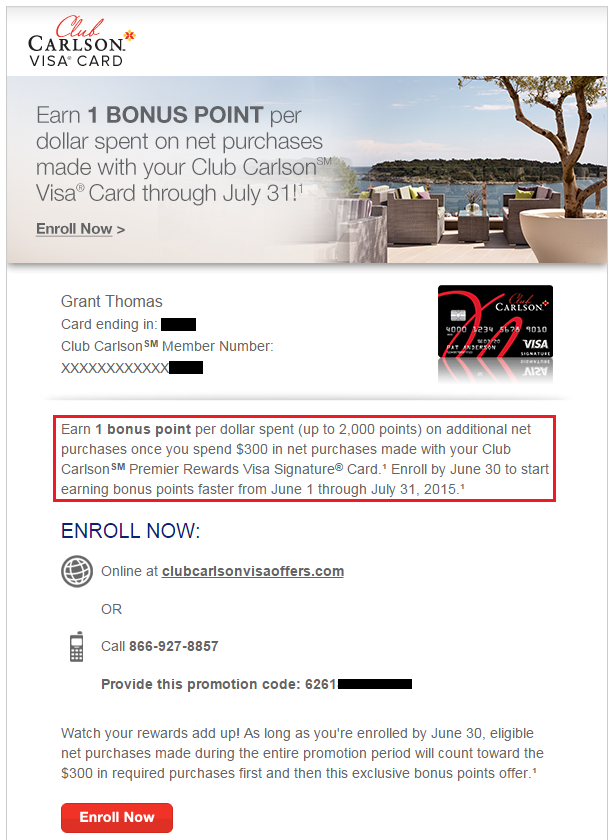

Good evening everyone, thank you to everyone who has shared their thoughts on my earlier post: Ever Stayed at Club Carlson Hotels in LHR, CDG, NCE, ZRH, DUB, CPH, OSL, or BGO? I just received an email from Club Carlson regarding a targeted offer on my US Bank Club Carlson Personal Credit Card. If you have any US Bank Club Carlson credit cards, look for an email from 1800USBanks@email.usbank.com with the subject line Earn Bonus Points on Purchases.

The bonus I received is nothing special. I can earn up to 2,000 bonus points by spending $2,300 over the next 2 months. Since my next US Bank Club Carlson statement closes around June 4, there is no time to earn the bonus points before the May 31 / June 1 Club Carlson devaluation. Therefore, I am going to sit this promo out. There might be better spending offers available, so check your email and spam folders. If you receive a better offer, please let me know in the comments. Have a good night everyone.

I received one, but says once I spend $500 not $300!!

Does it have the same 1x up to 2,000 bonus points?

Yap! All the other part is same.

Gotcha. Lame offer.

My email was exactly the same as yours, except it is once I spend $50. I hardly ever use the card so perhaps it is based on how much you have put on it before?

I think you are right. I haven’t used my CC for a while, so they want me to start using it again. Too bad the offer is not worth the spend.

I got 5X on restaurants up to 5000 pts. My husband only got 1X after $1100 spent.

Thank you Val. The 5x at restaurants seems to be a popular offer. Will you go after either offer?

Pingback: New Club Carlson Credit Card Spending Bonus Offers - Miles to Memories

I got one but I have to spend $850 to start earning 2000 bonus points. I heavily used it in the last 3 months so that explains the poor offer. I think I’ll pass.

Thanks for sharing, Dimi. That offer is no good :(

Wow. I guess mine is the worst. I have to spend $4000 to get to the 2000 points to start accumulating. I must of spent too much on the card preparing for the summer trips. I also had a similar offer a few months back with a large spend required. I guess they don’t like to reward people for using their card.

That is a terrible offer. Seems like the more you spend on the card, the worse your spend offer will be.