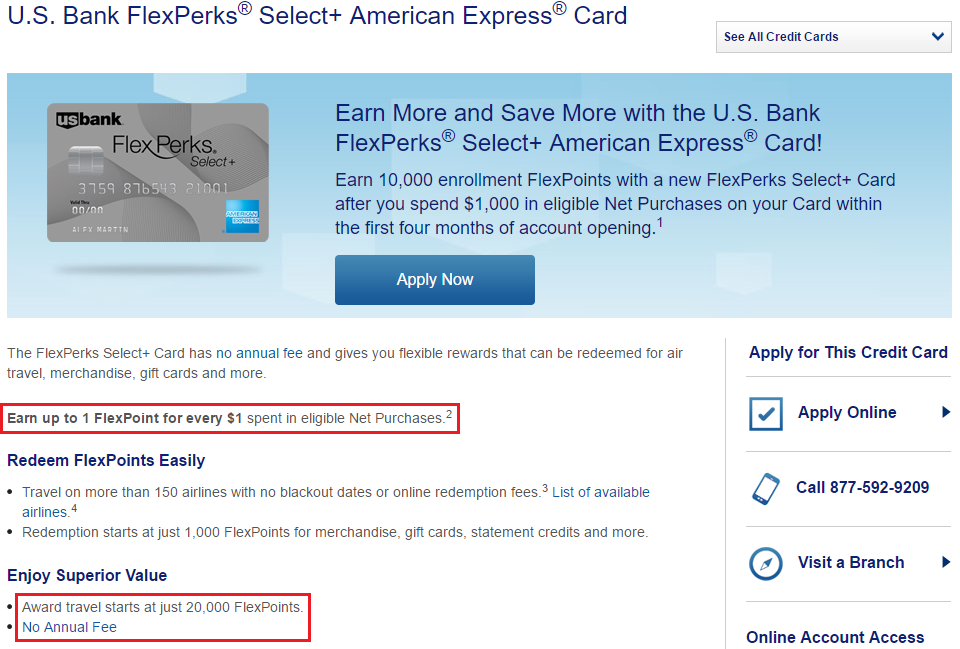

Good afternoon everyone, I hope everyone is having a great weekend so far. A few months ago, my $49 annual fee posted on my US Bank FlexPerks Travel Rewards Visa Signature Credit Card. Since I had spent down the majority of my FlexPoints, I decided to convert my US Bank FlexPerks Travel Rewards Visa Signature Credit Card into a US Bank FlexPerks Select+ American Express Credit Card. This credit card has no annual fee and earns 1 FlexPoint for every dollar spent with no bonus categories. This is by no means a good credit card, but it will keep your FlexPoints alive and you can continue to redeem 20,000 FlexPoints for an airline ticket worth up to $400.

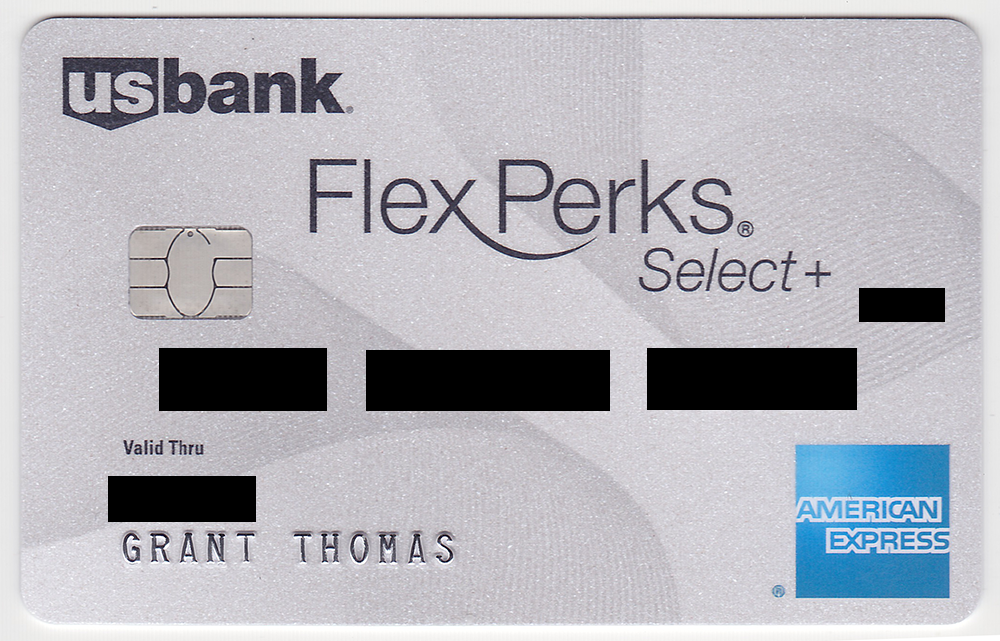

Here is the front and back of my new US Bank FlexPerks Select+ American Express Credit Card:

