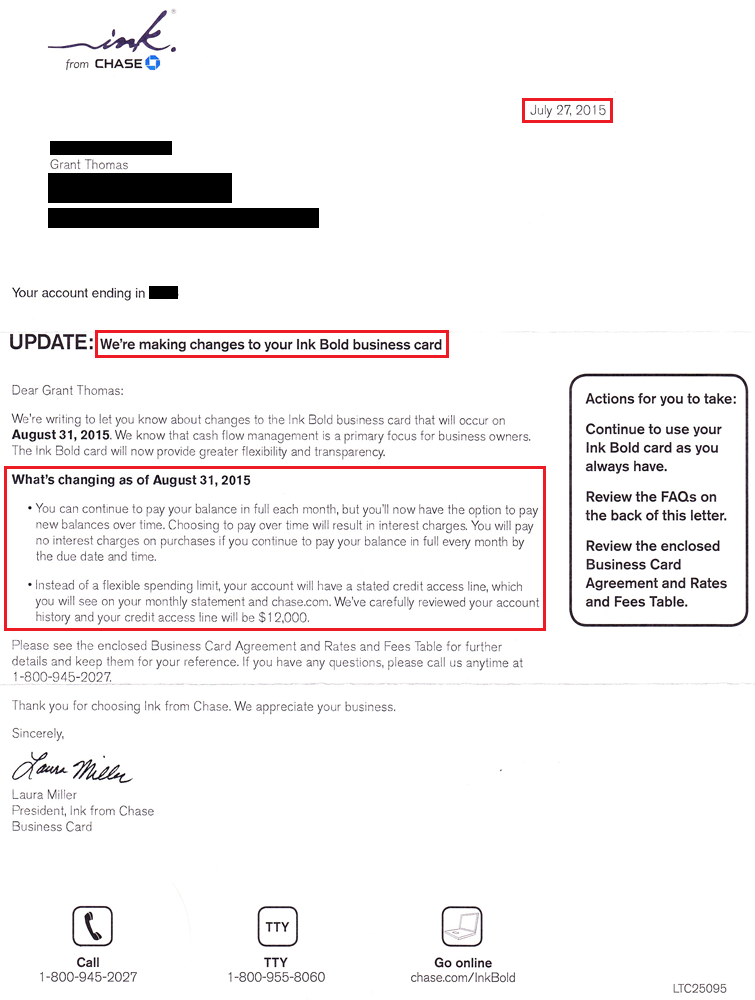

Good evening everyone, I just got home and checked my mailbox. Inside, there was a letter from Chase with details about upcoming changes to the Chase Ink Bold Business Charge Card, effective August 31, 2015. Here is the summary of both changes:

- Currently, the Chase Ink Bold is a charge card, meaning you must pay your balance in full, otherwise you will be charged a fee. The new Chase Ink Bold will allow you to pay your balance over time (instead of being charged a fee, you will instead pay interest on any balance that is not paid in full by your payment due date).

- Currently, the Chase Ink Bold has a flexible spending limit whereby you are allowed to go over your preset spending limit. The new Chase Ink Bold will have a stated credit access line (aka a credit line/limit) that will be shown on your monthly statement.

In summary, if you pay your balance in full every month and do not go over your stated credit access line, then these changes do not affect you. This looks like Chase’s attempt to slowly transform the Chase Ink Bold into a Chase Ink Plus, which makes sense since only the Chase Ink Plus and Chase Ink Cash business cards are currently available for new applications.

