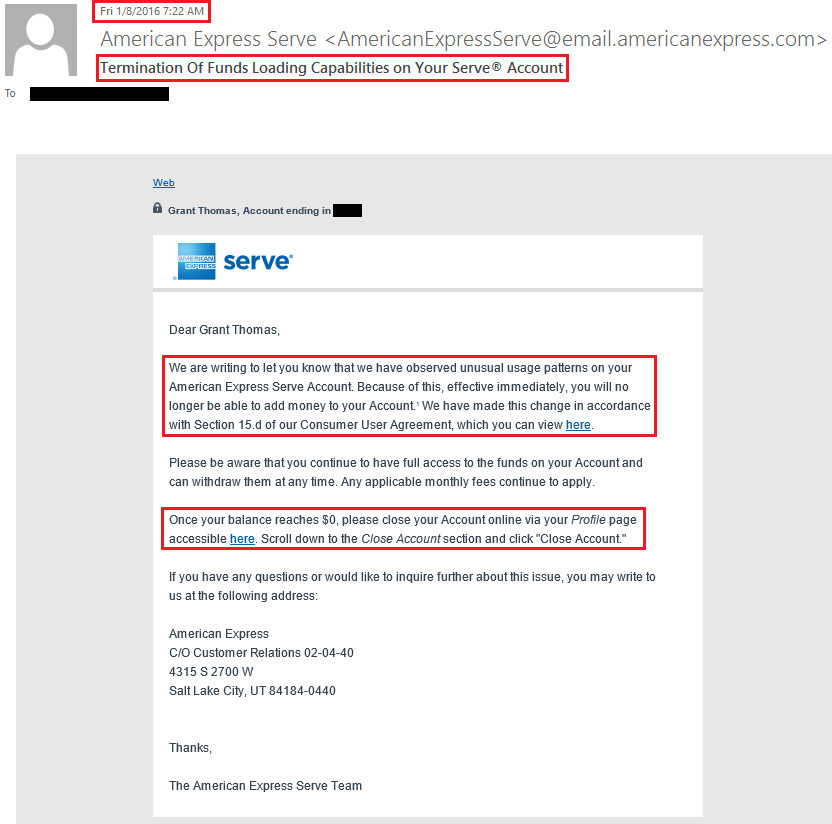

Black Friday! No, not the busiest shopping day of the year, but the day AMEX Serve sent out mass account closure emails with the subject line “Termination Of Funds Loading Capabilities on Your Serve® Account.” My account was flagged due to “observed unusual usage patterns.” I will explain what I was doing below, but here is what my email looks like:

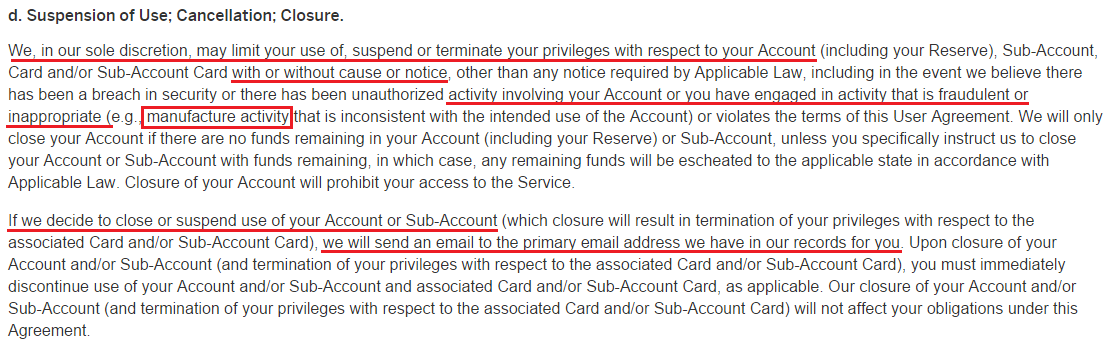

I clicked on the Consumer User Agreement link and noticed that the AMEX Serve terms were updated on 1/5/2016 (just 3 days ago). I scrolled down to Section 15.d and the section is titled Suspension of Use; Cancellation; Closure. I underlined the important sentences and drew a box around “manufacture activity” which is basically Manufactured Spending. They are on to us.

