(Hat Tip to Mike for the idea)

Good morning everyone. A few days ago, I wrote US Bank Club Carlson Visa Signature and Business Cardholders Receiving Free Night E-Certificate (Different from Anniversary Night Certificates) which showed that US Bank / Club Carlson is sending out free night certificates to cardholders. I received a letter for my US Bank Club Carlson Premier Rewards Visa Signature Credit Card and my US Bank Club Carlson Business Rewards Visa Credit Card. Other readers commented that the no annual fee US Bank Club Carlson Rewards Visa Credit Card also received a free night certificate.

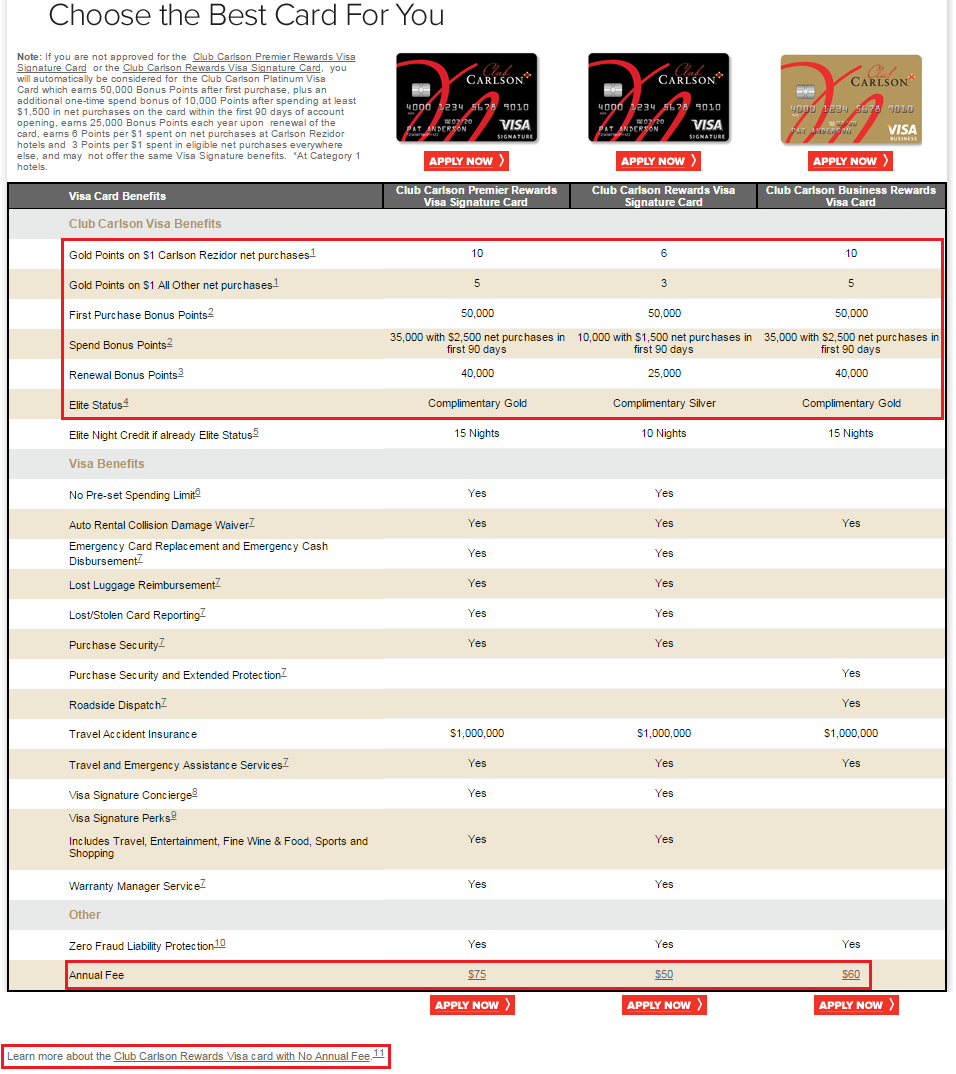

That got me thinking… if everyone got a free night certificate, is the US Bank Club Carlson Premier Rewards Visa Signature Credit Card worth $75 more than the no annual fee US Bank Club Carlson Rewards Visa Credit Card? If you look at the Club Carlson credit card comparison page, you will only see the 3 versions that have annual fees. If you scroll all the way to the bottom of the page, click the link to view the no annual fee Club Carlson credit card.

