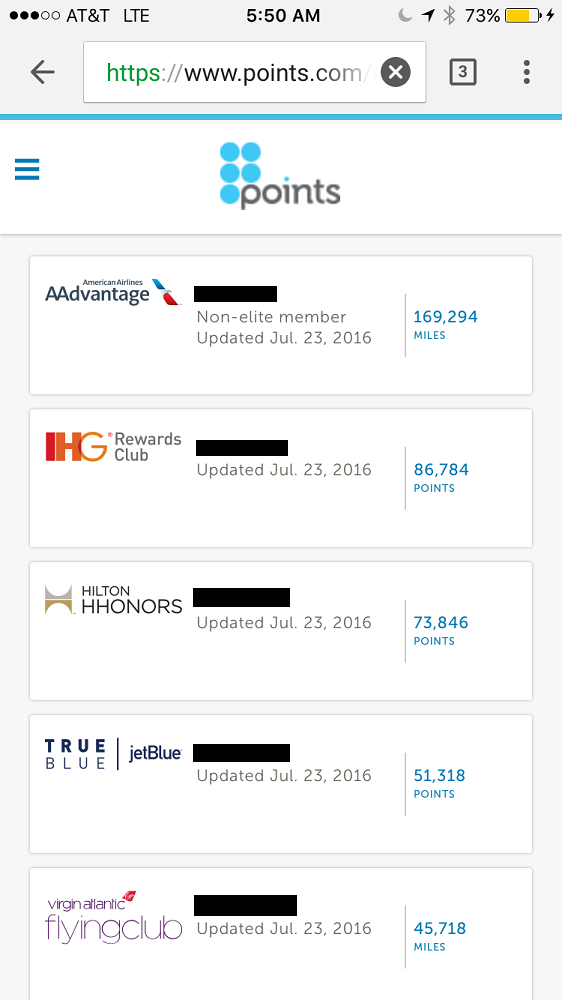

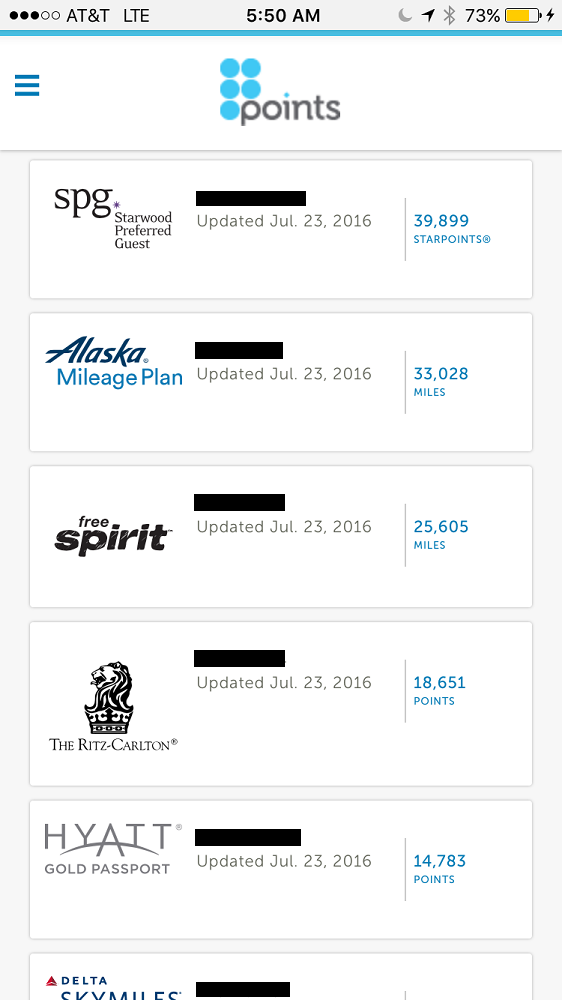

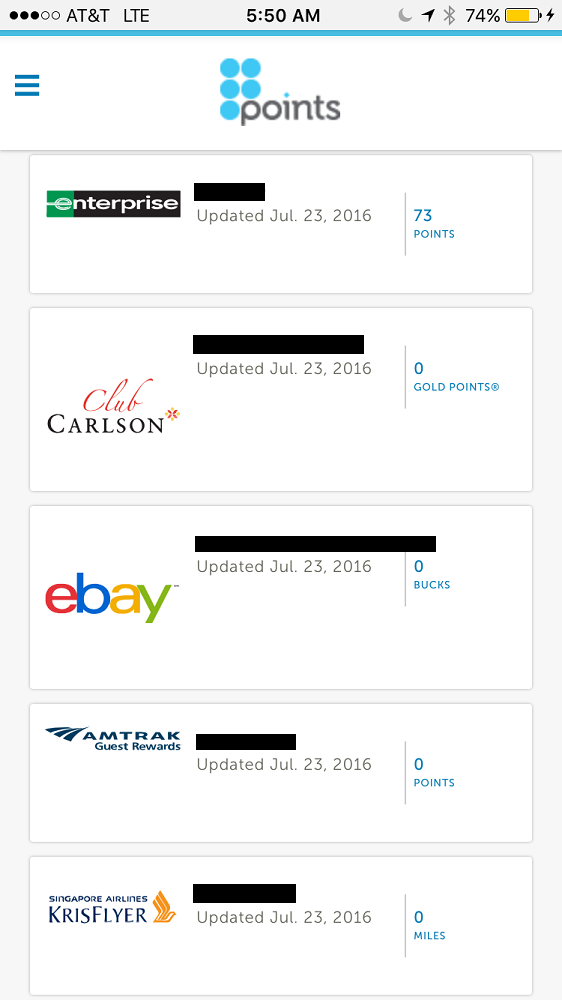

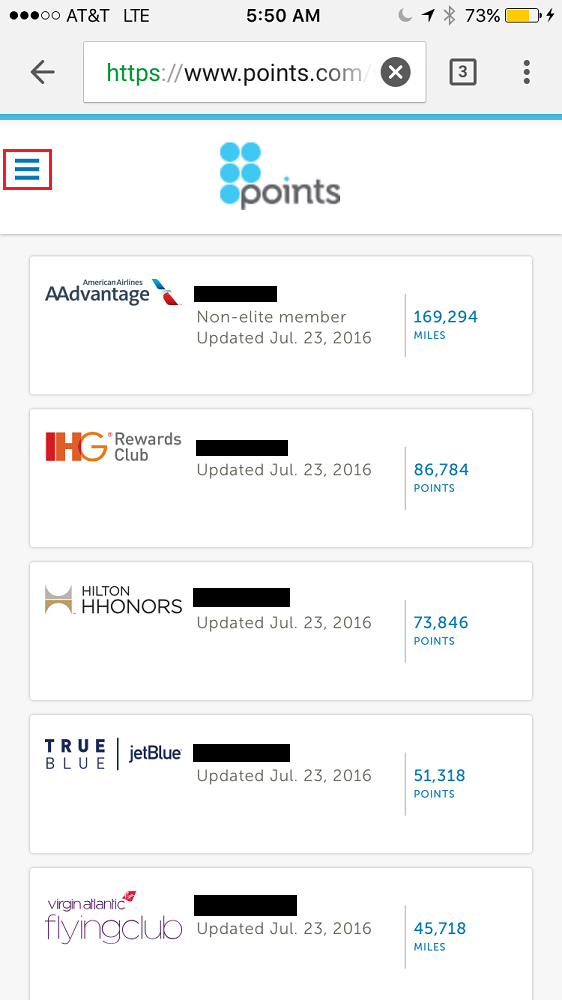

Good morning everyone. In today’s super long/boring post, I will show you how to use Points.com to exchange miles/points from one loyalty program into another loyalty program. Before I go on, let me explain that Points.com is somewhat similar to Award Wallet because you can add loyalty programs to your account and track their balances. You may be familiar with Points.com if you have ever looked into buying airline miles or hotel points, since Points.com is the broker for most loyalty programs. I am not going to talk about buying miles/points today. Instead, I am going to talk about exchanging miles/points from one loyalty program into another loyalty program. First things first, you need a free Points.com account and you will need to add your loaylty programs. Here are a few of my accounts that are currently tracked by Points.com.