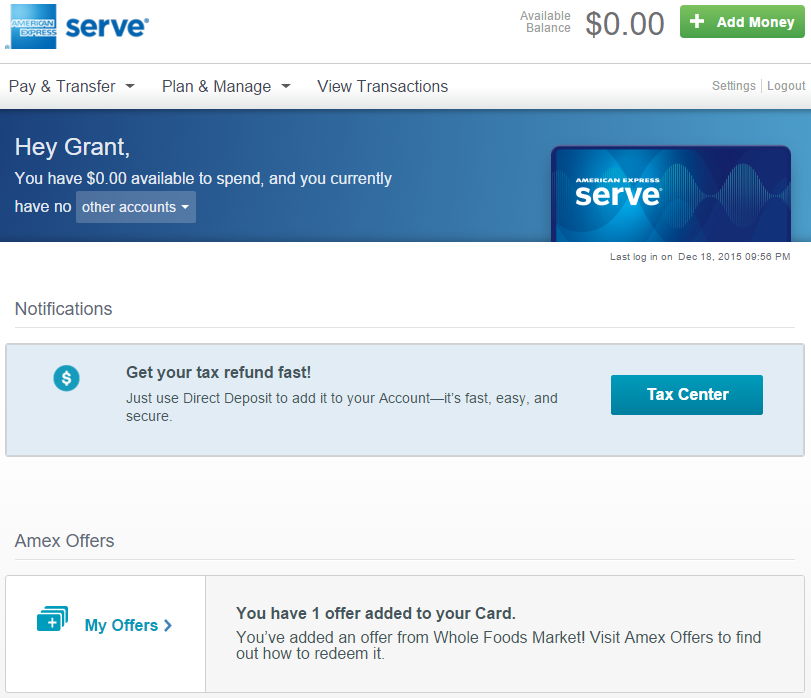

Surprisingly, when I logged into my AMEX Serve account, there were no warning messages anywhere.

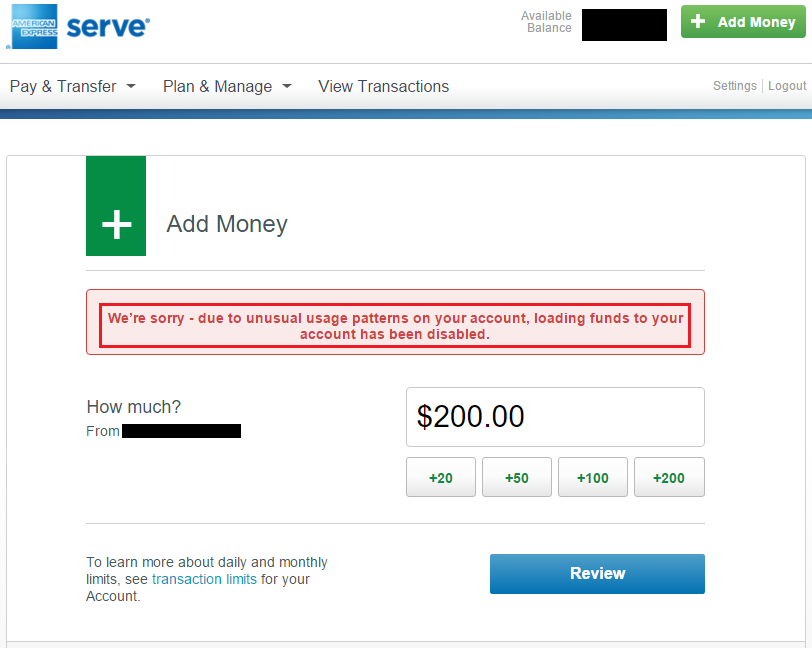

When I went to add funds to my AMEX Serve Card, I did get the following error message: We’re sorry – due to unusual usage patterns on your account, loading funds to your account has been disabled.

What is still working on a flagged AMEX Serve account?

- I moved funds from a flagged AMEX Serve account to another AMEX Serve account that is not flagged (yet).

- I made a bill payment from a flagged AMEX Serve account.

What are my current plans with a flagged AMEX Serve account?