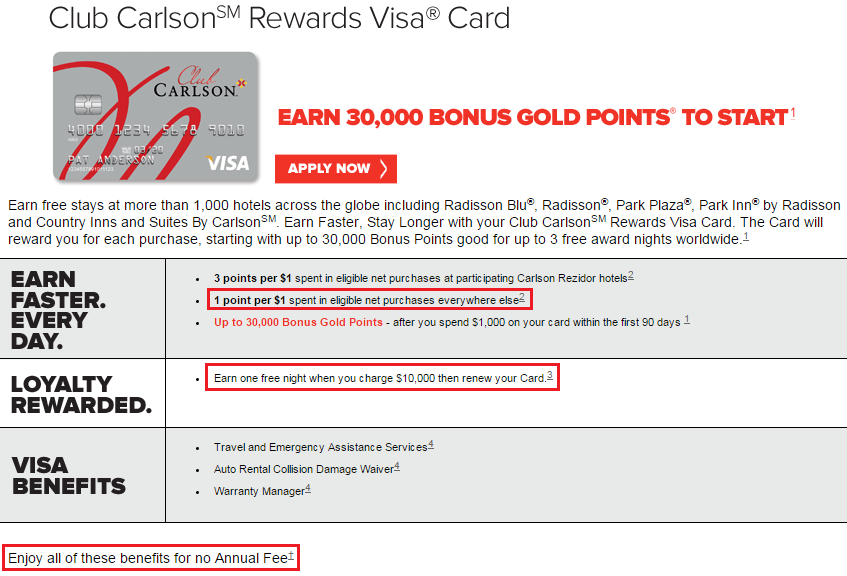

The no annual fee US Bank Club Carlson Rewards Visa Credit Card offers a free night certificate every year you spend $10,000 on the credit card, 3x at Club Carlson properties, and 1x on everything else. Ignoring the sign up bonus, here is what you would get for spending $10,000 per year on this credit card:

- 1 Free Night Certificate (valid only in the United States)

- 10,000 Club Carlson Points ($10,000 spend at 1x)

- No Annual Fee

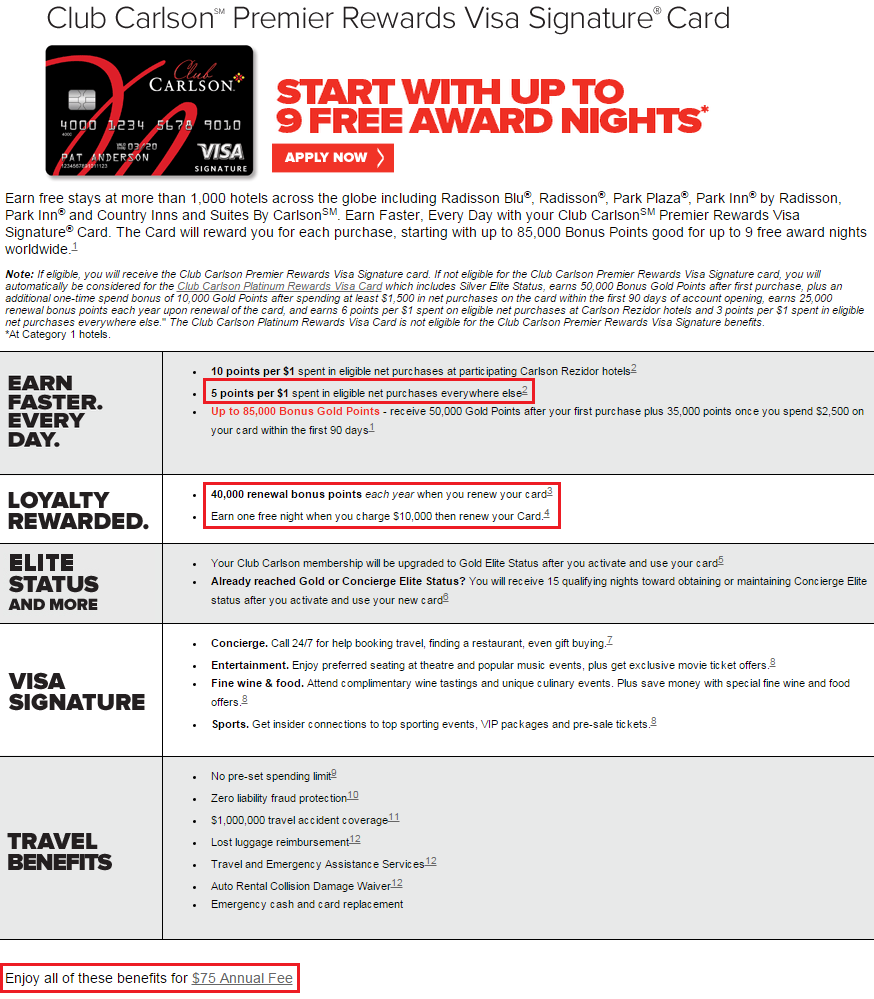

Ignoring the sign up bonus on the US Bank Club Carlson Premier Rewards Visa Signature Credit Card, here is what you would get for spending $10,000 per year on this credit card:

- 1 Free Night Certificate (valid only in the United States)

- 50,000 Club Carlson Points ($10,000 spend at 5x)

- 40,000 Club Carlson Points (anniversary / renewal bonus)

- $75 Annual Fee

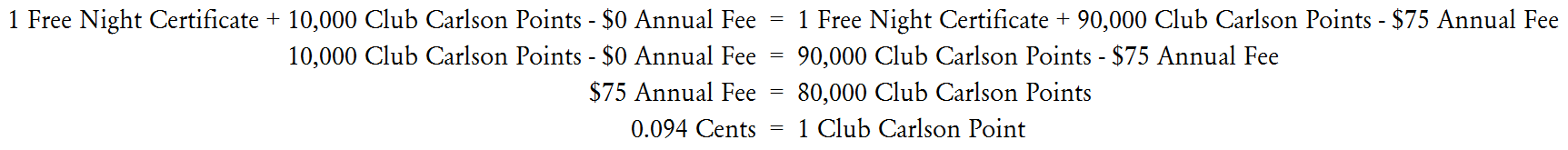

Let’s pretend this is a math formula and see if we can determine what the annual fee is worth. On the left, we have the no annual fee credit card; and on the right, we have the $75 annual fee card. If we cancel out the free night certificate, subtract 10,000 Club Carlson points, and add the $75 annual fee to both sides, we can solve for the $75 annual fee. By paying the $75 annual fee, we get an extra 80,000 Club Carlson Points, which comes down to 0.094 cents per point (roughly 10.6 Club Carlson Points per penny).

I should also mention that the $75 annual fee credit card comes with Club Carlson Gold Elite Status, while the no annual fee credit card gives you Club Carlson Red Elite Status. I’ve stayed at a few Club Carlson properties and the Gold Elite Status is pretty pathetic, so I don’t place much value on the status. Now if Club Carlson offered Gold Elite members free breakfast, that might be a different story.

On a side note, I think the best Club Carlson credit card is the US Bank Club Carlson Business Rewards Visa Credit Card. It has all the perks of the US Bank Club Carlson Premier Rewards Visa Signature Credit Card, but the annual fee is only $60, not $75. For completeness, if I replaced the annual fees in the above math equation, the answer would be $60 = 80,000 Club Carlson Points, or 0.075 cents per point (roughly 13.3 Club Carlson Points per penny). After looking at the numbers, I think I will keep both of my Club Carlson credit cards as is and not cancel or downgrade either credit card.

Do you agree or disagree with my thought process? If you have any questions, please leave a comment below. Have a great day everyone!

Thanks for mentioning the free night after $10,000 spend on the card, Grant, I did not know that and I have the card!

Nevertheless, I only got the card as it, too, afforded the extra free night on award bookings and now that it is gone, I was SD it until I found out that having the card, as per a DOC post, also permitted free checking from US Bank.

I’m not sure the card is valuable for anything more than that, though, as most people are looking to unload CC points now, not earn them, and with the Citi Prestige, I earn more by using that card at CC hotels than I do with the CC credit card!

Ahh yes, the US Bank checking account monthly fee is waived if you have a US Bank credit card.

I have to disagree that Gold Elite status is pathetic. Certainly it’s nowhere near as valuable as SPG Gold or Hilton Gold, but most of the time I do get a room upgrade. This plus the 35% point bonus and late check out makes it decent enough. If you figure the 40,000 point renewal bonus basically wipes out the annual fee, you could argue Gold status is pretty much free. I’ll take what I can get.

I was being a bit dramatic calling Gold Elite Status pathetic. I definitely doesn’t compare to gold status from other hotel chains, but it is definitely far from worthless.

What you say is correct however, the problem with CC is that it does not have a great presence here in the USA and certainly not with respect to top tier properties.

Although one can find Country Inns in relative abundance in the USA, they are in markets that also have competitors from other chains that you can spend your lodging dollar.

Consequently, CC strength was overseas and with the withdrawal l of the second night free, there really is no incentive for someone to put spend on their card here to earn at most a free night in the USA — when one can earn something similar with that same $10,000 spend — be it via MS or regular spend — and that is with the Citi HHonors card, to name but one.