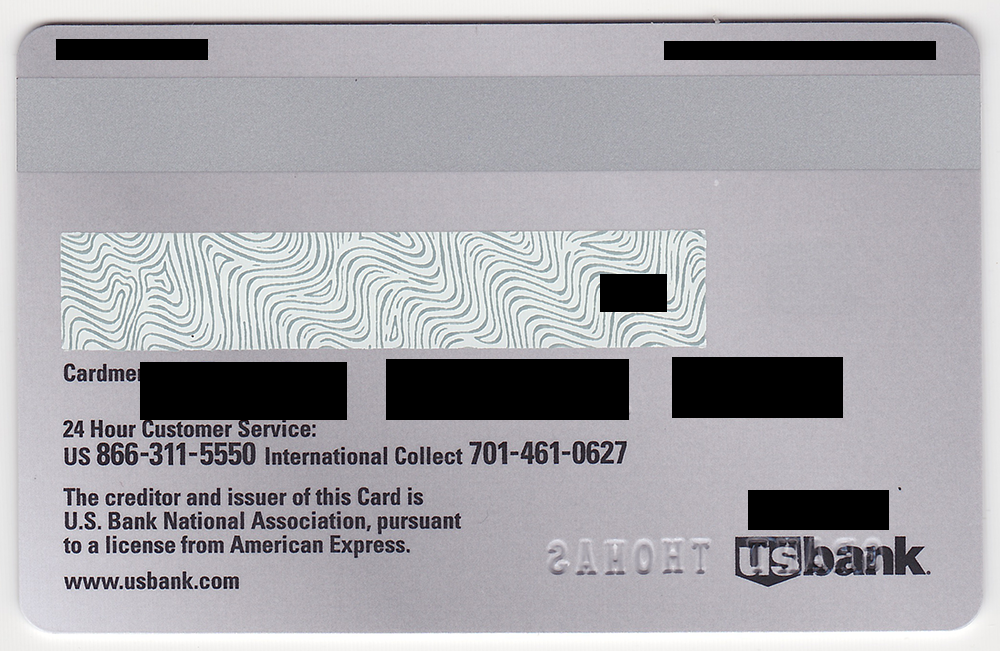

I called US Bank last week to inquire about the status of the $49 annual fee refund from my US Bank FlexPerks Travel Rewards Visa Signature Credit Card and the rep said that the annual fee refund would show up 2 statement cycles after converting my credit card. She explained that the conversion could be reversed within 2 statement cycles which explains why it takes 2 statement cycles for the annual fee refund to post. Fast forward to a few days ago when my US Bank FlexPerks Select+ American Express Credit Card statement closed. I was happy to see that the $49 annual fee from my US Bank FlexPerks Travel Rewards Visa Signature Credit Card was reversed and I had a $49 credit balance in my account.