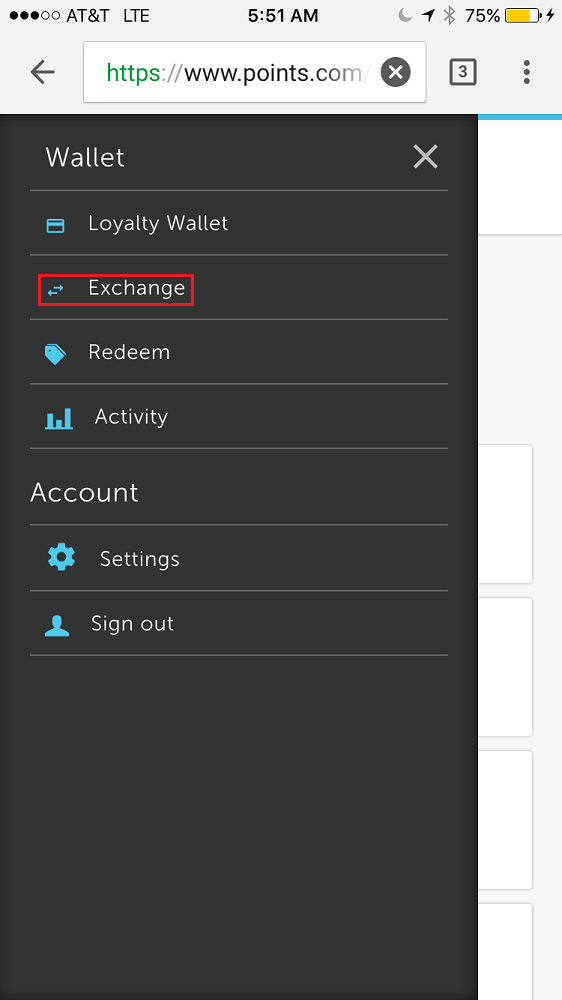

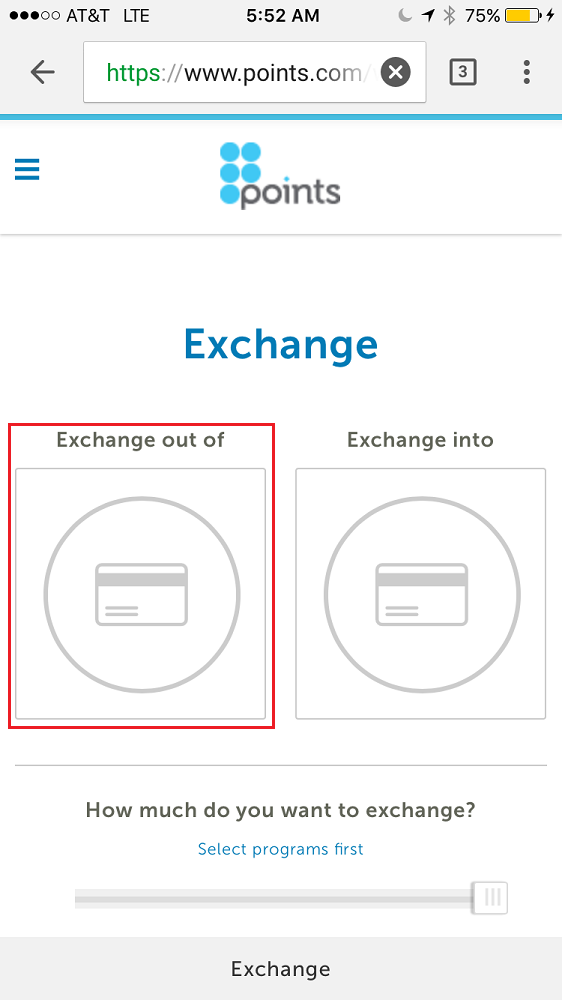

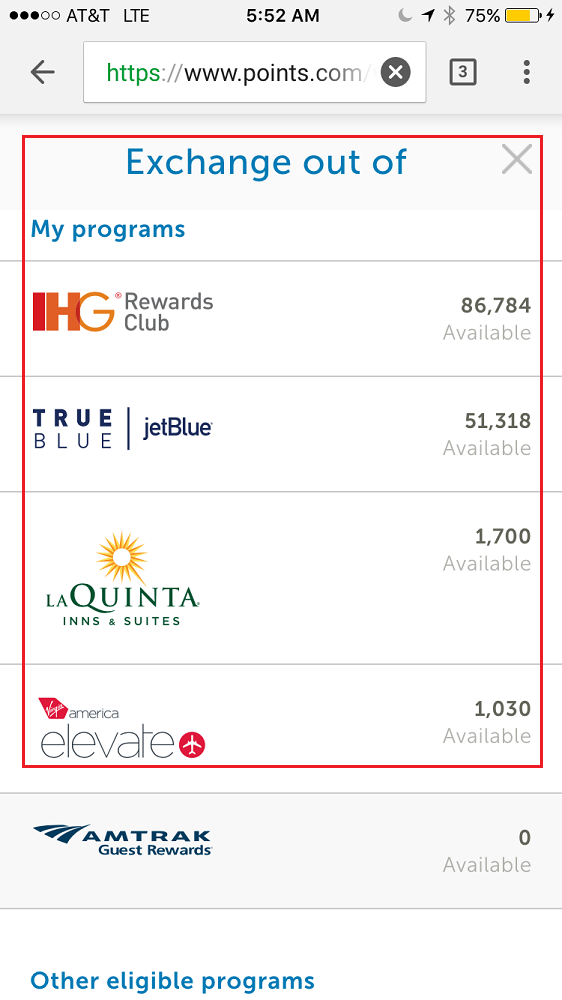

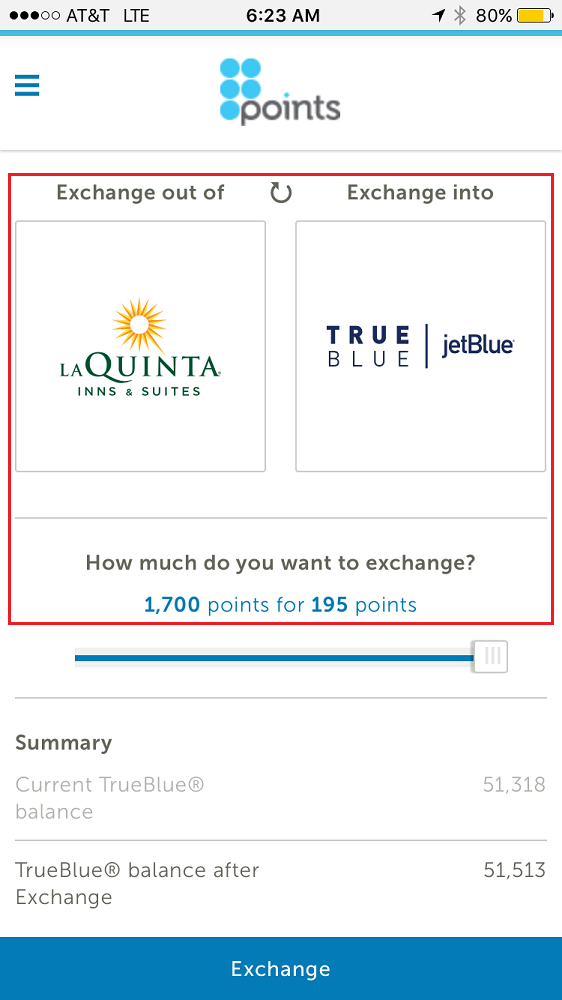

To exchange miles/points, click the 3 small blue bars in the upper left corner and click Exchange. You need to select a program to exchange miles/points out of – I have the choice of IHG, JetBlue, LaQuinta, Virgin America, and Amtrak. I will do a test exchange with LaQuinta since I got all those hotel points for free by watching short videos and signing up for different promotions with LaQuinta.

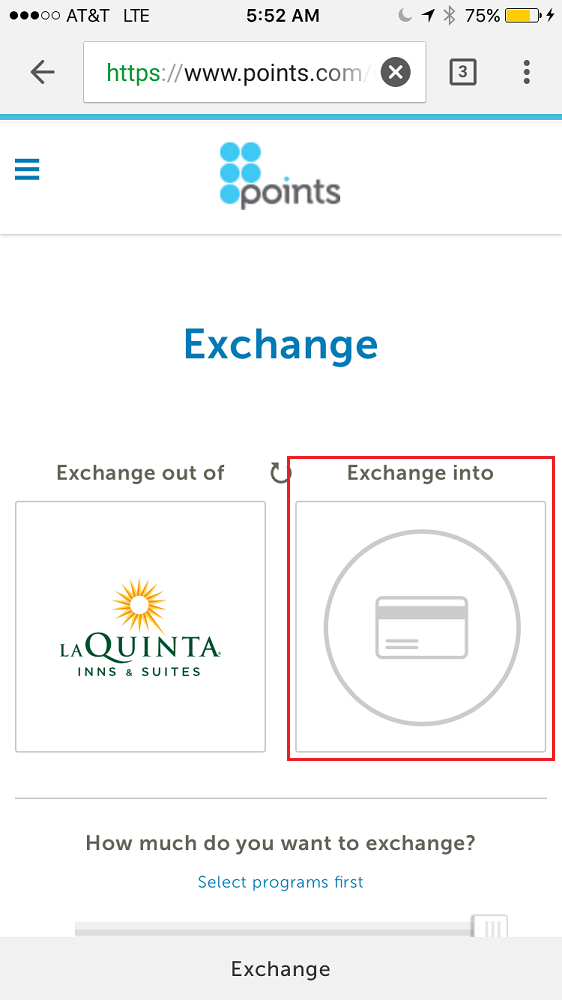

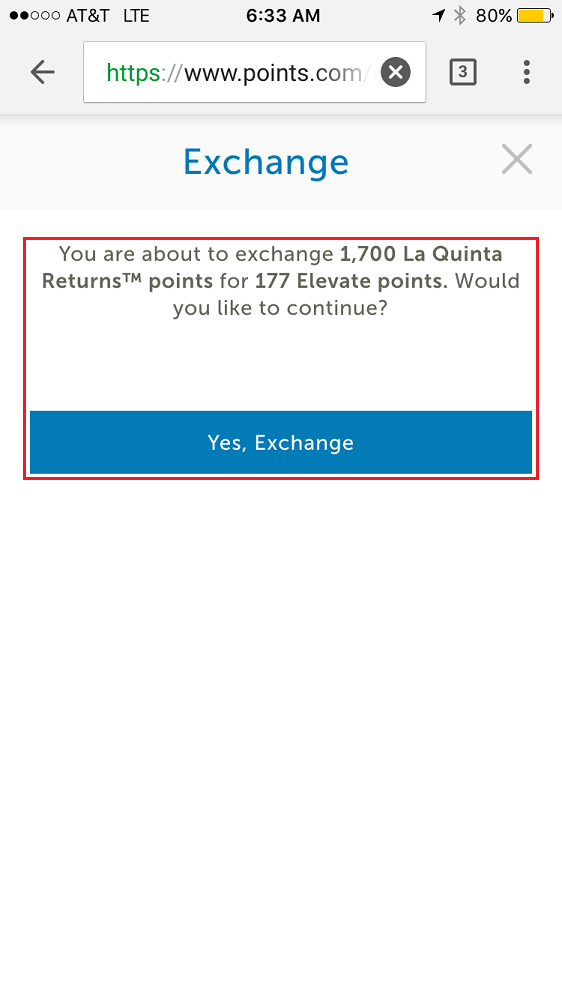

Now I need to select a program to exchange LaQuinta points into – I have the choice of JetBlue or Virgin America. If I transfer all 1,700 LaQuinta points, I can get 195 JetBlue TrueBlue points or 177 Virgin America Elevate miles. Which is the better deal? Let’s do some math!