Now, you value those points earned from the annual fee, and that is fine, but others don’t place that much of a high value on them anymore and are looking to unload those points, not earn more — it is simply based on one’s perspective as to whether patronizing CC properties and putting $$ on the card is worth it to them, when there are other lodging and credit card choices that can be had.

Thank you for your input Horace. I agree that the best Club Carlson properties are outside the US. If after the first year, I find little value with the Club Carlson credit card, I can certain downgrade or cancel the credit card. I will reevaluate in 12 months.

I think there is no downside to downgrading — from what I understand, keeping the card longer only enhances your credit history — even if you put little if any spend on it.

It provides an avenue towards free checking as mentioned above and who knows, having it might just target you for some sort of gift or bonus, like the one we just saw!

Along these lines, having one US Bank product also may make it helpful to obtain others, such as additional US Bank credit cards.

It definitely helped me get my latest US Bank credit card.

Exactly!

Even without MSing, I think I’m going to hold on to both my personal and business visa signature cards – I think I can get more than $60-75 out of the anniversary bonuses, even without the second night free benefit.

Sounds good Tonei, I’m holding onto my cards too.

I think you should compare the the $10K spend at 0.4cents (Club Carlson point value) and getting the free night at US CC properties against, let’s say, $10K spend for a 2% reward card (Citi dbl cash-no fee) or SPG pts@2.4cents and see how much you come out for a annual fee card (in addition to the 2 cards from Club Carlson). For lot of folks, $10K spend is a lot..so need to make sure getting the best value (i.e. will not spend $10K for Hilton)..

It is an individual choice, no doubt, but your valuing CC points @ .04 cents each is too high in my book, others may simply disagree.

I look at it this way, you are paying $75 Annual fee for 40,000 CC points and then an additional 50,000 CC points and the free night in the US for that 10,000 spend. To the best of my knowledge, US Bank does not waive the CC credit card fee. So, at the end of the day, you have 90,000 CC points plus 1 Free Night for the $75 annual fee and $10,000 spend on the card — not too shabby!! — if you wish to collect CC points, that is.

With the Citi HHonors Card, you pay a $95 annual fee and get automatic Gold and free breakfast and if you put $10,000 on the card, you get 1 free weekend night at most HHonors properties and at a minimum 30,000 HHonors points.

Now, I have read, but have just received my HHonors card so have not tried this yet, that Citi is pretty lenient with respect to offering retention bonuses or fee waivers.

So, one might find that the annual fee will be waived or reduced in some way to negate the $95 annual fee.

Therefore, one might find themselves with something resembling the following — and this is pure speculation —

1). 90,000 CC points and 1 free night at a US property for $75 and $10,000 spend

vs.

2). 30,000 HHonors points and 1 free worldwide weekend night and HHonors Gold status = Free Breakfasts and possible room upgrades for $10,000 spend and potentially $0 annual fee.

I grant you that it depends on your perspective, but if you are a US or worldwide traveler you will encounter far more Hilton family properties that CC properties — that goes without saying.

Second, if you have a family or plan on traveling with more than just 1 or 2 Hilton stays under your belt, then the free breakfasts are likely to add considerable value to your holding the Citi Reserve card.

30,000 HHonors points are not worth much and 90,000 points can buy you 1 night at the best of the CC properties, so at the end of the day, you have to decide whether CC or Hilton is the best one for you.

For me, centered in the USA, the opportunity to use 1 weekend night at top tier properties and have free breakfast by putting $10,000 on the Citi Reserve credit card whose annual fee may be waived by Citi beats having to pay $75 for the privilege of holding the CC credit card and using those points at a top tier CC property — where I definitely will not get free breakfast, nor likely much if any upgrade — as well as 1 free night at a US CC property just does not hold much interest, and even less value, but the choice is there for those to make — however, your travel plans/interests best suit your needs.

I will note that they are pretty close when it comes down to it, but I am more interested in running off my CC account balance and basically be done with program and direct my attention to programs that have a far greater distribution of hotels worldwide, but that, again is a personal choice.

I’m still hopeful that Club Carlson will allow the free night certificates to be used internationally. I hope I am right…

That’s a good point, but I would disagree that $10k spend is not that much (using MS).

Oh, I did not mean to say that it was a lot or a little, just that it is the threshold for essentially a free night for either credit card — each individual makes the decision whether they can support those terms and where to apply their funds, be it MS or regular.

I certainly understand that $10,000 smackers is not a small sum, but having read about MS — though as I have said elsewhere — I only intent to go after the low hanging fruit and then only as a means to pay of bills that I could not do so via a credit card, so via using Serve and the like.