- I haven’t called customer service yet to inquire why or how to overturn my account closure.

- I liquidated all my AMEX Serve accounts via bill payments.

- I will keep my accounts open with $0 balance and wait to see what happens next.

What was I doing with my 4 AMEX Serve Cards (me, mom, dad, and brother)?

- I never did any in-store reloads.

- All online reloads using the same US Bank FlexPerks AMEX Credit Card number (authorized user cards have the exact same number, but different names).

- I would load 1 AMEX Serve Card days 1-5 of the month, then the second AMEX Serve Card days 6-10, third 11-15, and fourth 16-20.

- I transferred all the funds from 4 AMEX Serve Cards onto 2 AMEX Serve Cards and paid credit card bills from those 2 AMEX Serve accounts.

I will update this post when more information and data points become available.

Did you receive the account closure email? How many AMEX Serve Cards do/did you have? If you have any questions, please leave a comment below. RIP old friend :(

They got me too, oh well screw it.

We will all mourn together #ServeStrong

My account also closed today with section15.d mention. I was loading just $1000/month($200×5) using my amex every day,to pay my rent.just wondering for this low activity they are saying manufacturing spend!!

I got the same email too and just wrote this post: http://travelwithgrant.boardingarea.com/2016/03/04/round-2-of-amex-serve-card-account-closures-march-4-2016/

Yep. Both my wife and I had Serve cards and we got the same email.

I had the classic serve account, would load it from my flexperks account days 1-5, and with visa gift cards and paypal debit cards at Wall mart 2 $500 loads a couple of days in a month. Then pay 2 different mortgage payments with it. When the shutdown was announced on the different websites, my card was still ok, but I couldn’t do debit loads at Wall Mart. So I tried loading cash at Rite Aid and CVS. Both had errors. Then when I tried to set up the load from the Flexperks account last night I got the same message, “due to suspicious activity on your account, you will no longer be able to load funds.” So I paid my mortgage with the remaining balance and now have a zero balance. Waiting to see if they shut down the account. I’m thinking of shutting it down on my own.

Yup, that’s unfortunately what happened to a lot of Serve cardholders. You can try closing the card, waiting 24 hours and then opening a new Serve account. That might work.

yes, mine also got flagged. But I was actually using the gift card load to pay legit bills. Did you try to call the customer service?

I didn’t call CS yet, but I did liquidate all my funds via bill pay. I am not going to close my accounts yet.

Customer service says to use snail mail to inquire. They will not provide any assistance whatsoever. On top of it, they are quite rude.

AMEX prepaid customer service has always been worthless, no surprise today :(

They closed my three active accounts. Luckily I just opened a 4th with my Mom, and it hasn’t been used yet. I was maxing out in store loads at walmart (5k a month), plus loading with my fidelity amex on each card.

Thanks for the data points Ted. Did you ever send funds between your AMEX Serve accounts?

nope. Never sent money between the accounts. Only ever took money out using the bill pay to pay off my credit cards.

Its interesting to note that my auto-load with fidelity card went though this morning (around 1am), and is dated Jan 8th. Its suppose to auto-load tomorrow as well, so i’m interested to see if that works tomorrow morning as well.

I just got an email for my BLUEBIRD – pretty much the same thing only citing section 22.d.

Bluebird terms of service Section 22.d (link) even mentions MS by name: “(iv)you structure purchases or conduct transactions with your Account, Family Account, SetAside Account and/or Card to manufacture spend”

they nailed me too. Was doing $5000 per month instore

Walmart loads.

Allison, how many accounts did you have?

only 1 BB. Haven’t heard back from my hubby yet to see if his account got stung too. I was just about an hour from going out to buy some gift cards and load today too. :(

Well, at least you saw the email before you bought more VGCs.

For me – Bluebird closure – FWIW – I loaded under $2100 a month, and used it to pay utility bills, etc. I withdrew cash once about 2 months ago. My loads were a variety of loads via Walmart. Different amounts ($300, $200, $100, and I never loaded the max in one day). At most I loaded $800 but that was a while ago when my Walmart still had a Kate. For the past couple of months, I’ve loaded about $300 a week tops.

Wow, those are pretty low levels, I’m surprised your account got flagged.