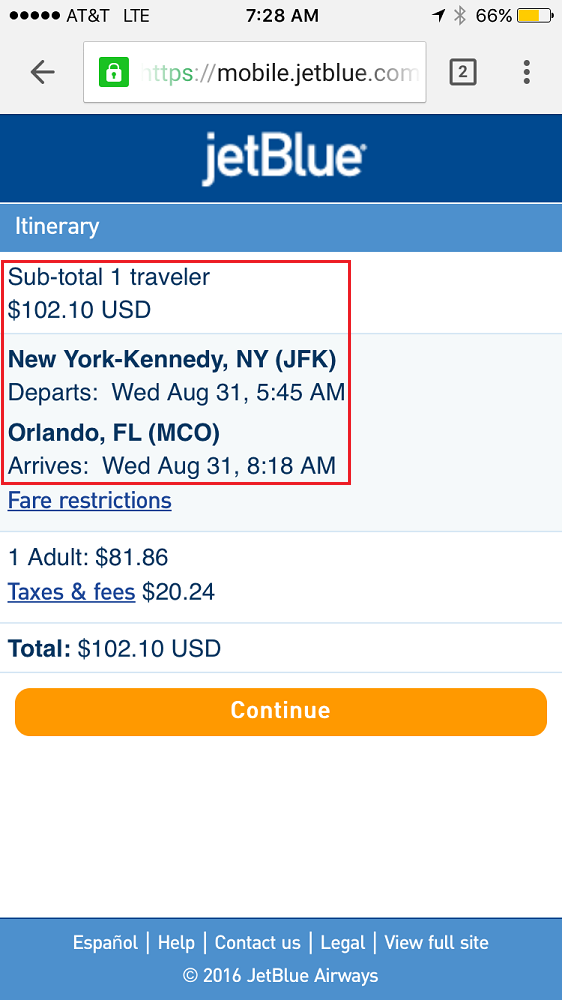

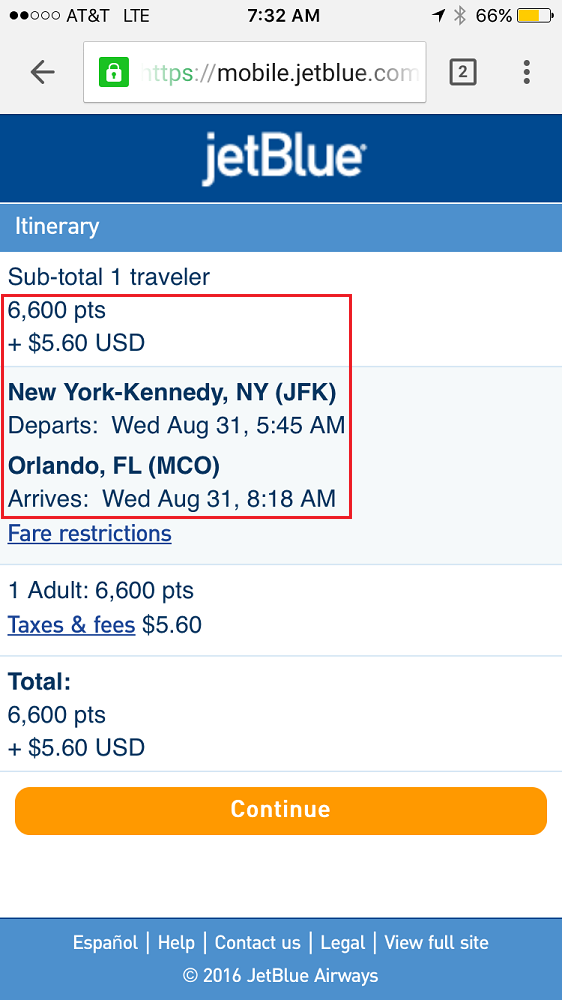

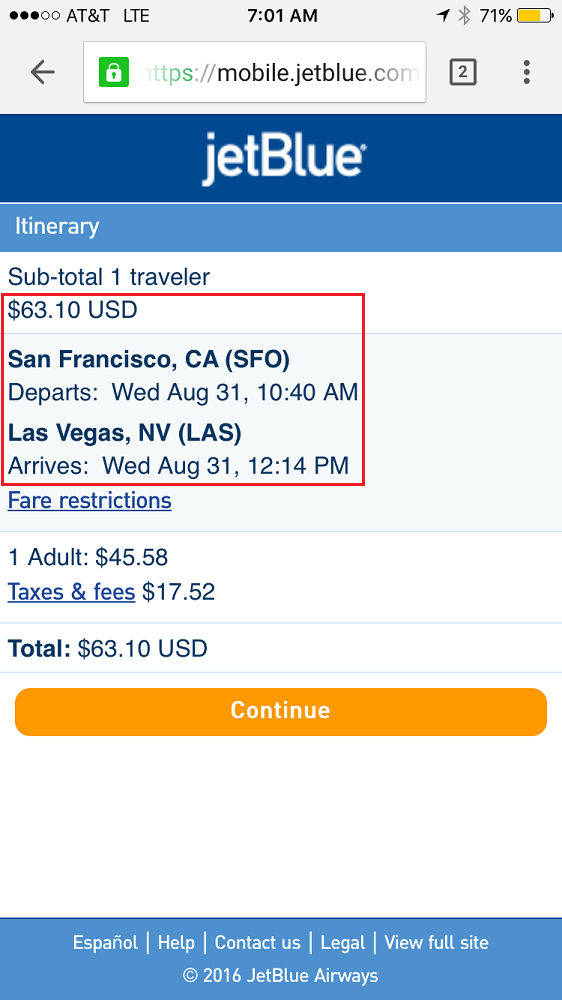

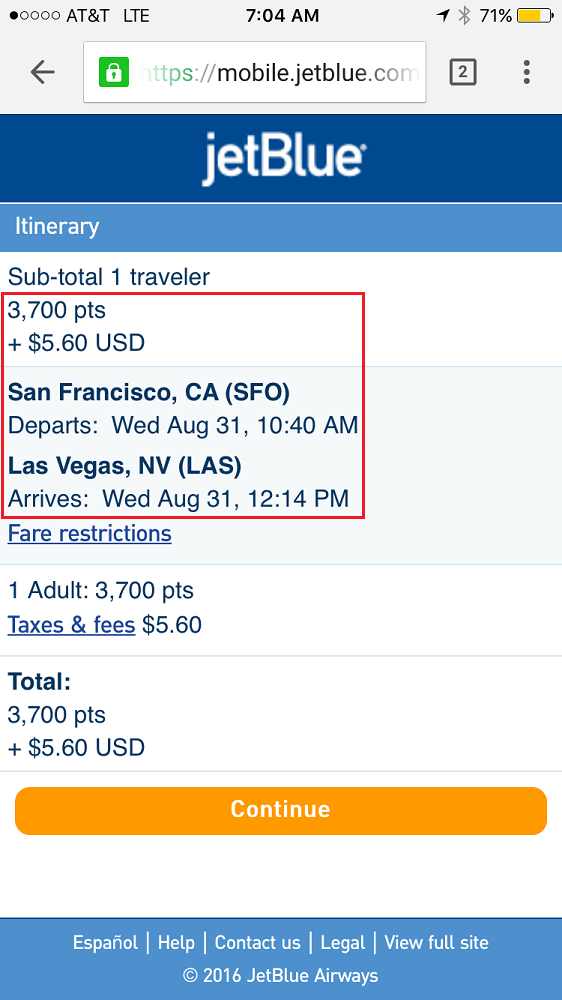

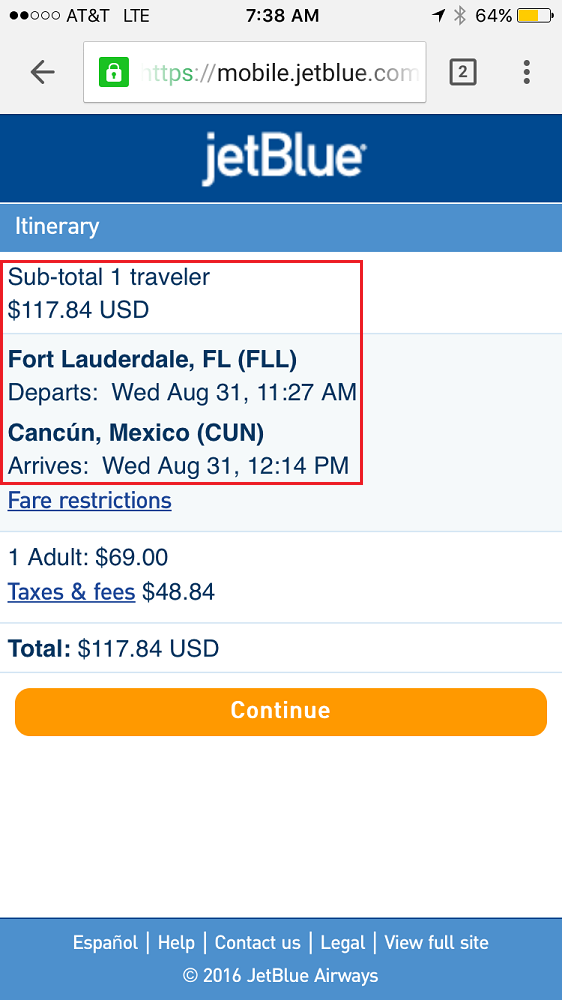

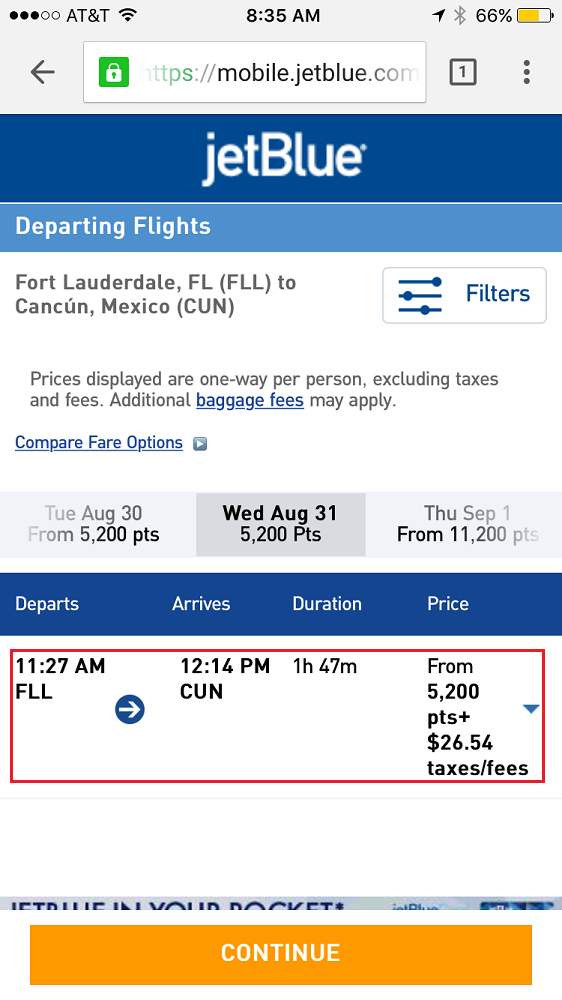

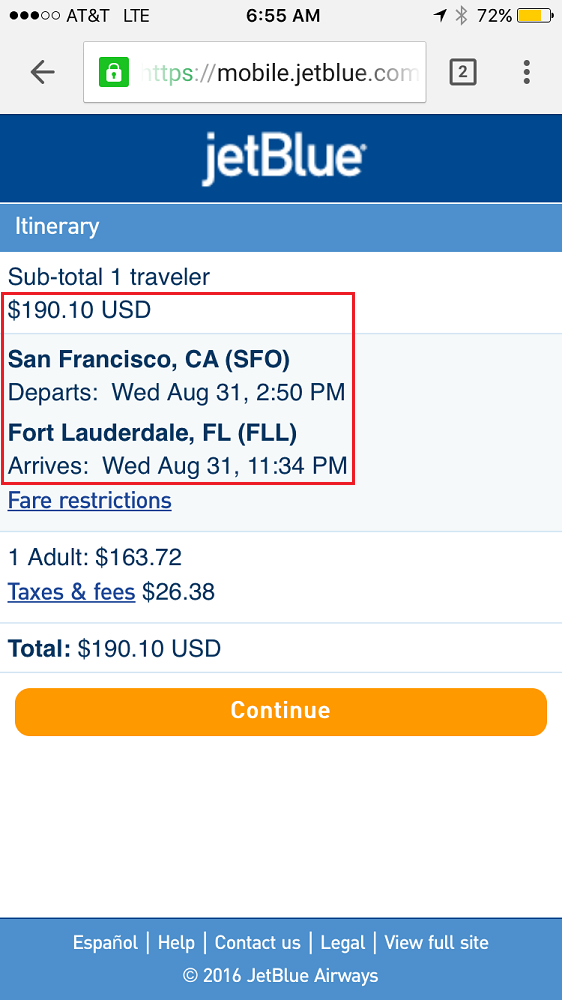

I picked 4 random JetBlue flights and compared the paid price to the points price to determine the cents per point (CPP) value of each JetBlue TrueBlue point:

- JFK-MCO = $102.10 or 6,600 + $5.60. $102.10 – $5.60 = $96.50 / 6,600 = 1.46 CPP.