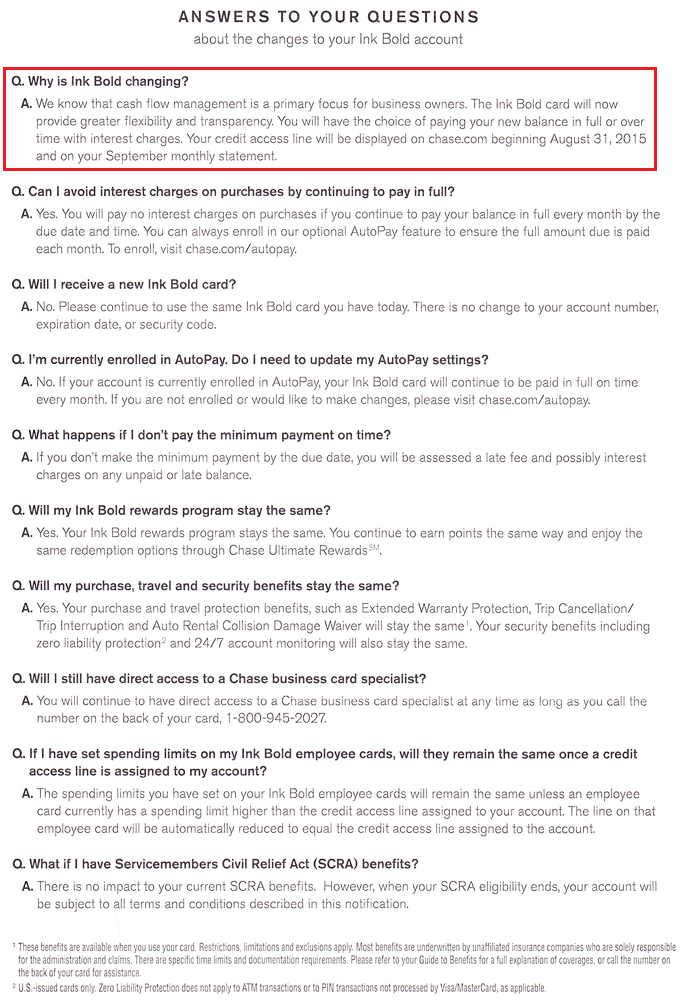

Here is the back of the letter with a few questions and answers. Nothing surprising here, except that this change creates “greater flexibility and transparency” for my Chase Ink Bold Business Charge Card. What if I want less flexibility and transparency? I’m fine with the current level of flexibility and transparency of my Chase Ink Bold Business Charge Card.

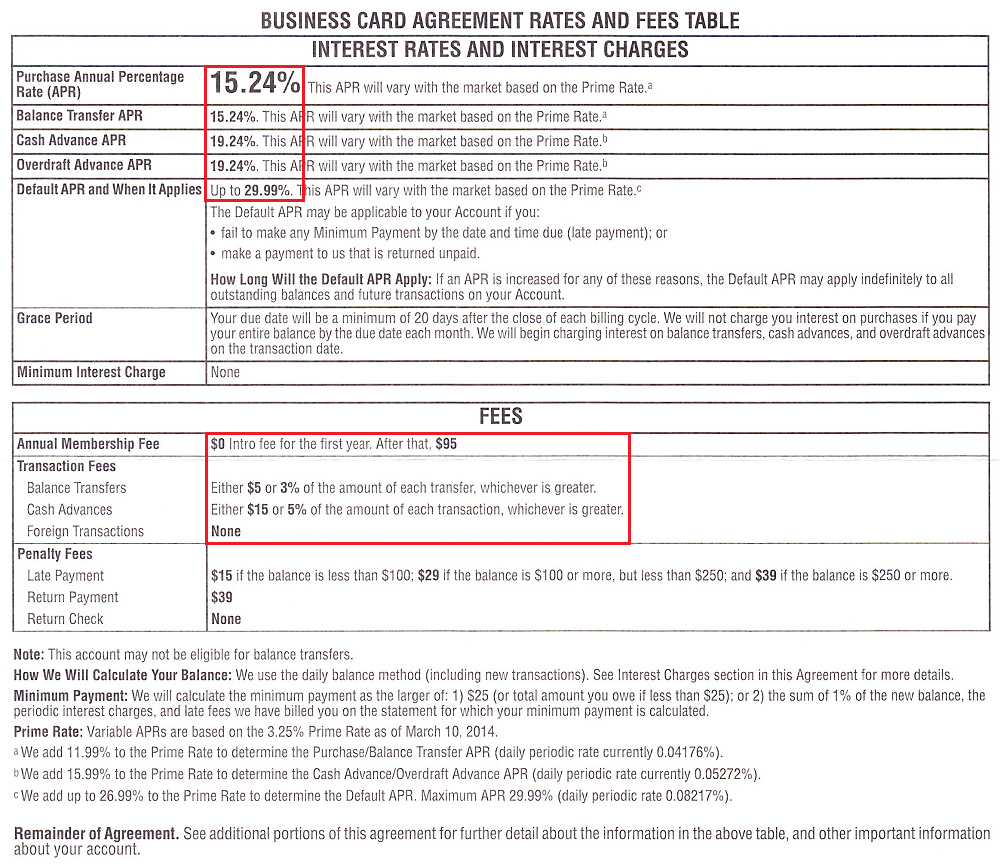

Last but not least, here is the second letter showing interest rates, annual fees, and other fees. Nothing appears to have changed in that department, except for the fact that I now know what my interest rate is now (previously I had no idea, nor did I care to know).