Both my accounts have been affected. I had no funds in either. But I did use them for MS and a fair number of genuine bills. Bummer!

Darn it Jeff, all good things come to an end :(

I also got shut down. My activity was similar- I loaded from only one card – US bank Flexperks – and then paid it off. Looks like I should have masked my movements better.

It would be easy for AMEX to identify the same card number being used on multiple AMEX Serve accounts. Oh well, it was nice while it lasted.

My 2 Serve got shut down, just withdrew the funds to the bank. Wondering if I should close the accounts and open bluebird for the next round. Both accounts are relatively new, opened after redbird died, have been maximizing online and in-store load every month. Sigh, not feeling well today.

I would wait a day or 2 to figure out what our next steps should be. Wait until the funds are deposited into your bank account before doing anything else.

They got me as well. I mainly used it for Walmart visa giftcard loading (around $2K per month) and used those funds to pay credit cards and my landlord.

I’m curious if they flagged accounts due to loading activity or unloading activity (paying bills/withdrawing/ATM use).

I have my 3 BB accounts shut down. I have around 7.5k in GCs and are currently unopened. Is there any way to return those back or use it? Cannot afford to have 7.5k sitting around in GCs.

Nope, it’s not possible to return VGCs.

Wow, that was fast! Got my email at 10:20 this morning. Oh well, on to the next thing. (whatever that is…..)

As a blogger, you have to be fast :)

I got a notice today on my SO BB account. Different BB T&C reference but the same wording. Haven’t called CS yet either, but I’m thinking of also writing to the address on the notice to see what they have to say if no success with CS.

Good luck with CS and writing a letter. Let me know what you find out :)

The Banks are reading all of the Blogs and they “know” what is going on with the entire MS. It shouldn’t be any surprise that they, highly paid, are also “smart” and they “learn” from the blogs as to what is going on.

I am surprised it lasted this long though!

I did last a very long time :)

I have one Serve account that I loaded monthly from a single Fidelity Amex Card. I did not use the funds to pay the Fidelity Card but paid shopping and utility bills, and sometimes tuition.

Did your AMEX Serve Card get flagged for your activity?

Yes it did – and I should have mentioned that.

we received same email for both of our Bluebirds this morning. I was loading max (or close to it) on both cards with VGC’s at WM each month. I paid the credits cards that I used to buy the VGC’s (obvs) through a combination of online bill pay and withdrawing cash at ATM’s. When I first opened the accounts a couple of years ago, I paid my housekeeper and pool guy with Bluebird checks about a half-dozen times, but I haven’t done that in ages. I think it’s pretty easy for them to detect MS activity, and they simply decided they wouldn’t tolerate it any more. It was fun while it lasted. I guess all MS strategies have a life-span, and BB’s and Serves have run their course, too, now. I think this is the end of the line for me with regard to MS. Paypal Cash Cards- I stopped before they could stop me; Visa Buxx: Dead; Vanilla Reloads: Dead; and now RIP Bluebird.

So many MS funerals lately. Is 2016 the year MS died?

Called Serve and go in touch with “supervisor,” who stated I can close the account after spending the money down and re-open a new one? I am not sure what to make of this. I dont think they know what’s going on either. Apparently this cannot be overridden via phone call (obviously)

Thanks for sharing, Ani. It would be interesting to see if you can reopen a new Serve account and be back up and running.

I have one Serve account that I loaded $1000 monthly from Fidelity Amex Card, no other activity. Received the e-mail this morning. Will this affect credit history/show up as a delinquency with Amex?

Prepaid cards do not affect your personal credit history/score. Nothing to worry about.

Hi, Grant,

I received the same email 2 hours ago for my Serve account. I used to load $1,500 per month and spent mostly through bill pays. Do we have any other method for MS?

Frequent Miler, Miles to Memories and Doctor of Credit have good posts about alternative MS avenues.

1 of my 3 were closed, which happened to be the oldest (fee free version). The two newer ones I obtained when Redbirds stopped working are both active still. I use them both to pay off credit cards bills, but also may 2 mortgages, electric, gas bills, in additional to credit card bills. Just trying to see if there is any pattern?

Same here, my oldest one got shut down, no news on the other 2 though….