- SFO-LAS = $63.10 or 3,700 + $5.60. $63.10 – $5.60 = $57.50 / 3,700 = 1.55 CPP.

- FLL-CUN = $117.84 or 5,200 + $26.54. $117.84 – $26.54 = $91.30 / 5,200 = 1.76 CPP.

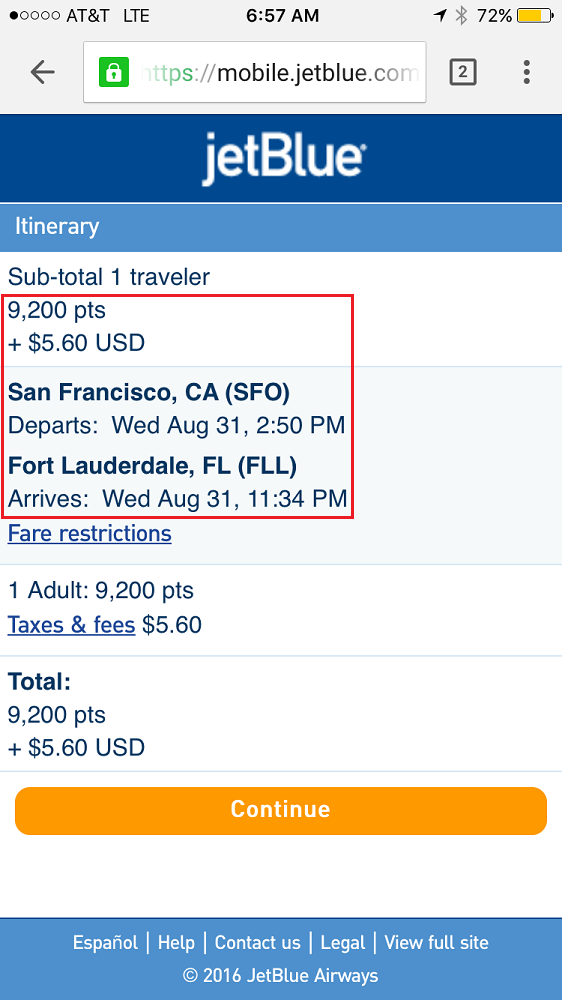

- SFO-FLL = $190.10 or 9,200 + $5.60. $190.10 – $5.60 = $184.50 / 9,200 = 2.01 CPP.

Based on these 4 random JetBlue flights, it looks like JetBlue TrueBlue points are worth between 1.46 and 2.01 CPP in value.

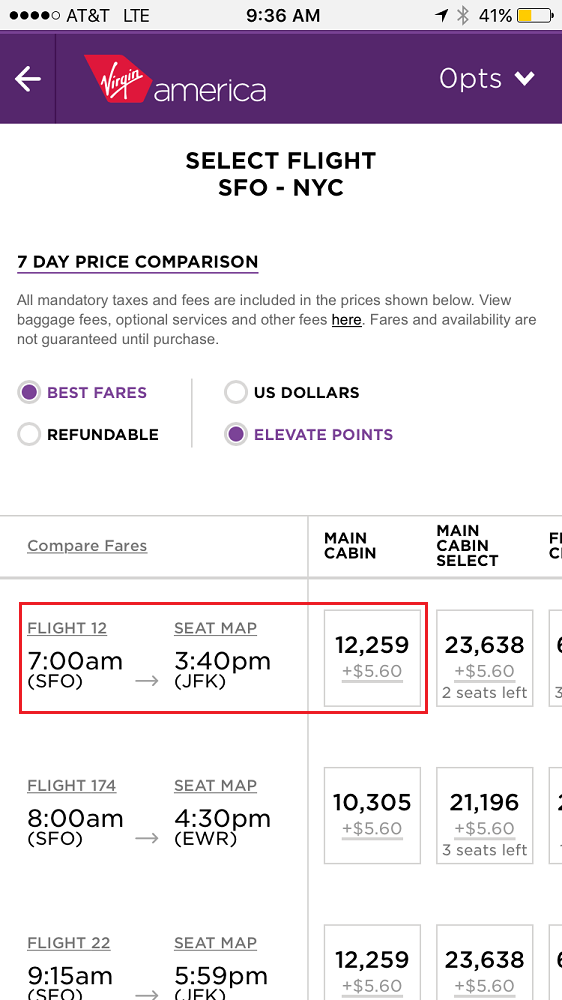

I picked 2 random Virgin America flights and compared the paid price to the points price to determine the cents per point (CPP) value of each Virgin America Elevate mile:

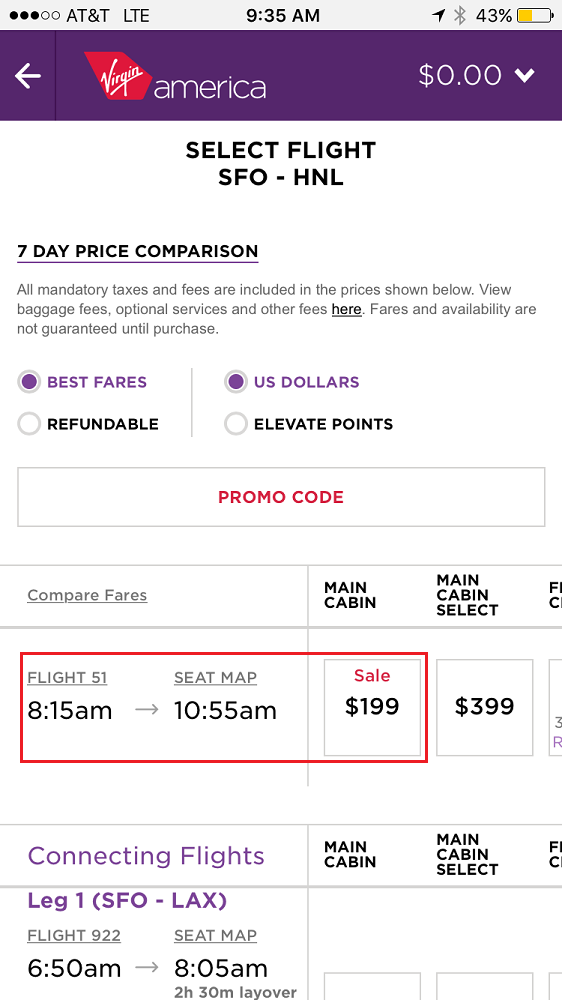

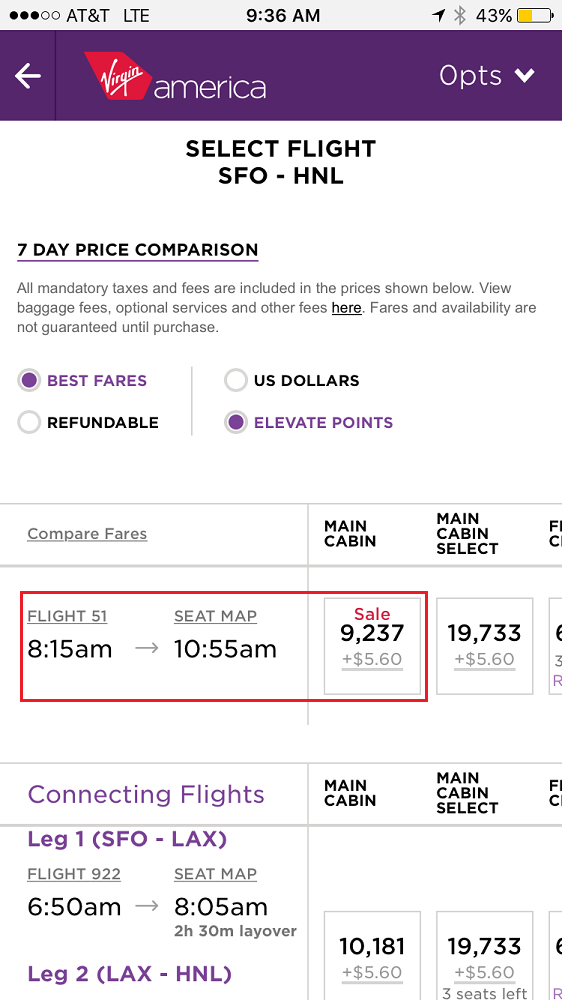

- SFO-HNL = $199 or 9,237 + $5.60. $199 – $5.60 = $193.40 / 9,237 = 2.09 CPP.

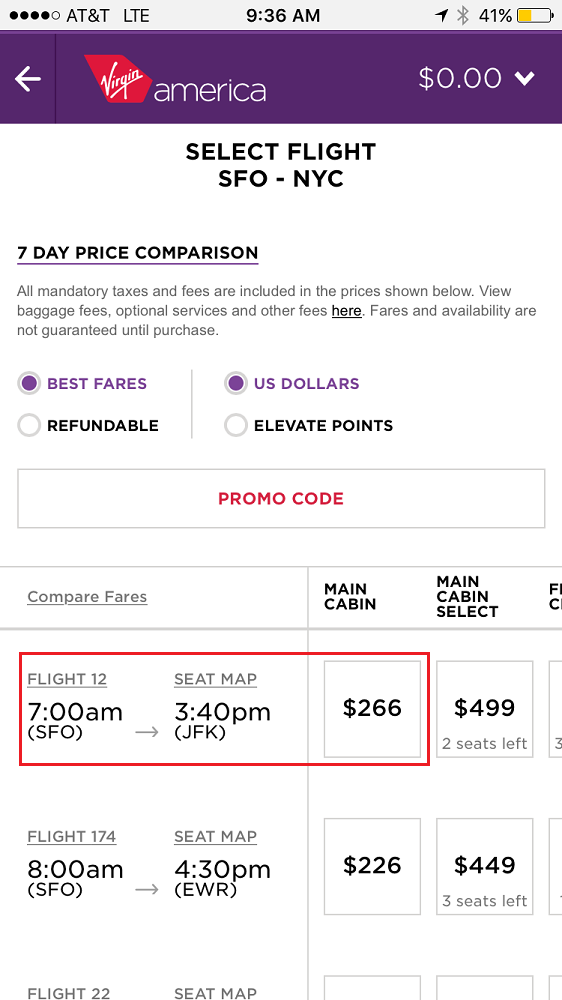

- SFO-JFK = $266 or 12,259 + $5.60. $266 – $5.60 = $260.40 / 12,259 = 2.12 CPP.