If you have a Chase Ink Bold Business Charge Card, you will probably receive a similar letter in the next few days. I also have a Chase Ink Plus Business Credit Card, but I have not received any letter or documentation about any upcoming changes.

If you have any questions, please leave a comment below. Have a great weekend everyone!

So what excuse do I use now to get an Ink Plus?

Good question! Maybe you want a business card with a lower interest rate (the Chase Ink Plus might be lower)?

I wonder if they will wave the AF the first year starting from August 31.

Unlikely, Chase will probably say this is an enhancement, not a negative change.

Scary. I have used this card extensively for years, but if they set a preset limit it may limit my business. It may also explain what happened recently when they suddenly changed my limit from 65K to 30K without warning (there was always a limit, but it was hidden and moved around). I got this card because it was a charge card, not a credit card.

Also, there have been major problems with the dates changing for when the year begins for bonuses. It was originally based on when you got the card. Then it was calendar year. They then changed it again to a date in February that has nothing to do with my account. I have letters from Chase confirming that all three dates are correct and all three letters contradict each other. Each time they keep changing it to slow down bonuses. Chase Ink Bold was by far my favorite card until about a year ago, but this may be the last straw.

That is very strange that you got 3 different letters stating 3 different dates. That wouldn’t bother me much, since I spend less than $4,000/month, so I would never spend more than $50,000 in a rolling 12 month period. That sure does screw up your plan if you want to earn lots of Chase UR Points though.

@grant

i have both inks. & 3 other chase personals.

annual fee due on 1 of the personals in 1 month. want to apply for UA biz 50k bonus, but im paranoid about being denied.

it will have had been 6mos since my last app round.

-any point in offering to sacrifice a personal in lieu of opening a biz in your opinion?

thanks!

I don’t have any experience applying for any Chase business cards other than my Chase Ink Bold and Plus from last year. I’m not sure if Chase can move credit lines from a personal card to a business card. Just apply for the business card, plan on calling the reconsideration number to approve the card, and hope for the best. Good luck!

I’ve moved CL from personal to business for my Bold to open the card on the reconsideration line to expedite. But, that had been several years ago.

I believe Business to Personal is next to impossible.

Thanks for sharing your experience. I was going to ask if that was a recent application, but you answered that question already. Based on reports from other banks, it is very difficult to move credit lines from business to personal (and between charge cards and credit cards).

It was Freedom to Bold (credit card to charge card).

It’s just too bad losing the charge card of theirs. The Bold is useful in that every month they do account review for hard limit (there’s an internal limit for how much you can spend per month. It can go up or down). Now, I guess CLI needs a HP :(

My spending pattern is pretty much the same from month to month, so I did not have any need for the limit to change from month to month. For some businesses, I could see that as an important feature of the charge card.

How come my post was removed? It was on point and not offensive. It appeared for several minutes and then disappeared.

Hi CarlH, your first comment went to pending since I have to manually approve every comment from a new commenter. You should see all future comments post immediately and not have to worry about anything in the future. Thank you for reading and commenting on this post.

Hey Grant…you’re post seems a little petulant. It wouldn’t have anything to do with the fact that you didn’t get approved for the CSP? ;-) #chaseloveaffairending LOL

Haha, thanks Bill. I had to look up the word petulant on google ((of a person or their manner) childishly sulky or bad-tempered.) that word accurately describes me and the post :)

So would this be a good chance to apply for the Ink Plus since that seems to be where the Ink Bold is headed anyways? You’d pickup 50k points in the process if you could actually get approved.

Ehh, this change does not really make is any more enticing to apply for the Ink Plus than before. Plus the difficulty of getting approved might be a challenge.

Have they tightened up that much on Biz approvals? I have a legit small biz with 200k+ in annual revenues. But I do have a few hard inquiries over the past 2 years.

I’m sorry, but I don’t have enough info to say whether Chase is getting more strict on approving business cards.

Pingback: Chase Ink Bold Business Card now Shows Credit Line and Cash Advance Limit | Travel with Grant