Pingback: BREAKING: Why did MY Serve account NOT get shut down like everyone else's? - Points with a Crew

Got the dreaded email this morning too. I was doing $1000 per month with fidelity card and an occasional in store reload. Sad. No notice on my wife’s account as of yet, but we just opened it a few weeks ago.

I wonder if Amex is planning on shutting down the whole business of prepaid cards? Maybe they decided that it’s simply not profitable for them. Obviously they have to wait until contracts with WalMart, etc end, but this could be a first step in the process.

Seems very likely to me. There were too many MSers that made AMEX prepaid cards unprofitable for everyone except us :)

Well, we can still liquidate VISA GCs by buying money orders (70 ct fee) at Walmart. Even the Post Office sells MO’s, $1.25

That’s true, but this is the death of an easy PJ MS :(

Closed. Opened mine after RB died and I used my ST card to load it until that got closed in November. Since then, I’ve only been doing online loads and then paying legit bills with the funds (pool guy, lawn care, mortgage, etc.).

Mine got closed too…

We had 3 BB’s closed, but our Serve One VIP has not been flagged yet. I guess Walmart Money Orders might be an option if it works in your area. We are in MN and I have not had good luck with that.

Where in MN lizwizbiz. Near MSP here and looking for others for Twin Cities points and miles craziness meetups.

It would be great to get together and discuss this hobby.

Go to http://msptravelz.blogspot.com/ and comment.

Grant, I think your original post “nails” Amex too — they changed their terms & conditions 3 days ago, and now apparently have it available to them as a “defense” as to what they mean by “unusual” activity. But seriously, Grant, they had to have known for years that MS activity is anything but unusual in their BlueBird, Serve, & RedBird products….

By chance does anyone have their original terms & conditions from when they opened their accounts? It’s not an idle point to know if the words “manufactured spend” was in them before. (I rather think not… — but would be pleased to have my suspicions or corporate fraud either confirmed or corrected)

(even more so if Amex starts putting black marks on our credit ratings over this)

ps: I seem to recall that when redbird was shuttered, you had then posted something about having a nationwide buxx account…. Still use that? (even after their recent changes?)

This link shows the old AMEX Serve terms: https://web.archive.org/web/20150921201647/https://serve.com/legal/Serve/#suspension

I still have 4 Nationwide Visa Buxx cards. I am still using them, until they become worthless too :(

Mine was shut down(wife’s not yet…) but when I went to “Add Money” tab no hateful message appeared like yours Grant. Not sure why.

Only have 6 Staples Visas to liquidate but would prefer thru Serve than spending.

i did in store reload every month for abour $500 or so using VGC, and use that to pay rent and electric bills, and i got the email too : (

Bummer, that is a pretty low volume to get flagged :(

i know! And i only started using it back on oct, just thought to earn some points for paying rent and bills

so as I said this morning my account got the dreaded death email BUT my husband NEVER received an email and when I went online to “load money” to his account the message that Grant had was not there. So I bust my butt to Walmart and buy (1) $500 VGC….stroll a little bit around Wmart and then attempt to load to BB at customer service register. denied and denied. So then I drove to another Wmart and denied again. Even though it appears his account is open and ready to load money to his BB it is not happening for us. Question: can you use a Walmart VGC to buy a money order from Walmart. The customer service gal said yes but when we went to do it too was denied. I checked my balance on the VGC online and it is loaded.

I’m not sure about buying MOs at Walmart with a VGC bought at Walmart, sorry.

My card that never used billpay is still open. My card that used billpay was closed. That’s the only difference I see.

Ditto. Two cards. One I used for bill pay and Amex offer spend – closed. The other only sent checks and Serve transfers and that one is alive.

So, assuming the pattern is the same, as soon as you use those unflagged accounts with bill pay and AMEX Offers, you might get flagged. Yikes :/

Yeah I’m going to take it slow and just load online with it until my savings is drained and then do a big transfer. That way I can still make a final $100 off it.

That’s a good plan, good luck :)

I was actually a bit concerned about my second account (my dad’s). He chose to load – and then unload via check to his own household this month. Had me sweating. His account is still live. He has never bill paid.