Based on these 2 random Virgin America flights, it looks like Virgin America Elevate miles are worth between 2.09 and 2.12 CPP in value.

If we go back up a little bit, I have my choice of converting 1,700 LaQuinta points into 195 JetBlue TrueBlue points or 177 Virgin America Elevate miles. Which is a better deal?

1,700 LaQuinta = 195 JetBlue

- 195 JetBlue x 1.46 CPP = $2.85

- 195 JetBlue x 2.01 CPP = $3.92

1,700 LaQuinta = 177 Virgin America

- 177 Virgin America x 2.09 CPP = $3.70

- 177 Virgin America x 2.12 CPP = $3.75

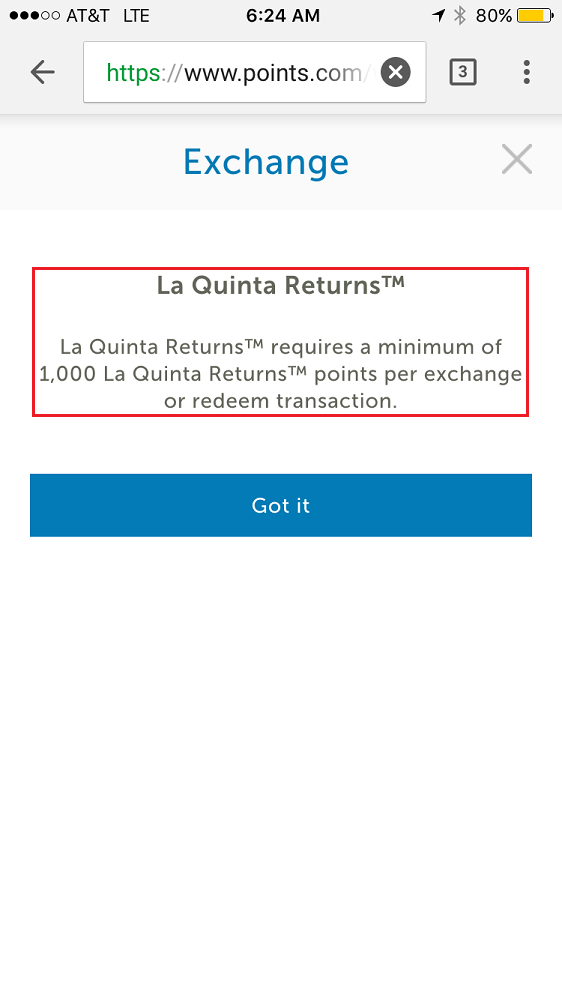

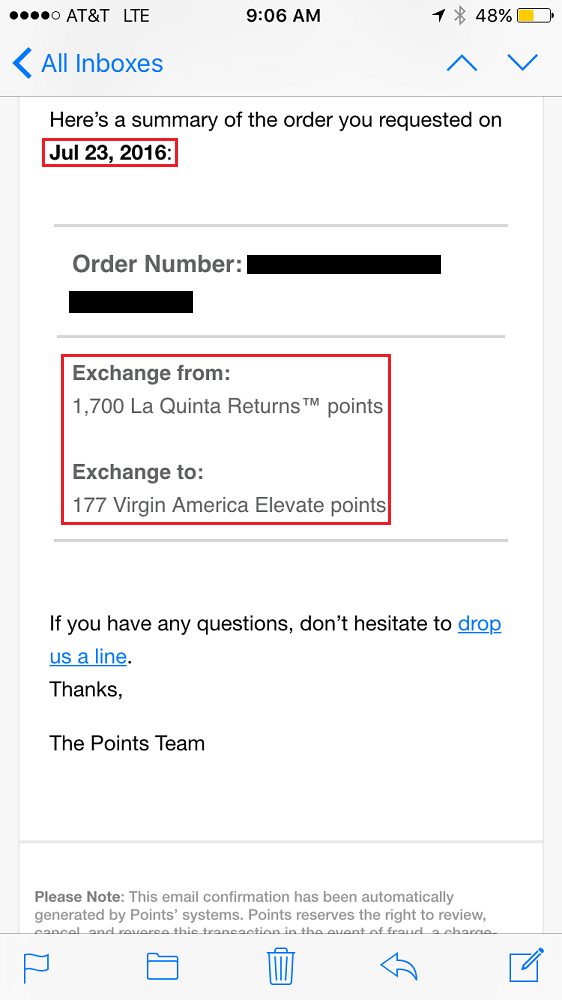

It looks pretty even, but I decided to go with Virgin America since I love Virgin America and use those miles very often (I don’t fly JetBlue much since they have only a few flights from SFO/OAK). Each loyalty program has their own exchange terms and LaQuinta requires transfers of 1,000 points or more. I previewed and confirmed the transfer from LaQuinta to Virgin America.

