Good morning everyone. After reading recent articles by Omar @ Travel Summary (It’s Time to Reduce Your Credit Card Annual Fees) and Doctor of Credit (Credit Card Annual Fee Due? Remember To Ask For A Retention Offer Before Cancelling), I decided to take a look at my credit cards, their annual fees, and whether or not they are worth keeping going forward. I will share my strategy for organizing my credit cards and my recent call with US Bank regarding my US Bank Altitude Reserve Credit Card.

I opened up my master credit card spreadsheet and looked at all the credit cards, debit cards, and authorized user cards in the table (68 total cards). I then removed all my debit cards and authorized user cards and was left with 42 credit cards in my name or Laura’s name. I then removed all the no annual fee credit cards and was left with 25 credit cards that have annual fees. The annual fees totaled $4,134. If you are curious about why we pay so much in annual fees, read I Paid $4,588 in Credit Card Annual Fees in 2019 & Was it Worth it? Here are the credit cards sorted by card name:

| Credit Card Name | AF | Credit Card Name | AF |

| AMEX Business Platinum | $595 | Chase Sapphire Reserve | $450 |

| AMEX Gold | $250 | Chase Southwest Airlines Priority (Laura) | $149 |

| AMEX Hilton Honors Aspire | $450 | Chase World of Hyatt (Laura) | $95 |

| AMEX Platinum Delta SkyMiles | $195 | Citi AT&T Access More 1 | $95 |

| Banco Popular Avianca Vuela | $149 | Citi AT&T Access More 2 | $95 |

| Bank of America Alaska Airlines (Laura) | $75 | Citi AT&T Access More 3 | $95 |

| Capital One Venture Rewards (Laura) | $59 | Citi Premier | $95 |

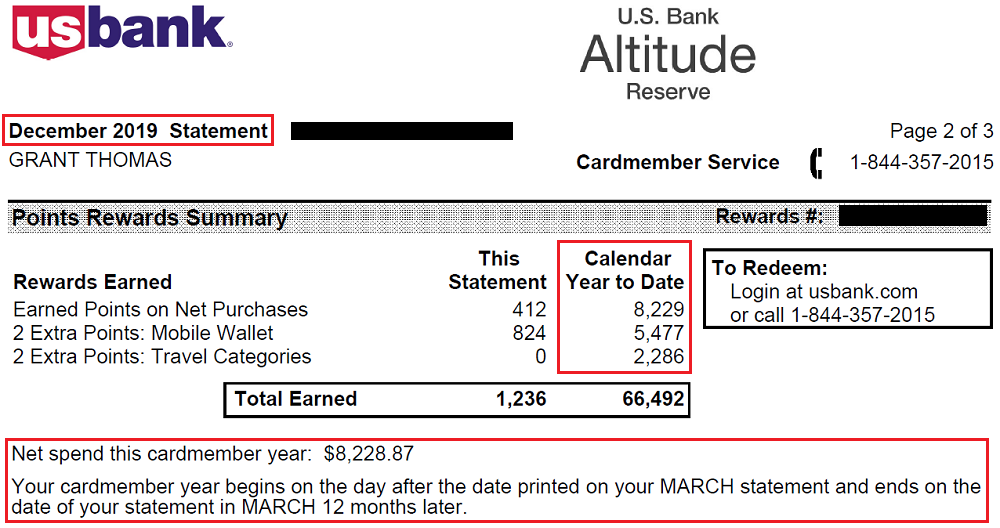

| Chase Hyatt Hotels | $75 | US Bank Altitude Reserve | $400 |

| Chase IHG Rewards Premier | $89 | US Bank Radisson Rewards Business | $60 |

| Chase IHG Rewards Select | $49 | US Bank Radisson Rewards Premier Visa Sig 1 | $75 |

| Chase Ink Plus | $95 | US Bank Radisson Rewards Premier Visa Sig 2 | $75 |

| Chase Marriott Bonvoy Boundless | $95 | Wells Fargo Propel World | $175 |

| Chase Marriott Bonvoy Premier Plus Business | $99 | Total Annual Fees | $4,134 |