Good Sunday morning everyone, I wanted to bring your attention to a new feature on the Boarding Area home page called Explore Categories. Last week when I visited the House Of Miles, Randy Peterson and I spoke about adding a new category on Boarding Area called Manufactured Spending (link). The new category just went live a few days ago and you can see all the latest Manufactured Spending posts from all the Boarding Area / Prior2Boarding bloggers. Since half of my posts are about Manufactured Spending, you will see a lot of my posts in that category.

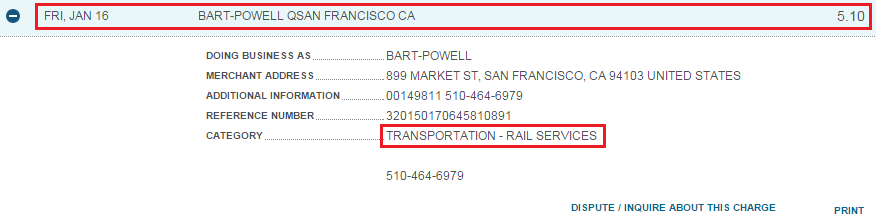

In other news, I was a bad manufactured spender this month. I have been taking BART (Bay Area Rapid Transport) all month without realizing that the transaction posted as TRANSPORTATION-RAIL SERVICES to my American Express credit card.

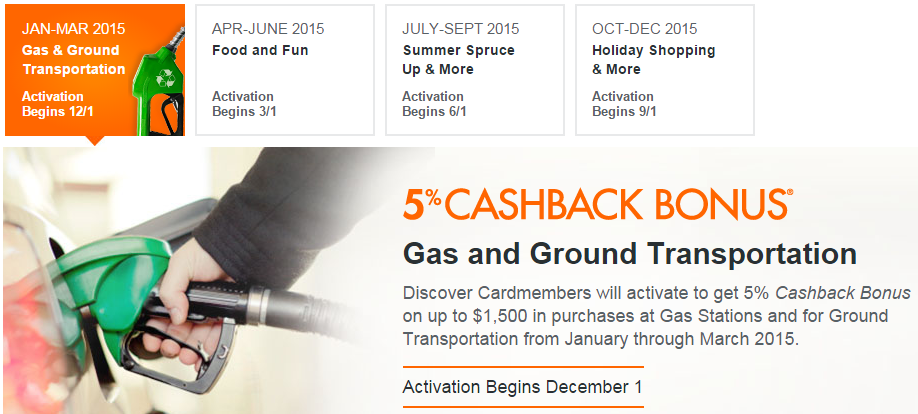

The Discover It Credit Card is paying out 5% cash back on all gas and ground transportation purchases this quarter (January 1 through March 31). According to Discover: Ground Transportation is defined as: local and suburban commuter transportation, including ferries; passenger railways; taxicabs, limousines and rental cars; charter/tour bus lines.