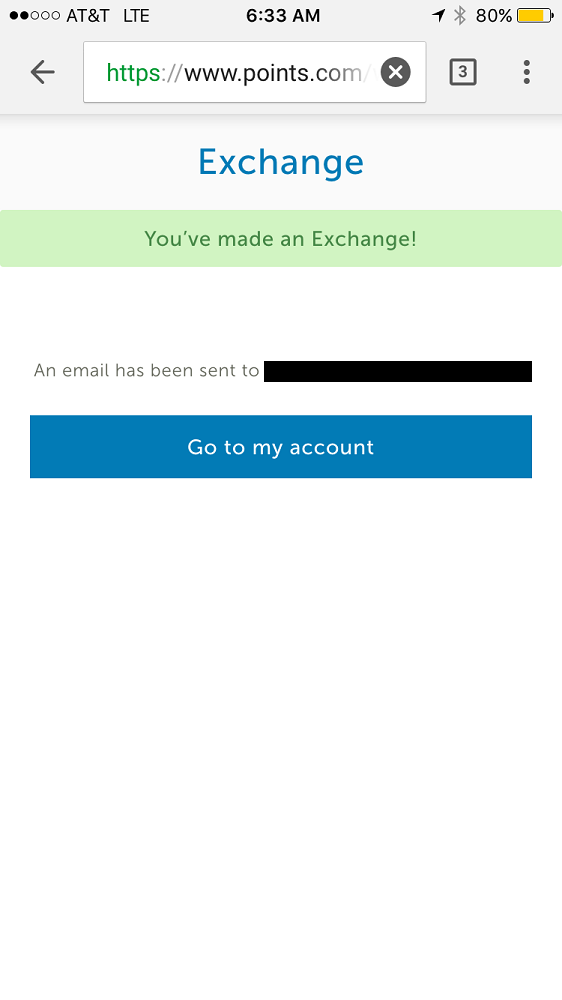

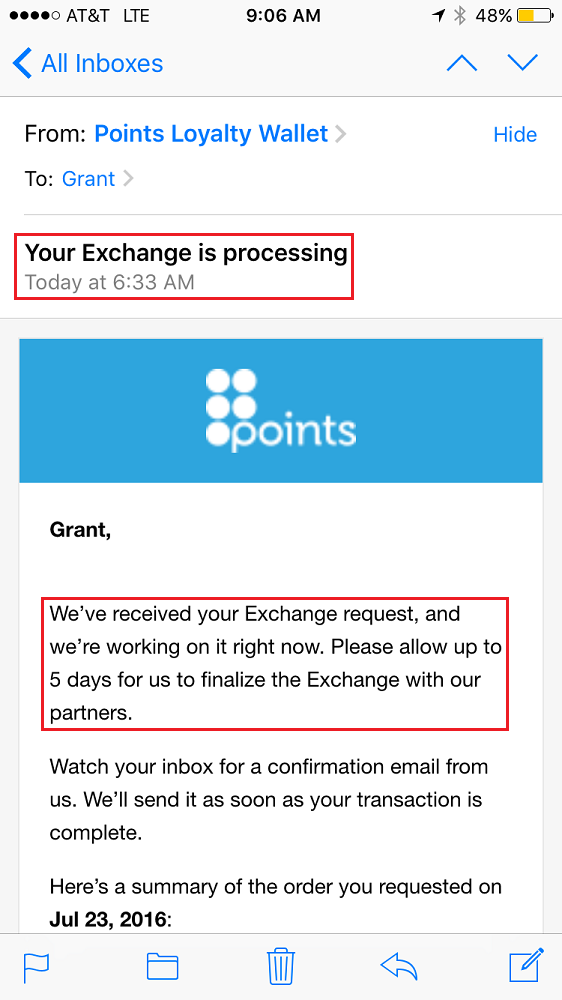

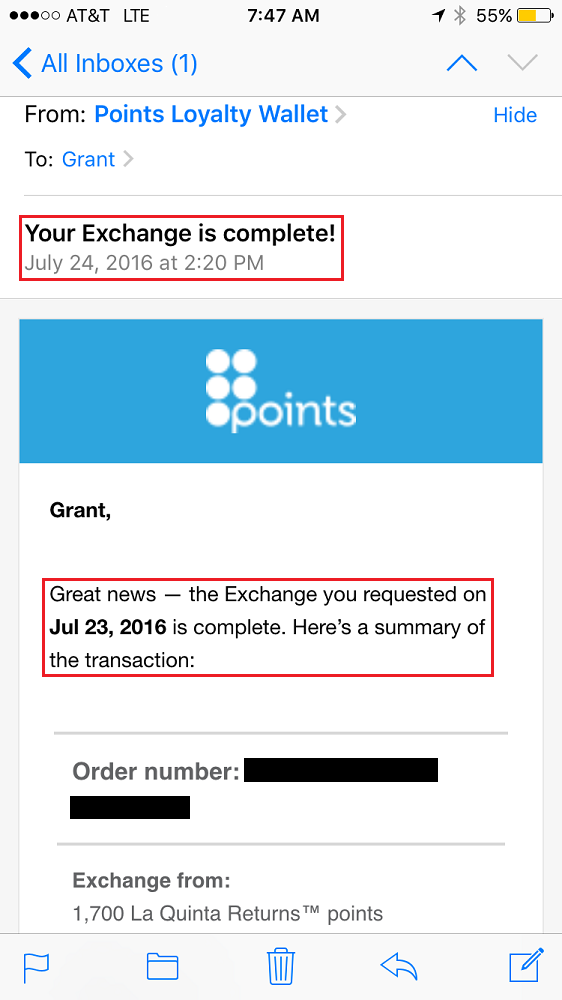

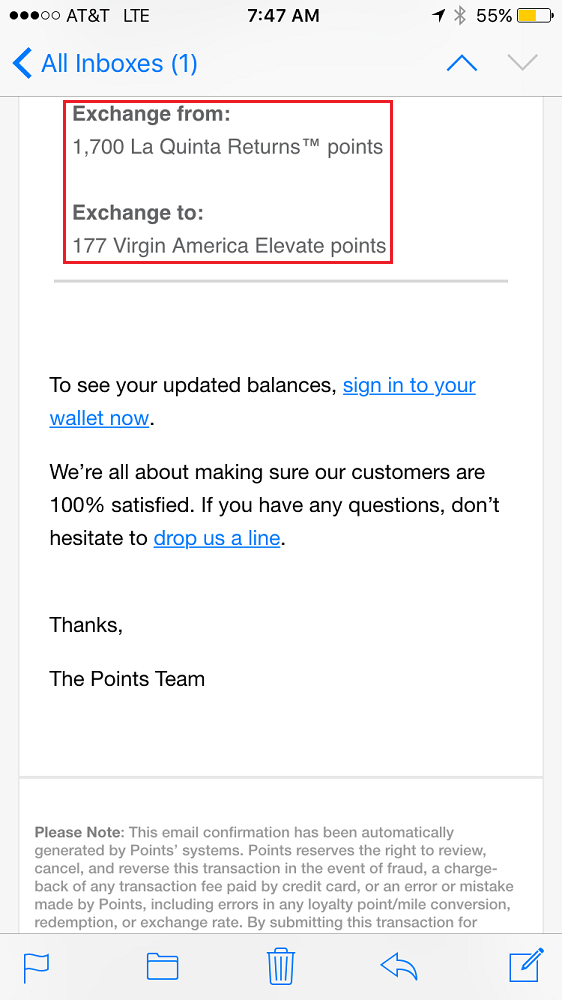

After submitting the exchange, I received a confirmation email. I received another email the following day that the exchange was successfully completed. That was very fast!

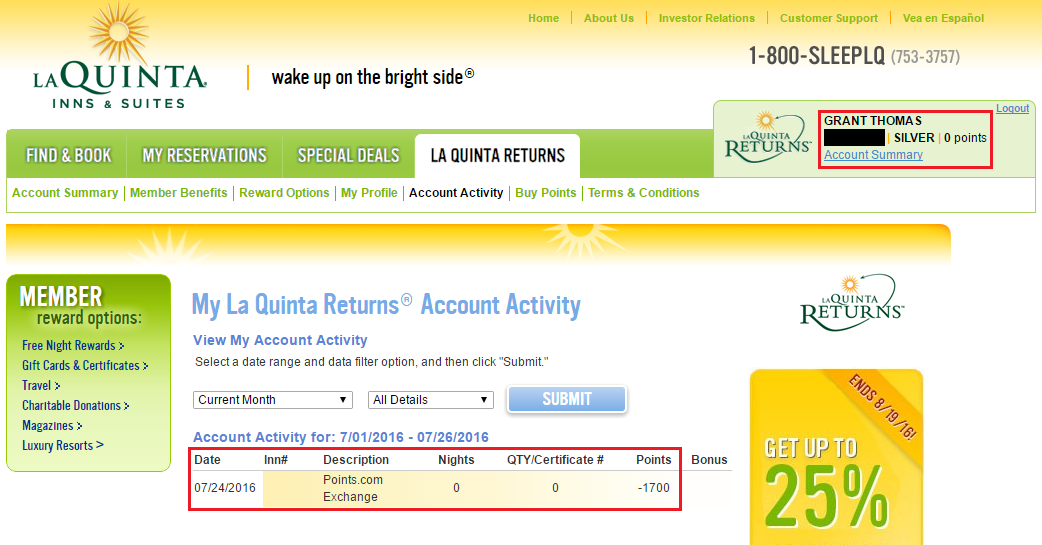

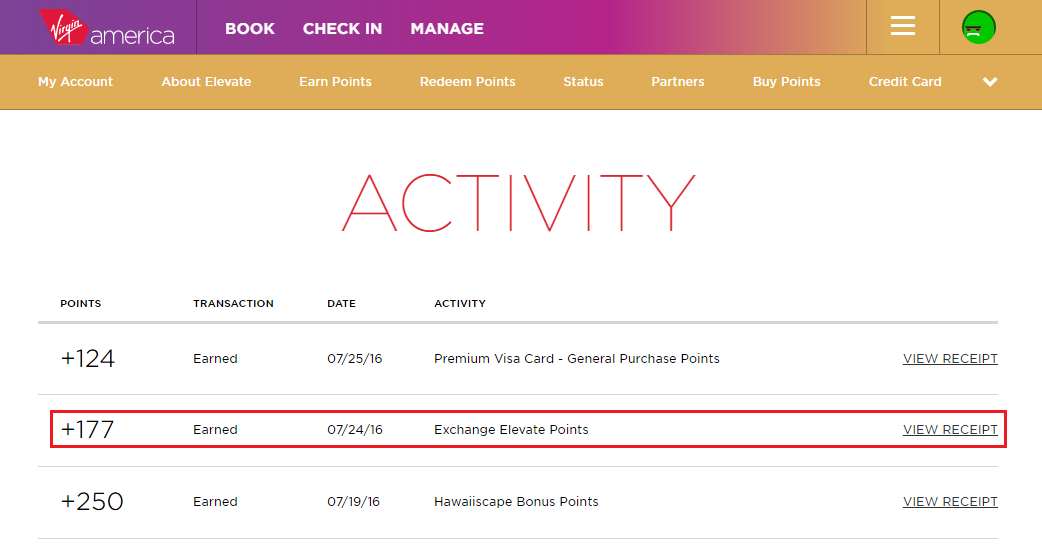

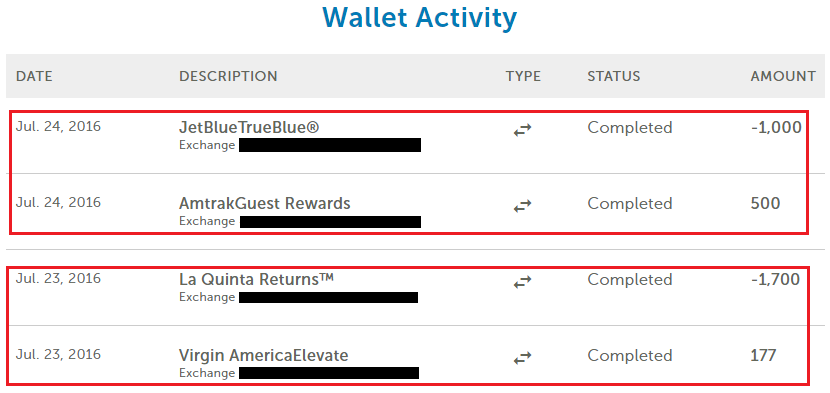

Here is the account activity from LaQuinta to Virgin America.