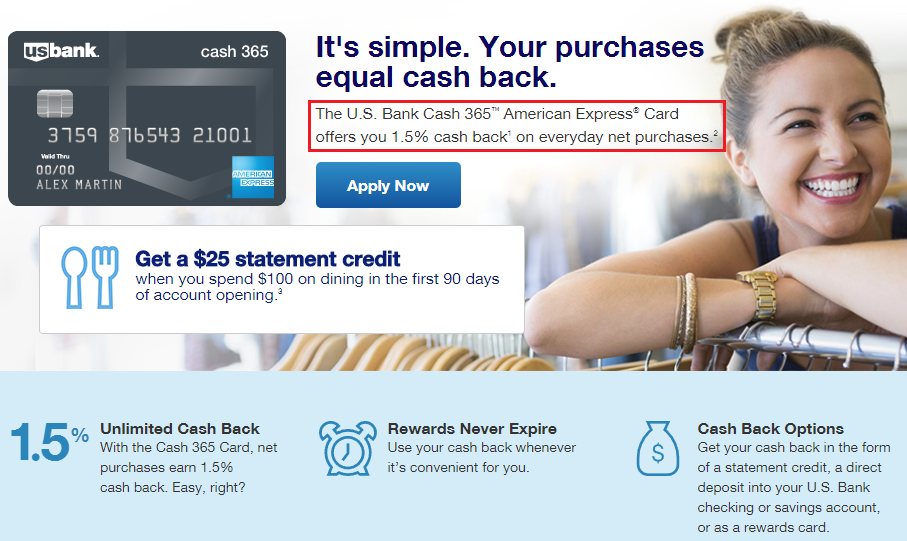

After converting the US Bank FlexPerks Travel Rewards Visa Signature Credit Card, I converted my US Bank FlexPerks Travel Rewards American Express Credit Card to a US Bank Cash 365 American Express Credit Card. I had the option of converting to another US Bank FlexPerks Select+ American Express Credit Card, but I decided to spread the love and get a different no annual fee credit card from US Bank. The US Bank Cash 365 American Express Credit Card earns 1.5% cash back on all purchases and has no annual fee. This is another lackluster no annual fee credit card from US Bank. I will never use this credit card as long as I have my Citi Double Cash Credit Card that earns 2% cash back.

