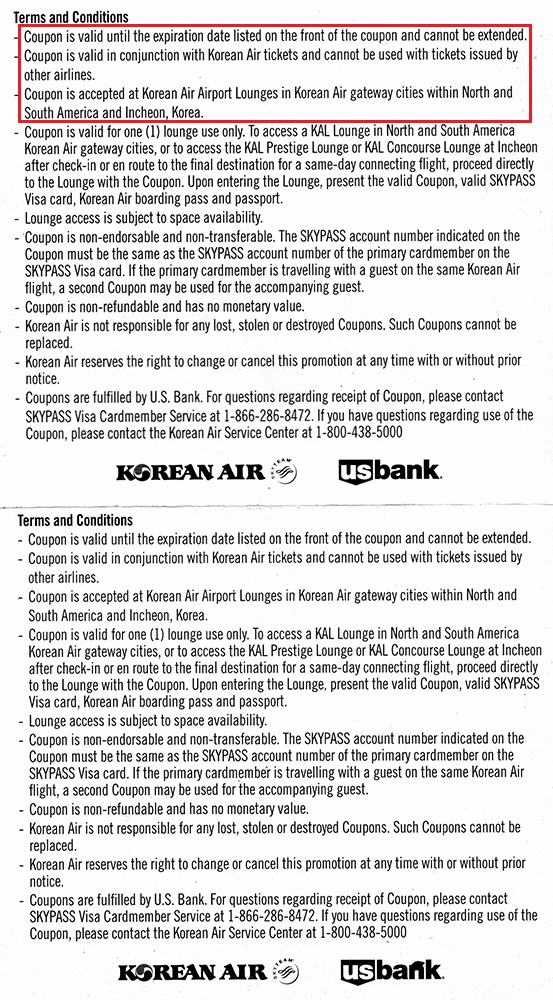

Here are the 2 Korean Air lounge passes that come with the credit card. Only credit card holders can use the lounge passes and you must have a valid Korean Air ticket to access the lounge.

Here is the front and back of the Comenity Virgin America Visa Signature Credit Card. This credit card is really weird since the front side is vertical and the back side is horizontal, which makes it kind of tricky to swipe this credit card correctly.

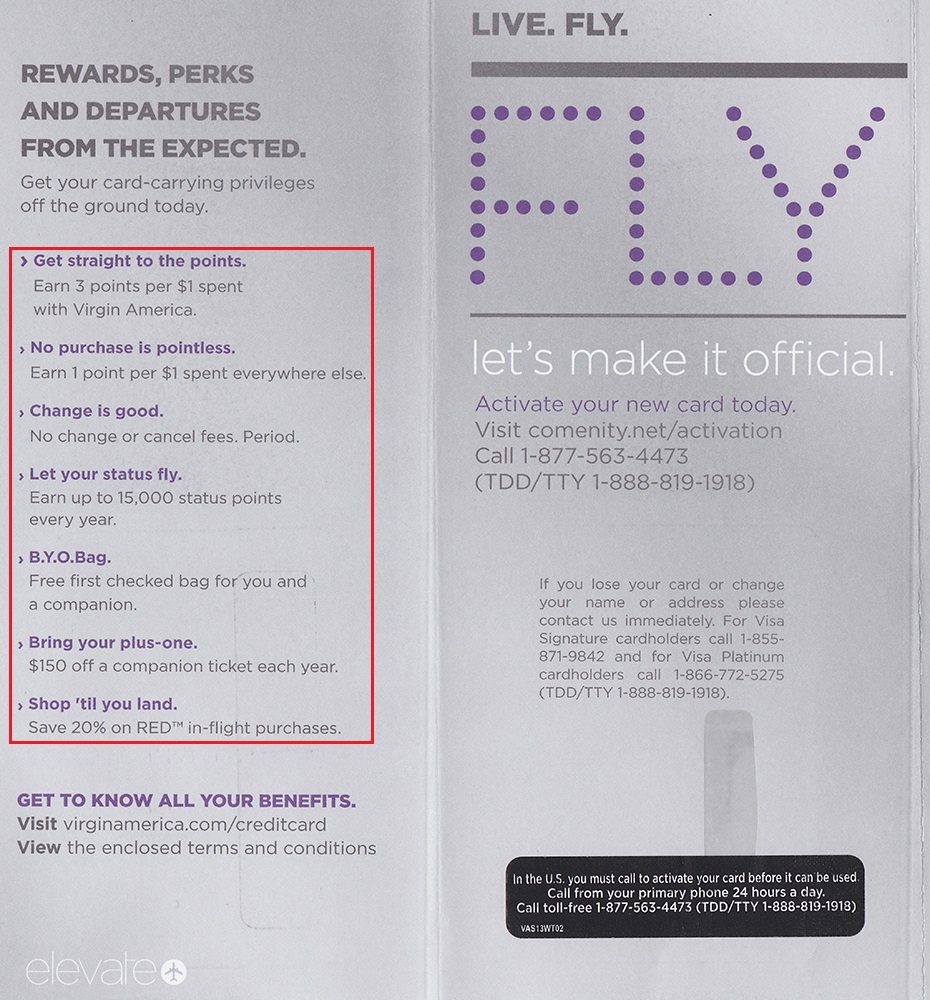

Here are the perks of using the credit card. No change or cancel fees will surely come in handy along with the $150 companion ticket discount.

If you have any questions about any of the credit cards or card benefits, please leave a comment below. Have a great day everyone!

What is the sign up bonus for citi access card that you got, and how much the min spend you need to meet within 3 months? And how do you plan to maximize it? Since iphone 7 is not come out yet and when it came out maybe the 3 months period already passed?

The sign up bonus is a new AT&T phone up to $650, min spend is $2,000 / 3 months. I will meet the $2,000 min spend now and then wait for iPhone 7 to come out in September. I will then pay off my AT&T Next plan on my iPhone 6S and sell that iPhone on eBay.

I couldn’t believe the Virgin America card. It’s all shiny, as though it’s something special, but it’s the thinnest card I own (out of 27), and it doesn’t have a chip, which is ridiculous now.

Ya, it’s a very cheap plastic. I blame Comenity. They are not very sophisticated.

What’s so good about the ATT card? I’m genuinely curious now since everyone wants one.. Thanks!

The sign up bonus is worth up to $650, 3x Citi TYPs for online purchases, and 10,000 anniversary Citi TYPs after spending $10,000.

Is Citi’s Access More completely gone now, or do you have an active link?

I think the link is dead now, sorry you were not able to get the card :(

Do you know which bureau the Korean Air card pulls from? Were you approved immediately? I have no experience with US Bank. I’ve read somewhere that we should freeze credit reports from some agencies I’ve never heard from for unexplained reasons. Also, US Bank supposedly approves cards that don’t get the bonus…or something fishy like that.

US Bank pulls from different credit bureaus depending on what state you live in. It’s best to freeze your ARS/IDA credit reports (bureau names may have changed), but follow this guide: http://travelwithgrant.boardingarea.com/credit-cards/freezing-your-ars-and-ida-credit-reports/

I was instantly approved, but sometimes US Bank will approve you for a lesser card and a lesser sign up bonus.

Pingback: How to Purchase New Apple iPhone 7 with Citi AT&T Access More Credit Card | Travel with Grant