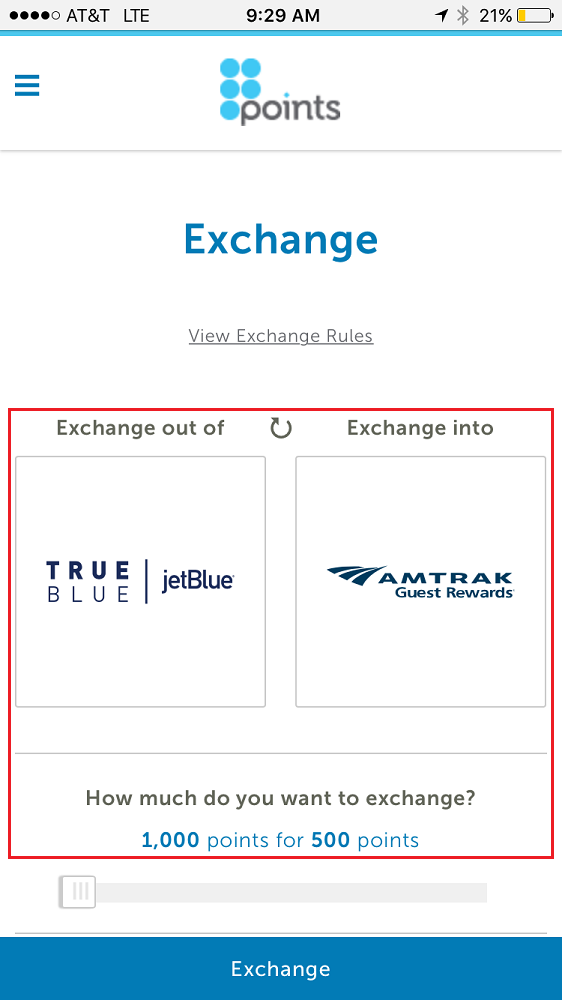

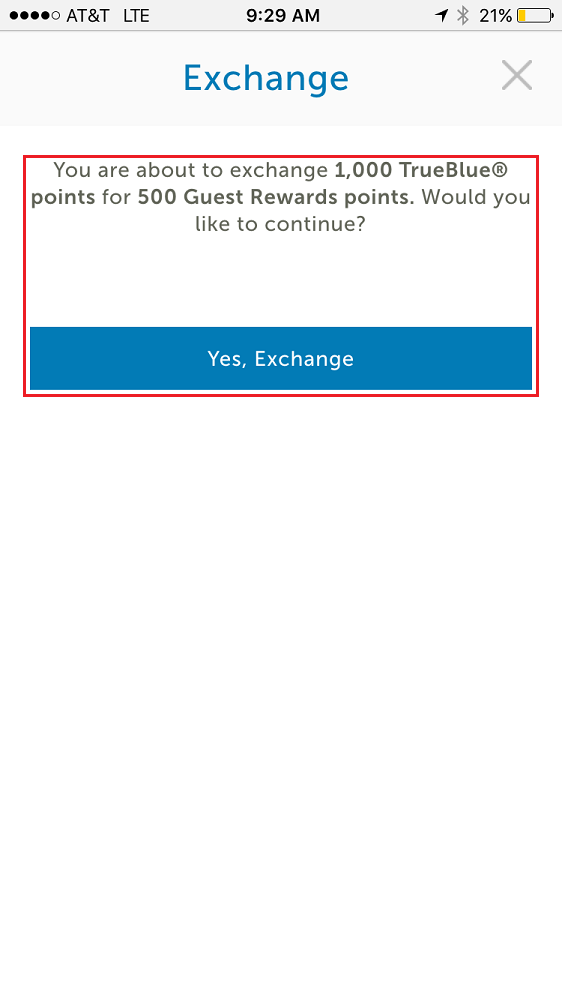

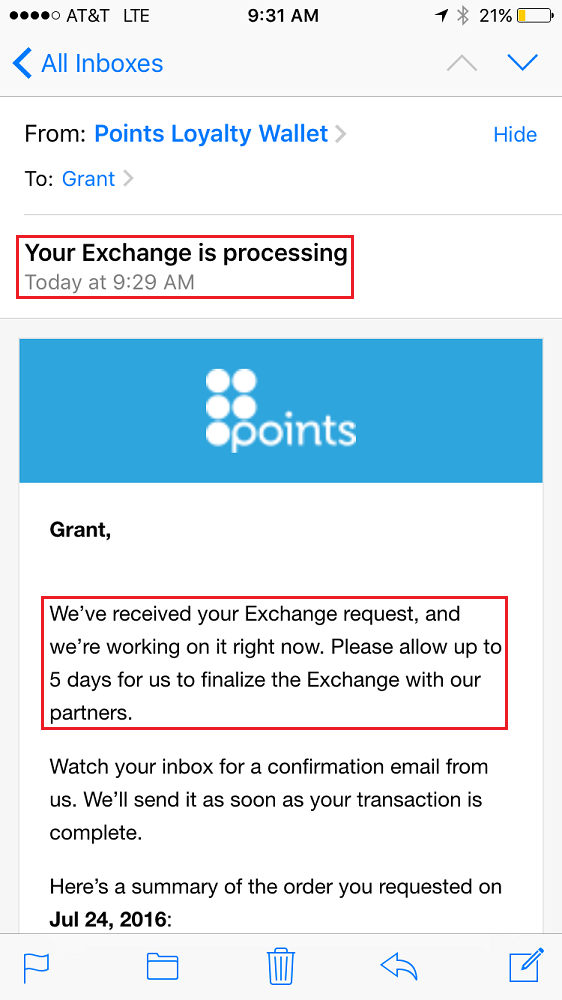

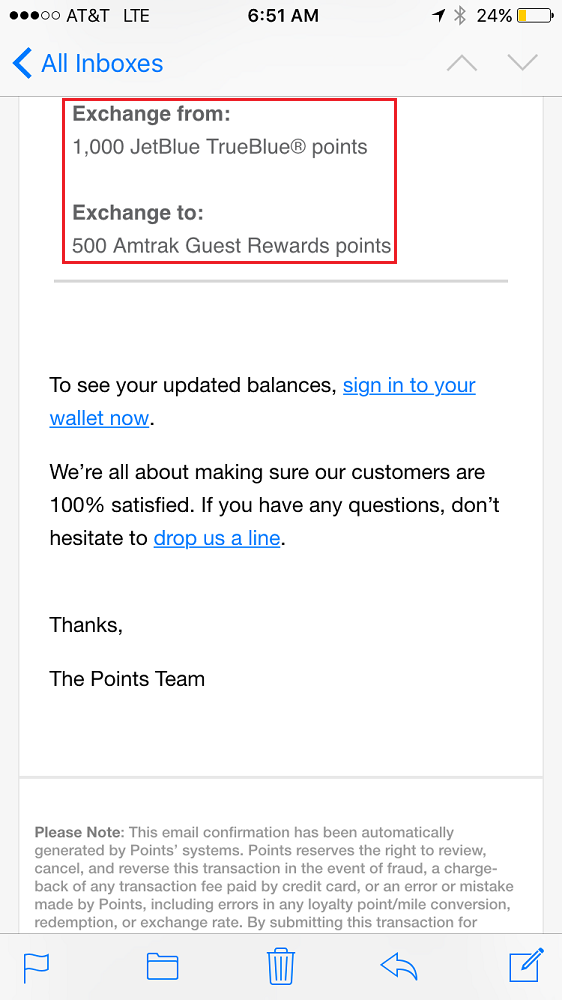

My next idea was to exchange JetBlue TrueBlue points into Amtrak Guest Reward Points. Points exchange at a 2:1 ratio, starting at 1,000 points and going up to 50,000 JetBlue TrueBlue points. I did a sample transfer of 1,000 JetBlue TrueBlue points into 500 Amtrak Guest Reward points.

After submitting the exchange, I received a confirmation email. I received another email the following day that the exchange was successfully completed. That was very fast!

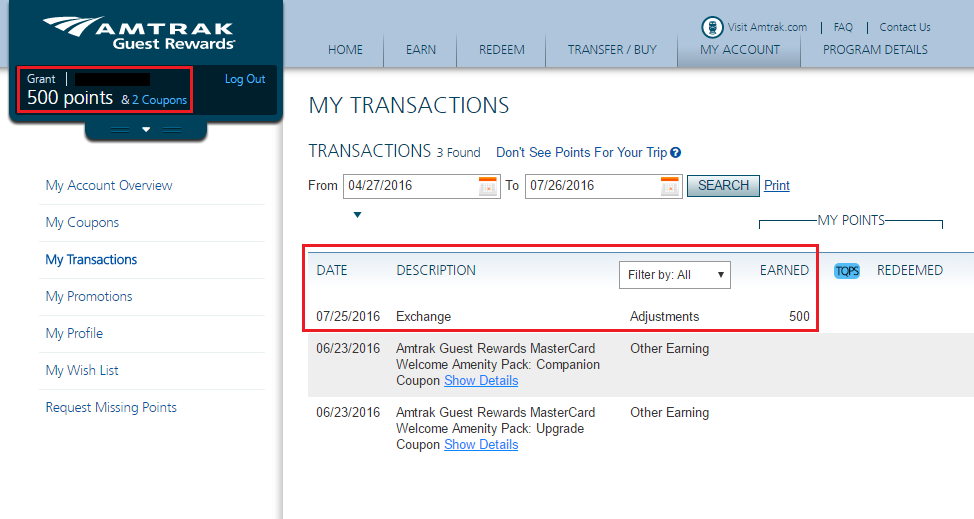

Here is the account activity from JetBlue to Amtrak.

Here are my account transactions/exchanges.