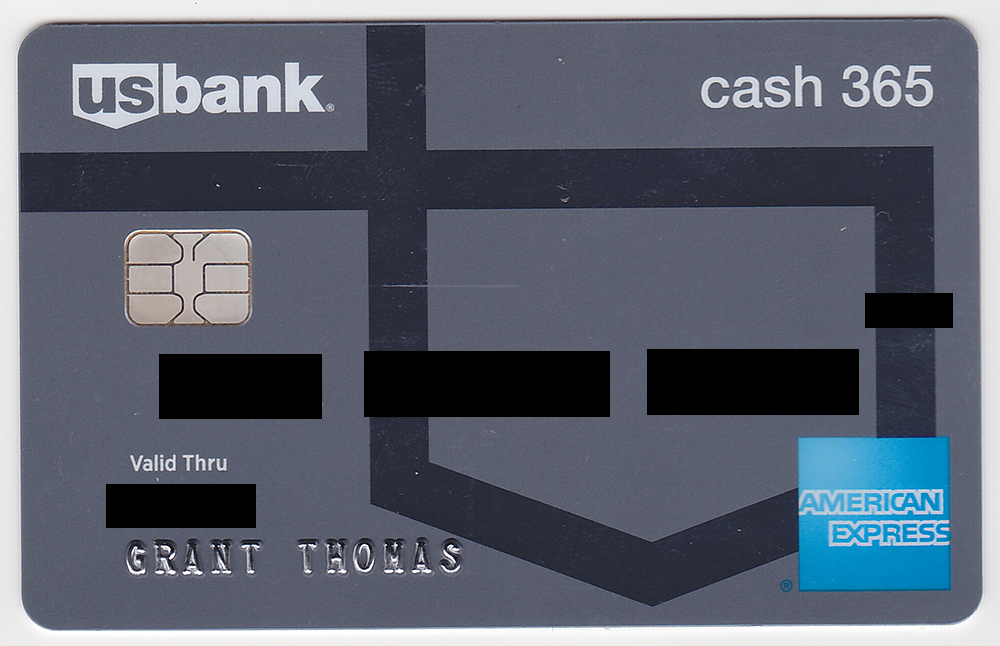

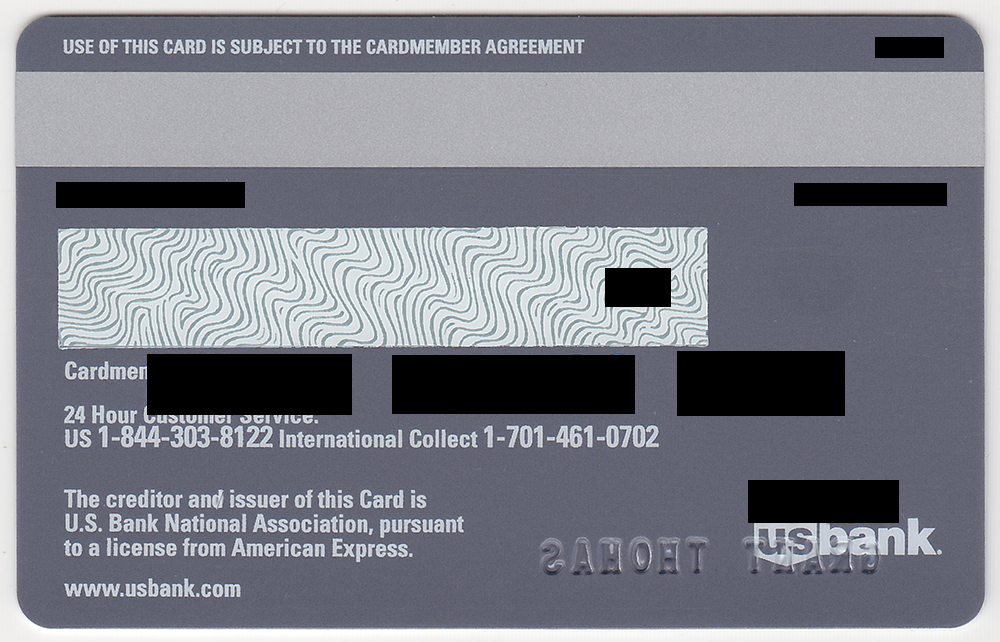

Here is the front and back of my new US Bank Cash 365 American Express Credit Card:

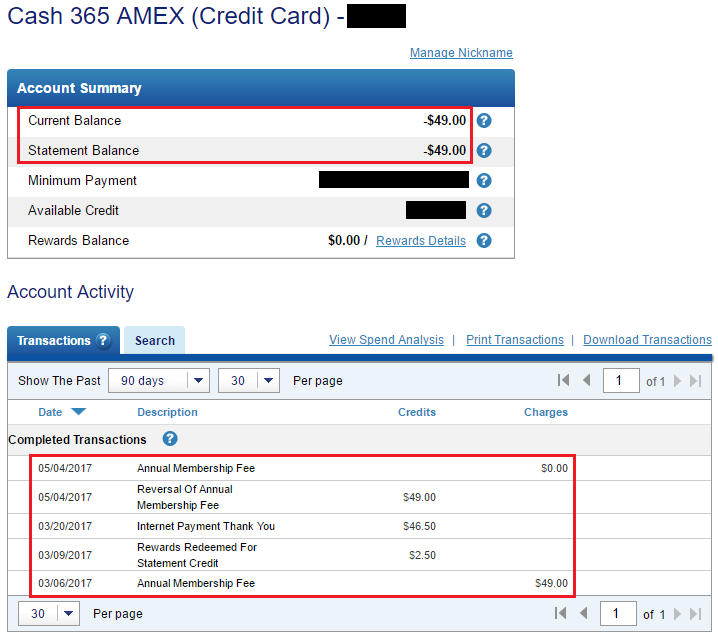

Since I converted both credit cards on the same day and both of my statements closed a few days ago, I was happy to see the $49 annual fee refund post to this account too. While reviewing my credit card transactions, I spotted a $2.50 transaction titled “Rewards Redeemed for Statement Credit.” After digging through a few old US Bank statements, I figure out what happened.

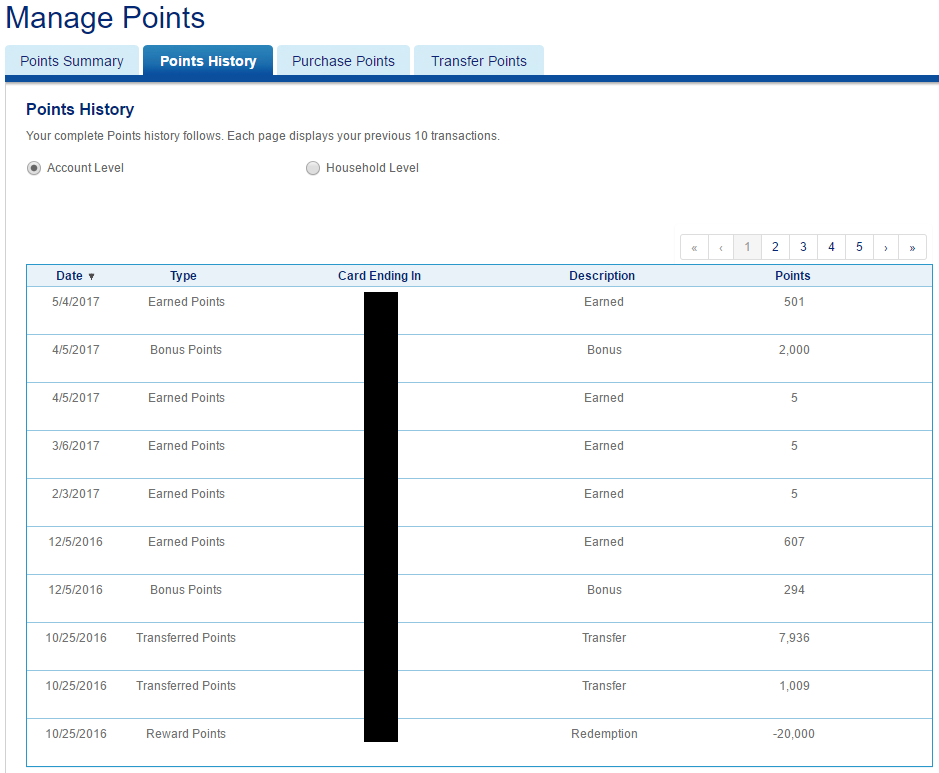

I first checked my FlexPoints point history to see if there were any redemptions on March 9. Nope.