I, on the other hand have kept a 5k balance for months and use my account for real billpay. Closed.

No one knows what is the true cause to get your account flagged, it is a mystery for now.

One down which used for pay bill, send money. Others OK just transfer to bank

Glad to hear most of your Serve cards are still working :)

I only have BB cards

The same to my two Bluebirds

My mom’s BB, which was used primarily as an overflow to mine, did not get flagged and I dumped the remaining amount of GC on it at Kate today. Both had swipes primarily on Amex Offers and was loaded through Kate with VGC and off NW Buxx. Debating whether to keep pushing GCs onto that BB to max out $5k – I may play it by ear and see how it is going.

That’s a tough call. You could argue that AMEX is probably doing account closures in bulk, so if you survived this round, you should be fine for a few more days/weeks. Slow playing it is probably not worth it if it takes you much longer to load and unload your Bluebird Card.

Just wonder anyone got email today for closing account?

I think all the emails came yesterday morning around 8am PT. no new emails after that.

WE need the data points from someone who did not get email and di load the money at Kate or Walmart cashiers

My brother and his wife got their cards shutdown, then later that night they uncancelled his wife’s card, so she can use it again… Did not call or do anything to have the cancellation reversed. Does that help anyone?

He did about 2.5k per month except for this last month he did $5k

That might be the only case I’ve heard of where an account was closed and then reopened with out any intervention from the user.

Had one serve account and loaded usually $400 per day no more than $2000 in any month. My GC loads at Walmart were always in $200 increments for the last year. No regular spend or atm withdrawals just bill pay to a few cc accounts

Thanks for the datapoint, Drew.

Me and my +1 got the same email about our BB cards. I would load $1,000 each month (two Simon mall Visa cards at $500 each) at Walmart and used the funds to pay for car loan and some other small bills (never cc though). Husband would load about $2,000 every couple of months and pay mortgage.

Oh well…it was a nice point booster.

That’s unfortunate that you guys got shut down. You were not even maxing out the reloads :(

At one time i was regularly loading cash from Amex Costco card / blue cash card, but stopped it for sometime.Did one reload this month and there you go!! you can not do it any more. I called the CS and they are asking me to write a letter to the mailing address mentioned in the eMail and they will respond back as to what is “the unusual activity”. Also came to know about the monthly charges 4.95$ which they have recently started (They will not deduct if account has no funds.) So i have withdrawn all the money. Lets C what they do?

Good luck Venkat!

Anyone load money to BB recently?

one BB card load OK the other could not load even not got the email

Hello,

If I purchase a gift card from Gift Card Mall with my Chase Ink plus card, do I get 5X the points?

aron

If you purchase those VGCs from Staples you do. They sell VGCs from the Gift Card Mall.

Molly is correct.

No, GCM is not associated with one of the 5x categories for the Chase Ink Bold/Plus card.

They charge you a Monthly fee for not loading enough funds on the card, but when you load the card to avoid paying the monthly fee they close your account. wth???

Haha, basically that’s true. I don’t mind paying the $1/month fee if I can keep the card open and load with a credit card.

Lol, IKR!

Wow someone stole my card. I never received it. Did a claim and in 2 days I received that email 15 d…what do I do. My taxes was loaded to that card. I don’t know what to do at this point or who to talk to. Help

You need to call the AMEX Serve customer service number and talk to the fraud department. They should help you get your money back.

Yeah, I did that and they not only rejected the fraudulent transactions as authorized, they added insult to injury by suspending the account permanently. Horrible company.

They wont give the money back im fighting them now over that. Its not right. Only account touched just the serve.

Pingback: Round 2 of AMEX Serve Card Account Closures (March 4, 2016) | Travel with Grant

Pingback: AMEX for Target Discontinuing Program & AMEX Serve $25 Sign Up Bonus

I got suspended from serve. I got a balance in the account. They just sent me an email stating my account is permanently suspended but no instructions how to get money out. It asked that I write to the address for further instructions. Any one has any dp on how quickly I can get my money back?

Sorry that happened to your Serve account. Have you tried using your Serve card to withdraw funds from an ATM or to make purchases? I thought you could spend down the funds but not add new funds to the account when your account gets suspended.