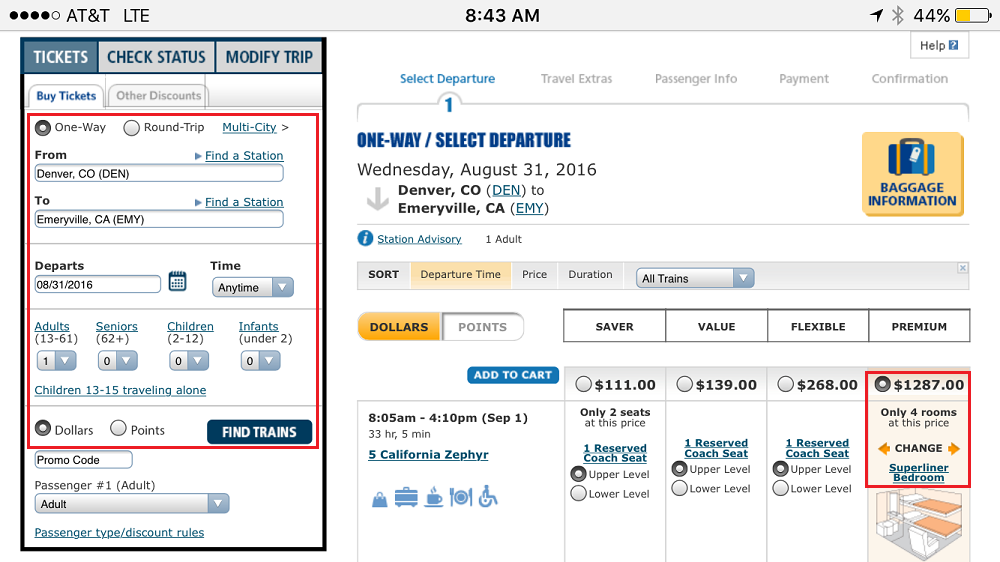

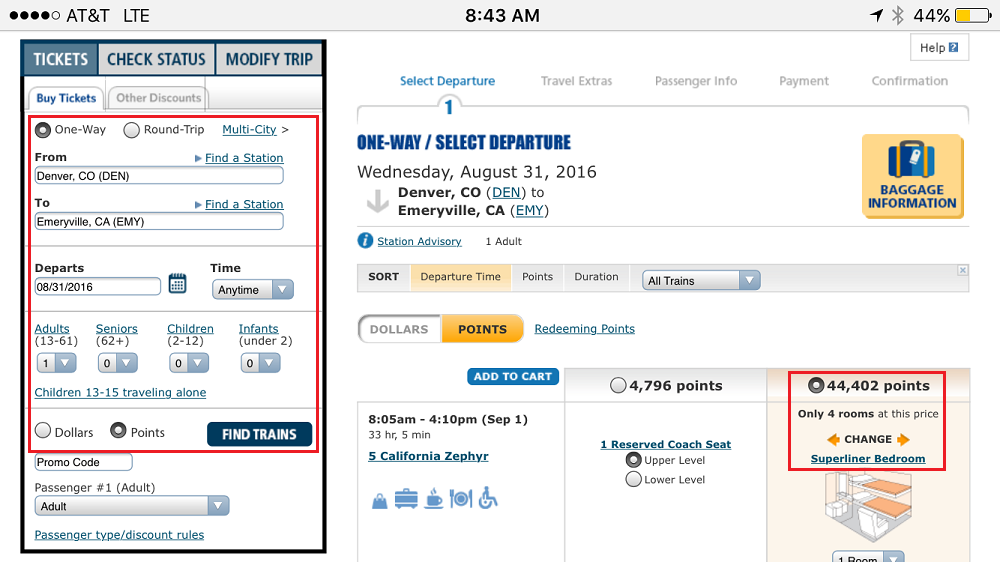

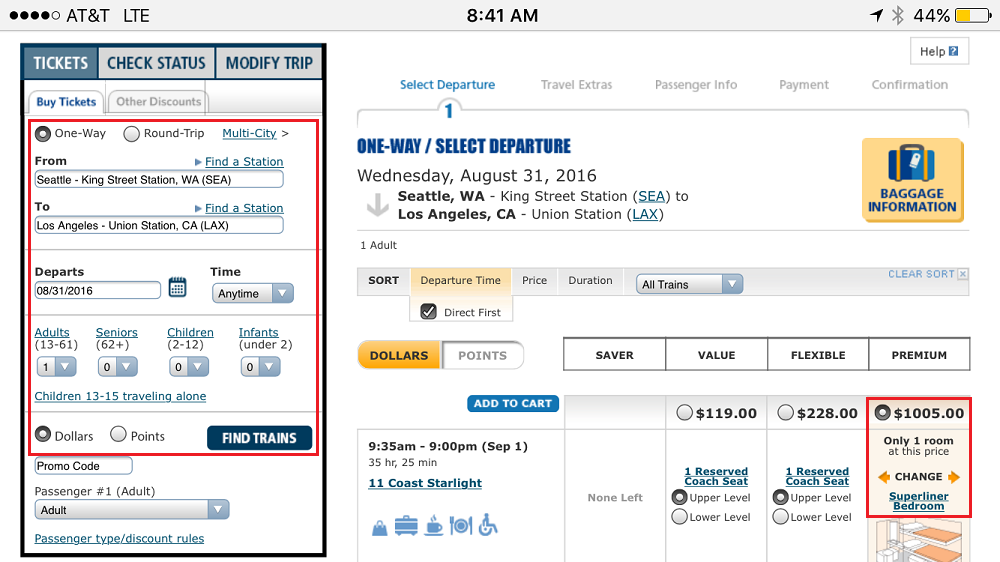

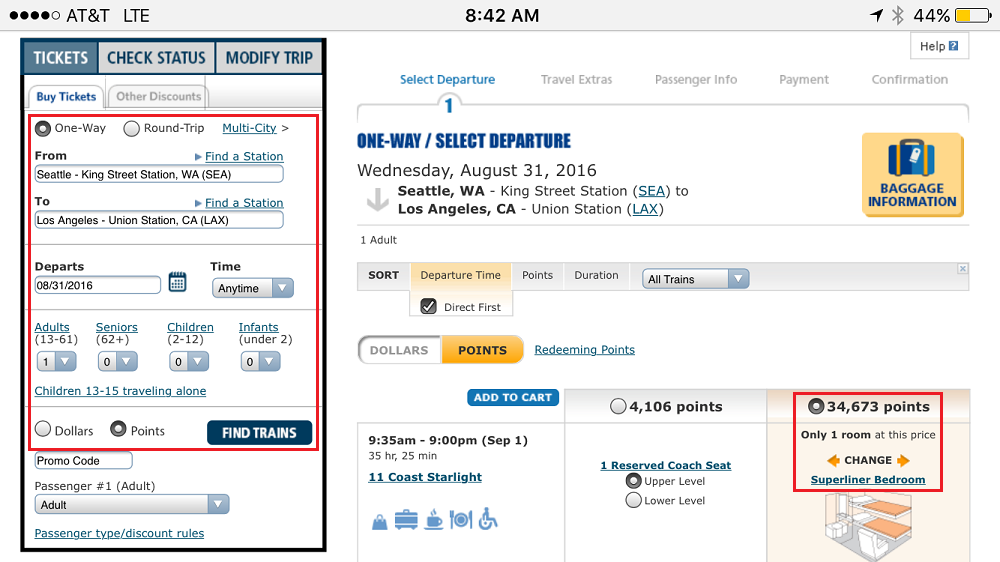

Before I go on, let’s do some calculations to determine how much Amtrak Guest Reward Points are worth and if it makes sense to exchange 2 JetBlue TrueBlue points into 1 Amtrak Guest Reward point. I looked up 2 sample routes that I have done before on Amtrak in a Superliner Bedroom (Coast Starlight from Seattle to Los Angeles and California Zephyr from Denver to Emeryville/San Francisco).

- SEA-LAX = $1,005 / 34,673 Amtrak = 2.90 CPP.

- DEN-EMY = $1,287 / 44,402 Amtrak = 2.90 CPP.

It looks like Amtrak Guest Reward points are worth 2.9 CPP, so let’s do some more math.

- 25,000 Amtrak x 2.90 CPP = $725 value

- 50,000 JetBlue x 1.46 CPP = $730 value

- 50,000 JetBlue x 2.01 CPP = $1,005 value

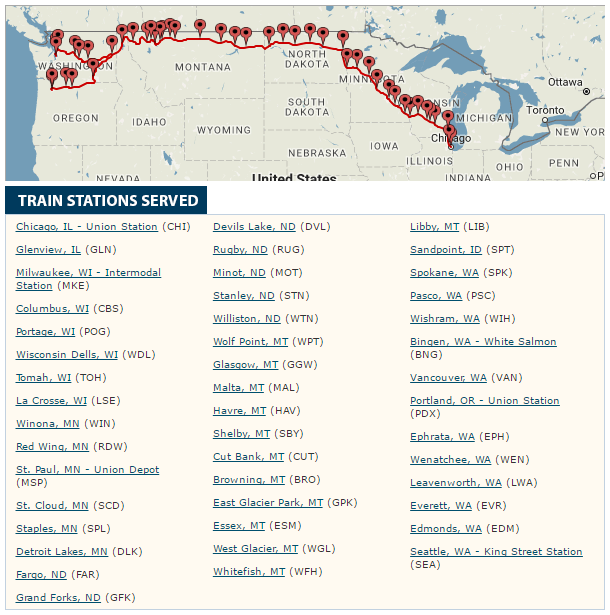

At the low end of the JetBlue spectrum, it looks like I would get almost the same value. At the high end of the JetBlue spectrum, I would be giving up almost $300 in value. I am leaning toward exchanging JetBlue TrueBlue points into Amtrak Guest Reward points since I definitely want to go on the Empire Builder Amtrak route from Seattle to Chicago (or vice versa).

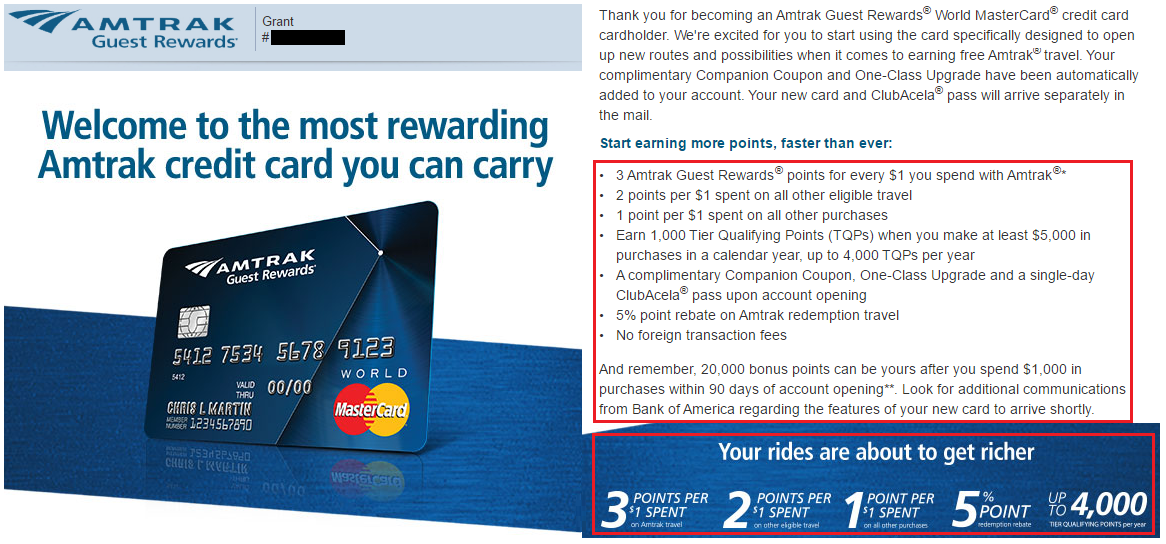

I recently signed up for the Bank of America Amtrak Credit Card and just met the minimum spend requirements – I am now waiting for my 20,000 Amtrak Guest Reward points sign up bonus to post. As a reminder, here is the earning structure of the credit card:

- 3 Points: Earn 3 points (2 bonus points and 1 base point) for every $1 of eligible Amtrak travel and onboard Purchases charged to the card where Amtrak is the merchant of record.

- 2 Points: Earn 2 points (1 bonus point and 1 base point) for every $1 of Purchases charged at eligible Non-Amtrak travel merchants, which include: airlines, car rental agencies, hotels, motels, inns, and resorts, steamship/cruise lines, and travel agencies.

- 1 Point: Earn 1 point for every $1 of Purchases charged to the card each billing cycle.

If you used this credit card as your everyday credit card for non-bonused categories, you would earn 1x = 2.9% cash back (which is actually a very good earning rate). If you used this credit card for eligible travel purchases, you would earn 2x = 5.8% cash back (which is better than 2x Chase Ultimate Rewards or 3x Citi Thank You Points). Plus, you get a 5% points rebate when you redeem Amtrak Guest Reward points for Amtrak travel.

If you made it all the way to the bottom of this post, I thank you for spending half your day reading this post. If you have any questions about exchanging miles/points with Points.com, please leave a comment below. If you have any thoughts about my Amtrak idea, I would love to hear your experience on the Empire Builder – what month did you go, which direction did you go, did you like the ride? Thank you for reading and have a great day everyone!

This was your big reveal?

Letdown

Sorry to disappoint, Lopere. I don’t fly JetBlue often, so JetBlue points do not have much value to me. Hopefully you learned something from the post. Have a great day.

So converting from ~1.6-2 cpp (TrueBlue) to 0.8 (Amtrak at ~1.6 but 2:1 ratio) is a good idea?

Maybe if you’re desperate for Amtrak Points and cannot otherwise get them, but still. TrueBlue points don’t expire. There’s no reason to liquidate an account just because.

You make a good point. If you live near a JetBlue hub and have lots of travel destinations that are competitively priced on JetBlue, then I would definitely prefer using JetBlue points for JetBlue flights.

From SFO/OAK, I can either fly to LGB or LAS or to the East Coast (BOS, JFK, or FLL). I don’t have any plans to fly to any of those airports or the East Coast, so I am looking for other options. Let’s agree to disagree :)

Nice that you were able to get value out of your JetBlue points. People think you always need to get maximum value out of loyalty points. Nice if you can, but if your plans don’t involve any activities to allow you to gain maximum value then get some value from practical activities. Thanks for the post.

That’s exactly how I feel. It’s just you and me vs. the world :)

I must have missed something. What’s the cost of exchanging those points?

No cost to exchange, it’s all free. Points.com used to offer a trade feature that used to cost money but I think they got rid of that feature.

Very nice. I always thought there was a charge but this makes it great for transferring leftover points.

Yes, it comes in handy every now and then :)

Are there any fees? How does Points.com make their profit?

There are no fees for transfers. They only make money when you buy (overpriced) miles/points from them.

Pingback: Redeem IHG, Hawaiian & Frontier Miles for Gift Cards with Points.com (Including Amazon, Walmart & More)