After digging through some old US Bank credit card statements, I discovered that when I converted my US Bank FlexPerks Travel Rewards American Express Credit Card to the US Bank Cash 365 American Express Credit Card, I had 250 FlexPoints linked to my US Bank FlexPerks Travel Rewards American Express Credit Card. When I converted that credit card, US Bank cashed out my 250 FlexPoints at 1 cent per point and gave me a $2.50 statement credit. I thought those FlexPoints were safely linked to my US Bank FlexPerks Select+ American Express Credit Card, but I guess not. I’m not going to bother US Bank over a missing $2.50 value, so I will let it go.

If you have any questions, please leave a comment below. Have a great day everyone!

Butttt those 12 Gogo passes! And seriously, you’re the FP expert. It’s so weird to think of that era ending.

I actually got the US Bank FlexPerks Travel Rewards Gold American Express Credit Card, so I’m back in the FlexPoints game. I think my 12 Gogo passes are still in my account and I might get more passes with this credit card.

Hi Grant,

You wrote “Since I had spent down the majority of my FlexPoints, I decided to convert my US Bank FlexPerks Travel Rewards Visa Signature Credit Card into a US Bank FlexPerks Select+ American Express Credit Card.”

Would the downgrade been a good idea even if you had not spent down most of the points? In other words, are flex points worth less if warehoused on the Amex version?

We have two US Bank FlexPerks Travel Rewards cards – a personal one and a business one – in our household, that date back to the Olympics promo. Haven’t gotten any airline tickets with either as yet. I’d prefer to hold the points for a good redemption and to do so without paying AFs.

Thanks!

You are correct, FlexPoints are worth the same, regardless of what FlexPerks credit card you have. I didn’t plan on converting/downgrading my 2 FlexPerks credit cards after the annual fee was scheduled to post, so I wanted spend down the FlexPoints.

Good to know. Thanks, Grant!

Flexperks are awesome; especially for Alaska and Southwest flyers :)

I can always find $399.96 SWA flights that are perfect for FlexPoints :)

Grant,

I believe I read in past posts on FlyerTalk that the AMEX and Visa versions of the Flexpoint credit cards each had their own Flexperks account numbers, respectively, and that one was not able to consolidate the one with the other when one closed either of the credit cards.

I would contact US Bank to make sure that your Flexperks account tied to your former Visa card has been consolidated into the Flexperks account associated with your new AMEX card, and that you don’t have 2 separate Flexperks account, with one not tied to an existing credit card.

Could you also inform us of the outcome of your call?

Thanks,

Hadley

Hi Hadley, great question. To complicate things, I recently got approved for the US Bank FlexPerks Travel Rewards Gold American Express Credit Card and received the 30,000 bonus FlexPoints. When I log into my US Bank online account and go to the FlexPerks rewards portal, I can view household FlexPoints in one place and it also shows points from my recently downgraded US Bank FlexPerks Select+ American Express Credit Card. It looks like everything is linked correctly.

Hi Grant,

Did they hard pull credit report when you down grade from Visa to AE?

No hard pull on the downgrade.

Except now they claim they no longer do product changes nor reallocate credit lines. :/

Oh no, that is not good.

Also trying to downgrade or PC to Cash+, but the CSR insists the only options are redeeming 3,500 FP toward the AF or cancelling the card.

You should be able to downgrade to a no annual fee version. You might need to speak to a supervisor though.

When you did the downgrade from Visa Signature to AmEx Select+, did the rewards account number also change along with the card account number? And were the balances maintained through the conversion?

I did a similar conversion 2 days ago and I can no longer see the FlexPerks rewards account in my US bank account. I do see the product change and see the fee reversal though. And I know it is not a cancellation + new account because I can see the old card transaction history under the new credit card listing. I am worried about the rewards account and balance though (117k points in there)

The credit card number changed, but the FlexPerks account number stayed the same. As far as the points balance, I had redeemed almost all of my FlexPoints, so I only had a 1,000 FlexPoints or so. I’m not sure if anything happened to my balance. Call US Bank and see if they can provide more info or just wait a few days for the dust to settle.