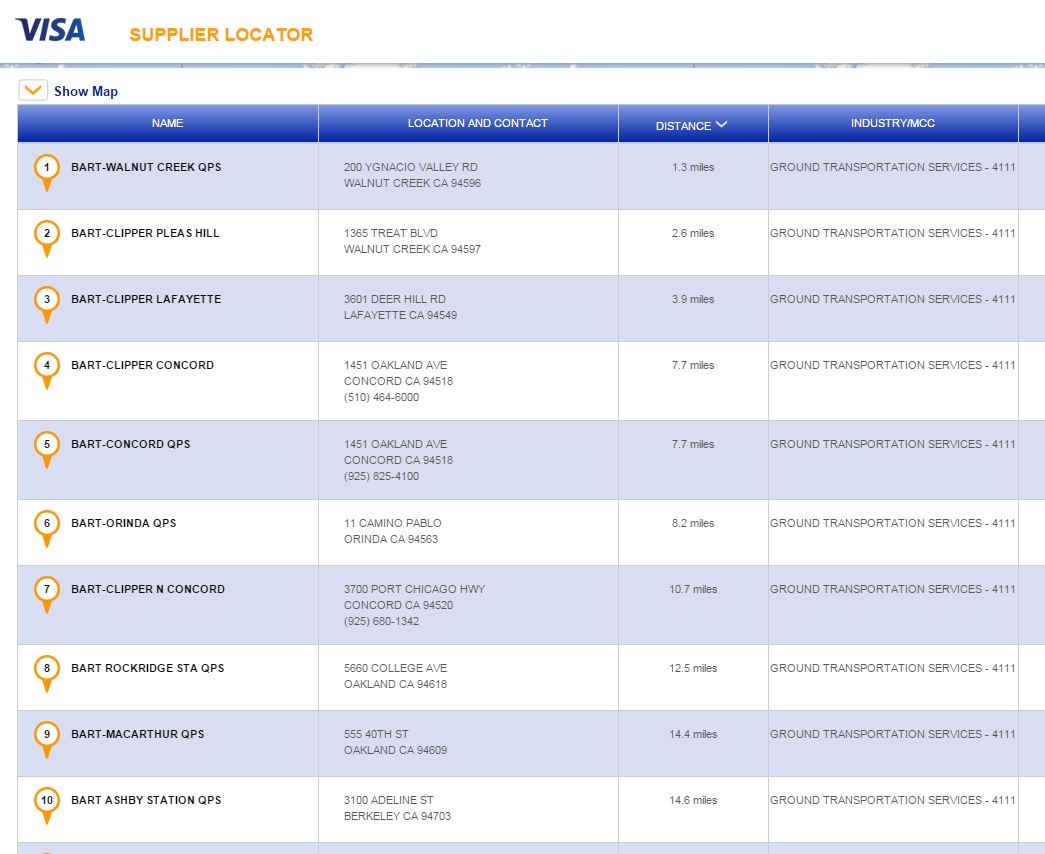

I checked on the Visa Supplier Locator website (helpful tutorial here) to see what BART is classified as for Visa. The MCC (merchant categorization code) says GROUND TRANSPORTATION SERVICES which sounds very similar to how American Express is categorizing BART. I hope Discover uses the same MCC, which I bet they are. I won’t know for sure until my January statement closes in early February. I will let you know what the results are at that time.

Learn more about Discover It, Chase Freedom, and Citi Dividend cash back cards here.

If you have any questions, please leave a comment below. Have a great weekend and go (insert best football team currently in the playoffs)!

could you look into if 7-11 qualifies as Gas for Discover ? thanks

There are no 7-11 near me to try :(

It does, Chuck tested this out last year: http://www.doctorofcredit.com/does-discover-count-7-eleven-as-a-gas-station/

Thanks Will, I’ll check it out.

I tried to buy a Paypal My Cash card from 7-11 today and they said they must be purchased with cash only, same with the Vanilla Reload. :(

I see, there are a few 7-11 by me so I might give it a try.

I’m pretty sure 7-11’s system is hard coded not to allow credit when buying PayPal My Cash or Vanilla Reload. The system WILL allow you to purchase One Vanilla gift cards with credit (max of two $500 cards per transaction), assuming the cashier doesn’t balk for some reason (mine never do). These can be liquidated by paying bills on Evolve Money that you unwise couldn’t pay with a credit card. Of course, YMMV so you have to try some of these things yourself at your local 7-11 and see what works.

Thanks for the data point, I have a few 7-11’s nearby that I can try.

I think “manufacturing spend” is different than using the appropriate card to maximize bonuses for transactions you’re making anyhow.

@choi: My nearest 7 Eleven (which doesn’t have fuel) posts as “service station” which Discover includes for this quarter’s cash back bonus.

You are probably right Hua. I think the proper term is category bonuses, in this case, I used the wrong card and missed out on the category bonus.

I can also confirm that 7-11 posts as a gas station in my area. I recommend making a small test purchase and seeing how Discover reports it on your statement. This makes Discover great for buying One Vanilla’s in my area where they take credit cards for them. Be advised, though, that their payment system will only allow you to buy two $500 cards at a time.

Thanks for the data point Smitty. Glad you have had success buying VGCs.

If your workplace has a pre-tax commuter benefit plan (and it’s been mandated in the Bay Area for those above 50 employees or so) you should get a debit card loaded with money and buy your transit fare pre tax. They are debit cards from Wageworks, Commuter Check, or one of those entities. The debit cards are good on transit nationwide and also Amtrak. The caveat is that they usually take 60 days or more to load because you have to make an election, get the money deducted from your paycheck, and then transfer the money to the plan. You also lose the money when you leave your employer, but you can load it to transit stored value before they shut off your card.

Thanks for sharing Hank, i had no idea that existed.

Ask your HR department or look at your work intranet or portal for more details. https://commuterbenefits.511.org/

Most employers pick Option 1 because they don’t have to do anything other than make the benefit available (i.e., they don’t have to contribute to the pre-tax account, just make deductions available for the employee to select). There is a fee for the third party provider but that is offset by not having to pay Social Security and Medicare tax for the amount contributed to the account. If you get a benefit card, you are supposed to use it for commuting purposes only, however the card is valid for Amtrak purchases as well as for transit nationwide (I’ve used my card to ride Airtrain to JFK and in Boston for the subway, for instance).

Great to hear, thanks for all tge helpful information.

Grant, I have a few 7-11s in my area, but none of them take credit cards for gift card purchases. Also, thanks to you, I got my $50 cashback from discover last quarter for buying gift cards from giftcardmall.com

I’m glad you were able to max out the 5% cash back last quarter. Chase Freedom is very simple to max out tgis quarter as well.

Use Amex OBC and reload clipper card at Walgreens

I didn’t know that was possible. Great idea though!

Is this a Bay area specific thing? Or another potential MS strategy? What is Amex OBC? It is old blue card?

Yes, this is strictly a Bay Area deal.

It’s not a MS technique, but good way to reduce transportation costs. Add in commuter tax benefit from your employer and pay transportation pre-tax, but the 5% CB on the full price.

Very true, great concept to save money on BART rides.