Good morning everyone, happy Friday! I just finished listening to the Miles to Memories podcast (latest episode) and enjoyed listening to them talk about Disney when they redeem miles vs. pay cash for flights. I don’t have a hard and fast rule that I live by, so I thought it would be fun to share my travel philosophy of when I redeem miles vs. pay cash for flights. I specifically mention flights because I plan to write a similar article about hotels and didn’t want to make this article too long. Lastly, when I use the word cash, that could mean paying for the flight with a credit card, or paying with an airline gift card, or using credit card rewards to pay for the flight – basically anything other than booking an award ticket with airline miles.

I also think it is important to share how many credit card reward points I have, since my thinking would be much different if I had 1,000 Chase Ultimate Reward Points vs. 1 million Chase Ultimate Reward Points. With that said, here are my transferable points balances, as of March 2020, from smallest to largest:

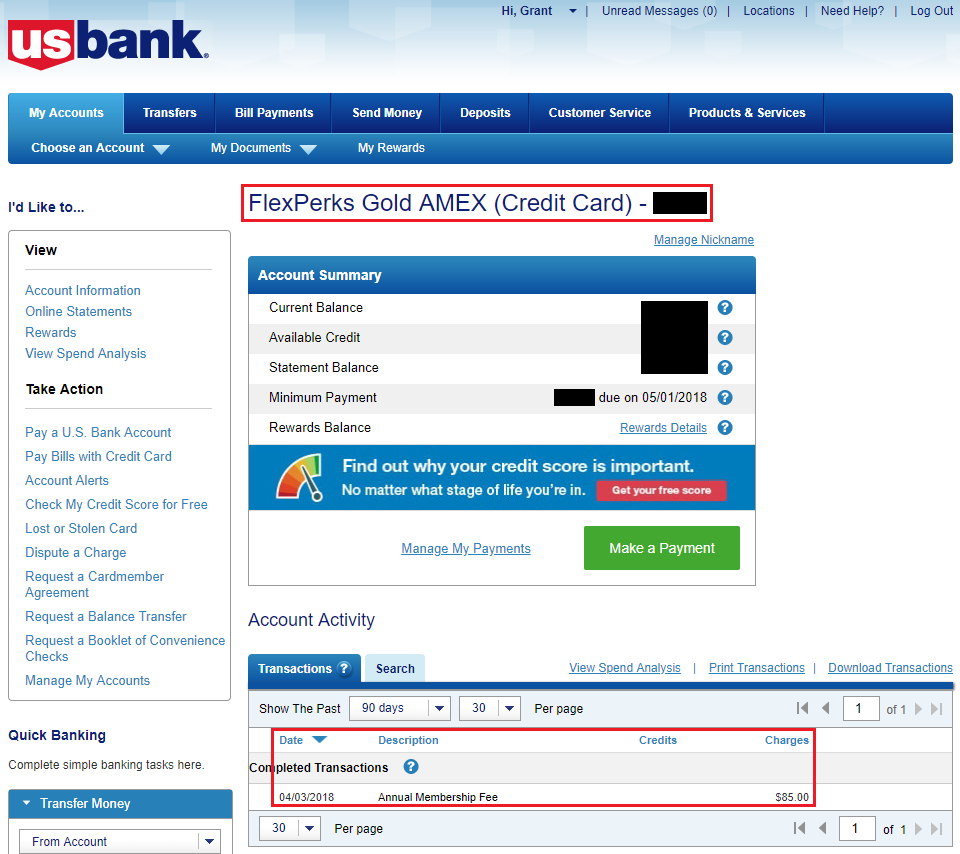

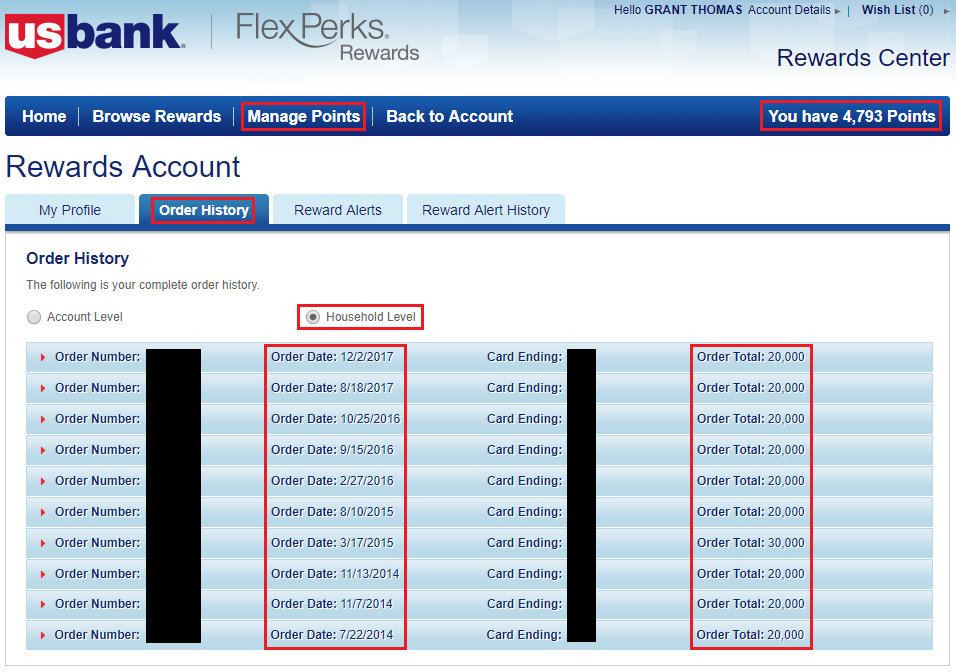

- 8K US Bank FlexPoints (worth ~$120 in travel, assuming 1.5 CPP with my US Bank Altitude Reserve Credit Card)

- 37K Capital One Reward Miles (Laura’s account) (worth ~$370 in travel, assuming 1 CPP)

- 115K Chase Ultimate Reward Points (worth ~$1,725 in travel, assuming 1.5 CPP with my Chase Sapphire Reserve Credit Card)

- 206K Citi Thank You Points (worth ~$2,575 in travel, assuming 1.25 CPP with my Citi Premier Credit Card)

- 290K American Express Membership Reward Points (worth ~$4,466 in travel, assuming 1.54 CPP with the 35% rebate from my American Express Business Platinum Charge Card)