Not everyone got the free night… i’m one who didn’t…

I called to complain about the loss of the 2nd night free — which was a benefit of the no fee card, as well, so I lost something in their decision.

Perhaps they kept a database of those who called to complain and only those who did so, are getting the free night certificate?

Yes, that seems like a logical approach. I’m sure a small group of people complained.

I’m sorry you didn’t get a free night certificate. Did you get bonus Club Carlson points?

I sent a complaint about not getting the free night certificate on the heels of losing the 2nd night free benefit to Club Carlson through their website. No response. Should I have directed my complaint to US Bank instead?

Yes, call US Bank directly.

Forget about the spend – to me it is a deal breaker between the two versions of this card. With a $75 fee I automatically get 40,000 points upon renewal and without spending a dime. 40,000 points could be easily translated into at least a $200+ hotel room anywhere. So, I come ahead without too much work whereas not so much with a no-fee card where I still have to spend nearly $1,000 a month and get “an opportunity” to stay in a Cat 1 hotel (9,000 points required).

The free e-certificate is not guaranteed in the future. It sounds like right now US Bank is trying to shut up all the bad publicity it has created but is doing it in a highly inconsistent matter of “applying oil to the squeaking wheels”, i.e. complaining members. I, for example, got neither a letter nor an e-certificate. In 12 months all this devaluation noise is going to die down and there will be no need to for them to issue those certs.

Well, I disagree with your assessment about the value of the 40,000 points but could luck to you in your endeavors.

Since I am sitting on large amounts of points from each of the Big 4 hotel programs, it makes little sense for me to accumulate more points in yet another program, especially if I have to:

1). Pay $75.00 for those points;

2). Those points were essentially halved in value by the loss of the 2nd night free aspect of the card; and

3). The best utilization of those points are at properties overseas since domestically there are not all that many nice CC properties that I wish to stay at (I live in the NYC area so no need of the Martinique, and frankly, going to stay 1 night in Philly or Chicago is not in the cards. and

4). The remaining domestic properties are fair and have plenty of competition from other chains that I do have points/status.

But if CC figure into your travel plans in the future, go for it, it is not a bad deal.

You are right that the free night certificate is a last ditch effort to please the complainers. I’m not expecting another free night certificate in the future, though that would be very nice.

Not everyone got the free night e-cert. We didn’t. We hold the $75 version.

Thanks for the data point, PT. Did you call US Bank after the devaluation was announced?

Yes, we called and had no success getting the 7,500 points. Only was told about the 30,000 bonus points with the next stay, which we did get. Haven’t checked online to see if e-cert deposited in last couple of days. Last time I checked it was not there. Last name is at the end of the alphabet, maybe that’s it! I’ll call next week.

Good luck PT, I hope you get your free night certificate :)

Not worth paying the AF at all. The free cert is only good at US locations, which are mostly very undesirable, and fairly cheap anyway. Not only do you have to pay the $75, you lose out on the cash back for $10K in spend, which could be as much as $220. So you are paying $275 for a free night probably worth $90. Not counting that if you just pay for the stay, you will get points for the spend, and if you stay on an award you won’t. Finally, at 10K bonus points per year, you will get enough “free” points for a night at a 70K points premium European hotel once every SEVEN YEARS. :(

Much better to just cancel the card, wait six months, and reapply. If you get approved your AF will get you enough sign up points for a night at a premium European property. If you don’t get approved, you are not really missing out anything worthwhile anyway.

I don’t wholly disagree with your outcome analysis, but you have made some errors. The no fee earns 3 points per $ and the others, 5 points per $$ so, one would not have 10,000 points at the end of the day with that spend but either 30,000 or 50,000 points — still not enough as I pointed out above for a decent CC property, but not the 10,000 points you alluded to above.

Moreover, US Bank in particular is not a bank to “churn,” and the others are tightening up on this practice. So your expectation of doing so works in theory, not in practice.

In any event, as I have outlined above, I don’t think it really worth it to go after, but still better to hold onto the card for the benefits it can bring you with respect to other US Bank financial products, or the odd CC stay that you might have, especially if they run any sort of promotion with use of the CC Visa card as a payment option.

As for me, the 3 TY points/$$ earned as a result of the Citi Prestige card, far outweigh even the modest 3X or 5X mulitplier that the CC cards can provide — even at their own hotels!!

I believe the no AF Club Carlson CC is 1x everywhere, not 3x or 5x.

Ahh, yes you are right — i stand corrected.

Still not much of a deal, anyway, then even less.

Best to SD the card and wait if it brings anything other than for what it is intended!

Also, not worth the hard pull to “churn” the card.

CC points have for most, outlived their usefulness.